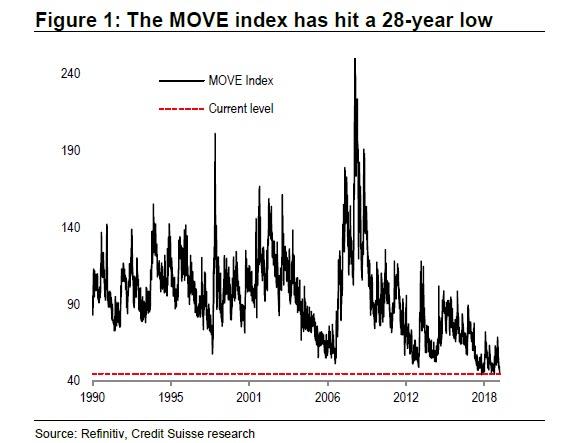

Yesterday we presented some thoughts from Credit Suisse and Deutsche Bank on the recent plunge in government bond vol, which according to the MOVE index has tumbled to all time lows.

However, it’s not just bonds where volatility has evaporated: in addition to equities in both developed and emerging markets, vol has also crashed in currency trading, as represented below by the Deutsche Bank CVIX FX vol index.

In light of this collapse in volatility across virtually all asset classes, it’s no no surprise, SocGen’s FX strategist Kit Juckers writes, “that we’re fielding more questions that usual about why volatility is so low in the FX market. Nor is it all that surprising that FX carry strategies are back in vogue.”

As Juckes explains, there are four ingredients that combine to make this low volatility, carry-favourable environment:

- The first is the US interest rate backdrop. As Juckes explains, the peak in Fed Funds seems likely to be even lower than the downward-revised estimates of neutral real rates suggested, and there’s enough econometric work out there showing that how fed Funds behave through the cycle is the biggest driver of volatility.

- Secondly, major central banks’ monetary policy is going nowhere – the Fed is patient, the ECB is on hold and the BOJ may be even more on hold than either of them.

- Thirdly, the combined size of the fed, ECB and BOJ balance sheets is going to be bigger, for longer, than most would have guessed a few months ago.

- Finally, China is under pressure from the US to ensure yuan stability, which as Juckes notes “funnily enough is something that the Chinese themselves already seemed to favor.” In other words, if the world’s most important currency (possibly) is set to be stable, then the FX market will be quiet for a while. And carry hunters in FX will like owning the yuan, while bond investors will go on liking Chinese bonds.

So when will this “global goldilocks” period end? To the always skeptical Juckes, “all of this has an ‘Indian Summer’ feel to it – i.e., a late-cycle rally before wintery conditions return.” He then suggests that what ends the low vol period, will be the downside of the economic cycle, particularly in the US.

Despite the unexpectedly strong delayed Q4 GDP print earlier this morning, the slowdown is only just starting and quite a few economists are cutting their forecasts of slower US growth: already the consensus looks for 2.5% growth this year, slowing to 1.9% in 2020 and 1.8% in 2021. To Juckes, it would be a stretch to call that a downturn at all, and if the consensus is right, markets will go from early spring, to summer and back to spring without any kind of winter at all. And while SocGen finds this “absurdly over-optimistic”, the bank’s fx strategist concludes that “it won’t stop the carry party rolling on for a few more months.”

via ZeroHedge News https://ift.tt/2Ejkzlm Tyler Durden