Authored by Gail Tverberg via Our Finite World blog,

Financial markets have been behaving in a very turbulent manner in the last couple of months. The issue, as I see it, is that the world economy is gradually shifting from a growth mode to a mode of shrinkage. This is something like a ship changing course, from going in one direction to going in reverse. The system acts as if the brakes are being very forcefully applied, and reaction of the economy is to almost shake.

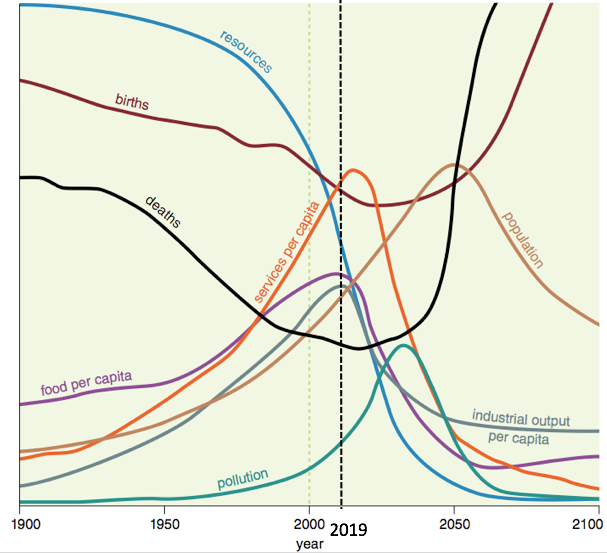

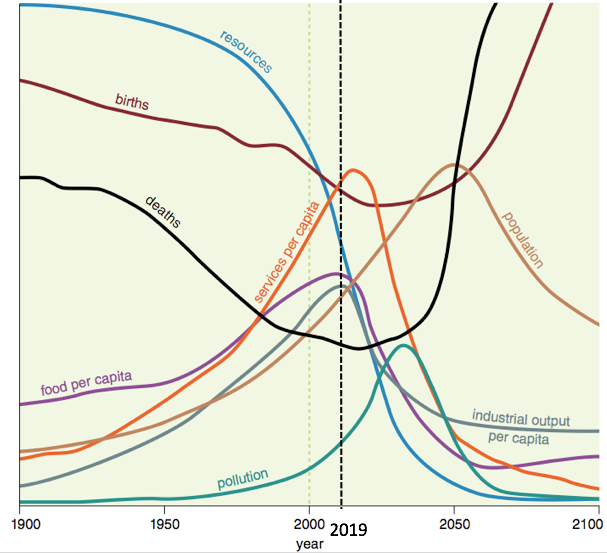

What seems to be happening is that the world economy is reaching Limits to Growth, as predicted in the computer simulations modeled in the 1972 book, The Limits to Growth. In fact, the base model of that set of simulations indicated that peak industrial output per capita might be reached right about now. Peak food per capita might be reached about the same time. I have added a dotted line to the forecast from this model, indicating where the economy seems to be in 2019, relative to the base model.

Figure 1. Base scenario from The Limits to Growth, printed using today’s graphics by Charles Hall and John Day in Revisiting Limits to Growth After Peak Oil with dotted line at 2019 added by author. The 2019 line is drawn based on where the world economy seems to be now, rather than on precisely where the base model would put the year 2019.

The economy is a self-organizing structure that operates under the laws of physics. Many people have thought that when the world economy reaches limits, the limits would be of the form of high prices and “running out” of oil. This represents an overly simple understanding of how the system works. What we should really expect, and in fact, what we are now beginning to see, is production cuts in finished goods made by the industrial system, such as cell phones and automobiles, because of affordability issues. Indirectly, these affordability issues lead to low commodity prices and low profitability for commodity producers. For example:

-

The sale of Chinese private passenger vehicles for the year of 2018 through November is down by 2.8%, with November sales off by 16.1%. Most analysts are forecasting this trend of contracting sales to continue into 2019. Lower sales seem to reflect affordability issues.

-

Saudi Arabia plans to cut oil production by 800,000 barrels per day from the November 2018 level, to try to raise oil prices. Profits are too low at current prices.

-

Coal is reported not to have an economic future in Australia, partly because of competition from subsidized renewables and partly because China and India want to prop up the prices of coal from their own coal mines.

The Significance of Trump’s Tariffs

If a person looks at history, it becomes clear that tariffs are a standard response to a problem of shrinking food or industrial output per capita. Tariffs were put in place in the 1920s in the time leading up to the Great Depression, and were investigated after the Panic of 1857, which seems to have indirectly led to the US Civil War.

Whenever an economy produces less industrial or food output per capita there is an allocation problem: who gets cut off from buying output similar to the amount that they previously purchased? Tariffs are a standard way that a relatively strong economy tries to gain an advantage over weaker economies. Tariffs are intended to help the citizens of the strong economy maintain their previous quantity of goods and services, even as other economies are forced to get along with less.

I see Trump’s trade policies primarily as evidence of an underlying problem, namely, the falling affordability of goods and services for a major segment of the population. Thus, Trump’s tariffs are one of the pieces of evidence that lead me to believe that the world economy is reaching Limits to Growth.

The Nature of World Economic Growth

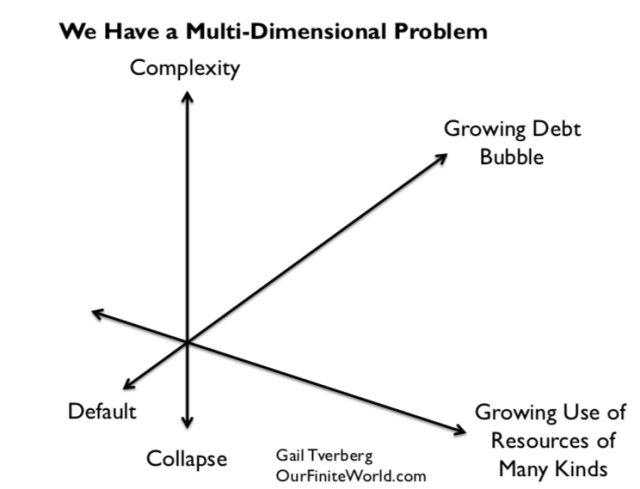

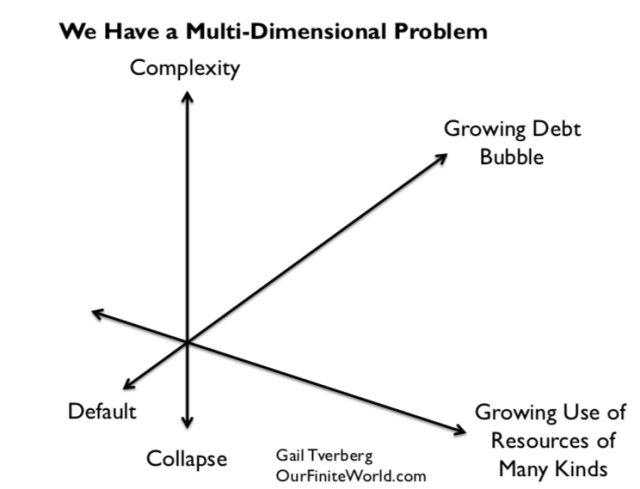

Economic growth seems to require growth in three dimensions (a) Complexity, (b) Debt Bubble, and (c) Use of Resources. Today, the world economy seems to be reaching limits in all three of these dimensions (Figure 2).

Figure 2.

Complexity involves adding more technology, more international trade and more specialization. Its downside is that it indirectly tends to reduce affordability of finished end products because of growing wage disparity; many non-elite workers have wages that are too low to afford very much of the output of the economy. As more complexity is added, wage disparity tends to increase. International wage competition makes the situation worse.

A growing debt bubble can help keep commodity prices up because a rising amount of debt can indirectly provide more demand for goods and services. For example, if there is growing debt, it can be used to buy homes, cars, and vacation travel, all of which require oil and other energy consumption.

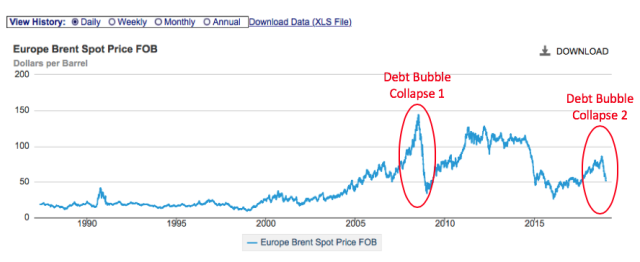

If debt levels become too high, or if regulators decide to raise short-term interest rates as a method of slowing the economy, the debt bubble is in danger of collapsing. A collapsing debt bubble tends to lead to recession and falling commodity prices. Commodity prices fell dramatically in the second half of 2008. Prices now seem to be headed downward again, starting in October 2018.

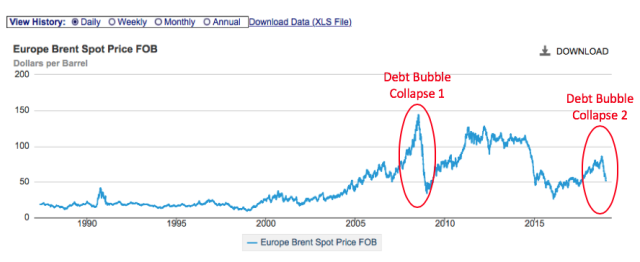

Figure 3. Brent oil prices with what appear to be debt bubble collapses marked.

Figure 4. Three-month treasury secondary market rates compared to 10-year treasuries from FRED, with points where short term interest rates exceed long term rates marked by author with arrows.

Even the relatively slow recent rise in short-term interest rates (Figure 4) seems to be producing a decrease in oil prices (Figure 3) in a way that a person might expect from a debt bubble collapse. The sale of US Quantitative Easing assets at the same time that interest rates have been rising no doubt adds to the problem of falling oil prices and volatile stock markets. The gray bars in Figure 4 indicate recessions.

Growing use of resources becomes increasingly problematic for two reasons. One is population growth. As population rises, the economy needs more food to feed the growing population. This leads to the need for more complexity (irrigation, better seed, fertilizer, world trade) to feed the growing world population.

The other problem with growing use of resources is diminishing returns, leading to the rising cost of extracting commodities over time. Diminishing returns occur because producers tend to extract the cheapest to extract commodities first, leaving in place the commodities requiring deeper wells or more processing. Even water has this difficulty. At times, desalination, at very high cost, is needed to obtain sufficient fresh water for a growing population.

Why Inadequate Energy Supplies Lead to Low Oil Prices Rather than High

In the last section, I discussed the cost of producing commodities of many kinds rising because of diminishing returns. Higher costs should lead to higher prices, shouldn’t they?

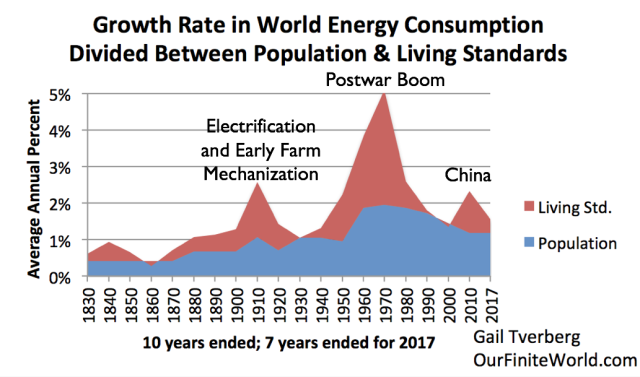

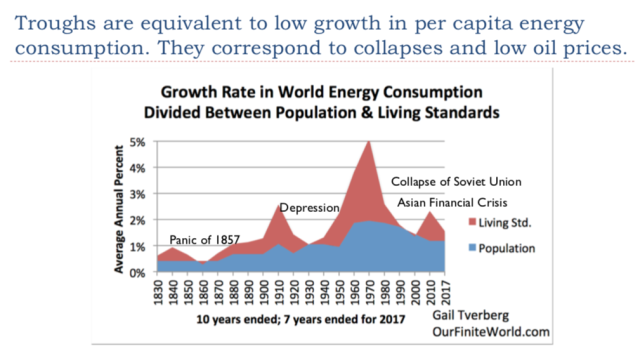

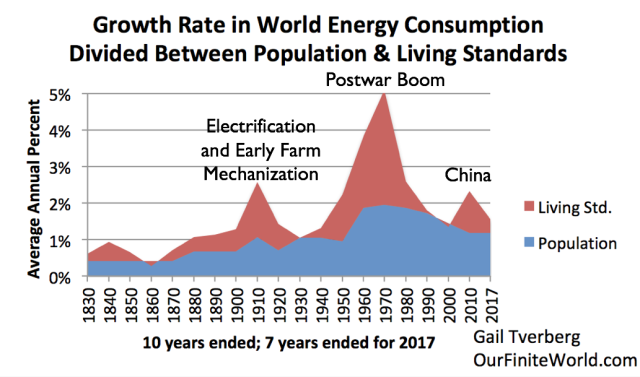

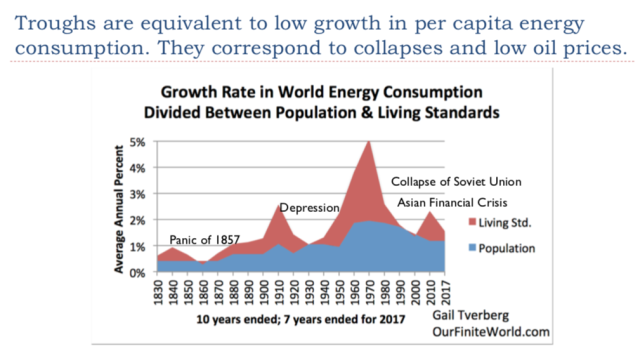

Strangely enough, higher costs translate to higher prices only sometimes. When energy consumption per capita is rising rapidly (peaks of red areas on Figure 5), rising costs do seem to translate to rising prices. Spiking oil prices were experienced several times: 1917 to 1920; 1974 to 1982; 2004 to mid 2008; and 2011 to 2014. All of these high oil prices occurred toward the end of the red peaks on Figure 5. In fact, these high oil prices (as well as other high commodity prices that tend to rise at the same time as oil prices) are likely what brought growth in energy consumption down. The prices of goods and services made with these commodities became unaffordable for lower-wage workers, indirectly decreasing the growth rate in energy products consumed.

Figure 5.

The red peaks represented periods of very rapid growth, fed by growing supplies of very cheap energy: coal and hydroelectricity in the Electrification and Early Mechanizationperiod, oil in the Postwar Boom, and coal in the China period. With low energy prices, many countries were able to expand their economies simultaneously, keeping demand high. The Postwar Boom also reflected the addition of many women to the labor force, increasing the ability of families to afford second cars and nicer homes.

Rapidly growing energy consumption allowed per capita output of both food (with meat protein given a higher count than carbohydrates) and industrial products to grow rapidly during these peaks. The reason that output of these products could grow is because the laws of physics require energy consumption for heat, transportation, refrigeration and other processes required by industrialization and farming. In these boom periods, higher energy costs were easy to pass on. Eventually the higher energy costs “caught up with” the economy, and pushed growth in energy consumption per capita down, putting an end to the peaks.

Figure 6 shows Figure 5 with the valleys labeled, instead of the peaks.

Figure 6.

When I say that the world economy is reaching “peak industrial output per capita” and “peak food per capita,” this represents the opposite of a rapidly growing economy. In fact, if the world is reaching Limits to Growth, the situation is even worse than all of the labeled valleys on Figure 6. In such a case, energy consumption growth is likely to shrink so low that even the blue area (population growth) turns negative.

In such a situation, the big problem is “not enough to go around.” While cost increases due to diminishing returns could easily be passed along when growth in industrial and food output per capita were rapidly rising (the Figure 5 situation), this ability seems to disappear when the economy is near limits. Part of the problem is that the lower growth in per capita energy affects the kinds of job that are available. With low energy consumption growth, many of the jobs that are available are service jobs that do not pay well. Wage disparity becomes an increasing problem.

When wage disparity grows, the share of low wage workers rises. If businesses try to pass along their higher costs of production, they encounter market resistance because lower wage workers cannot afford the finished goods made with high cost energy products. For example, auto and iPhone sales in China decline. The lack of Chinese demand tends to lead to a drop in demand for the many commodities used in manufacturing these goods, including both energy products and metals. Because there is very little storage capacity for commodities, a small decline in demand tends to lead to quite a large decline in prices. Even a small decline in China’s demand for energy products can lead to a big decline in oil prices.

Strange as it may seem, the economy ends up with low oil prices, rather than high oil prices, being the problem. Other commodity prices tend to be low as well.

What Is Ahead, If We Are Reaching Economic Growth Limits?

1. Figure 1 at the top of this post seems to give an indication of what is ahead after 2019, but this forecast cannot be relied on. A major issue is that the limited model used at that time did not include the financial system or debt. Even if the model seems to provide a reasonably accurate estimate of when limits will hit, it won’t necessarily give a correct view of what the impact of limits will be on the rest of the economy, after limits hit. The authors, in fact, have said that the model should not be expected to provide reliable indications regarding how the economy will behave after limits have started to have an impact on economic output.

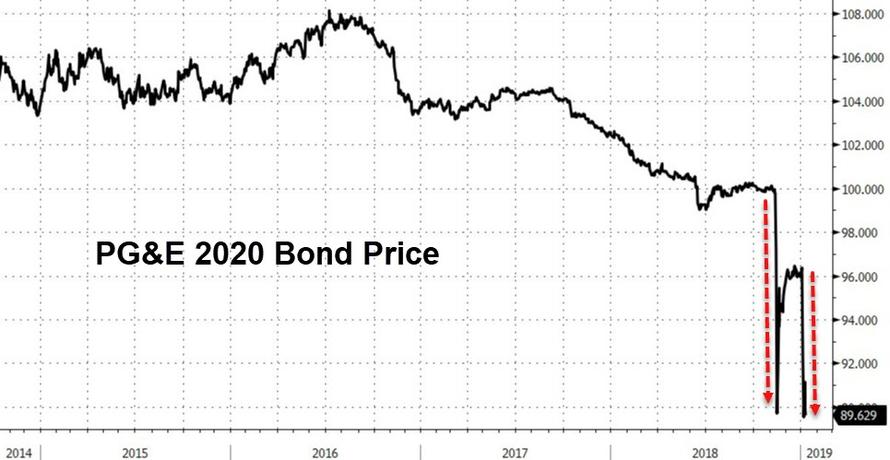

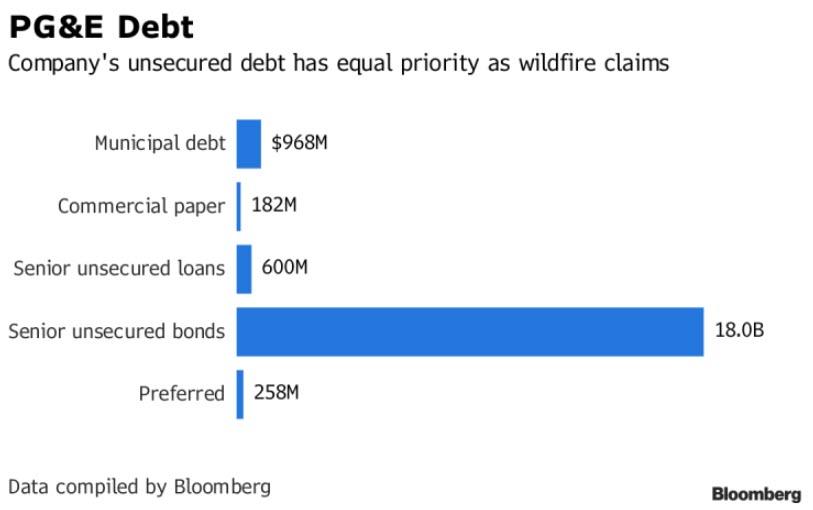

2. As indicated in the title of this post, considerable financial volatility can be expected in 2019 if the economy is trying to slow itself. Stock prices will be erratic; interest rates will be erratic; currency relativities will tend to bounce around. The likelihood that derivatives will cause major problems for banks will rise because derivatives tend to assume more stability in values than now seems to be the case. Increasing problems with derivatives raises the risk of bank failure.

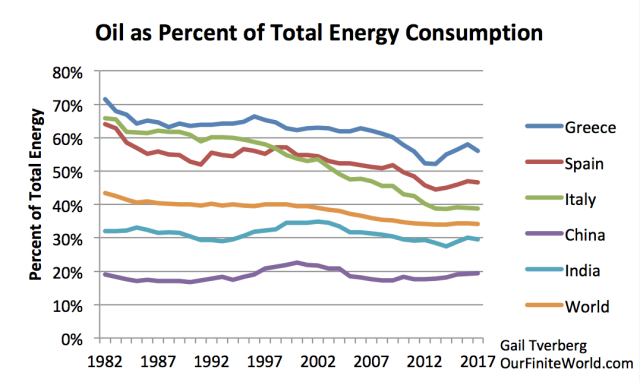

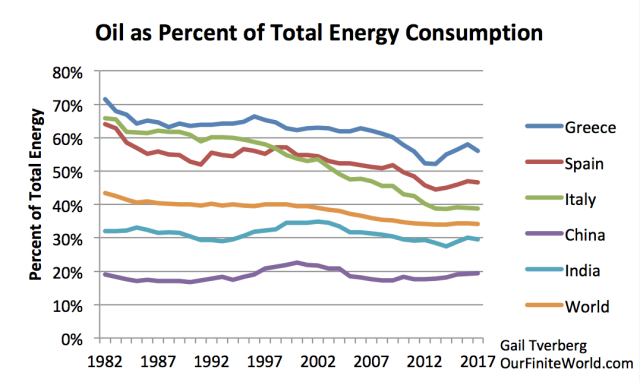

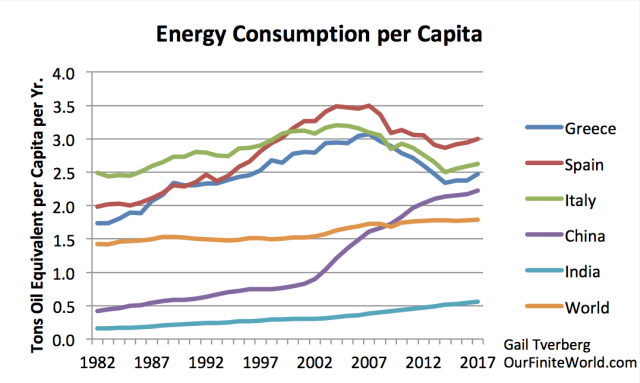

3. The world economy doesn’t necessarily fail all at once. Instead, pieces that are, in some sense, “less efficient” users of energy may shrink back. During the Great Recession of 2008-2009, the countries that seemed to be most affected were countries such as Greece, Spain, and Italy that depend on oil for a disproportionately large share of their total energy consumption. China and India, with energy mixes dominated by coal, were much less affected.

Figure 7. Oil consumption as a percentage of total energy consumption, based on 2018 BP Statistical Review of World Energy data.

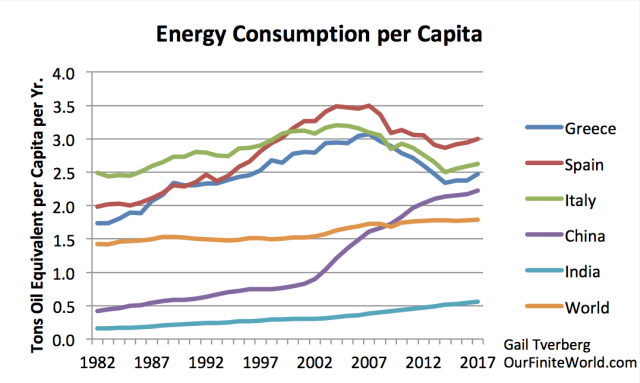

Figure 8. Energy consumption per capita for selected areas, based on energy consumption data from 2018 BP Statistical Review of World Energy and United Nations 2017 Population Estimates by Country.

In the 2002-2008 period, oil prices were rising faster than prices of other fossil fuels. This tended to make countries using a high share of oil in their energy mix less competitive in the world market. The low labor costs of China and India gave these countries another advantage. By the end of 2007, China’s energy consumption per capita had risen to a point where it almost matched the (now lower) energy consumption of the European countries shown. China, with its low energy costs, seems to have “eaten the lunch” of some of its European competitors.

In 2019 and the years that follow, some countries may fare at least somewhat better than others. The United States, for now, seems to be faring better than many other parts of the world.

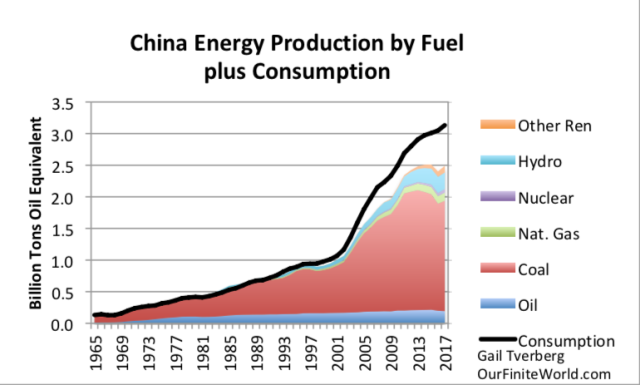

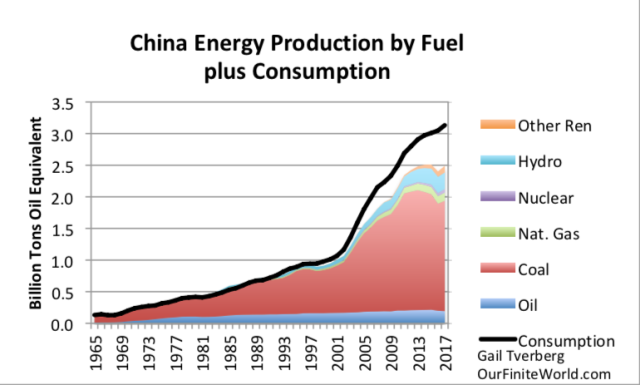

4. While we have been depending upon China to be a leader in economic growth, China’s growth is already faltering and may turn to contraction in the near future. One reason is an energy problem: China’s coal production has fallen because many of its coal mines have been closed due to lack of profitability. As a result, China’s need for imported energy (difference between black line and top of energy production stack) has been growing rapidly. China is now the largest importer of oil, coal, and natural gas in the world. It is very vulnerable to tariffs and to lack of available supplies for import.

Figure 9. China energy production by fuel plus its total energy consumption, based on BP Statistical Review of World Energy 2018 data.

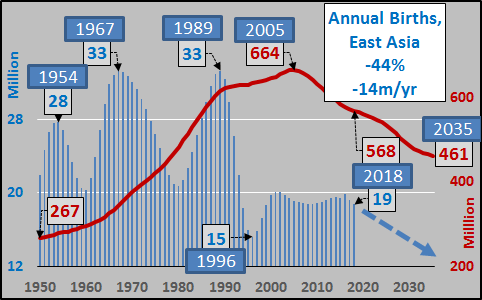

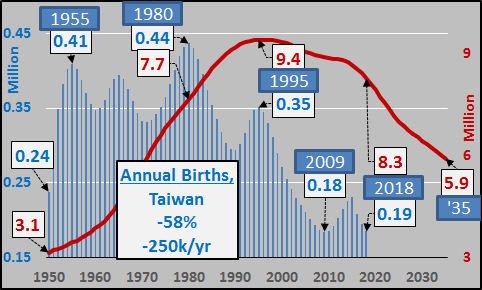

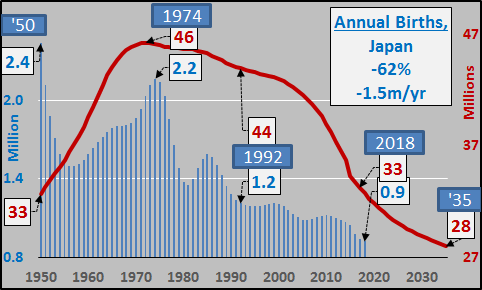

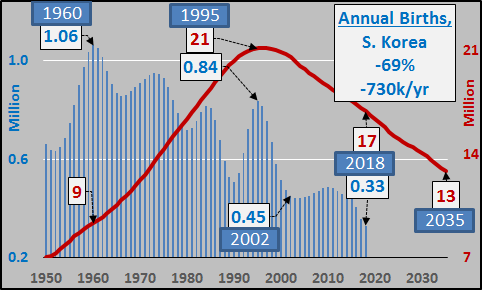

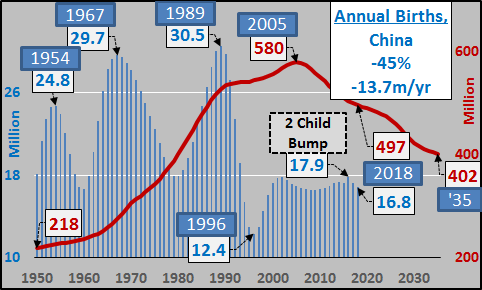

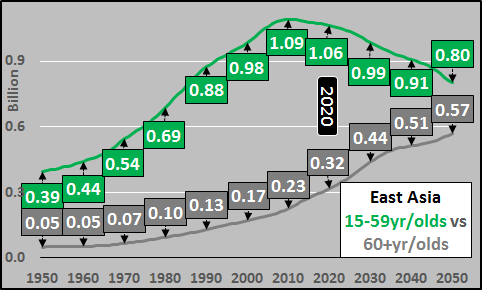

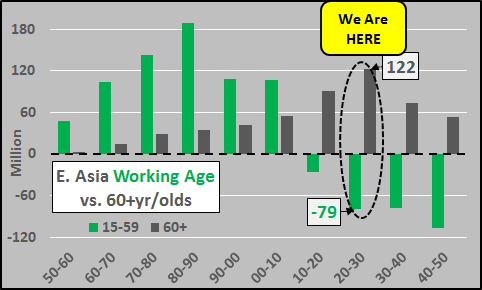

A second issue is that demographics are working against China; its working-age population already seems to be shrinking. A third reason why China is vulnerable to economic difficulties is because of its growing debt level. Debt becomes difficult to repay with interest if the economy slows.

5. Oil exporters such as Venezuela, Saudi Arabia, and Nigeria have become vulnerable to government overthrow or collapse because of low world oil prices since 2014. If the central government of one or more of these exporters disappears, it is possible that the pieces of the country will struggle along, producing a lower amount of oil, as Libya has done in recent years. It is also possible that another larger country will attempt to take over the failing production of the country and secure the output for itself.

6. Epidemics become increasingly likely, especially in countries with serious financial problems, such as Yemen, Syria, and Venezuela. Historically, much of the decrease in population in countries with collapsing economies has come from epidemics. Of course, epidemics can spread across national boundaries, exporting the problems elsewhere.

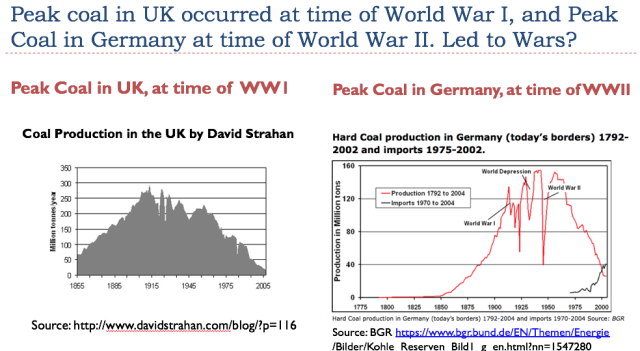

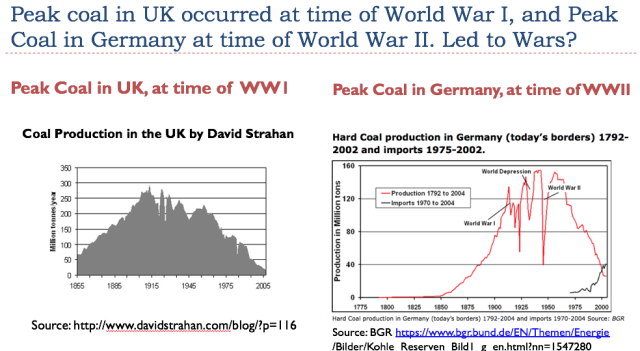

7. Resource wars become increasingly likely. These can be local wars, perhaps over the availability of water. They can also be large, international wars. The timing of World War I and World War II make it seem likely that these wars were both resource wars.

Figure 10.

8. Collapsing intergovernmental agencies, such as the European Union, the World Trade Organization, and the International Monetary Fund, seem likely. The United Kingdom’s planned exit from the European Union in 2019 is a step toward dissolving the European Union.

9. Privately funded pension funds will increasingly be subject to default because of continued low interest rates. Some governments may choose to cut back the amounts they provide to pensioners because governments cannot collect adequate tax revenue for this purpose. Some countries may purposely shut down parts of their governments, in an attempt to hold down government spending.

10. A far worse and more permanent recession than that of the Great Recession seems likely because of the difficulty in repaying debt with interest in a shrinking economy. It is not clear when such a recession will start. It could start later in 2019, or perhaps it may wait until 2020. As with the Great Recession, some countries will be affected more than others. Eventually, because of the interconnected nature of financial systems, all countries are likely to be drawn in.

Summary

It is not entirely clear exactly what is ahead if we are reaching Limits to Growth. Perhaps that is for the best. If we cannot do anything about it, worrying about the many details of what is ahead is not the best for anyone’s mental health. While it is possible that this is an end point for the human race, this is not certain, by any means. There have been many amazing coincidences over the past 4 billion years that have allowed life to continue to evolve on this planet. More of these coincidences may be ahead. We also know that humans lived through past ice ages. They likely can live through other kinds of adversity, including worldwide economic collapse.

via RSS http://bit.ly/2VNLv4t Tyler Durden