Two months ago, in the depth of the December market doldrums, one person said that it was time to go long stocks ahead of the Fed’s dovish reversal, Mnuchin’s call to the plunge protection team and Trump’s appeal to Americans to buy stocks on Dec 25 2018: that man was “world-renowned commodity guru” Dennis Gartman, and for the subsequent 8 weeks, Gartman has been stadfast, and correct, in his contrarian at the time reversal which promptly became a consensus call after stocks rebounded in their best January since 1987, a rally which has since continued into February and the S&P is fast approaching its Sept 20 all time high.

Which then begs the question: has Gartman’s reptuation of being the world’s most contrarian indicator finally ended? That remains to be seen, however, it is worth noting that after being relentless bullish for the duration of the S&P’s 400 point increase, this morning Gartman has another contrarian call: “we say here this morning that the time for buying stocks and or for adding to long positions is past. The time for being less involved… less long… less enthusiastic in the short term is now upon us.”

Of course, having learned from prior mistakes and staying from absolute trade recommendations, Gartman is quick to note that the rally may indeed continue, to wit:

We remain positive of equities in the long term … not, however, in the short term and we’ve more on this below… for the same reason that we’ve been bullish thus far for most of this year: that we are certain that the Fed has adopted a changed and more expansionary monetary policy, made quite clear by the Fed’s Chairman, Mr. Powell, over a month ago when he spoke on his own regarding this fact and made even clearer following the FOMC meeting when he noted in his post-meeting press conference that the Fed’s balance sheet will continue to be run-off through the process of its debt securities being allowed to mature, but in a far more “patient” manner than had been its course of action previously. This, we suspect, shall be made clearer still this afternoon when the minutes of the last FOMC meeting are made public at 2:00 p.m..

Further…and this we do in fact believe has been materially overlooked by so many others in the capital markets on a daily basis and it is all the more important given the focus upon the Chinese Renminbi’s valuation being focused upon far more certainly as explained above in our comments on the forex market… we continue to view the Chinese government’s cut in bank reserve requirements and the tax cuts announced nearly five weeks ago are materially long term supportive of shares in China and eventually to the markets abroad. As we have said previously several times, reserve requirement changes are the monetary authorities’ equivalents of a handy piece of lumber applied to the head of a reluctant mule: It does indeed get the mule’s attention and sometimes the mule even likes it!

That’s the good news. Now the not so good:

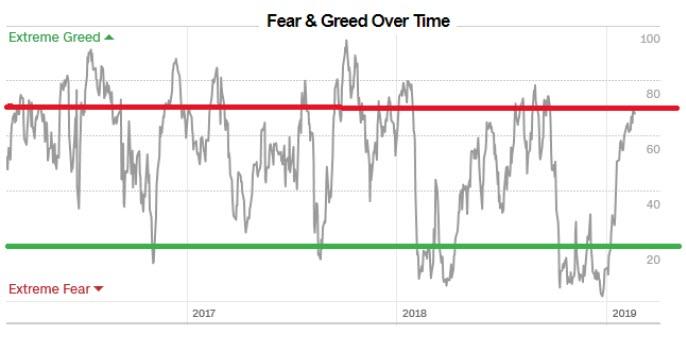

Note that the CNN Fear and Greed Index made its way to 70 as of the close on Friday but closed 2 “points” lower yesterday at 68. The CNN Index has in the past proved its merit time and again and we’ve maintained that until it has risen above 70… and preferably to 75… and then has turned down, we’ve no choice but to remain bullish. It’s 68 presently and it has turned lower, but only very marginally so.

Thus we say here this morning that the time for buying stocks and or for adding to long positions is past. The time for being less involved… less long… less enthusiastic in the short term is now upon us.

And then this:

Given our comment above that the CNN Fear & Greed Index has made it to 70 and has turned lower and given that the short interest on both the NYSE and the NASDAQ have fallen, and given simply that the markets have run a very, very long way since late December we will absolutely not be adding to long positions at this point and will likely be taking defensive actions to protect our profits. Buying puts; selling futures; buying “short side” derivatives and selling calls against long positions to reduce our exposure a bit. This seems both rational and reasonable.

If this “new and improved” Gartman is no longer the contrarian indicator of years past, algos – and bulls – better take note: if he is right, and many other strategists are confident we will top out just around the “quad top” around 2,800, this may be as good as it gets.

via ZeroHedge News https://ift.tt/2BLZm2K Tyler Durden