For much of Q4, as the stock market was shaken by historic tremors, Fed policy errors and culminated with the worst December for the S&P since the great depression, not a week would go by without JPM’s head quant publishing a note (and another, and another) urging JPMorgan clients to throw caution to the wind and just buy stocks even as volatility rose and stocks tumbled. Alas, with every subsequent call to “buy the dip”, the market kept sliding lower and lower, until, some time in December, even Kolanovic threw in the towel and on January 3 admitted that “the month of December proved us wrong in the view that the market would rise into year-end and in 2018 overall.”

There was also a modest mea culpa, with footnotes:

Despite being wrong on the overall market direction, we had several correct predictions in 2018: we forecasted volatility and tail risk to rise, accurately predicted local market bottoms on Feb 9, May 1, and October 30, argued for EM-DM convergence, and pointed to US administration policies and the Fed as the key risks.

That, however, did not stop the JPM quant at the beginning of December from blaming a “viciously negative news and social media cycle” as well as “specialized websites that mass produce a mix of real and fake news [and] often these outlets will present somewhat credible but distorted coverage of sell-side financial research, mixed with geopolitical news, while tolerating hate speech in their website commentary section” for screwing up his bullish bias.

He then decided to take a one month sabbatical, during which period the market imploded.

So now that the market has rebounded over 17% from its Christmas Eve lows, Marko is back, and he is not only as bullish as he was for all of Q4, but in taking a page from Charlie McElligott, believes that as a result of so many market participants having missed the recent rally (i.e., refusing to listen to Kolanovic), they will now have no choice but to be “forced in” to chase returns, a “re-levering cycle” which according to the JPM quant, may continue for another three months, or “could last between now and e.g. May.“

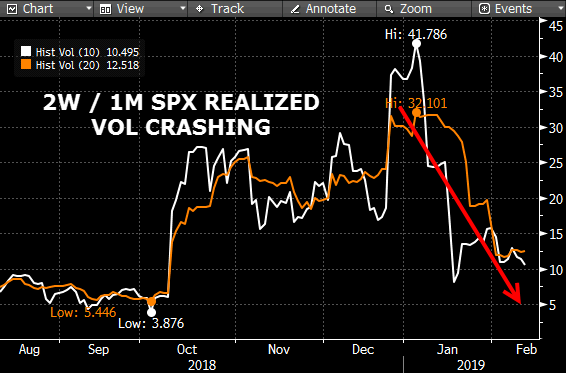

Marko’s argument should be familiar to anyone who read Charlie McElligott’s latest note, in which he explained why with volatility tumbling…

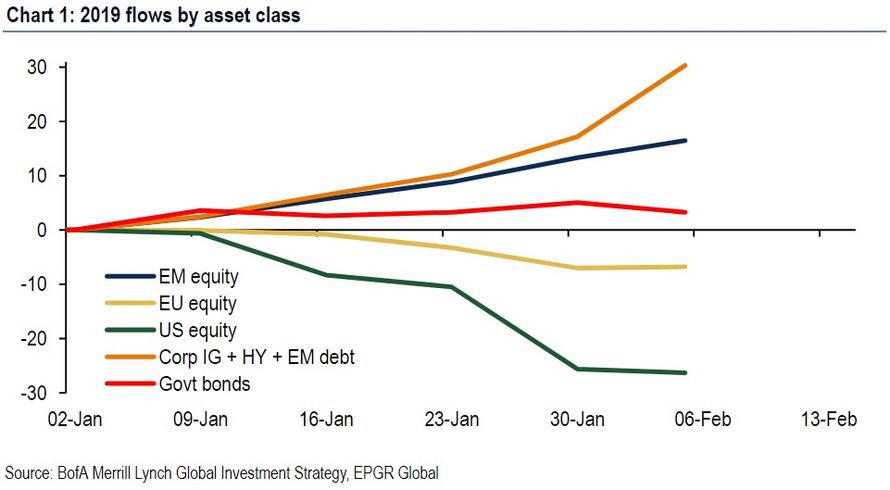

… and with most active investors not only painfully underinvested and selling stocks for much of the past 6 weeks…

… but force-squeezed on their shorts, coupled with systematic funds such as risk parity and vol-targeting rushing back into stocks, hot on the heels of CTAs who have recently gone 100% “max long” again, the JPM strategist is confident that these investors will become bulls mostly due to FOMO.

Here is Marko’s summary:

important groups of systematic and fundamental investors did not re-risk and missed a significant portion of the rally. This includes volatility sensitive managers, trend followers, and to a large extent hedge funds and retail.

“If volatility stays contained (and this is favored by gamma positioning), re-risking should continue” according to Kolanovic, who appears to gloss over the fact that all of these underinvested investors would have been in the market if only they had listened to him (suggesting that for some inexplicable reason the “viciously negative news and social media cycle” has more influence on Wall Street’s professional money managers than one of the most respected quants in the business).

But we digress, because now that the fiasco of Q4 2018 is in the rearview mirror, it’s time to double down for the JPM quant:

Following the January rally, our S&P 500 price target (3000) is no longer considered outlandish by most. Calls from various strategists for a 1929-style recession, rolling bear market, or imminent retest of lows are now getting quieter.

That said, perhaps as a result of some recent harsh market lessons, Kolanovic did hedge his latest breakout of bullishness, cautioning that “a negative outcome from the ongoing trade negotiations with China” could promptly crush his thesi:

In addition to various tail risks, by far the largest risk would be a failure in trade negotiations with China. A decline in the President’s approval rating on the back of the government shutdown and Q4 market selloff, may result in some market stability near term and may improve the likelihood of a positive outcome from trade negotiations.

Kolanovic also warns that there is a risk the market gets “too bullish”: “If the rally continues, investors would need to monitor the pace of re-leveraging and start hedging once the leverage of various investor cohorts becomes high.”

Of course, as we noted above, the rush into risk is just “one” page of the McElligott playbook; what Kolanovic did not focus on is that this alleged scramble to relever would take place at what McElligott dubbed the most “dangerous” period for stocks, with several reasons suggesting more pain is coming shortly, among which:

- Remember that Chinese data is expected to “print lows” in Q1 / Q2 (“gets worse before it can get better”), with the potential to dictate a disinflationary drag globally (despite the start of year “credit / liquidity injection IMPULSE”)

- In 2Q19 we too could see the potential commencement of the “earnings recession” with very tough 2Q18 comps

- From here, it’s even harder for the Fed—as the data has to either get way worse for them in order to get more dovish (for “bad” cycle-reality reasons!) OR the data stabilizes / strengthens, in turn risking another possible FOMC tone inflection which could put us back on the “FCI vicious cycle”—especially if stocks continue their re-pricing higher and “short volatility” positions are re-accumulated.

None of this was discussed by Kolanovic, who in recent years ever since his promotion, has been increasingly focusing on just one side of the trade (not the bearish one), which is perhaps why Charlie McElligott’s star has risen even faster in the recent past.

But it’s not just the Nomura strategist: Kolanovic’s now trademark optimism also contrasts with a recent take by Goldman strategists who warned that the latest rally is set to stall now that share prices already reflect confidence in stable growth and a dovish Federal Reserve, leaving little room for positive surprises. Morgan Stanley’s Michael Wilson doubled down on this point, saying that the hurdle for further rate action from this point on is that much higher, as either the economy would have to collapse for further action by Powell, or else the Fed will be forced to tighten soon if stocks, and economic indicators, continue to rebound, short-circuiting the Fed “pause”, and spooking risk assets once more.

None of this bothered the JPM quant, however, who is once again staunchly confident that – all else equal – once investors start to abandon their defensive stance on stocks, it’s going to be a mutli-month process of adjustment, and investors should ride along, he said. According to the firm’s estimates, funds’ equity exposure sit in the 10th to 20th percentile of the historic range.

“For instance, we are now in the ~10-20th percentile, and one could run long until exposure reaches the ~70-80th percentile, when the risk of another market seizure increases. ” Kolanovic wrote. “This re-levering cycle could last between now and e.g. May.”

Whether Kolanovic (who is now on the same side of the trade as Dennis Gartman, with the “world-renowned commodity guru” even more bullish in recent weeks) be right this time, or will algos pull the rug from under the “underinvested” just as they capitulate and decided to give bullishness a try, we’ll know in just over two weeks when the US-China tariff deadline hits, assuming of course it has not been delayed once again by then.

via ZeroHedge News http://bit.ly/2Gqz3Dc Tyler Durden