With both the dollar and yen sliding, most notably after the BOJ’s Kuroda told parliament the Japanese central bank can ease far more if necessary, it is perhaps not surprising that gold has surged $14 higher today, rising above $1,341/ounce, up over $140 from gold’s early November levels when it was trading in the low-$1,200s, and the highest price since April 2018.

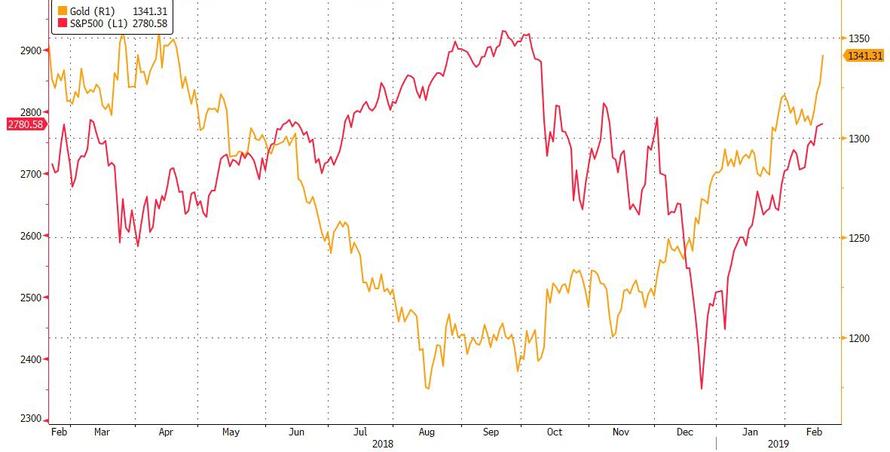

Yet what has left traders puzzled is that despite gold’s surge, it is not trading as a safe haven, because after correlating inversely with the S&P for much of 2018, the correlation flipped to positive in late-December, right around the time the Fed flipped from hawkish to dovish, meaning that gold has instead regained its status as a hedge against central bank idiocy. Indeed, gold’s correlation to the S&P has paradoxically surpassed that to other safe havens such as Treasurys, the yen, the Swiss franc and even the USD.

Or maybe gold is simply trading as a plain vanilla commodity: after all, it is not only the S&P that soared starting in December, so did WTI, which rebounded from a multi-year low in the low $40s to a year to date high of $55+ today. Base metals have had an even more amazing recent track record: take Palladium for example, which has soared by more than 50% since August, surpassing the price of gold in nominal terms, and hitting a new all time high today amid reports of shortages as the market continues to drift away from diesel-powered vehicles.

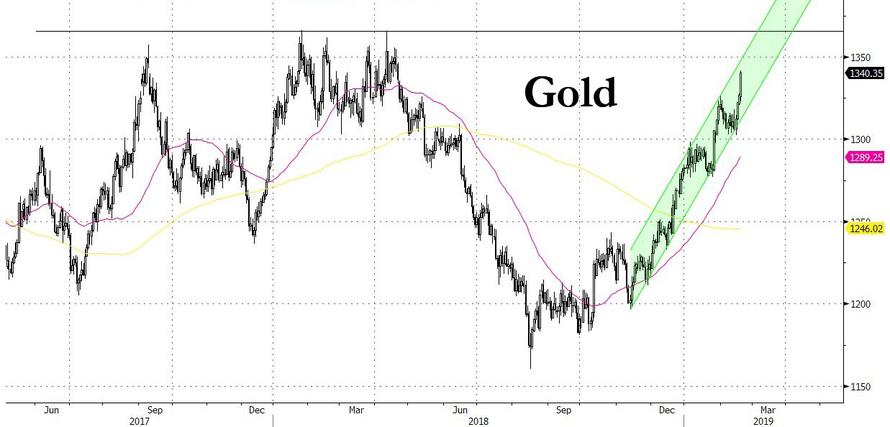

Or maybe it’s just trend-chasing algos and CTAs who are the marginal price setters: as several desks have pointed out, gold is trading within a clearly defined upward channel with upside resistance expected to hit around $1366, which is where gold topped out on three prior breakout attempts in early 2018. Should the current upward channel provide support, expect a major test some time in mid-to late March when the upward support clashes with solid resistance.

Which way gold moves after that will likely depend on just how more “activist” central banks become over the next month. Considering the accelerated race to the FX bottom in recent weeks, it is safe to say that gold may be printing new multi-year highs as soon as one month from now.

via ZeroHedge News http://bit.ly/2T1MXBD Tyler Durden