Kraft Heinz has crashed 25% ahead of today’s open after writing down the value of some of its best-known brands in an acknowledgment that changing consumer tastes have destroyed the value of some of the company’s most iconic products.

This is not your typical “reset the base and everything will be fine” story; the earnings report was “disastrous”

Analysts at JPMorgan, Stifel, Piper Jaffray, Barclays and UBS cut their ratings on the stock following what Stifel described as a “barrage of bad news: Quarterly profit missed estimates, the outlook for 2019 was disappointing, and Kraft Heinz cut its dividend, lowered profit-margin expectations and took a $15.4 billion writedown on key brands.”

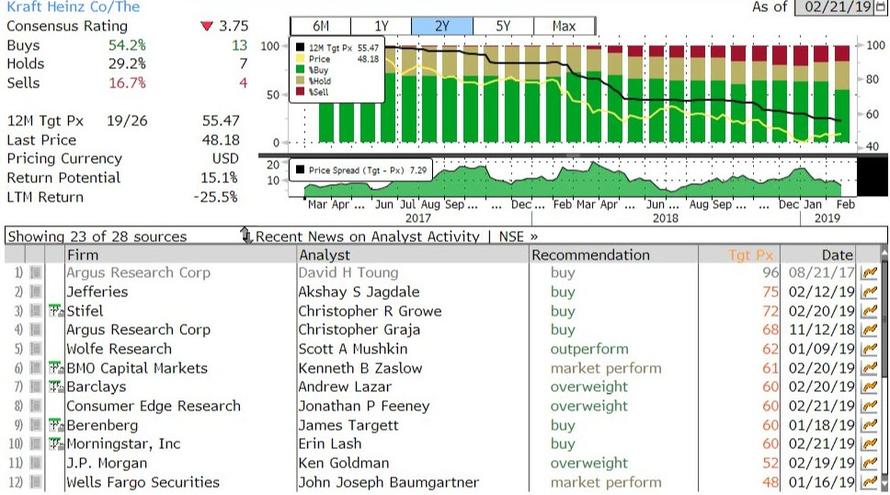

Bear in mind that before this “disaster” 13 analysts had buy reccs, 7 holds, and only 4 sells…

But apart from that, everything is awesome right? Well no…

The company also admitted it had received a subpoena in October “associated with an investigation into” its accounting policies, procedures and internal controls related to its “procurement function.”

This includes “agreements, side agreements, and changes or modifications to its agreements with its vendors,” said Kraft.

“Following this initial SEC document request, the Company together with external counsel launched an investigation into the procurement area,” said Kraft. As a result of the probe’s finding, the company had $25 million more in costs of products sold during the fourth quarter, said the company, “as an out of period correction.”

Kraft is now implementing “certain improvements” to its internal controls and has take other “rel measures,” it said.

“We continue to cooperate fully with the SEC and at this time the Company does not expect matters subject to the investigation to be material. For context, this $25 million increase to costs of products sold compares an annual procurement spend of over $11 billion annually for the total company,” Kraft Heinz spokesman Michael Mullen told TheStreet in an email.

The result was a 20% drop oven right which has extended this morning to a 25% collapse to a record low for the stock…

Bloomberg’s Kenneth Shea, global food and beverage analyst, notes that

“Persistently weak organic sales growth generated by Kraft Heinz’s stable of branded cheeses, meats and coffee products has begun to weigh on its industry-leading operating margins. Management’s plan to shore up sagging cash flow and reduce debt leverage through reduced dividend payout and asset sales is a sign of the urgency to restore growth.”

And finally, Warren Buffett is feeling the pain this morning as Berkshire Hathaway’s investment in Kraft declined from a valuation of about $15.7 billion to $11.7 billion as the stock plunged below $36 at this morning. Thursday’s announcement marks the second time this year that a Berkshire holding has disclosed unfavorable news after the markets closed, hurting its stock. Apple trimmed its revenue outlook in January, which pummeled shareholders. That stock has since recovered.

via ZeroHedge News https://ift.tt/2SQIgeO Tyler Durden