The most perplexing aspect of the post-Christmas stock rally, which has sent the SPX almost 20% higher from its December lows, continues to confound investors.

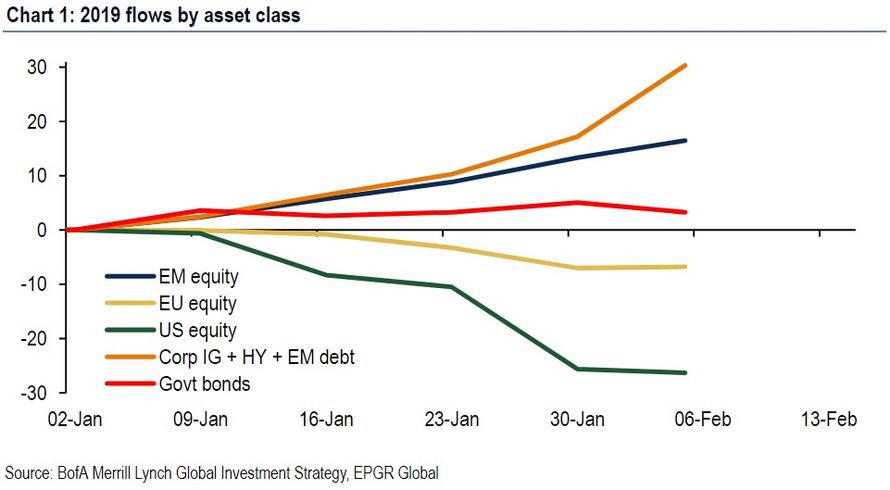

As we discussed earlier this week, one of the more bizarre observations to emerge over the past two months has been that despite the torrid rebound in stocks so far in 2019, culminating with the best January for the S&P since 1987, investors have shunned US equities, selling stocks when they should be buying, and allocating the proceeds into bonds and emerging markets, as the following recent chart from Bank of America demonstrated.

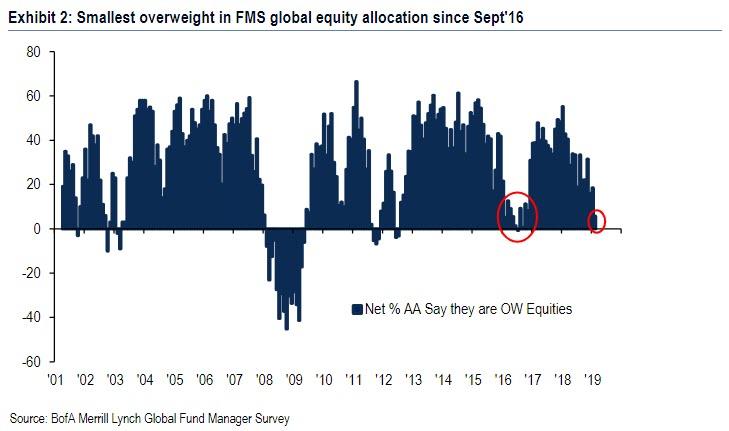

This was confirmed by the latest Fund Managers’ Survey from BofA, which found that the allocation to global equities tumbled 12% to just net 6% overweight in February, the lowest level since September 2016, and the biggest MoM drop relative to the performance of global equities (+7% from Jan 4th start of Jan’19 survey) to Feb 7th (end of Feb’19 survey) on record. This confirms that neither professional nor retail investors have any faith in the current rally.

And now, according to the latest EPFR data, the conundrum continues, because despite the latest breakout in stocks, which are rapidly approaching not only 2,800 but their Sept 20 all time highs, the selling continues unabated, with global equity funds sees another $6.9 billion in outflows ($2.3bn ETF inflows, $9.2bn mutual fund outflows).

The picture for equity funds targeting the US stocks is even worse, as US equity funds saw a %0.6 billion outflow in the latest week, the 11th consecutive week of outflows according to BofA, in other words for the entire duration of the past 7 weeks rally, investors have been continuously selling stocks.

Oddly, instead of reallocating funds to risk despite the Fed’s recent dovish relent, investors have continued to plow money into yield, with the last week seeing $8.8 billion in bond inflows, including REITs and a record $2 billion inflows into MBS …

… as well as chunky inflows into corporate, EM bonds…

…further confirmation that “yield” is the investment theme winner of 2019 according to Bank of America.

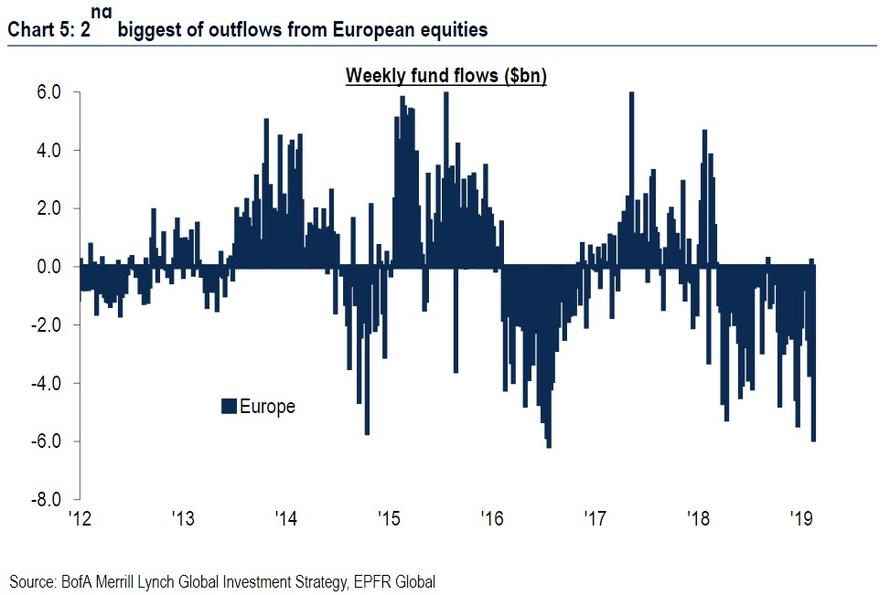

Meanwhile, while investors may hate the US, they absolutely loathe Europe, confirmed by the 2nd biggest outflow ever, for $5.9 billion, from European equities.

So while we know who is selling – virtually everyone – the question remains: who is buying stocks so aggressively as to push markets not only above their 200DMAs, but has sent the S&P 500 near 2,800.

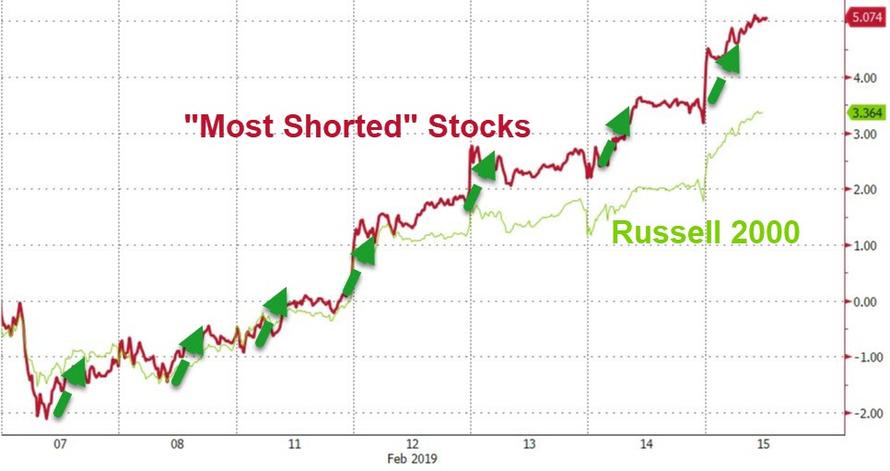

As we discussed on Wednesday, the answer is twofold: powerful force lifting stocks higher has been short covering, which we showed recently has been instrumental in if not so much lifting stocks higher, then certainly causing further distress to hedge funds, which just as they loaded up on shorts, found themselves rushing to cover.

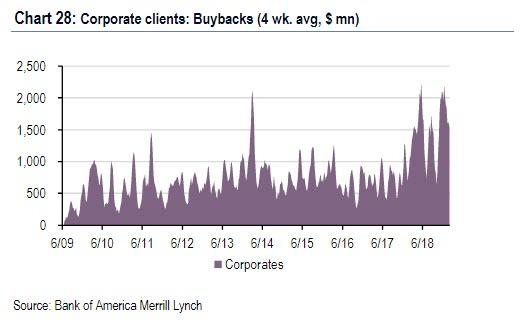

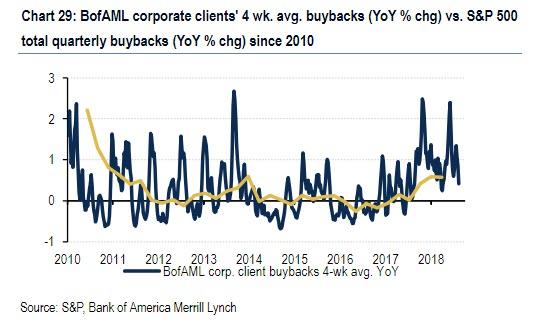

But it is hardly likely that mere short selling has offset the 11 weeks of consecutive institutional and retail sales since the December lows. Which brings us to the second, and highly politically charged, answer: stock buybacks. As Bank of America showed earlier this week, corporate buybacks last week not only offset the selling by all of the bank’s other clients, leading clients to remain aggregate buyers of single stocks overall…

… but on a year-to-date basis, buybacks are already tracking far above last year’s records, and are in fact a whopping +78% higher compared to the same period in 2018 (as a reminder, total announced buybacks in 2018 hit a record $1 trillion).

And with the bulk of the buyback window now behind us as Q4 earnings season is almost over, it will probably not come as a surprise that the S&P Buyback Index has solidly outperformed the broader market.

Which begs yet another question: if investors have boycotted the “easy” upside from the past 2 months, will they finally jump in, as Nomura’s Charlie McElligott wrote earlier this week at just the most “dangerous” time, or will the boycott persist until buybacks are finally exhausted and the market finally tumbles.

via ZeroHedge News http://bit.ly/2TVE6yU Tyler Durden