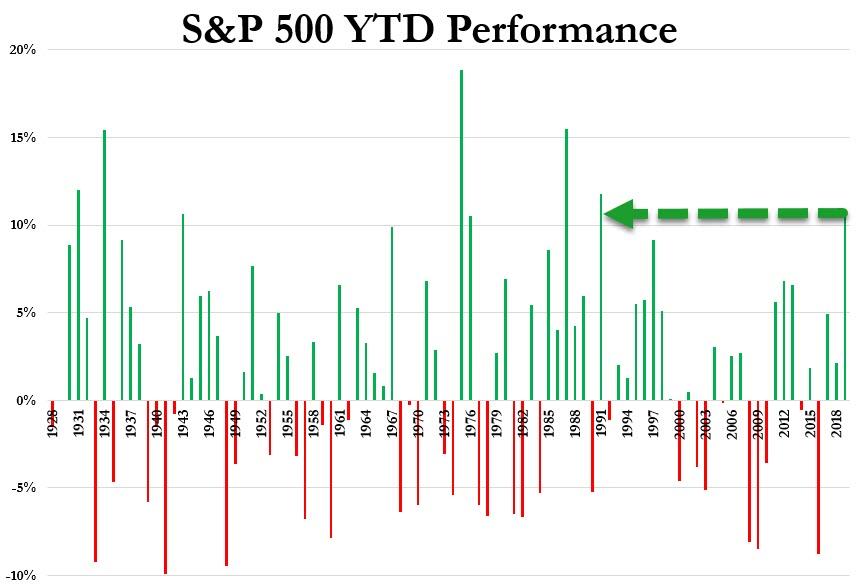

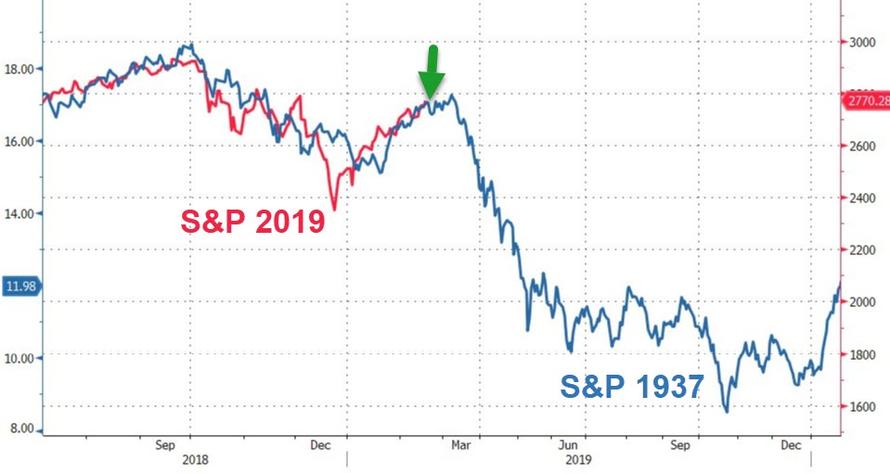

2019 is off to the best start to a year since 1991 for the S&P 500…

As Earnings expectations have their worst 3-month drop in four years…

And macro data collapses…

That is the biggest weekly collapse in US Macro data since June 2011…

So, Stocks are back near record highs, earnings expectations have collapsed to 6-month lows and US Macroeconomic data is the weakest in 18 months (and crashing)…

* * *

Very mixed week for Chinese stocks with tech/small cap-heavy CHINEXT soaring and mega cap SSE50 almost unchanged…

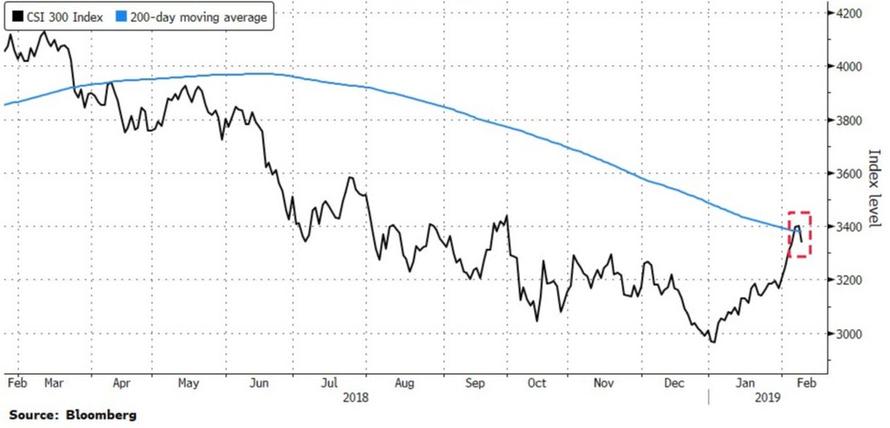

And China’s CSI-300 broke back below its 200DMA…

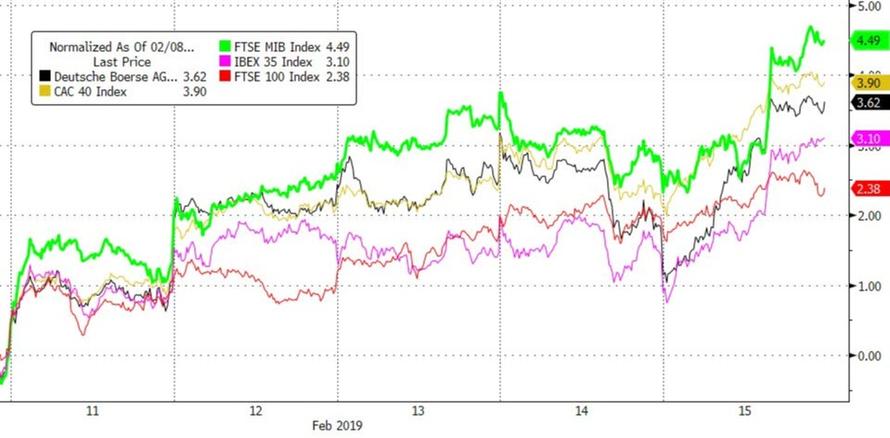

European markets were all higher on the week, led by Italy up 4.5%…

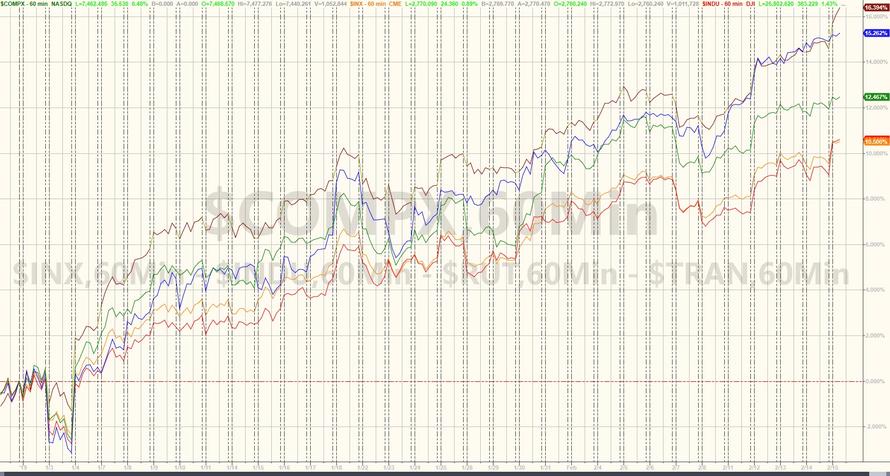

All major US equity indices surged this week – for the 8th straight week…

After 4 days with a drop in the last 30 mins of trading, today saw the late-day buying-panic reappear…

Futures show the craziness better as markets went vertical at the cash open but Dow (up) and Nasdaq (down) diverged notably…

Dow futs closed over 600 points higher than the overnight lows on the shittiest week’s macro-economic data in 8 years!! “Goldilocks, my ass” as one veteran trader said.

S&P managed to break above its 200DMA but Nasdaq could not…

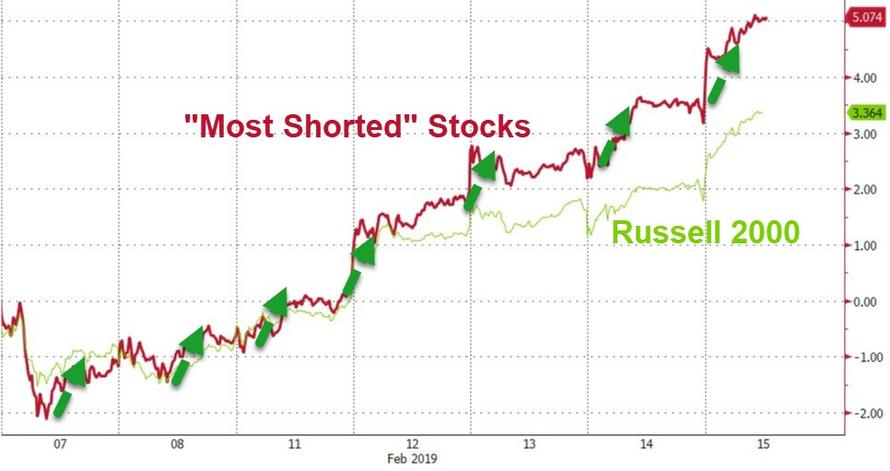

Shorts were squeezed higher for the 7th day in row…

And Buybacks dominated once again…

AAPL traded down on the day after Buffett reduced his exposure…(and so did AMZN amid all the NY chaos)

Toymakers were trounced…

Small Caps are the year’s best performer – up over 16% YTD… (Dow, S&P up over 10%)

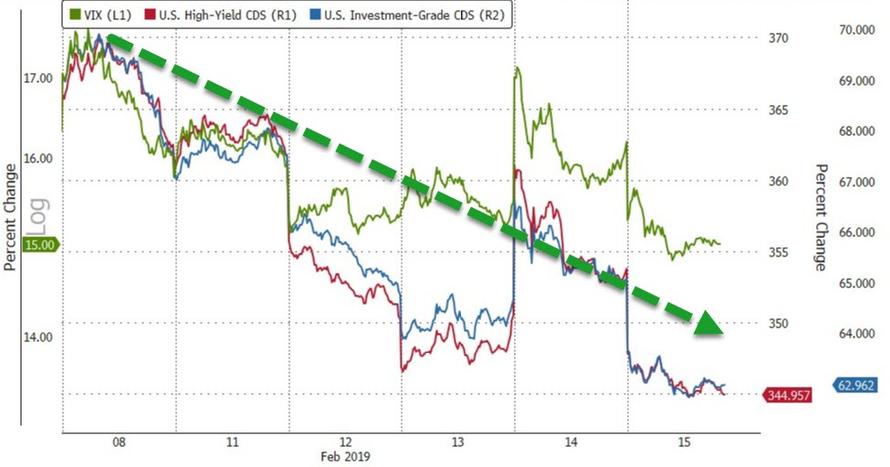

VIX tumbled to a 14 handle and credit spreads collapsed on the week…

And before we leave equityland, here is the S&P 500 Low Volatility ETF!!!

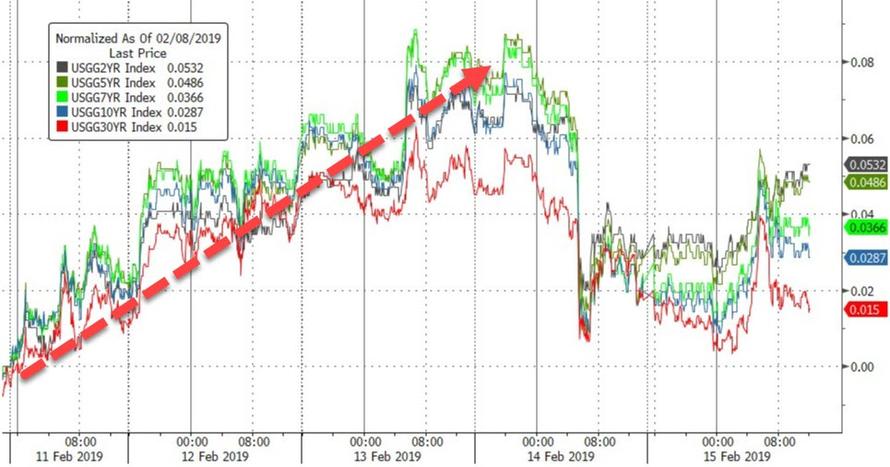

While stocks soared, bonds were nto playing along (again)…

Treasury yields rose modestly on the week (with the long-end outperforming)…heavy calendar early in the week drove rates higher

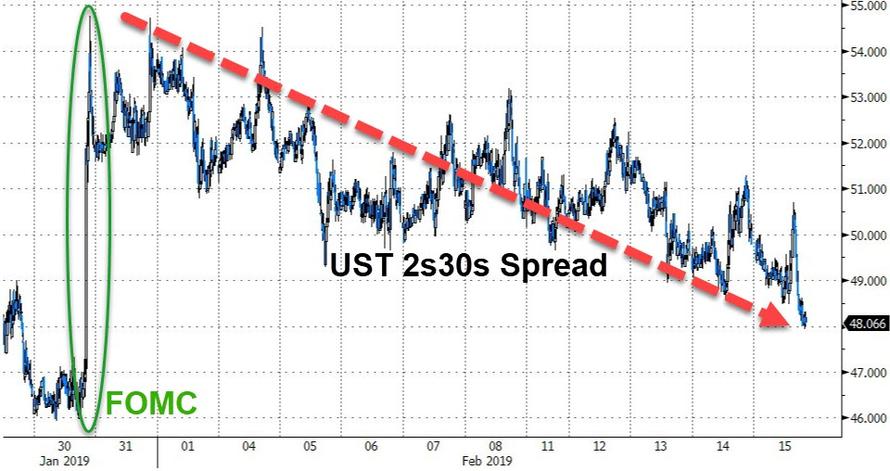

Sending the yield curve notably flatter once again…

And 30Y Yield closed back below 3.00%…

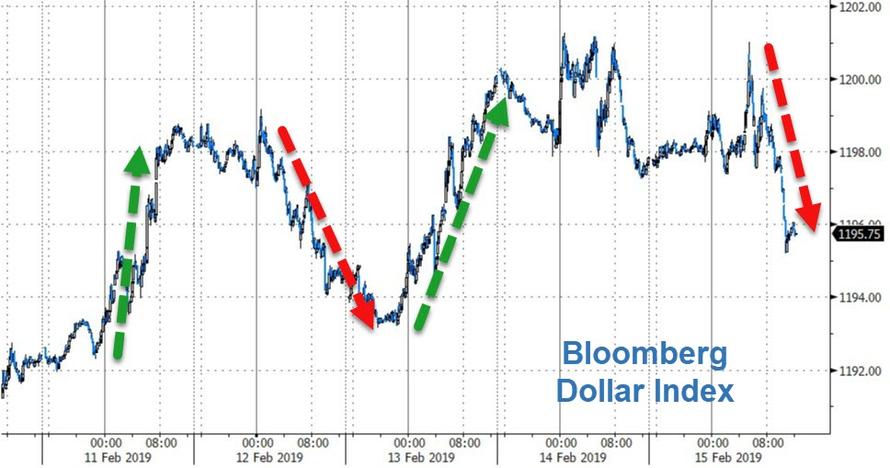

The dollar dipped for the second day in a row but ended higher on the week…

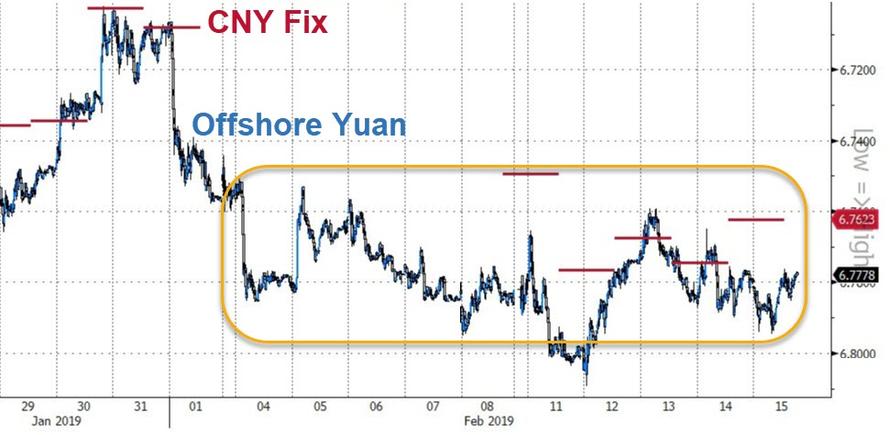

China came back from its weeklong new year holiday, but the Yuan went nowhere…

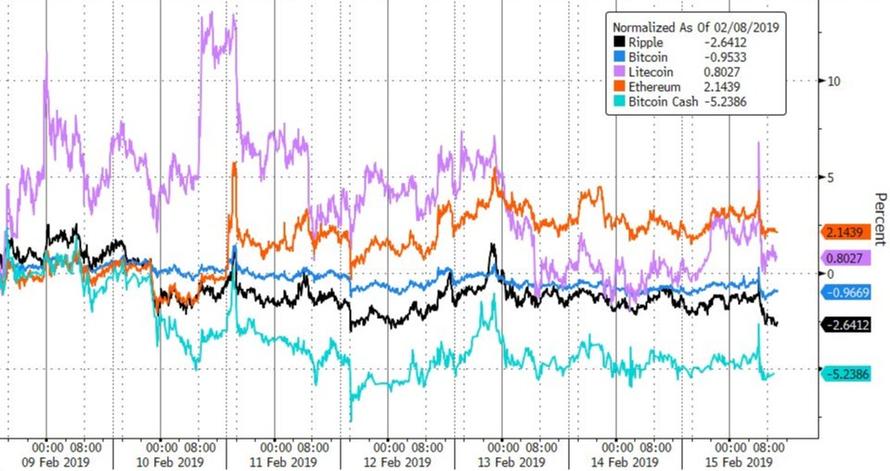

Ether and Litecoin managed gains on the week with small losses for Bitcoin…

Despite dollar gains on the week, crude and gold both made gains…

It’s been quite ride for oil prices…

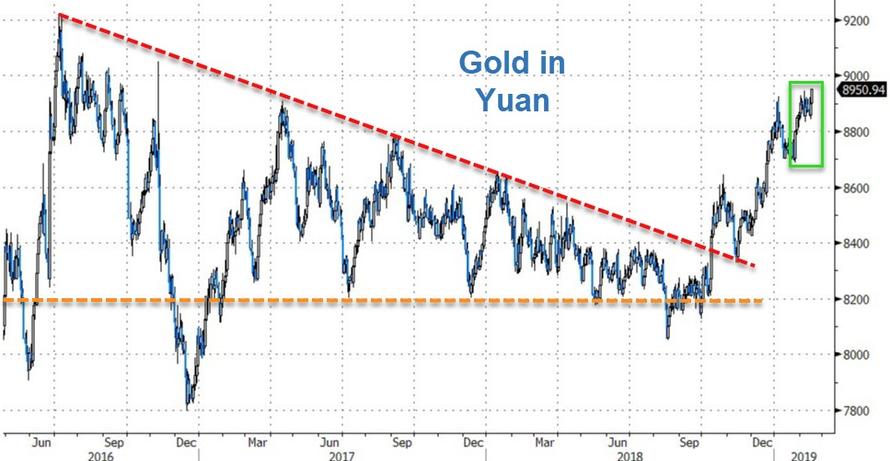

Gold was modestly higher against the dollar on the week, but notably stringer against the Yuan – strongest since 2016

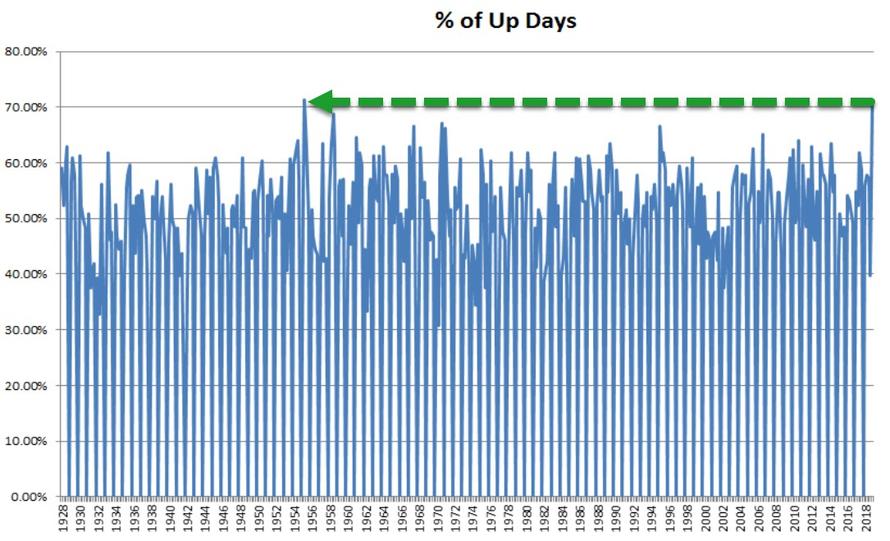

Finally, as Bloomberg’s Ye Xie notes, by one measure, the S&P 500 is on track for the second best quarter in history.

The S&P has gained 22 days this year as of yesterday, or 71% of the trading sessions. If this pattern holds, it’ll be the best three-month period since second quarter of 1955, when the SPX jumped 12% and closed up 26% on the year.

Probably nothing to worry about…

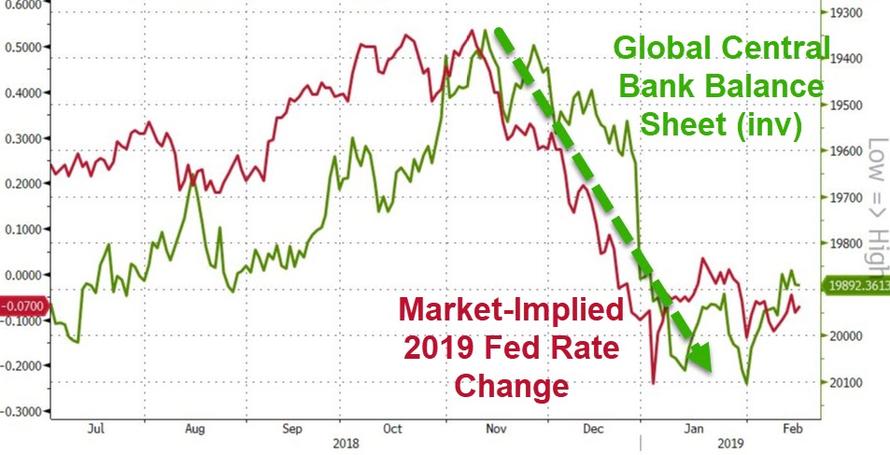

But if there’s nothing to worry about, why did The Fed signal its extreme dovishness and why did the world’s central banks suddenly restart the printing press?

Bonus Chart: Cheap, it ain’t!!

via ZeroHedge News http://bit.ly/2TR4v0G Tyler Durden