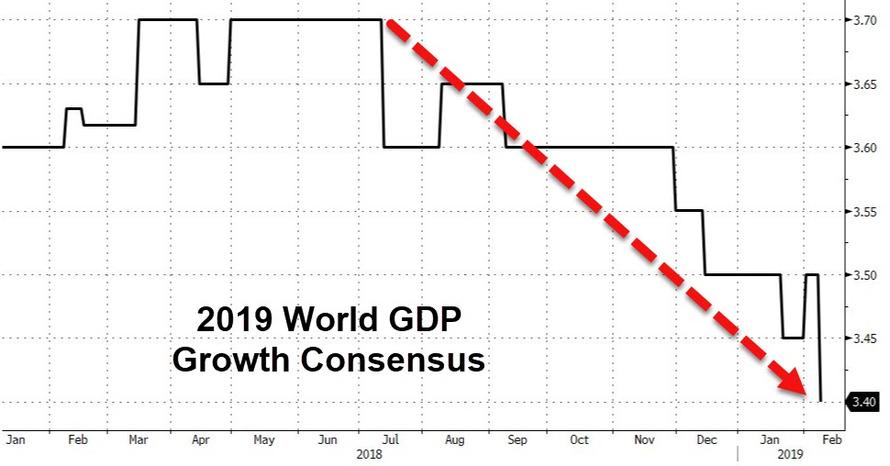

World GDP growth expectations are tumbling…

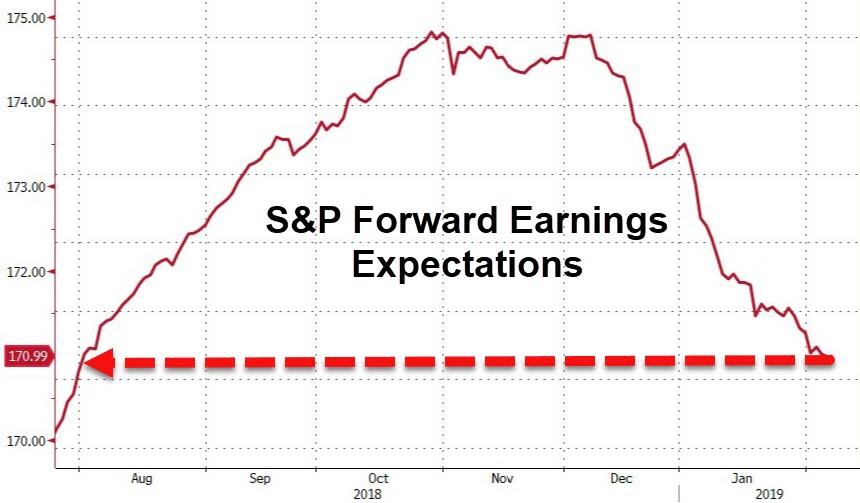

Earnings expectations are plunging…

And still stocks manage to hold gains…

“f*** this”…

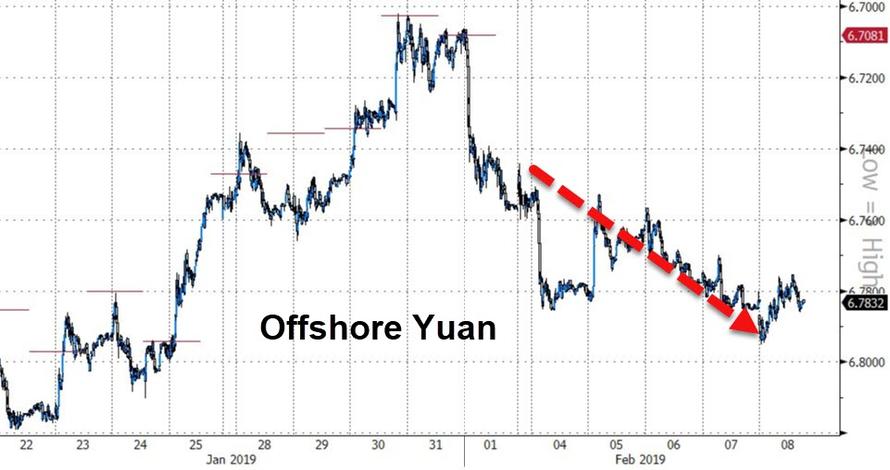

With Chinese stock markets closed for the week as the nation celebrates the lunar new years, Yuan has drifted weaker…

And China Large Cap ETF has also been sliding…

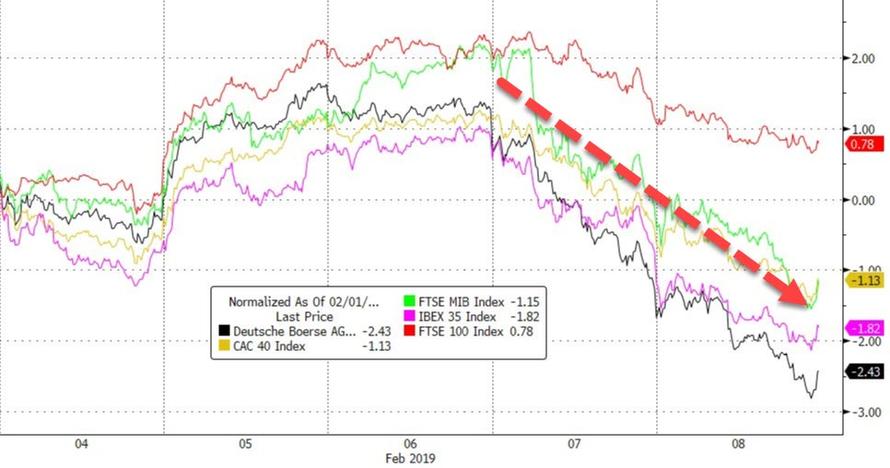

After a good start to the week, European stocks suffered their first weekly loss in six, led by DAX…

What a total farce – a late day panic-bid ensured the weekly win streak remains alive…

Futures show the day best with the incessant bid beginning to lift stocks after Europe closed…and then panic bid into the cash close…

The S&P failed at its 200DMA and then broke back below (and closed below) its 100DMA…

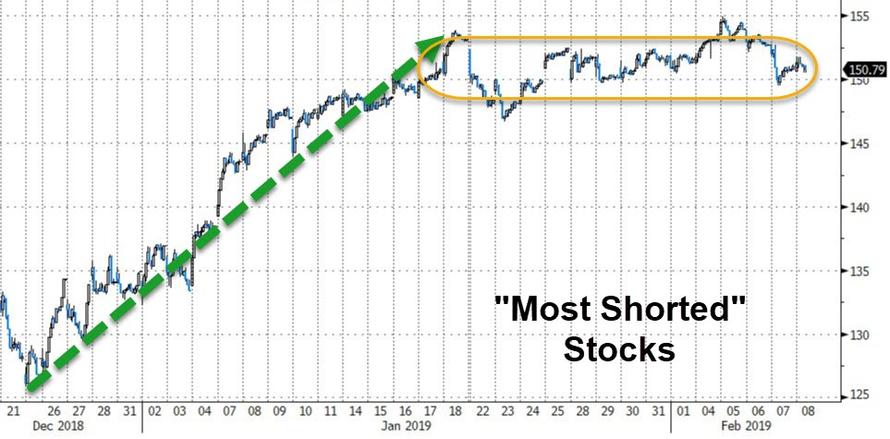

“Most Shorted” stocks actually fell this week as the juice that sent stocks soaring in January has well and truly run out…

Bond yields and stocks have really decoupled…

Credit and equity protection costs surged midweek…

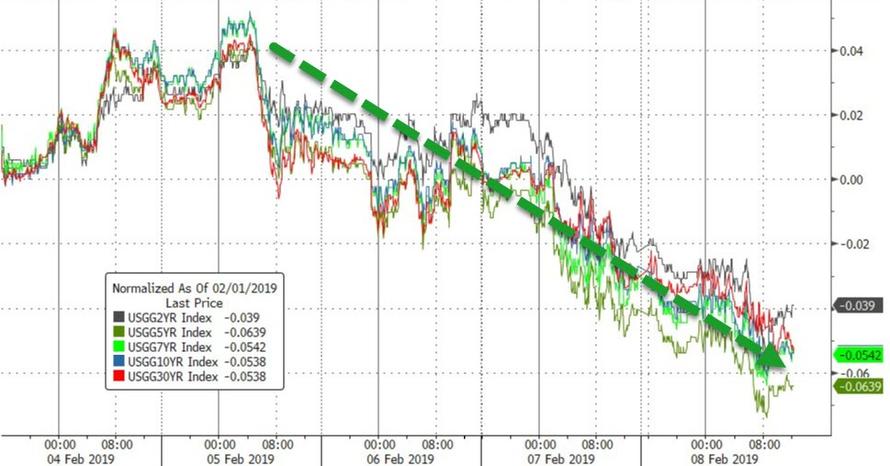

Treasury yields tumbled on the week (3rd weekly decline in 10Y Yields in a row)…

This is the lowest weekly 10Y Yield close since Jan 2018…

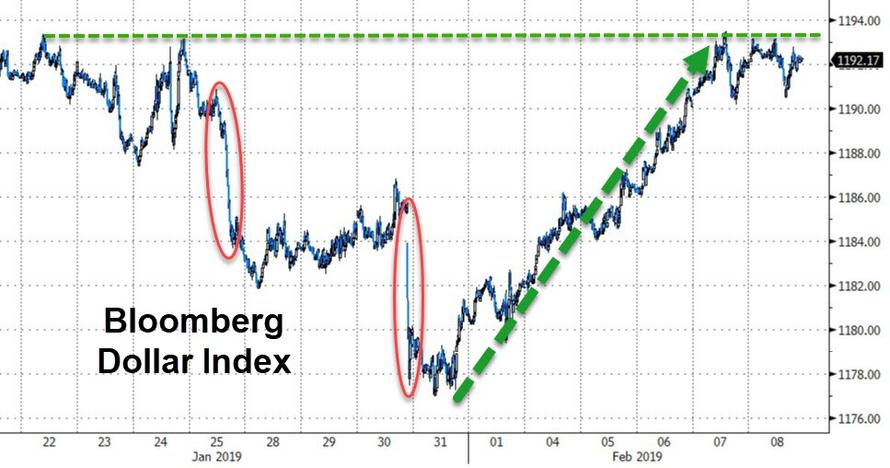

The Dollar index is now up 7 days in a row – the longest winning streak since Dec 2017…

We note that the Chinese are back next week.

Despite the dollar gains, cryptos had a huge week, led by Litecoin…

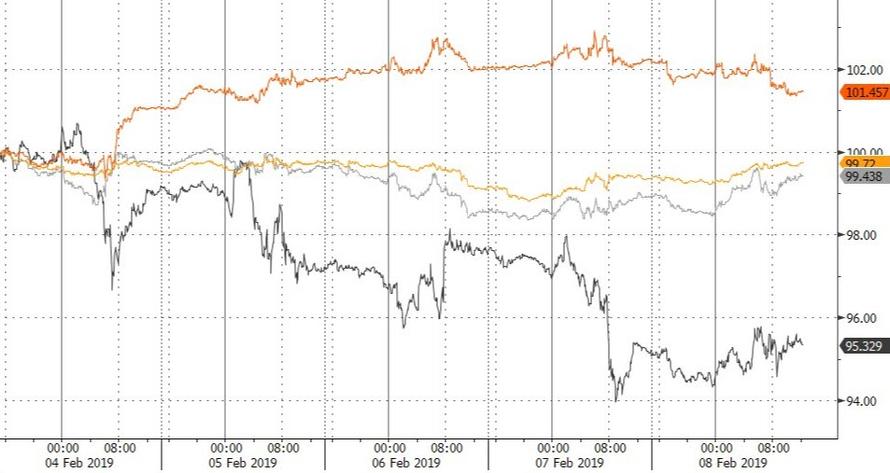

WTI had an ugly week, copper outperformed (but faded today) and PMs managed small losses (despite the dollar surge)…

It seems $52 is the magic number of crude…

Gold bounced back above the pre-Powell lows…

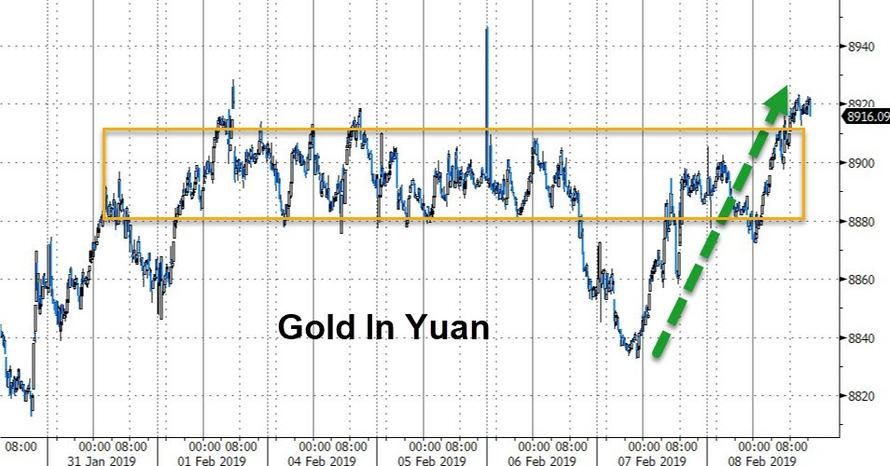

Gold gained against the yuan…

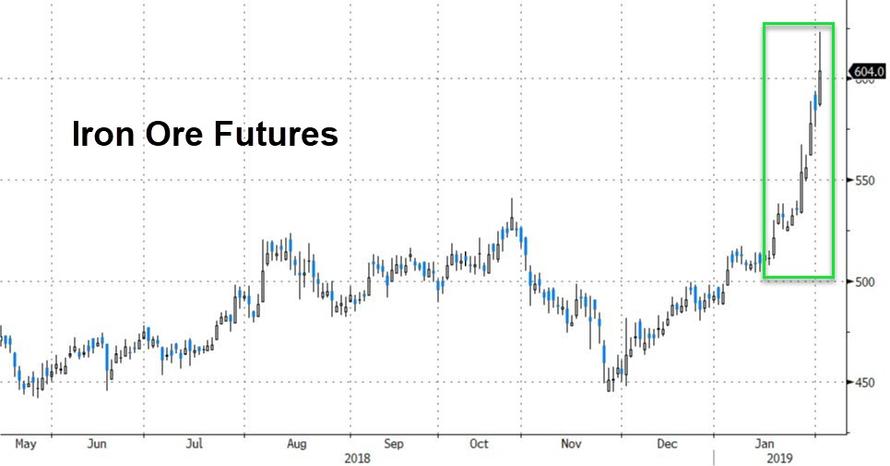

Of course, Iron Ore is the big winner, following the Vale disaster..

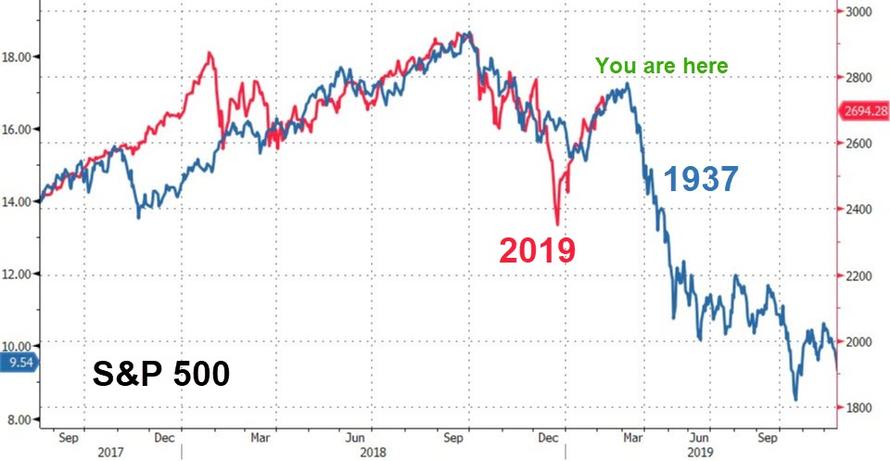

Finally, there’s this…

And this…

via ZeroHedge News http://bit.ly/2GxbE2o Tyler Durden