What made The Fed stomp on the brakes and slam the monetary trajectory into reverse so fast? Probably nothing!!

China’s stock markets were levitated late Thursday, early Friday (after The Fed) back into the green for Shanghai Composite (tech heavy indices underperformed)…

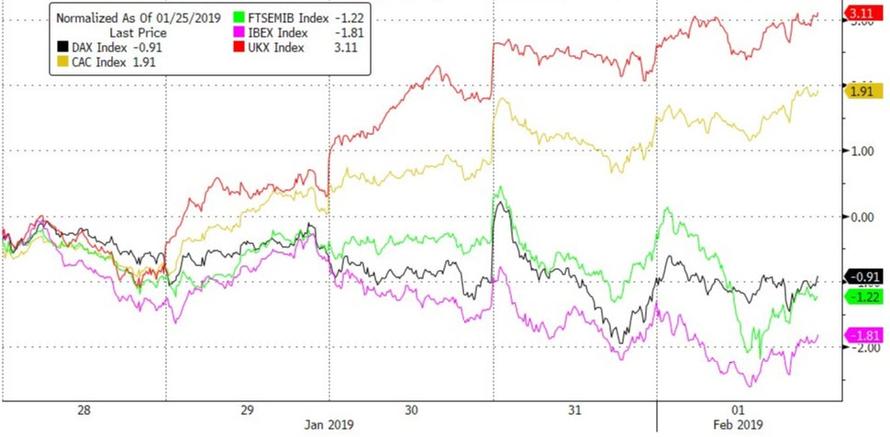

A Mixed week too in Europe with UK’s FTSE outperforming and Spain and Italy underperforming…

No “mix” for US stocks – they are all green. Trannies were best on the week with the rest of the majors holding around the same gains (Dow up 6 straight weeks)

S&P, Dow, and Small Caps all lifted into the close to end green but Nasdaq ended red (Thanks to AMZN)

Futures show today a little better – the surge on payrolls and again on ISM then fade from the European close…

The major US equity indices all stalled at the 100DMA…

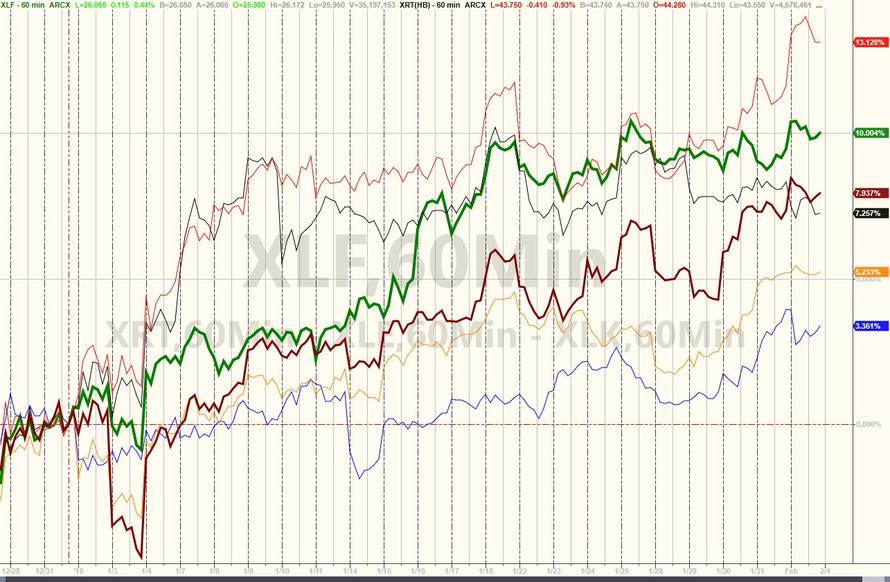

Energy, Financials, and Tech continue to lead the market this year, though financials underperformed on the week…

AMZN spoiled the party this week (down for 2 straight weeks, back into bear market)…and is unchanged since Jan 7th…

VIX tumbled to a 16 handle and credit spreads crashed in the week…

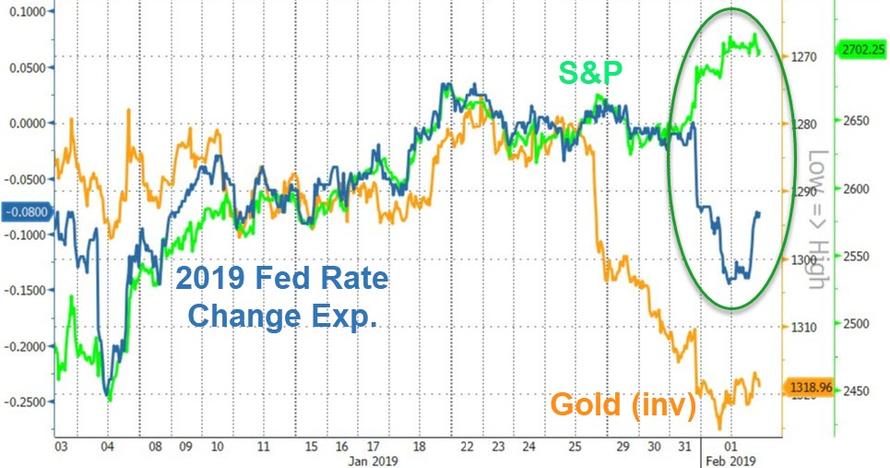

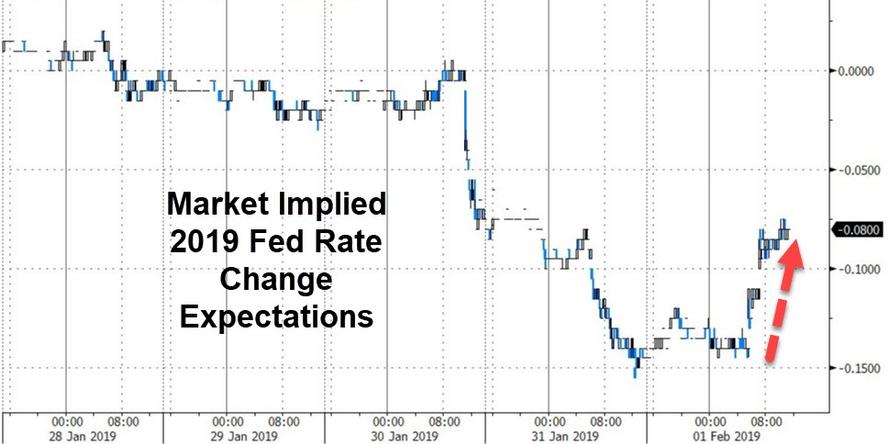

As the Fed’s implied easing plunged…

Treasury yields tumbled on the week after The Fed but rose today after good payrolls/ISM data…

This was the biggest yield drop for 2Y since 2018… sending the curve notably steeper… (though hitting resistance once again)

And the market shifted more hawkish on the day after the “good” data…

The Dollar plummeted after The Fed flip-flop and only rebounded around half of the loss after good data today…

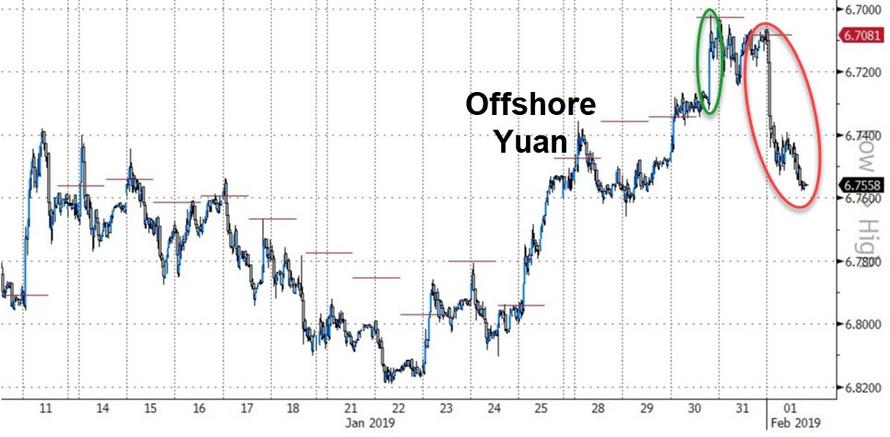

Yuan was practically unchanged on the week after a big roller-coaster run higher then lower…

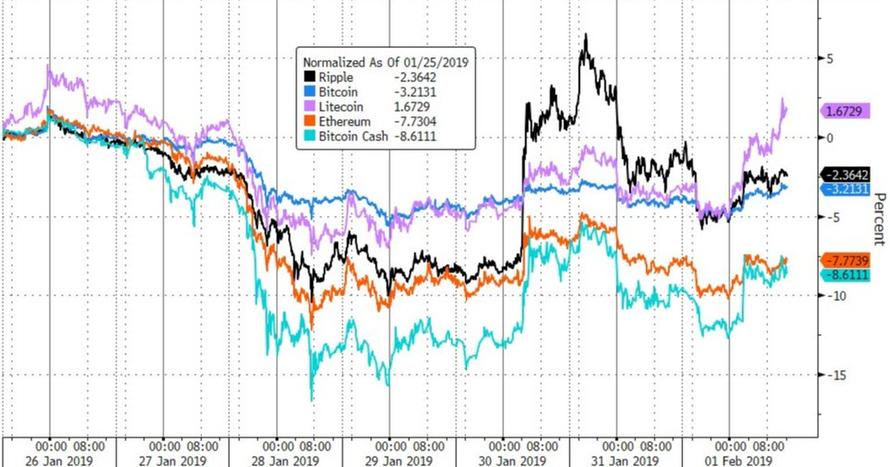

Litecoin managed to rally on the week but the rest of the major cryptos continued their slide…

Commodities are higher across the board this week, led by WTI…

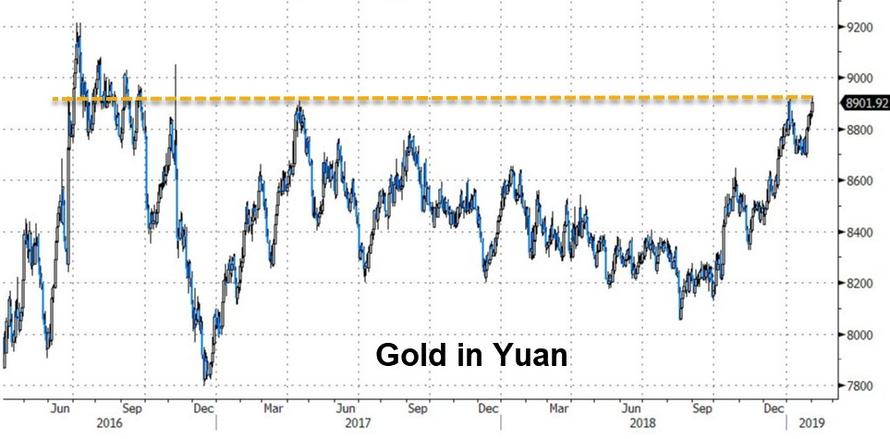

Gold had a second good week in a row – closing at the highest since May 2018…

And against the Yuan, surged back to early Jan highs…

WTI rose to its highest since November, back above $55…

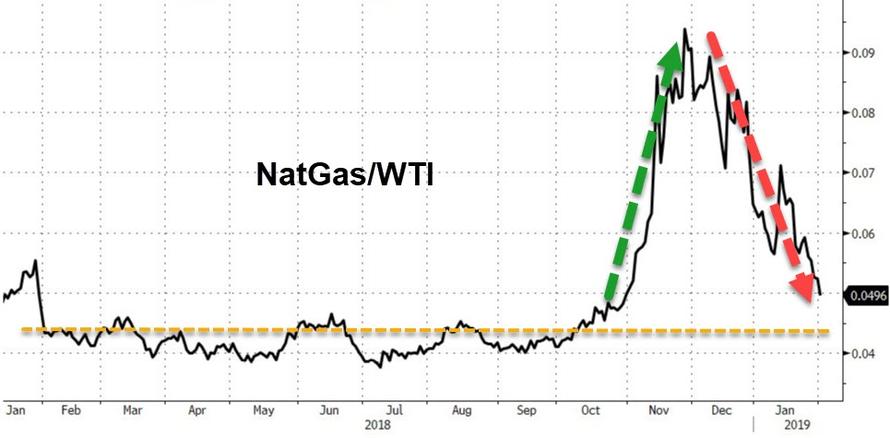

And the coldest week on record prompted a big sell-off in NatGas…

As The Nattie/WTI ratio continues to re-normalize…

Finally, we note that while macro surprises have exploded today (thanks to payrolls), earnings expectations continue to tumble (to six month lows)…

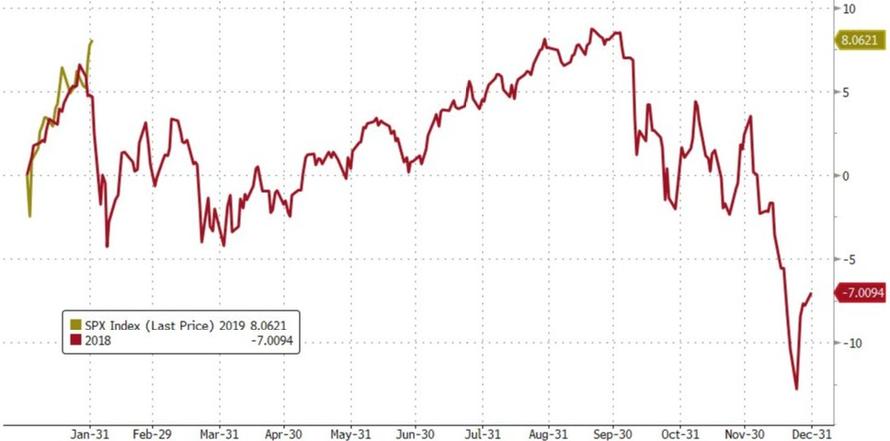

Let’s just hope its not 2018 deja vu all over again…

And remember what is driving all this exuberance in stocks…

via ZeroHedge News http://bit.ly/2Gnh4gr Tyler Durden