One day after Bad economic news was briefly bad news again – when a barrage of US economic data misses hammered the S&P – the trusty old “trade talk optimism” is back with a vengeance, and the result is a sea of green in global markets, with European stocks and US equity futures trading at session highs ahead of today’s main event, President Trump’s scheduled, and apparently quite bullish, meeting with China’s top trade negotiator in Washington. Also helping is the avalanche of Fed speakers, which today will see no less than 8 Fed speeches spreading the dovish gospel among BTFD algos everywhere.

- 8:15 AM Atlanta Fed President Bostic (FOMC non-voter) speaks

- 10:15 AM New York Fed President Williams (FOMC voter) and San Francisco Fed President Daly (FOMC non-voter) speak

- 12:00 PM Fed Vice Chairman Clarida (FOMC voter) speaks

- 12:30 PM New York Fed Executive Vice President Potter speaks

- 1:30 PM Vice Chairman for Supervision Quarles (FOMC voter) speaks

- 1:30 PM St. Louis Fed President Bullard (FOMC voter) speaks

- 1:30 PM Philadelphia Fed President Harker (FOMC non-voter) speaks

- 5:30 PM New York Fed President Williams (FOMC voter) speaks

And so one day after markets perplexingly closed in the red, US markets are set for a higher open, following similar moves across the world.

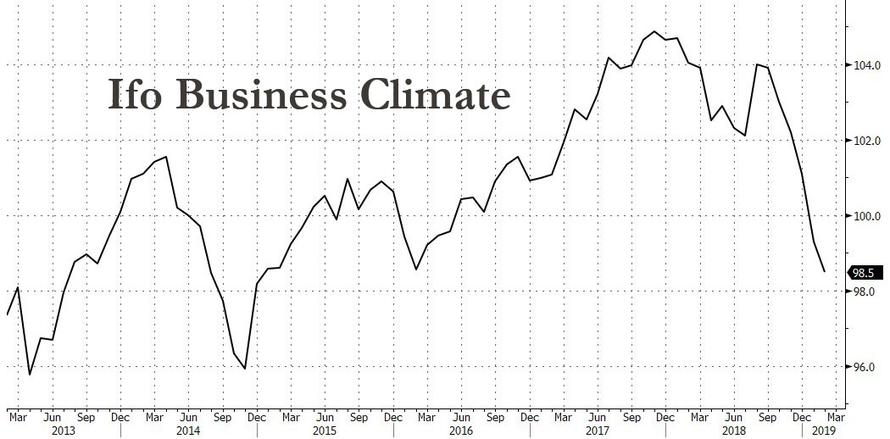

Following a mixed session in Asia, European stocks, bonds and FX markets traded near session highs in anticipation of more optimistic headlines from top-level trade talks between America and China, while ignoring the latest disappointing German data, where all February IFO survey components (business confidence, current assessment, expectations) fell from prior month, and missing forecasts while Germany’s final Q4 GDP of 0.0% was unrevised from the preliminary print.

Mining and technology shares led the advance in the Europe Stoxx 600 Index as Bloomberg’s industrial-metals subindex headed for its highest level since October, as positive earnings from companies drove big stock swings as European markets opened, with traders now awaiting European Central Bank President Mario Draghi’s a speech later Friday.

In the final Euro-area CPI data, both core (1.1%) and headline (1.4%) were unrevised from preliminary readings. More notably, ECB’s Nowotny said the central bank has no conclusions yet on TLTROs, and expects a decision on targeted loans to come later than March, adding that the Governing Council has until summer to reach a decision. Over in Sweden, central bank head Ingves says risks are now mostly on the downside, noting that if risks were to materialize Riksbank policy would need to be adjusted.

Across the Atlantic, futures on the Dow, S&P 500 and Nasdaq Composite indexes all climbed, even as Buffett darling Kraft Heinz plunged to the lowest on record after announcing a $15.4 billion writedown late Thursday. The S&P is now up 8 of the past 9 weeks

Emerging-market stocks rose for a fifth day, the longest streak since May, and a gauge of smaller Chinese stocks entered a bull market. Japanese shares slipped,

Earlier in Asia, shares were buoyed by a late rally in Chinese shares, with the Shanghai Composite closing 1.9% higher. Chinese shares had faltered earlier amid concern about slowing domestic growth and indications that China would cut its benchmark interest rate only as a last resort to boost the economy. Japan’s Nikkei ended 0.2% lower after data showed core consumer inflation accelerated in January but remained far from the central bank’s 2 percent target. Elsewhere, Australian shares gained 0.5 percent and Seoul’s Kospi ended up 0.1 percent.

As Bloomberg summarizes the narrative that has prevailed every day for weeks, markets were cautiously optimistic as U.S. President Donald Trump was set to meet with China’s top trade negotiator in Washington Friday, with the two sides facing a March 1 deadline to avoid a further escalation in tariffs. Optimism for an accord between the world’s economic superpowers combined with a less-hawkish stance from some of the biggest central banks has sent an MSCI global gauge of stocks surging 15% in less than two months. Still, concerns about global growth persist.

“Central banks will take center stage in March, and we believe their appetite to continue with tighter monetary policy will be scaled back,” Nedbank Group Ltd. strategists Mehul Daya and Walter de Wet said in a note. “Once again the global economy and especially financial markets cannot endure tighter monetary policy and would have to rely on policy makers to stimulate economic growth. These are symptoms of a fragile global economy and financial system.”

Still, it’s all about trade, as trade talks and a growing number of policy U-turns by global central banks have propped up equities in recent weeks. Trade talks between U.S. and Chinese negotiators continued in Washington, with little more than a week left before a U.S.-imposed deadline expires, triggering higher tariffs. Reuters reported on Wednesday the two sides were drafting language for six memoranda of understanding on proposed Chinese reforms, progress that had helped to lift investor sentiment.

Meanwhile, Chinese Vice Premier Liu He will meet with U.S. President Donald Trump at the White House on Friday, the White House said. “Given that enough headway seems to have been made to warrant a meeting between Trump and the Chinese negotiator today, it appears more likely that the U.S. will not raise the levies, which should help high-beta currencies and equities push higher,” said Konstantinos Anthis, head of research at ADSS.

In FX, the Australian dollar recovered after falling more than 1% on Thursday, when Reuters reported the Chinese port of Dalian had banned imports of Australian coal indefinitely. China’s foreign ministry said on Friday coal imports continued but customs had stepped up inspections environment and safety checks on foreign cargoes. Reserve Bank of Australia Governor Philip Lowe cautioned against seeing restrictions as being directed at Australia, and Prime Minister Scott Morrison said the ban does not indicate a souring relationship between the countries. Separate comments by Lowe that a rate increase may be appropriate next year also helped to boost the Aussie dollar. It was last up 0.35 percent at $0.71120.

Elsewhere, the dollar gained for a third day as traders awaited the outcome of U.S.-China trade talks and a series of speeches from Fed policy makers; the euro was 0.1 percent higher at $1.1346, nearing a two-week high. German business morale fell for a sixth time in a row, to its lowest in over four years, a survey showed. European Central Bank policymakers asked for swift preparations to give banks more long-term loans, minutes of its last meeting showed on Thursday.

New Zealand’s dollar weakened against all its major peers after the central bank said proposals to increase lenders’ capital requirements could eventually lead to an interest-rate cut. Sweden’s krona advanced versus all Group-of-10 peers after minutes of the Riksbank’s February meeting showed that “some board members discussed the recent depreciation of the krona and Deputy Governor Martin Floden even suggested that a weaker currency could play a part in him advocating for another rate increase already in two months

In rates, Italian government bond yields crept up on Friday, reflecting caution among investors before a Fitch ratings review. US Treasurys were generally unchanged, with the 10Y TSY trading at 2.68%.

The dollar and gold were flat, while West Texas oil traded rose above $57 a barrel in New York. Brent (+0.5%) and WTI (+0.5%) prices were firmer after a lacklustre overnight session, ahead of US President Trump meeting with Chinese Vice Premier Liu He. Goldman Sachs revised their 2019 US oil supply growth expectations to 1.4mln BPD from 1.2mln BPD. Looking ahead, we have the Baker Hughes rig count which last week saw oil rigs increase by 3 to 857, as such the total rig count figure was 1051 from the prior 1049. Gold (U/C) has been largely unchanged taking the lead from an uneventful dollar ahead of multiple key Fed speakers today, including Federal Reserve Vice Chair Clarida.

No major economic data are expected today, while several Fed representatives are due to speak. Cabot Oil, Magna International and Royal Bank of Canada are among companies reporting earnings

Market Snapshot

- S&P 500 futures up 0.3% to 2,782.50

- MXAP up 0.2% to 159.29

- MXAPJ up 0.5% to 523.30

- Nikkei down 0.2% to 21,425.51

- Topix down 0.3% to 1,609.52

- Hang Seng Index up 0.7% to 28,816.30

- Shanghai Composite up 1.9% to 2,804.23

- Sensex down 0.05% to 35,881.89

- Australia S&P/ASX 200 up 0.5% to 6,167.31

- Kospi up 0.08% to 2,230.50

- STOXX Europe 600 up 0.1% to 370.86

- German 10Y yield fell 1.1 bps to 0.116%

- Euro up 0.03% to $1.1339

- Italian 10Y yield fell 2.6 bps to 2.473%

- Spanish 10Y yield fell 2.0 bps to 1.183%

- Brent futures up 0.1% to $67.16/bbl

- Gold spot up 0.1% to $1,322.72

- U.S. Dollar Index little changed at 96.64

Top Overnight News

- Germany stagnated in the fourth quarter as an inventory slump wiped out support from consumption and investment, and business sentiment suggests the weak phase will continue as Ifo business confidence came in at 98.5 in Feb., vs est. 98.9

- China’s top leaders said they will work to keep the economy operating within a “proper range,” and reiterated that monetary policy will remain “prudent” and fiscal policy will remain “pro-active,” state-run Xinhua News Agency reported on Friday

- Chinese officials are jamming up imports of Australian coal, with at least one major port suspending customs clearance, but Beijing has denied a report of an official ban

- The U.K. said Brexit Secretary Stephen Barclay and Attorney General Geoffrey Cox discussed with the EU’s chief Brexit negotiator Michel Barnier “the positions of both sides and agreed to focus on what we can do to conclude a successful deal as soon as possible”

- EU Trade Commissioner Cecilia Malmstrom said a trans-Atlantic trade deal could be achieved before year-end, stressing a readiness to work speedily as the bloc tries to keep at bay the threat of U.S. automotive tariffs

Asian stocks were mixed following the weak lead from their peers in the US where all US major indices declined and the Nasdaq snapped its 8-day win streak, with sentiment weighed by uninspiring data. ASX 200 (+0.5%) and Nikkei 225 (-0.2%) were mixed with the Australian benchmark resilient as participants took a breather from the recent deluge of earnings and as financials remained afloat, but with upside capped by weakness in Energy following similar underperformance by the sector stateside and with Woodside Petroleum shares down by over 4% as it traded ex-dividend. Conversely, Japanese stocks were lacklustre after the recent flows into the JPY, while Hang Seng (+0.6%) and Shanghai Comp. (+1.9%) initially conformed to the indecisive tone but with losses in the mainland eventually reversed after a tepid liquidity injection by the PBoC and as focus remained on US-China trade talks with President Trump set to meet China Vice Premier Liu He later today. Finally, 10yr JGBs were initially underpinned by the weak risk sentiment and BoJ’s presence in the market for a total JPY 685bln of JGBs, but then pared a majority of the gains after hitting resistance at 153.00 and as the regional stock markets bounced off intraday lows.

Top Asian News

- Korea’s Oldest Conglomerate Hit by Weak Economy, Shares Drop

- Spreading African Swine Fever Hits Wilmar Earnings in China

- Philippine Central Bank Stays Hawkish on Policy, Deputy Says

- China Said to Slow Australian Coal Imports as Beijing Denies Ban

All major European indices are seeing mild gains [Euro Stoxx 50 +0.3%] after a mixed Asia session which took the lead from the US where all US major indices declined. Sectors are mixed, there is some slight outperformance in material names, with the likes of Thyssenkrupp (+2.0%) and Anglo American (+2.7%) in the green. Other notable movers include Wirecard (+3.4%) at the top of the Dax (0.4%) after the Co’s CEO stated that business remains strong. Sartorius (-2.3%) are towards the bottom of the Stoxx 600 after being downgraded to sell. Elsewhere, firmly in the green are Telecom Italia (+3.0%) after the Co. reported earnings with revenue broadly in-line with expectations; the Co. have also announced that they are to launch a partnership with Vodafone (+1.2%) to share their 5G mobile network. Nestle (-0.5%), the largest Co. in the Stoxx 600 which has a 3% weighting, in the red due to Kraft-Heinz being down 20% in the pre-market following downbeat earnings, a USD 15.4bln write-down and being subpoenaed by the Securities and Exchange Commission.

Top European News

- Inventory Slump Hits Germany as Business Outlook Slides Further

- European Food Stocks Slide After Kraft Heinz SEC Investigation

- Telecom Italia Pledges 2020 Return to Growth With New Plan

- Non-Standard Finance Makes All-Share Bid For Provident Financial

- Swedbank CEO Still Has Board’s Support Amid Laundering Shock

In FX, AUD,NZD,SEK More volatile trade down under, as the Aussie receives a welcome reprieve from China that has now categorically refuted reports that it blocked coal imports having initially claimed no knowledge rather than issuing a firm denial. However, Aud/Usd still seems top heavy amidst recent more dovish RBA calls, even though the Kiwi has been rattled by similar RBNZ impulses, and from the horse’s mouth as it were given comments from Bascand overnight about proposed rises in bank capital requirements heightening easing prospects, in time. Aud/Nzd has rebounded further from sub-1.0400 lows in response, as Nzd/Usd reversed through 0.6800 to circa 0.6760 at one stage. Conversely, Eur/Sek is around 10.6000 in wake of Riksbank minutes and accompanying statements from Governor Ingves in the main, playing down weaker than forecast Swedish inflation in January and keeping guidance for H2 tightening in place, albeit conditional on economic developments and unless downside risks (largely due to external factors) do not materialise.

- EUR,GBP The single currency and Sterling remain relatively rangebound on the 1.1300 and 1.3000 handles vs the Dollar respectively, but both currencies are getting indirect support from the Greenback’s failure to muster/sustain any positive momentum of its own. Eur/Usd continues to hit resistance above 1.1350 and a downbeat German Ifo survey has not helped, while Brexit is a constant weight for the Pound along with related fall-out on the domestic political front. From a tech perspective, 1.3000 is obvious support, especially as the 200 DMA is just 2 pips below, while for Eur/Usd a decent 1.6 bn expiry at the 1.1300 strike may underpin vs a 1.1362 Fib and the 30 DMA in close proximity at 1.1369.

- CAD, JPY Not much action in the Loonie or the Japanese currency, though the former is marginally benefiting from gains in the oil complex, mostly driven by market sentiment. Similarly, risk appetite has marginally weakened the JPY, with USD/JPY currently residing just below the top of the 110.65-90 intraday range. Back to the CAD, retail sales may spur some action in the Loonie with the headline expected at -0.3%, up from the prior -0.9%.

In commodities, Brent (+0.5%) and WTI (+0.5%) prices are firmer after a lacklustre overnight session, ahead of US President Trump meeting with Chinese Vice Premier Liu He at 19:30GMT. Of note Goldman Sachs have revised their 2019 US oil supply growth expectations to 1.4mln BPD from 1.2mln BPD. Looking ahead, we have the Baker Hughes rig count which last week saw oil rigs increase by 3 to 857, as such the total rig count figure was 1051 from the prior 1049. Gold (U/C) has been largely unchanged taking the lead from an uneventful dollar ahead of multiple key Fed speakers today, including Federal Reserve Vice Chair Clarida at 17:00 GMT. Elsewhere, recent newsflow has seen China’s foreign ministry denying reports that some ports in China have halted Australian coal imports; stating that Chinese customs are quality and environmental checks surrounding coal. Barrick Gold is reportedly considering a hostile bid for Newmont Mining Corp, at around USD 19bln in stock; which has the possibility of being one of the largest mining-deals ever

Looking at the day ahead, there’s no data due in the US, however it is a busy day for Fedspeak with Bostic, Williams, Daly, Clarida, Potter, Bullard, Harker and Quarles are scheduled to speak. The ECB’s Draghi is also due to speak at a ceremonial event this afternoon.

US Event Calendar

- Nothing major scheduled

- 8:15am: Atlanta Fed’s Bostic Delivers Opening Remarks in New York

- 10:15am: Fed’s Williams, Daly Discuss Inflation at Forum in New York

- 12pm: Clarida Speaks in New York on Fed Tools, Communications

- 12:30pm: New York Fed’s Potter Discusses Quantitative Tools

- 1:30pm: Fed’s Bullard to Speak on Balance Sheet in New York

- 1:30pm: Fed’s Harker Takes Part in Panel Discussion on Balance Sheet

- 1:30pm: Quarles Speaks in New York on Future of Fed Balance Sheet

- 5:30pm: New York Fed’s Williams Gives Closing Remarks at Fed Event

DB’s Jim Reid concludes the overnight wrap

I got home from Frankfurt yesterday to find windows open and duvets abandoned. Summer has temporarily arrived. However we forgot to close the window after dark and it was freezing going to bed. As could have easily been predicted, my eyes and nose have started to react horribly to the change in weather. Hay Fever is showing its ugly head again with a vengeance. One of the rare side effects of taking too many of my prescribed anti-histamines is apparently hair growing in usual places. For me that would mean my head. So if the corporate picture of me on this email looks different on Monday you’ll know what’s happened. Before the heatwave continues here in Europe over the weekend, a reminder that you can download our new podcast series “Podzept” on sites like Spotify. More details on this page http://www.dbresearch.com/podzept . This series includes one from me on what the history of populism can teach us.

Before you plug in your headphones for the weekend, markets have lost a bit of momentum over the last 24 hours. Indeed equity markets traded lower yesterday as a slew of mostly negative economic data, some signs of more intense trade disruptions, and a slight hawkish lean from the ECB combined to weigh on sentiment. The S&P 500, DOW, and NASDAQ fell -0.34%, -0.40%, and -0.39%, respectively, and the moves had a distinctly defensive tinge to them, with S&P 500 utilities and consumer staples (+0.75% and +0.28%) rising. In Europe, the STOXX 600 retreated -0.28% and Sweden’s OMX Stockholm 30 index underperformed sharply after Swedish regulators opened a money laundering investigation of its banking system. Swedbank (-9.34%), Nordea (-4.49%), and SEB (-4.04%) led declines.

Despite the mild selloff in equities, safe havens failed to rally much either. Treasury yields rose +4.1bps and bunds were up +2.7bps. Gold fell -1.15% and the dollar was close to flat. In fact, some of the only assets to rally yesterday were peripheral European spreads, which tightened -5.4bps, -3.5bps, and -2.5bps in Italy, Spain, and Portugal.

Data didn’t help yesterday with the big story being the flash February PMIs in Europe. To be honest we’ve had easier PMIs to summarise. In a nutshell a big jump in the services data more than offset a worrying decline in the manufacturing sector. The dilemma for markets is that modern economies are far more serviced based but asset prices tend to be correlated more to the manufacturing cycle – something that rung true yesterday.

In aggregate the Euro Area composite nudged up a bit more than expected, by +0.4pts to 51.4 (vs. consensus forecast for 51.1). The services reading jumped +1.1pts to 52.3 (vs. 51.3) however the flip side was the manufacturing print sliding below 50 and to the lowest in 68 months at 49.2 (vs. 50.3 expected and 50.5 previously). The data throws open the question of which way the gap may be closed – up to the services reading or down to the manufacturing reading?

Yesterday’s divergence was most stark in Germany. The services reading jumped +2.1pts to 55.1 (vs. 52.9) and the highest in five months while the manufacturing fell -2.1pts to 47.6 (vs. 49.8 expected) and the lowest in 74 months. The gap of 7.5pts between the two is the biggest since 2009. Like the broader Euro Area reading, the surprising increase in the services component did help the composite lift to 52.7 from 52.1. As our economists put it however, the overall data in Germany did little to provide any evidence of a normalization let alone a rebound. Indeed they note that on the contrary, the weak development in the industrial component points to negative GDP growth in Q1.

On the trade front, news was mixed, as Secretary of State Pompeo said in an interview that “real progress” is being made by negotiators. A subsequent report by Canadian newspaper Globe and Mail said that the two sides are making “the most significant progress yet toward ending a seven-month trade war.” That progress reportedly includes an offer from China to increase its imports of US agriculture products by $30 billion, which would be substantive but insufficient since the US is pushing for more commitments on intellectual property and other non-trade issues. Overnight, Bloomberg has reported that the US President Trump plans to meet China’s Vice Premier Liu He today afternoon (US time) while, the FT reported that the US and China negotiators are attempting to resolve disputes involving semiconductor companies – Micron and Fujian Jinhua – as part of the larger trade agreement as solid agreements on long-running commercial disputes may help the US sell a broader trade deal. The FT report further added that other measures being discussed include easing China’s restrictions on US polysilicone imports and final approval by the PBOC for Visa and MasterCard to provide domestic payment services in China.

Despite the more positive headlines on trade overnight, Asian markets are largely heading lower following Wall Street’s lead with the exception of China – the Shanghai Comp (+0.19%) is up while the Nikkei (-0.28%), Hang Seng (-0.34%) and Kospi (-0.26%) are all down. Elsewhere, futures on the S&P 500 (-0.07%) are trading flattish.

Somewhat related to trade, Reuters reported yesterday that China has blocked all coal imports from Australia at its Dalian port. While not a major destination for Australian coal (around 2% of exports), it may indicate that China is coercively flexing its trade power, and the Australian dollar weakened -1.05% (trading flat this morning). Separately, Maersk, the world’s largest shipping firm, announced a very low profit forecast for 2019 of $4bn, versus consensus estimates for $4.77bn. The CEO cited trade disruptions and macro slowdown as key factors, and the company’s shares slide -10.12% in Copenhagen.

To wrap up the PMIs, the data in France was a bit less exciting but all the same we did see the composite nudge up to 49.9 from 48.9, boosted also by an increase in the services reading of +2pts to 49.8 (vs. 48.5 expected), as the effect of the ‘Yellow Vest’ protests fades. The manufacturing reading rose +0.2pts to 51.4 (vs. 51.0 expected). So some big divergence across countries and sectors in the Europe PMIs which is only going to make it harder to build an ECB consensus. Next month’s meeting should be an interesting watch.

The PMIs weren’t the only developments in Europe yesterday with the ECB minutes and comments from Rehn and Nowotny also garnering attention. On the former, the minutes highlighted that “technical analyses” is required to prepare policy options for future liquidity operations and that this is needed to “proceed swiftly”. That reinforces the clearly converging sense of urgency amongst governing council members and is clearly no longer the big secret that it once was. The minutes also flagged that policy makers will assess the growth outlook “in more depth” in March when new forecasts are available.

As for Rehn’s comments, given his position as a contender to succeed Draghi later this year, it was notable to hear his use of the famous phrase “whatever it takes” which would clearly signal some form of policy continuity. Meanwhile Nowotny was at the margin a bit hawkish, saying specifically that “I personally can’t identify a need for additional liquidity”. DB’s Mark Wall did make the important point however that “no further liquidity” could just be consistent with a TLTRO2 solution that allows existing net exposures to be rolled over. Indeed, that policy option was explicitly referenced in a later MNI report, citing eurosystem sources, that policymakers are considering an extension of existing TLTROs for up to two years, with less generous terms than prior facilities. Overall, that would be toward the less-accommodative end of the spectrum of policy options.

Over on the other side of the Atlantic, the US chose not to be outdone on the data front. Of particular note was the plunge in the Philly Fed survey in February by 21.1pts to -4.1 (vs. +14.0 expected). That was the largest single month drop since August 2011 and notably new orders were also very soft (-2.4 vs. +21.3 previously). The good news was that the six-month ahead component was a lot more positive which perhaps lends an argument to the government shutdown impact. In better news, the latest jobless claims reading declined 23k to 216k. That followed three straight weeks of >235k prints so we were running out of time to blame the shutdown. As for the December orders data, ex transportation (+0.1% mom vs. +0.3% expected) and core capex orders (-0.7% mom vs. +0.2% expected) both missed which is significant for Q4 GDP, while the flash February PMIs also diverged (as with elsewhere around the world) with services +2pts to 56.2 and manufacturing -1.2pts to 53.7. Finally the January leading index (-0.1% mom vs. +0.1% expected) and existing home sales (-1.2% mom vs. +0.2% expected) data both missed.

Over to Brexit and the UK Parliament vote was confirmed for the 27th. In all likelihood the newsflow suggests that the vote won’t be on a new withdrawal agreement according to DB’s Oli Harvey and so therefore remains to be seen what May can offer MPs to stave off a Boles/Cooper revolt which would force the government to extend Article 50 (though the amendment is now technically called Letwin-Cooper). So a delicate few days of negotiation ahead at home and in Brussels but it seems any concession from the latter isn’t going to come ahead of next week so for May’s strategy to work she seemingly needs to take Parliament with her well into March. Challenging!! Moreover, Bloomberg has reported that the EU sees PM May asking for a three-month extension to Brexit assuming that a deal is reached in March to give the UK parliament enough time to pass necessary legislation related to its departure from the EU while adding that both sides are keen to avoid an extension of longer than three months as it would put the UK under pressure to take part in European elections on May 23-26. Elsewhere, the Telegraph reported yesterday that a group of 100 conservative lawmakers have signed a letter addressed to Julian Smith, the chief whip of the party, indicating that they’d vote against May to force her to delay Brexit and take no deal off the table in case she is not able to reach a deal and have called for a free vote next week on a backbench bid to take no deal off the table. In part this gives more legs to the Letwin/Cooper amendment. Sterling finished -0.11% weaker yesterday.

In other news, CNN reported that the US Justice Department is preparing to announce as soon as next week the completion of Mueller’s Russia investigation. On this, Bloomberg reported yesterday that Democrats were seeking to potentially subpoena Mueller if the results aren’t publically released. Expect this to be a big topic next week.

Finally to the day ahead where this morning we get the final Q4 GDP revisions in Germany. A reminder that the preliminary reading came in at +0.02% qoq and therefore implied that Germany had avoided a recession by the thinnest of margins. As we stated last week it was a margin roughly equivalent to the EuroMillions winner’s cheque from last week. So even the smallest of downward revisions could see Germany tip into a technical recession with Q1 also not looking great so far (see earlier). Also due out will be the February IFO survey in Germany before we get the final January CPI revisions for the Euro Area and February CBI survey in the UK. There’s no data due in the US, however it is a busy day for Fedspeak with Bostic, Williams, Daly, Clarida, Potter, Bullard, Harker and Quarles are scheduled to speak. The ECB’s Draghi is also due to speak at a ceremonial event this afternoon.

via ZeroHedge News https://ift.tt/2GYeVYS Tyler Durden