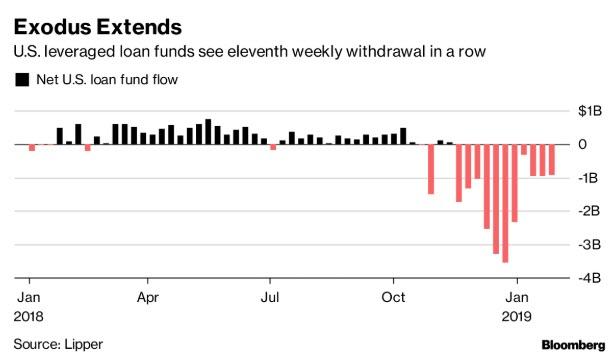

While credit spread and leveraged loan prices rebounded sharply in the past month, the pain for leveraged loan funds has continued with another $935 million in outflows in the week ended Jan. 30, extending the losing streak to 11 weeks. According to Lipper, $718 million was pulled from mutual funds and $216 million from ETFs. In total, investors have pulled $3.15 billion from the funds year-to-date.

This week’s exodus is the latest in a string of outflows for leveraged loan funds which started in mid-November, and which included four of the biggest weekly withdrawals on record. The 11 week stretch of outflows is the longest such streak since 2017 according to Bloomberg data.

While in recent years loan funds saw persistent inflows on expectation of rising interest rates, this has now changed with the Fed’s tightening phase now largely seen as over and the market expecting the next move from the Fed to be a rate cut.

The leveraged loan market was slammed by four record-setting outflows in December, as existing loan prices plunged sharply to a more than two year low and some liquid names fell multiple points as the market was, on occasion, bidless. While the moderation of fund outflows from December’s records has allowed the loan market to stabilize in January, the continuous run has hamstrung the recovery. While the S&P/LSTA Leveraged Loan Index is returning 2.6 percent this month, most of the gain came in the first six sessions.

And, as Bloomberg notes, with the stabilization in prices, the capital market machine has revved back into gear. Even though the volume is slighter lower than January 2018, new loan launches hiked to $32.8 billion this month, with new money making up the bulk. CLOs, the largest buyer of loans whose purchases ground to a halt in December, have also seen new issuance come back.

Even so, some new deals struggled to attract enough buyers, forcing some banks to fund underwritten deals themselves or push syndication to 2019. In fact, as Bloomberg reported earlier today, private equity giant Apollo let some of its lenders off the hook as it agreed, or rather was forced to put up more equity to close its acquisition of a $1 billion portfolio of energy-related investments from General Electric.

The PE firm had to rely on additional equity contributions from outside investors and some of its own partners to replace a $275 million loan that a group of lenders led by Royal Bank of Canada had failed to syndicate. The partially failed deal highlights how private equity firms have been making some concessions to help banks clear a pipeline of unsold loans that grew to over $3.6 billion when investors pulled back from risky investments at the end of last year.

A similar approach was taken by CVC Capital Partners, which agreed to contribute more equity to allow its buyout of ConvergeOne to close this month, Bloomberg previously reported. CVC’s banks, however, are still stuck with over $1 billion of unsold loans for that deal. As we reported previously, Royal Bank of Canada, Goldman Sachs Group Inc. and Bank of Montreal had agreed to provide debt financing for Apollo’s acquisition, which was announced in October. They were forced to fund the loans before the new equity injection came in.

via ZeroHedge News http://bit.ly/2WyrMpV Tyler Durden