Several days ago, the ECB sparked the ire of pretty much anyone with a working frontal cortext when it made the indefensible claim that, drumroll, QE had helped reduce inequality.

ECB asset purchases have reduced inequality in the eurozone, our research shows. They have especially benefited low-income households, which suffer the most from unemployment. Full Research Bulletin here https://t.co/MlMQO2BXxK pic.twitter.com/4DtpcOsqms

— European Central Bank (@ecb) January 30, 2019

That’s right, reduce. The central claims are: (1) by lowering unemployment at the lower end of the socio-economic ladder, QE put money in people’s pockets; (2) higher stock prices didn’t have any influence on wealth inequality; and (3) higher house prices helped to reduce inequality.

Rabobank’s Michael Every had the best response to the idiotic argument, claiming he could hear the stunned silence: “That’s wonderfully convenient for the ECB, and for Davos Man, as the 2019 WEF started by warning of the need to look after “the losers of globalisation” and to refocus its moral mission – and then failed to provide a single proposal for how we do that, again, switching the topic to climate change and hoping we wouldn’t notice because it’s so serious a topic. Yet now there is a cure for global inequality – more QE!

At first reading I thought that these ECB results were the kind of start-with-your-conclusion-and-work-backwards, pick-and-mix, pseudo-scientific gibberish that I have come to expect from the same central bank economic research teams who didn’t see the GFC coming, expect to have to do QE after the GFC, didn’t see the new normal coming, didn’t see populism coming, and now don’t understand that QT (in the US) causes a market meltdown. However, I was too generous.

It’s not that the ECB can’t prove QE helped reduce unemployment; or that the jobs created are widely accepted as being low paid; or that the ECB’s survey data covers just four of the Eurozone’s diverse members; or that it is insane to argue nobody gets richer from rising equities; or that rising house prices, and rents, must mean inequality for those who don’t own houses. It’s because on closer examination, the authors are not Useful Idiots. They are shills.

The give-away is that at the end of the accompanying video explaining why the ECB has reduced inequality there are two piles of graphic money. The smaller one, lower-income households, grows. (Yay!) The larger one, richer households, shrinks as if the rich are getting less money in some kind of tax redistribution mechanism. (Yay!) That is objectively not true. Yet it’s what they want viewers to see. That is the kind of spin you’d associate with a populist politician. As my colleague Christian Lawrence quipped after I shared the video with him, “Next the ECB will be telling us negative interest rates help the homeless.”

We were not the only ones to feel that way. The responses on Twitter were a flood of very angry rebuttals. Indeed, I don’t think the ECB realises just what a stupid mistake it has made. It is never a good thing to be spotted as a shill: crowds tend to get angry. Worse, the ECB have made a (false) economic case that QE helps inequality, when actually it exacerbates it. That means when we do more QE people will be expecting to see greater equality and will get the opposite – again, the crowd will get nasty. The ECB have also opened the door to those same angry populists to say “If your QE can reduce inequality slightly, imagine what our kind of QE could do!” – and what intellectual defence could the ECB mount? “You can’t do that – it’s…too effective(?)”

To be sure, just hours after the ECB’s claim, none other than Oaktree’s Howard Marks smacked down this unprecedented stupidity, when in response to a CNBC question whether Fed’s policies have exacerbated wealth inequality, Marks said:

Well clearly they have. It’s been a — exacerbate makes it sound like they shouldn’t have done it. They did to get us out of the global financial crisis what they had to do. A side effect of that was asset inflation which, of course, only benefited the people who own assets and that has created a widening of the net worth gulf.

So no, QE did not help reduce inequality: on the contrary it made inequality reach unprecedented proportions, resulting in the populist, anti-establishment movement sweeping across Europe… oh, and Brexit in the UK and Trump in the US. But the nuance was not lost on observers, who noted that by making this claim, the QE was merely launching a trial balloon and setting the stage for even more wonderful, noble QE.

And in keeping with carefully phrased trial balloons, earlier today the San Francisco Fed, best known for wasting millions in taxpayer funds on research to overturn what is blatantly obvious even to five year olds, released what may be the next, even more critical trial balloon, asking “How Much Could Negative Rates Have Helped the Recovery?” and finding, surprise, that it would have helped by quite a bit.

As a reminder, unlike Europe or Switzerland, where deposit rates have been negative for years, the US central bank is generally perceived as not having a mandate to take rates below the “lower bound” or negative, i.e. to implement what is affectionately known as “NIRP.”

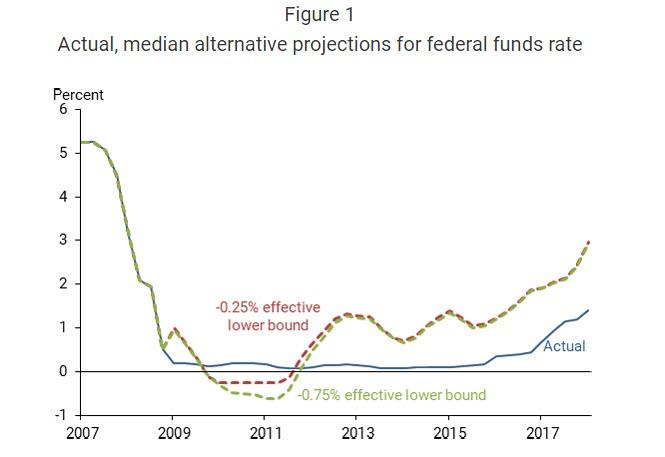

And yet, according to the San Fran Fed this is a mistake, because research from San Fran Fed’s Vasco Curdia, “allowing the federal funds rate to drop below zero may have reduced the depth of the recession and enabled the economy to return more quickly to its full potential. It also may have allowed inflation to rise faster toward the Fed’s 2% target. In other words, negative interest rates may be a useful tool to promote the Fed’s dual mandate.“

While the report engages in the type of tortured, goalseeked analysis that we have grown to “love” from central banks for the past decade, the same central banks who did not anticipate that their disastrous bubble-blowing policies would result in the financial crisis of 2008 (which last we checked, has not been blamed on Putin just yet), and presents the following chart to confirm that, indeed, if only the Fed had cut rates to -0.75%, the recovery would have magically been far stronger…

… and even though the author at least tangentially admits he could be dead wrong…

Like any statistical and economic model, these estimates are only as good as the model. This model is a simple representation and is not guaranteed to accurately mimic outcomes in the complex U.S. economy. Thus, these results should be viewed as an estimate to illustrate how much stimulus negative rates can provide, although the exact numbers are not definitive.

Furthermore, the analysis assumes that the effects on the economy from interest rate changes are largely unchanged in the event of a negative rate. However, setting a negative interest rate could trigger people to save less and search for alternative ways to invest their money, potentially circumventing the negative rate. In this case, a negative interest rate would be less stimulative than my analysis suggests.

… the conclusion is that NIRP is precisely what the (econ) PhD(octor) should have ordered:

This Letter quantitatively evaluates the beneficial impact a negative Fed policy rate could have had during the recovery from the Great Recession. While it’s difficult to capture all the complexities of the economy in a model, this analysis suggests that negative rates could have mitigated the depth of the recession and sped up the recovery, though they would have had little effect on economic activity beyond 2014. The analysis also shows that the interest rate does not have to fall too deeply into negative territory to accomplish meaningful economic improvements.

In short, NIRP would have made the recession shorter and less acute according to the San Francisco Fed, and since there is nobody would can argue the counterfactual, we now have “research” that sets the framework for what happens next.

Needless to say, the implication of this report is troubling because what it suggests is that, in a tortured trial balloon just like that launched by the ECB last week according to which the next QE-driven downturn can only be solved with even more QE, so the US Federal Reserve system now has a blueprint for how to handle the next economic recession/depression, and – simply said – it will involve NIRP.

Here once can extrapolate what Rabobank’s Every said last week, when he concluded that he doesn’t think “the ECB realises just what a stupid mistake it has made. It is never a good thing to be spotted as a shill: crowds tend to get angry. Worse, the ECB have made a (false) economic case that QE helps inequality, when actually it exacerbates it. That means when we do more QE people will be expecting to see greater equality and will get the opposite – again, the crowd will get nasty.“

Now replace the above with Fed instead of ECB and NIRP instead of QE and you can see where this is heading… and for those who can’t, the answer is simple: there is now a green light to use not only more QE during the next recession, something which Powell already hinted at last week with his shocking dovish reversal, but to go all the way and drag rates negative, ignoring the fact that despite NIRP and QE currently in place, i.e., all of its monetary policy ammo, Europe’s economy is once again on the verge of a recession.

And since we know what will happen when the next recession strikes, we also can extrapolate what happens when neither QE nor NIRP succeed in restoring economic growth as both the ECB and Fed have now promised: as Rabobank summarized “That means when we do more QE people will be expecting to see greater equality and will get the opposite – again, the crowd will get nasty.“

We can’t wait to see the analysis the world’s central banks will use in several years to explain why, in agreement with Paul Krugman, civil (and no so civil) war is actually quite beneficial to GDP growth.

via ZeroHedge News http://bit.ly/2BgeuoU Tyler Durden