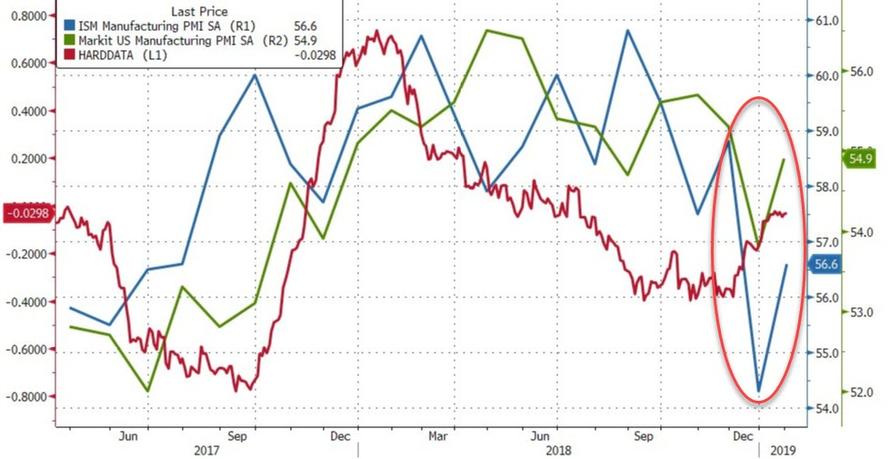

With European, Japanese, and Chinese manufacturing PMIs plunging, all eyes are on today’s ISM and Markit manufacturing data (after ADP reported the greatest surge in manufacturing jobs since 1968) as the latter confirmed its Flash print, rebounding to 54.9 – against the global trend…

Below the surface of the Manufacturing PMI, however, it was not all sunshine and unicorns as new export order growth slumped but overall it seems the government shutdown did not affect survey respondents’ sentiment at all as business confidence rebounded notably.

Chris Williamson, Chief Business Economist at IHS Markit said:

“January saw US manufacturers start the year with renewed vigour. Production rose at a markedly increased rate, commensurate with the factory sector contributing to robust economic growth of approximately 2.5% in the first quarter if such momentum can be sustained in coming months.

“Other encouraging signs included an improved rate of job creation and increased purchasing of inputs, suggesting firms are in the mood for expanding capacity.

“The upturn in business activity in January helped lift confidence in the outlook, though many companies clearly remain concerned about the impact of trade wars and rising protectionism.

“Domestic markets provided the main source of new work for manufacturers, offsetting a near-stalling of export trade, the latter linked to subdued demand for US goods in foreign markets.

“Although higher than December, the overall rise in new orders was the second-lowest since last August, hinting at a slight cooling of demand growth in recent months which served to keep the headline PMI below the average recorded last year.”

It seems, from the first chart above, that perhaps US sentiment is on a lag to the rest of the world – remember there is no decoupling.

And after December’s plunge in ISM Manufacturing data, expectations were for no bounce, but like Markit’s PMI, ISM rebounded from an upwardly revised 54.3 to 56.6 in January…

…as New Orders soared as prices paid and employment slipped…

ISM respondents are notably les ebullient than the headline projects:

“Unlike in the last few years, we are experiencing a first quarter slowdown.” (Paper Products)

“Overall, business continues to be good; however, margins are being squeezed.” (Transportation Equipment)

“Concerns about oil prices are fueling questions of how strong the economy will be the first half of 2019.” (Chemical Products)

“We continue to enjoy the benefits of a strong general economy. We are busy and maintain a backlog of sales orders.” (Machinery) . We are busy and maintain a backlog of sales orders.” (Machinery)

“Business conditions are good, and our demand and production are tracking to our forecasted growth levels for the year. (Miscellaneous Manufacturing)

“Going to be a very strong spring. Business levels will be just as good [compared to] the same time frame in 2018.” (Fabricated Metal Products)

“Sales nationally appear to be on target for 2019 and slightly ahead of 2018.” (Nonmetallic Mineral Products)

Mixed enough for everyone to be happy.

via ZeroHedge News http://bit.ly/2RzcLjU Tyler Durden