The Bank of England kept its rates on hold at 0.75%, as expected, in a unanimous decision despite rumors of a hawkish dissenter.

We have kept interest rates at 0.75%. Find out why in our visual summary: https://t.co/jXRdChLwsM #InflationReport pic.twitter.com/LyDNKvu3sX

— Bank of England (@bankofengland) February 7, 2019

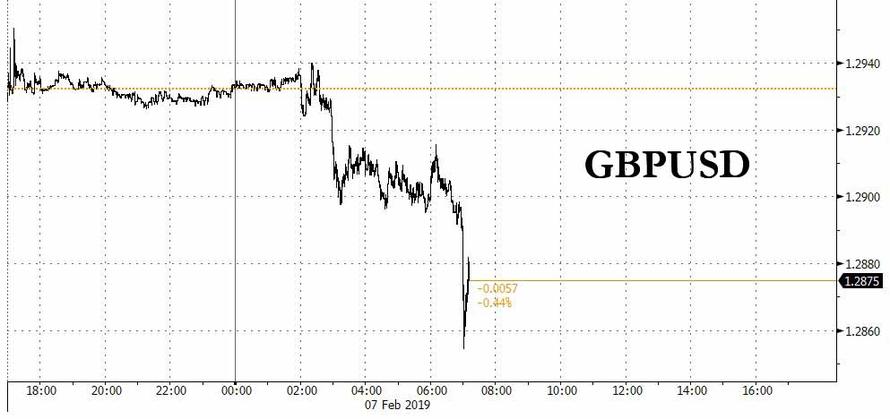

However, the reason why pound plunged following the report is that the central bank joined the Fed and other central banks, in retreating from plans for multiple interest rate rises as it downgraded its economic outlook amid mounting Brexit uncertainty and slowing global growth.

With the March 29 deadline to leave the EU and no Brexit deal yet concluded which has depressed spending and confidence, the BOE said that “uncertainty had intensified,” and now forecasts 1.2% growth this year, down from 1.7% predicted three months ago, the biggest downgrade since the 2016 referendum according to Bloomberg. The global backdrop has also weakened, as highlighted in the European Commission’s sweeping cuts to the euro-area economic outlook on Thursday.

The messaging was clearly negative, even as potential growth offsets the debate around slack in the economy, meaning less growth is required for inflation; so while the report was not unequivocally dovish, the GBP tumbled on the release, with the 10Y gilt now down at 1.1650.

The BOE’s decision follows recent dovish statements from the U.S. Federal Reserve and European Central Bank. U.K. officials noted the impact of China’s slowdown and said trade wasn’t contributing as much to growth as they expected.

The forecasts came alongside the latest policy decision by the Monetary Policy Committee, led by Governor Mark Carney. It voted 9-0 to hold the key interest rate at 0.75 percent, as predicted by all economists in a Bloomberg survey. The bank last lifted the rate in August.

Some details from the report:

- With the final Brexit terms still unresolved, the BOE said that its forecasts would need to be updated “once greater clarity emerged about the nature of EU withdrawal.” Acknowledging the huge impact of uncertainty, it ran an analysis showing that less uncertainty would lead to much stronger growth – 1.6% this year and 2.2% in 2020.

- Assuming a smooth Brexit, policy makers reiterated that limited and gradual rate increases will be necessary. Nevertheless, the forecasts suggested that just one more quarter-point hike would be needed in the next three years to return inflation to close to the 2 percent target, down from almost three hikes seen in November.

- The MPC also cut their prediction for business investment to a 2.75% drop this year, having previously forecast a +2% increase.

- Why Brexit outcomes are so important: On GBP, the MPC highlighted that their forecasts are especially sensitive to moves. A 5% depreciation in GBP would lift inflation to 2.4% percent by the end of 2021, versus 2.1% in the current projections – while a gain of that magnitude would drop the rate to 1.8%.

As a result, investors now see almost no chance of a quarter-point rate move by the end of the year. Furthermore, the BOE bank said that productivity is recovering more slowly than it had thought and that the supply capacity of the economy had shrunk. Officials said that potential supply growth is now a “little below” the 1.5 percent previously estimated.

The report wasn’t uniformly dovish, and in two years, the BOE sees demand outstripping supply, implying some inflationary pressure building in the economy. In the near-term, however, inflation will drop below the BOE’s 2 percent goal due to lower oil prices.

The committee also noted how sensitive its forecasts are to swings in the pound. A 5 percent depreciation in sterling would lift inflation to 2.4% by the end of 2021 versus 2.1% in the current projections, while a gain of that magnitude would drop the rate to 1.8 percent. Judging by today’s GBP drop, more inflation, or rather stagflation, may be in the cards.

via ZeroHedge News http://bit.ly/2te7bJP Tyler Durden