Fed Chairman Jerome Powell isn’t the only leader of a major central bank to capitulate to political (and market) pressure so far this year. On Thursday, RBI Gov. Shaktikanta Das during his first meeting at the helm of the bank led a 4-2 vote to cut rates after raising them twice last year.

Shaktikanta Das

Das was widely seen bowing to pressures from Prime Minister Nahrendra Modi, who is desperately trying to boost economic growth ahead of a re-election fight later this year. As one analyst at Mizuho Bank pointed out, the move risks reviving inflationary pressures in India after they had largely eased last year. Das was hastily appointed to lead the central bank in December after his predecessor quit following a very public battle over the RBI’s autonomy.

“If caught wrong-footed by higher oil, twin deficit worries and global risk aversion, the rupee may have to pay the price for monetary complacency, whether perceived or real,” says Vishnu Varathan, head of economics and strategy at Mizuho Bank Perceptions matter for India’s monetary policy, which is trying to target inflation expectations USD/INR may rise above 72.5 over the next 3-4 months; Mizuho’s view was for a prolonged hold in policy

The RBI cut its repurchase rate 25 basis points to 6.25%, a move that only 11 of 43 economists polled by Bloomberg had anticipated. The rest had expected no change.

The board also voted unanimously to switch the central bank’s policy stance to neutral from “calibrated tightening.”

Unsurprisingly, the Indian government cheered the cut, with Finance Minister Piyush Goyal tweeting that it would “give a boost to the economy, lead to affordable credit for small businesses, home buyers etc. and further boost employment opportunities,” said Indian Finance Minister Piyush Goyal in a post on Twitter.

RBI’s decision to reduce the repo rate by 25 basis point from 6.5% to 6.25% and change of stance to ‘Neutral’ will give a boost to the economy, lead to affordable credit for small businesses, homebuyers etc. and further boost employment opportunities

— Piyush Goyal (@PiyushGoyal) February 7, 2019

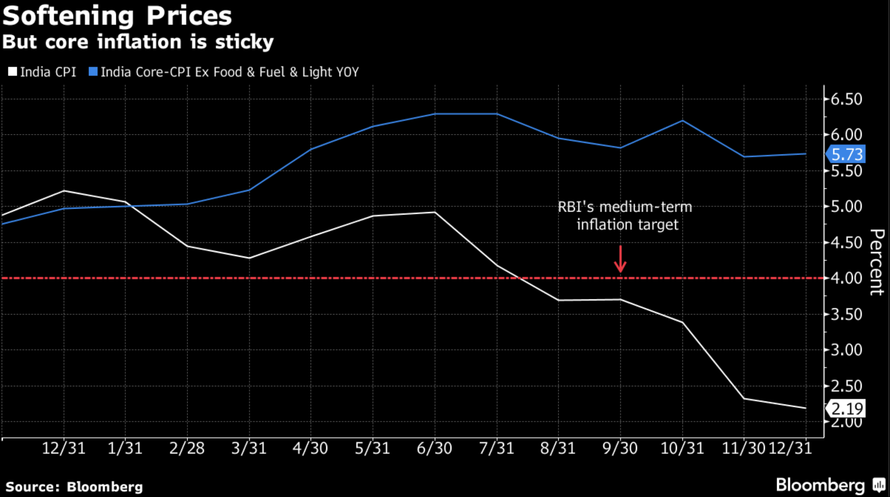

Speaking with reporters after the decision, Das said the rate cut would help bolster growth “as long as inflation remains benign.” The inflation rate slowed to an 18-month low of 2.2% in December, leaving it well below the central bank’s target of 4% (though core inflation, which excludes volatile food and fuel costs, remains closer to 6%).

“It is vital to act decisively and in a timely manner to address the objective of growth once price stability as defined in the Act is achieved,” Das told reporters in Mumbai, referring to the central bank’s inflation targeting mandate. “The shift in stance from calibrated tightening to neutral provides flexibility to address, and the room to address, sustained growth of India’s economy over the coming months as long as inflation remains benign.”

One economist said the fact that inflation “has significantly surprised on the downside” is what gave the RBI the room to cut rates. Of course, the Fed’s decision to “pause” its own rate hikes has removed some of the pressure from emerging-market central banks to keep pace with rate hikes of their own.

“The MPC will now be looking at a balance of growth and inflation rather than just focusing on inflation alone,” said Teresa John, an economist at Nirmal Bang Equities Pvt. in Mumbai. “The rate cut is also driven by the fact that inflation has significantly surprised on the downside.”

Even some developed-market central banks have started to shift, with the RBA this week moving its policy stance to ‘neutral’. And while at least one economist said the fact that veteran board members appeared to endorse the rate cut would seem to contradict the perception that the central bank’s credibility was at risk, the timing of the cut – which almost immediately followed the unveiling of an expansionary budget of $13 billion by Modi’s government – can’t be ignored.

One BBG economist said the cut shows that the central bank has “restored growth maximization” as a secondary objective of the RBI. The rupee dipped following the cut as Indian stocks moved higher – reflecting the policy shift that risks reviving inflationary pressures while boosting growth and the country’s stock market – but the moves were largely muted.

via ZeroHedge News http://bit.ly/2RIOxnu Tyler Durden