Tomorrow at 830am, the BLS is expected to announce that in January the US added 165k payrolls, a sharp drop from December’s 312K, while both average hourly earnings and unemployment are expected to remain unchanged at 3.2% and 3.9%, respectively. More importantly, absent some unexpected shock, if the jobs number is positive it will represent the record 100th month of job creation.

That said, the 800,000 furloughed workers in the past month and recent hard data makes the post-shutdown jobs report more of a focus than usual.

Below, courtesy of RanSquawk are the key highlights of what Wall Street expects:

- Non-farm Payrolls: Exp. 165k, Prev. 312k

- Unemployment Rate: Exp. 3.9%, Prev. 3.9% (the FOMC projects unemployment will stand at 3.5% at the end of 2019, and 4.4% in the longerrun)

- Average Earnings Y/Y: Exp. 3.2%, Prev. 3.2%

- Average Earnings M/M: Exp. 0.3%, Prev. 0.4%

- Average Work Week Hours: Exp. 34.5, Prev. 34.5

- Private Payrolls: Exp. 170k, Prev. 301k

- Manufacturing Payrolls: Exp. 17k, Prev. 32k

- Government Payrolls: Prev. 11k

- U6 Unemployment Rate: Prev. 7.6%

- Labour Force Participation: Prev. 63.1%

EXPECTATIONS: The Street is expecting a slower pace of payroll additions (165k) at the February release when compared to both the 12-month average of headline nonfarm payrolls (202k for Feb 2018-Jan 2019) and the previous blowout figure of 312k. Capital Economics notes that the release will only be partly affected by the Federal shutdown as those affected who will now receive pay for the reference period will be counted as employed. As such the main impact may be felt in the private payrolls component as a result of jobs contingent on Federal contracts, alongside the unemployment rate due to employees who stayed home during the shutdown. ING expects slower payroll growth in 2019 vs. 2018 because of “fading support from the fiscal stimulus, lagged effects of higher interest rates and the strong dollar plus ongoing fears about trade protectionism at a time of weaker external demand”. These analysts also cite a nearterm lack of availability of workers to employ, as evidence by the NFIB reporting that 39% of US small businesses have vacancies that they cannot fill. As such they expect payroll growth of 140k.

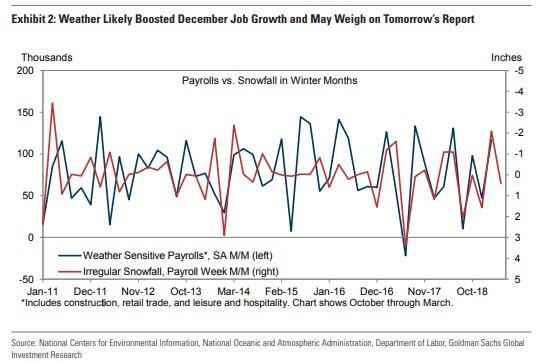

While weather likely contributed to the 312k December gain, Goldman expects only a partial payback tomorrow (of around 10-25k), as January was also relatively warm and dry during the reference week. In terms of the impact of the partial government shutdown, the BLS has clarified that furloughed and unpaid government workers will be included in tomorrow’s payroll counts.

Arguing for a stronger report:

- Jobless claims. Initial jobless claims edged lower on net over the four weeks between the payroll reference periods (averaging 221k vs. 223k in the December payroll month). While initial claims rebounded sharply in today’s report, this increase occurred after the January payroll month, and it also followed a 49-year low in the previous week. Given this and the possibility that seasonal distortions related to the Martin Luther King holiday affected the data, we continue to believe that the pace of layoff activity remains low (albeit somewhat higher than in the early fall).

- Labor supply constraints. Historically, labor supply constraints are less likely to bind in January, perhaps reflecting the relatively low hiring rates (and high layoff rates) in that month of the year. January first-print private payrolls have accelerated relative to the previous months in 4 of the last 5 tight-labor-market years—defined as years in which the employment gap (NAIRU minus the unemployment rate) is already positive in the first quarter.1 And as shown in Exhibit 1, job growth on average peaks in January of those years.

- ADP. The payroll-processing firm ADP reported a 213k increase in January private payroll employment—32k above consensus and just above its average pace over the prior six months (+205k). While the inputs to the ADP model likely contributed to the strength, the ADP report suggests that the pace of job growth remained solid at the start of the year.

Arguing for a weaker report:

- Service-sector surveys. Service-sector business surveys were generally soft in January. Similarly, the employment component to Goldman’s non-manufacturing survey tracker declined to a 27-month low (-1.4pt to 52.3). Service-sector job growth rose 227k in December and averaged 164k over the last six months.

- Winter weather. Last month’s blockbuster payroll report likely received a boost from mild winter weather of around 75k. However, some of this reflected the unwind of a sizeable drag in November. Additionally, January weather has been warmer than usual, and our population-weighted snowfall series was slightly below average during the January payroll reference week (see chart below). Taken together, we expect the net effect of weather on January payroll growth will be a small or moderate drag (perhaps between -10k and -25k).

- Government Shutdown. We expect only a modest drag from the partial government shutdown on payroll growth. The BLS clarified that the roughly 800k furloughed and unpaid federal workers will be included in the January payroll counts (in the establishment survey). However, we still see scope for a modest drag on federal hiring (we expect unchanged government payrolls mom sa) and on government contractor employment in the private sector (a possible drag on the information and business services categories)

FED: With the Fed reaffirming its data dependent stance, and the market jitters noted in December extending their reverberations into the new year enough to see the Fed fall back into neutral gear, the labour market release this time round will have magnified focus as the now-rectified Government shutdown has furloughed the market of both hard data and Government workers. ING believes that “any slowdown in jobs growth this month is as much due to a lack of available workers as it is to a slowdown in hiring intentions after a bumper end to 2018”. Whilst payroll additions are seen moderating from the astronomical print of 312k in January, ING has additionally quoted wage growth as a key take away from the report. They note that “wage pressures [are] clearly ris[ing] in the US with the annual rate of pay growth running at 3.2%” and believe that this will continue to climb “given the intense competition to find suitable workers when unemployment is at multi-decade lows”.

JOBLESS CLAIMS: Claims fell to 216k against a consensus 233k within the relevant survey period, whilst the four-week average rose marginally to 221,750. Analysts at SocGen suggested that the claims figure might have been even lower had the US government shutdown not played a role as around 380k of the 800k workers furloughed by the US government shutdown became eligible to submit jobless claims, suggesting a strong labour market. Whilst not reflected in the upcoming labour market report, this effect has only been exacerbated in the following weeks, with suggestions of a slowing labour market stoked by the 1 ½ year high print of 253k (vs. Exp. 215k) in the latest report.

ADP PAYROLLS: ADP reported 213k nonfarm payrolls additions, beating expectations of 178k, which Moody’s Zandi cited as evidence of the “job market weather[ing] the government shutdown well. Despite the severe disruptions, businesses continued to add aggressively to their payrolls”. Analysts at Pantheon Macroeconomics digested this print as “inevitable” and a “healthy-looking gain”. It did note, however that ADP likely overstates the official NFP print as ADP is generated by “a model which incorporates lagged official data”. Pantheon added that it “can’t say for sure how big this effect was, because ADP does not release its model”, and given the small error in their ADP forecast (220k) they have left their 180k prediction for NFP unchanged as “labor demand remains extremely strong, despite the pressure on the manufacturing sector from China’s slowdown and the trade war; manufacturing accounts for only 8.4% of U.S. payrolls”.

BUSINESS SURVEYS At the ISM Manufacturing release in January, the employment subcomponent fell 2.2ppts to 56.2 from 58.4 with ISM noting that “employment continued to expand, supporting production growth, but at the lowest expansion levels since June 2018, when the index registered 56 percent”. In a reaction to the data release analysts at Pantheon warned that the figure could fall much further without a rebound in new orders. The non-manufacturing release also saw a similar decline in January, with a fall of 2.1ppts to 56.3 to its lowest point since July 2018 and comments from respondents stating they were “adding staff to address growing orders” alongside noting that whilst capacity constraints have lessened, employment-resource challenges remain.

JOB CUTS: Challenger reported US employers had announced 52.988k in January an increase of 9.104k on a monthly basis and above the three-month average of 45k. Challenger Gray & Christmas noted that “Employers are continuing the trend of reducing staff that we saw in the fourth quarter of last year, as several industries pivot to emerging technologies. Companies are battling economic uncertainty and, while consumer confidence was high, consumer spending missed estimates at major retailers during the holiday season”. The retail sector led the pack in job cuts with 22,327, with them noting “Retail is going through a transformation that may cost many jobs, but is also creating many jobs” after Gymboree’s plan to liquidate their stores in the US and Canada.

via ZeroHedge News http://bit.ly/2DPzYL1 Tyler Durden