Everything is awesome, right? (just don’t pay attention to bonds, gold, or the dollar)…

Well it had to be higher on SOTU day…

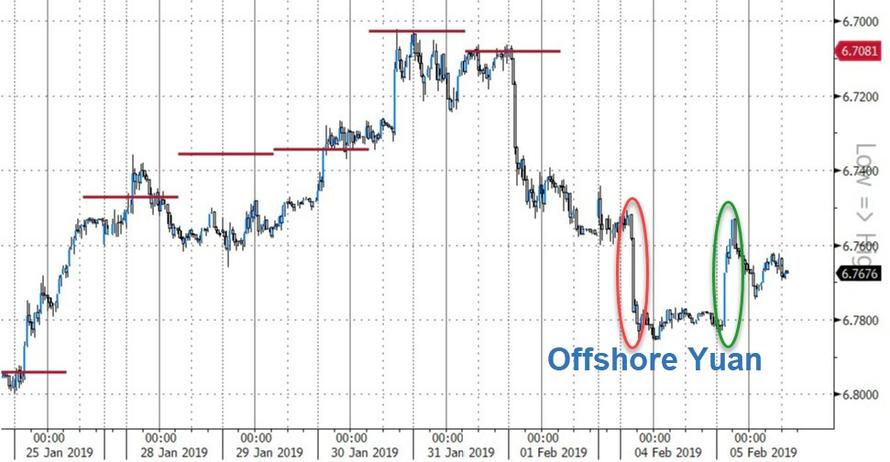

Chinese equity markets remain closed for the lunar new year holiday but yuan surged overnight – erasing the plunge from the day before…

European equity markets soared, playing catch up to US markets’ ramp and continued into the close (wth FTSE 100 outperforming)…

US equities rampaged higher at the cash open once again, but dipped notably shortly after EU closed.

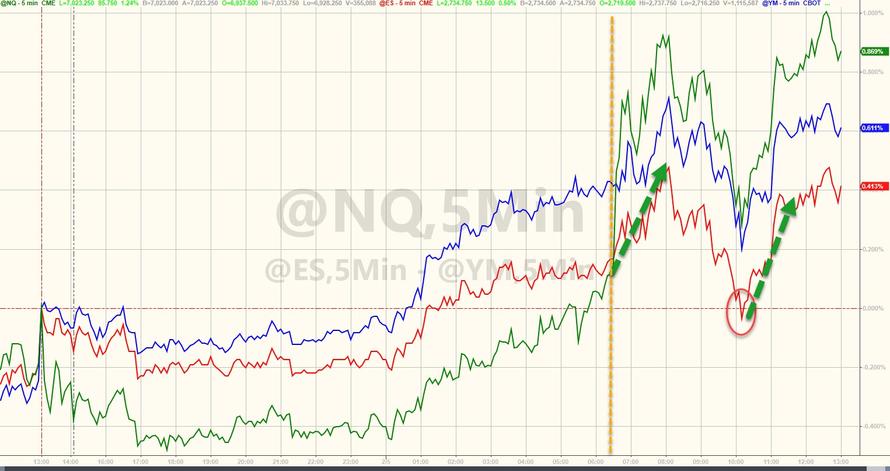

On the cash side, Nasdaq outperformed thanks to a rebound in GOOGL…

Today was a double-rainbow day – two short-squeezes for the price of one…

The S&P was unable to break its 200DMA…

US Equity market breadth is extreme to say the least and stocks are “overbought”…

Nasdaq is the most overbought since its highs in August…

But it seems the Buy-The-Afternoon-Dip trade just won’t stop…

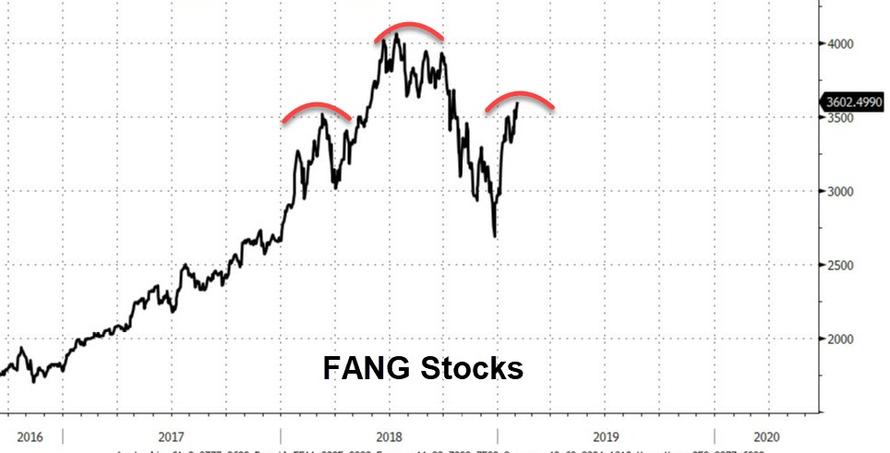

FANG Stocks soared again but some are wondering if a head-and-shoulders is forming…

VIX collapse continues (back to a 15 handle), likewise, credit spread compression charges on…

Despite the equity market gains, bonds were also bid today…

Notably 10Y was bid off the pre-Powell highs…

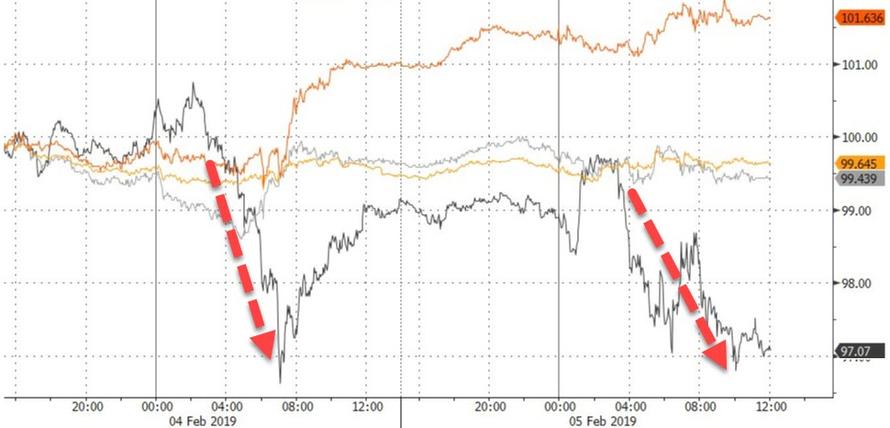

The dollar index lifted modestly, but remains stuck around the pre-FOMC highs range…

Cryptos went nowhere fast…

Copper continues to rise but crude tumbled for the 2nd day in a row…PMs flatlined.

Copper is now at its highest since late November…

Gold bounced after erasing its post-Powell gains…

After trading tick for tick, WTI and Stocks decoupled today…

And before we leave commodities, we note the collapse in the Baltic Dry Index (global trade?) is now the worst start to a year since 2012…

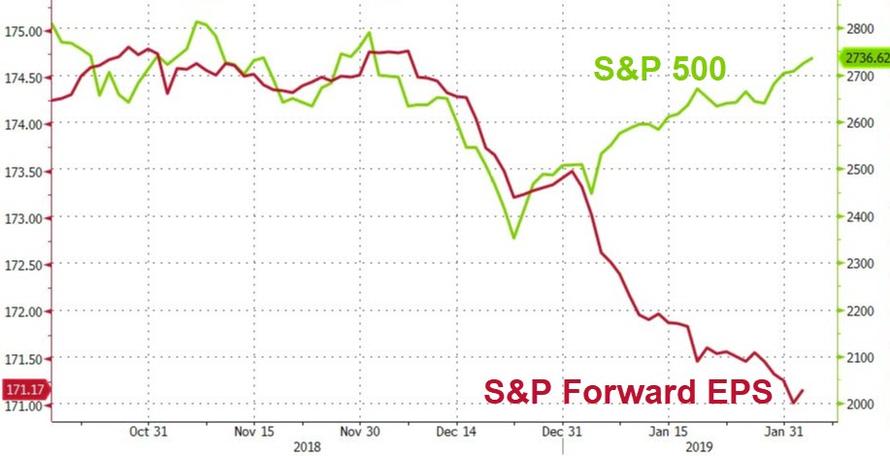

Finally, this is the best start to a year for the S&P 500 since 1987 and worst start for Earnings expectations in three years…

And don’t forget – The stock market is up 100% of the time on the day after Trump and Powell share a steak

Since Powell backtracked and the PBOC stepped up liquidity injections, global money supply has roundtripped to March 18 levels.

Forget earnings or macro. This is why markets have rallied. pic.twitter.com/ANxj0EcdD1

— Daniel Lacalle (@dlacalle_IA) February 5, 2019

via ZeroHedge News http://bit.ly/2RDkwp2 Tyler Durden