Heading into 2019 with the ECB’s sovereign debt QE ending, there was a question who would buy Italian debt at a time when the biggest buyer of Italian debt in the past two years, Mario Draghi, had stepped away. The answer, it appears, is everyone.

On Wednesday, Italy priced €8 billion euros ($9.1 billion) of 30 Year bonds in its second syndicated sovereign sale this year, as investor appetite is appears to only be growing following the record-breaking deal just three weeks ago.

Not only was the total orderbook the largest on record, with demand for the 30Y paper surpassing €41 billion, but coming in at over 5x oversubscribed, today’s offering was even stronger than January’s sale of €10 billion in 10Y notes which saw a total of €46.5 billion in demand. Confirming the demand frenzy, the September 2049 notes priced at 18 bps above benchmark rates, as much as four basis points tighter than the initial price target.

Today’s record oversubscribed offering came even as the European Commission was said to slash Italy’s 2019 growth forecast to a fraction above recession, or 0.2%, from 1.2%. This also means that the Italian budget deficit, the source of so much consternation heading into 2019, will indeed be far greater than what is generally accepted due to the lack of growth which will have to be made up with, you guessed it, even more debt.

As Bloomberg notes, Italy aims to raise about €250 billion of debt this year, a number which until recently was seen as insurmountable with the ECB out of the picture, and Rome has rushed back into the bond market to take advantage of calm financial conditions and a declining risks that the Fed will raise interest rates which in turn is stoking demand for high-grade debt and yield. Austria, Belgium and Finland all got record syndicated orderbooks in recent weeks. Even Greece had no problem offering a medium-term note.

Italy’s rapid return “speaks volumes about the current attractive backdrop for issuers,” said Commerzbank rates strategist Rainer Guntermann, who added that Italy is set “to front-load as much funding as possible as uncertainties from politics or central banks may be looming later in the year.”

To be sure, one month after the best return for junk and IG bonds in years, coupled with record trading volumes, demand for fixed-income paper has been scorching. Just a few days earlier, Japan received the strongest response for a 10-year offering in 13 years, while even serial defaulter Ecuador managed to sell $1 billion in new debt without a glitch. Most remarkably perhaps, a recent €2.5BN Greek bond offering was four times oversubscribed.

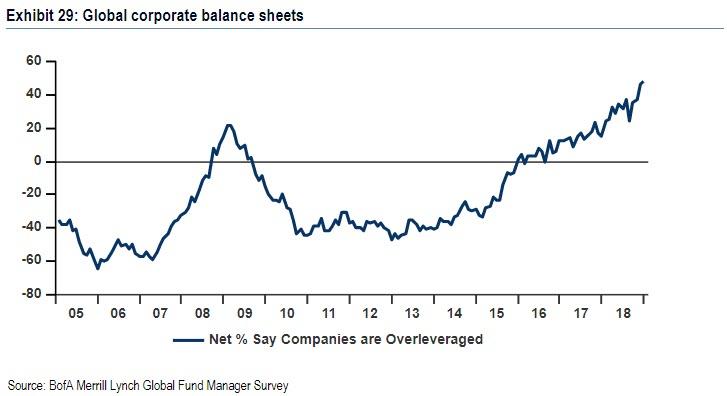

The biggest irony: this renewed scramble for fixed income, both corporate and sovereign, comes even as BofA’s latest fund manager survey found that a record number of respondents were worried that companies are overleveraged. Apparently that “fear” was only an issue as long they didn’t have to chase their competitors into this extremely risk asset class.

Indeed, 2019 has seen a stark reversal in investor sentiment toward debt: whereas in 2018 Italian bonds plunged, and were one of the worst performing asset classes, Italian debt notched up a third month of gains in January, lifted by thawing political risk and diminishing investor conviction that the ECB will be able to increase interest rates this year. In other words, bad news for the economy is once again great news for investors.

This is manifesting in bond prices and yields, which in the case of Italy’s 10Y bonds, have tumbled from 3.3% in October to just shy of 2.50% today.

And whereas we would note that today’s record auction comes just days after Italy – which has the largest stock of debt in Europe at $1.7 trillion – officially entered a technical recession for the first time since 2013, following two quarters of GDP declines, we are once again in the phase of the market cycle where all fundamentals are ignored by markets which are instead focusing solely on what central banks do next.

Another risk ignored by the market: relations between the two ruling parties – the League and the Five Star Movement – have been fraught, raising the possibility of early elections.

“It’s a lot of duration supply in a short period of time,” said Pooja Kumra, Toronto-Dominion European rates strategist. “Clearly the treasury wants to pre-fund as much as it can in this low-yield environment.”

For now the market is more than happy to comply with this decision.

via ZeroHedge News http://bit.ly/2BpPxY6 Tyler Durden