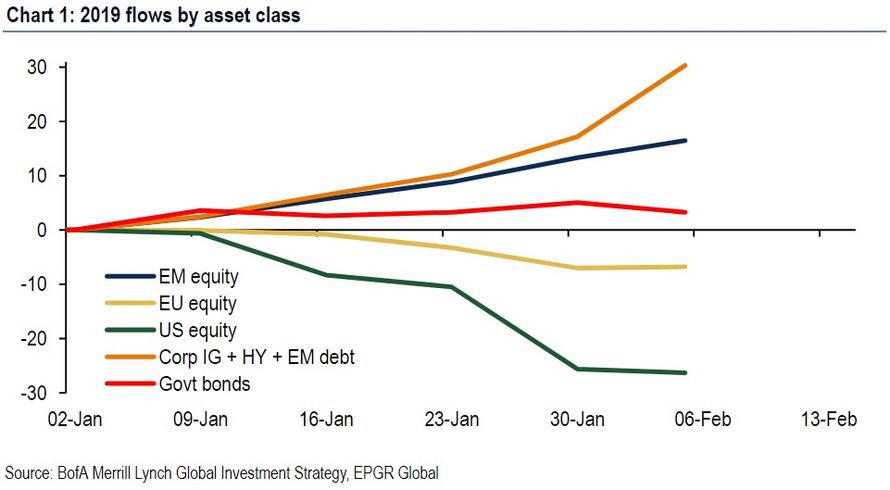

First the good news. Earlier we noted that whereas the ongoing exodus of investors remains a mystery, suggesting that the recent surge in stocks has been mostly a function of short covering and stock buybacks, something which is seen vividly in the following chart…

… BofA was confident that the bullish case will, sooner or later, push enough investors into the stock market because of, first and foremost, policy as the global central bank tightening cycle is now ending (rolling 6-month rate hike tally peaked at 33 hikes in Oct’18, now 23), while the Fed panic over a global “credit event” worked, noting that the epicenter of pain, levered loans, are now back near all time highs.

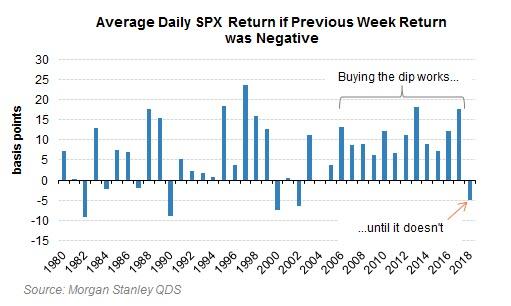

Additionally, there has been a clear shift in if not investor then algo “psychology” because what was until recently a “sell the rip” mentality, has once again mutated into “buy the dip”: according to Hartnett, in 2018 correct strategy was “sell-the-rip”, something which Morgan Stanley correctly observed first last October, however that has now changed.

Meanwhile, the key lead indicators to monitor remain SOX, XHB, KOSPI, and all signal bullish, although there is a lingering worry that the yield curve still stubbornly flat and that the breakdown in the retail XRT below the 50dma remains a tactical negative.

That covers the good news, what about the bad?

Here, Hartnett first notes that while Positioning & Policy have been investor “green lights”, Profits have not and goes on to note that “for example S&P500 EPS 12-month forecast down from around $175 in Sept to just under $170 today; multiple has expanded from 14X to 16X since the lows.”

This means that any meaningful upside to new highs in markets would require EPS downward revisions to halt on stronger global growth – which is unlikely until Q2 at earliest – or for investors to go “1999”, a play on irrational late-cycle upside.

But even more concerning than the lack of profit growth, BofA notes that “the greatest threat to EPS in the next 3 years is an acceleration of global populism via taxation, regulation & government intervention.” Meanwhile, in the next 3-6 months, populism simply means investors discount higher budget deficits (US government already spends $1 billion every 2 hours) and avoids government bonds…equities would benefit.

Of course, judging by the chart at the top of the page, that has yet to happen.

Finally, as an aside, when looking at the portfolios of BofA private clients, i.e., those who are served by BofA’s Global Wealth and Investment Management, and who have $2.3 trillion in AUM, Hartnett highlights the following two key fear & greed signals:

- When GWIM’s Top 10 common stock portfolio beta rises above 1, that has preceded (Nov’15 & Jul’18) big market tops (Chart 10). It is back above 1 once more.

- ETF flows in the 3 months prior to Apr’11, May’15, Jan’18 market tops have revealed big inflows to EM debt, non-US stocks, small cap stocks & industrials. This is precisely what we are seeing now as well.

via ZeroHedge News http://bit.ly/2Bv92yB Tyler Durden