-

China trade deal – “Looks good” – may delay March 1st tariff deadline.

-

Collusion – “nope” – Senate Intel Committee admits it was all a witch hunt.

-

Border/Shutdown deal – “not happy” but no shutdown expected.

A triple whammy of wins for President Trump and the stock market fell right in line…

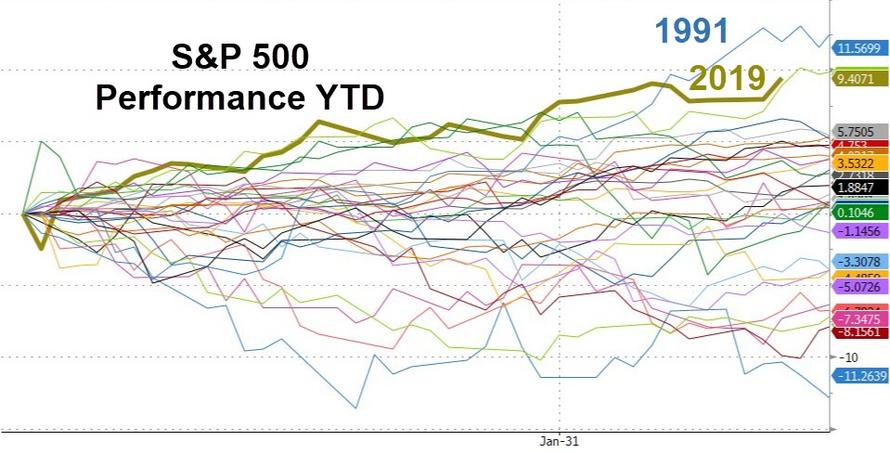

While one could shrug off the surge in stocks as an epic dead-cat-bounce from December’s collapse, there is no getting around the fact that today’s spike has sent the S&P 500 to its best start to a year since 1991…

As Bloomberg’s Cameron Crise notes, using the last 90 years of SPX data, it still looks pretty good. By my reckoning, it’s the seventh best start to the year through this point since 1928. Does that mean that it’s clear sailing from here? Not necessarily. Two of the six years that started better were during the Depression (1931 and 1934), and another was 1987 – not the greatest year for stock market bulls to keep company with.

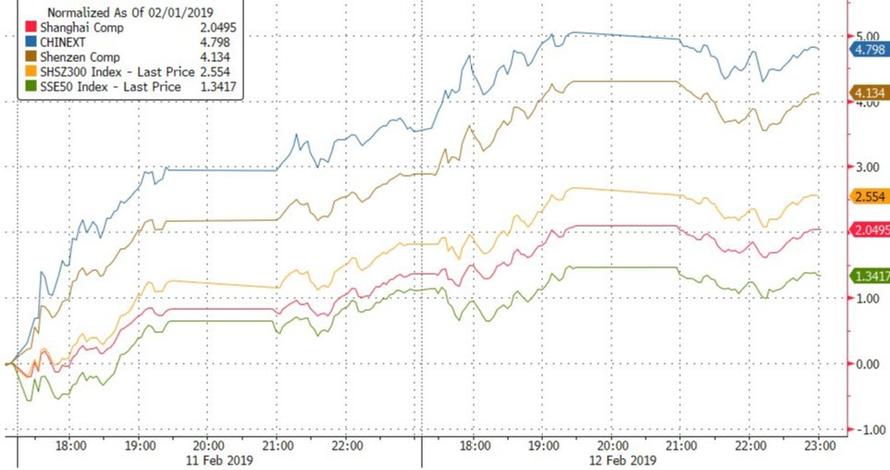

While Chinese stocks did not surge like the night before’s catch-up, they did extend post-holiday gains on positive trade talk headlines…

European stocks went vertical at the open once again overnight and most held their gains (while FTSE drifted into red)…

All the major US equity indices surged out of the gate and drifted higher for the best day in Feb…

S&P managed to get back above its 200DMA…

VIX plunged to a 15 handle and credit spreads collapsed…

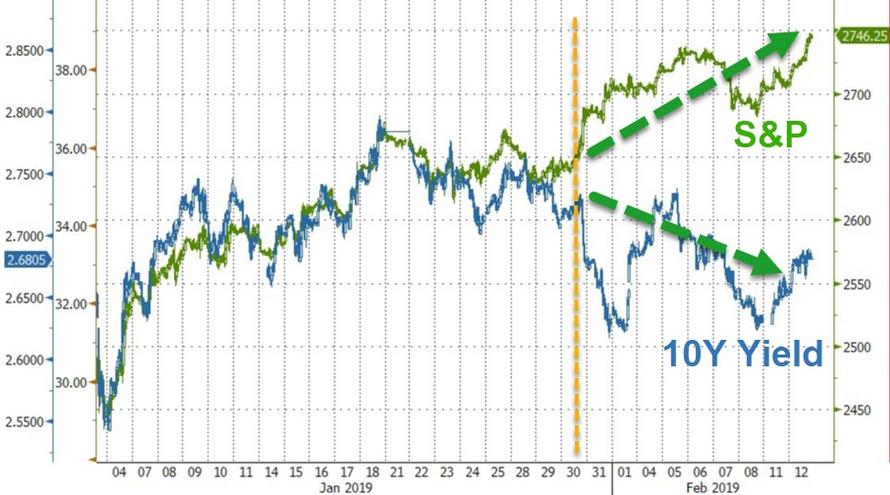

Bonds and Stocks remain decoupled since The FOMC…

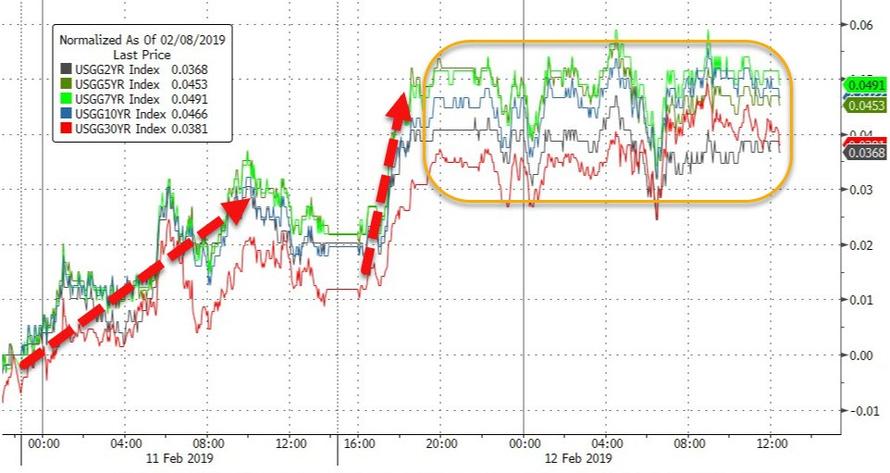

Treasury yields pushed higher on the day by around 2bps or so (which was all driven into the Japanese open as The BoJ tapered) as the IG calendar is still weighing on rates…

30Y back above 3.00%…

Markets are still pricing in rate-cuts for 2019 (around 8bps)…

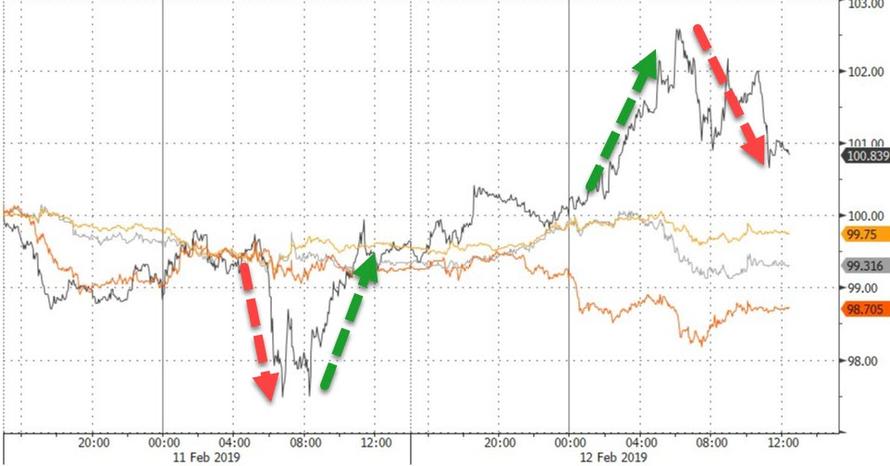

The dollar suffered its first losing day in the last nine after reaching briefly back into the green for 2019…

Bitcoin limped back up to unchanged since Friday, Litecoin continues to hold gains along with Ether…

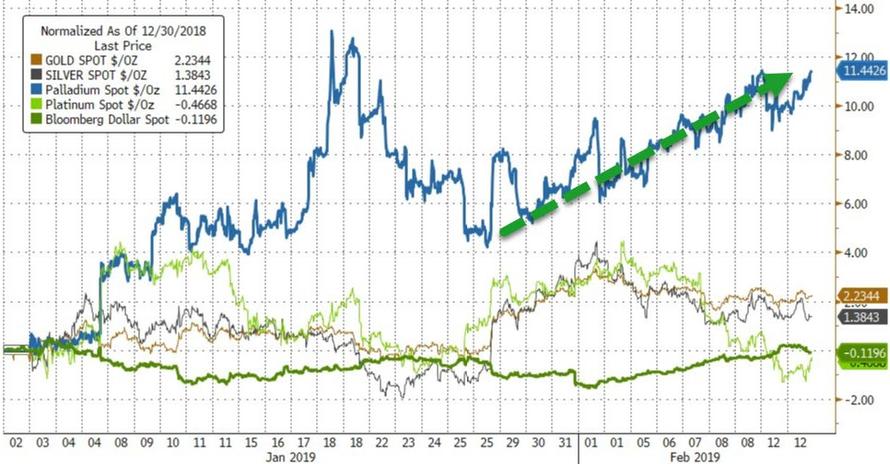

WTI whipped higher and faded – just like it ripped lower and bounced yesterday – as copper drifted lower but PMs held gains on the weaker dollar…

WTI tagged $54 and dropped ahead of tonight’s API inventory data…

Gold has been rangebound for a few days…

Palladium continues to rebound back near January highs (as the dollar dips back to unchanged in 2019)…

Finally, we note that ‘soft’ survey data continues to languish below current ‘hard’ data (which itself is starting to roll over)…

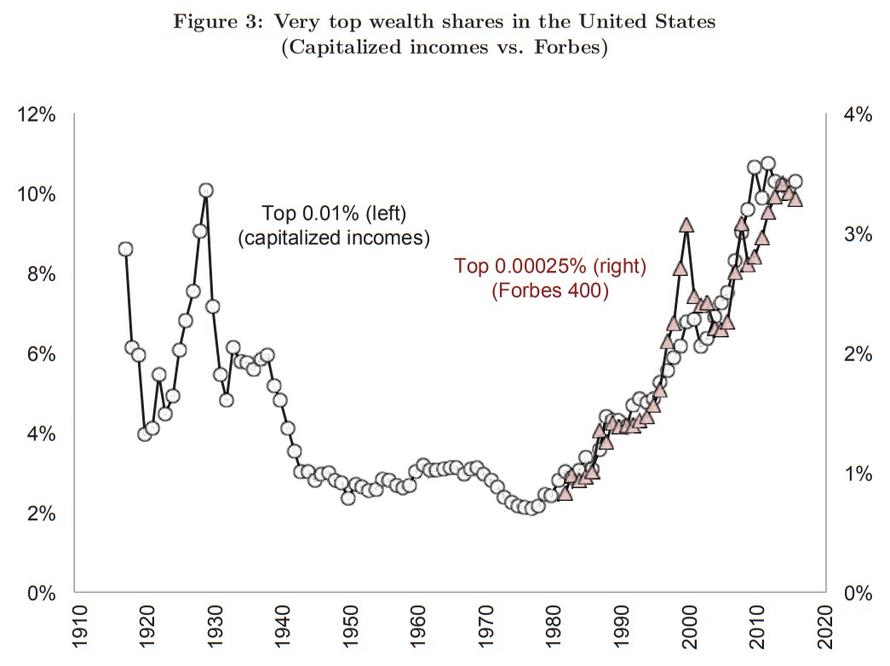

And this is just funny…

Let’s just hope it’s not 1937 all over again

But that would be ironic given the level of the 1% relative wealth…

via ZeroHedge News http://bit.ly/2TLbkAT Tyler Durden