Authored by David Robertson via RealInvestmentAdvice.com,

One of the most fundamental arguments for investing in stocks is to benefit from growth. Whether it arises generally from growth in the broader economy or more specifically from opportunities in sectors or individual companies, growth can drive investments. Outperformance of the growth style over that of value for the last ten years has hammered home the primacy of growth.

The natural appeal of the growth proposition, however, also belies important risks for investors. One is that the benefits of growth are often offset by declines in return on capital. Another is that growth can easily be overestimated. Either way, the unfortunate reality is that too often investors do not benefit from growth as much as they anticipate.

As important as growth is in investment analysis, the association between growth and investment returns is often poorly understood. A recent study by Jean-Francois L’Her, CFA, Tarek Masmoudi, and Ram Karthik Krishnamoorthy, CFA in the Financial Analysts Journal [here] explores the association and provides some interesting new insights.

The authors acknowledge that in practice:

“Economic growth forecasts are core inputs used to differentiate long-term expected stock market returns”.

But the authors also point out that the link between economic growth and stock returns is more fraught than many practitioners appreciate.

Several different studies using different data sets show that “high (low) economic growth may not necessarily turn into high (low) returns.” At best, studies correlating real aggregate GDP to market returns have been mixed. At worst, several studies focusing on the growth rate in GDP per capita produce negative correlations between returns and economic growth. The lack of a conclusive relationship between growth and returns has been viewed as a“puzzle”.

In order to better understand the relationship between growth and returns the authors examine returns of stocks in 43 different world markets over the period from 1997 to 2017. In doing so, returns are decomposed into eight distinct components. Most of them include factors that investors are quite familiar with such as inflation and currency effects, margin growth, payout ratio variation, real per capita GDP growth, price-to-dividend variation, and dividend yield.

Two of the factors, however, require a bit of explanation. They represent “slippage” that prevents economic progress from being realized in returns. One is relative dynamism which reflects the degree to which entrepreneurial efforts are or are not captured by indexes of public stocks. The other is net buybacks which reflects the increase or decrease in the ownership percentage of existing shareholders as a result of new issues or repurchases.

With that, one finding from the research was simply to corroborate earlier studies: The results “confirm that economic growth does not necessarily translate into stock market returns.”

Another finding, however, is more surprising — and more meaningful. It turns out that the dispersion of returns is absolutely dominated by one factor.

The authors report:

“Net buybacks have explained 80% of the cross-sectional dispersion of stock market returns of developed and developing markets since 1997, hence dwarfing the seven other building blocks considered in the decomposition of stock market returns.”

In short, it’s not economic factors that dominate differentiation, but rather slippage.

These findings are especially relevant for emerging market investors, many of whom have been pitched the narrative that emerging markets are attractive because they are exposed to higher economic growth. The research disproves this narrative and Peter Tasker provides an excellent illustration that captures why the narrative fails in the Financial Times [here].

“Rich and stable cashflows are much rarer in emerging economies than in mature economies. So even the companies that do survive and prosper – the emerging world’s emerging champions – will likely finance their growth by repeatedly raising large amounts of new capital. This is of no benefit to shareholders without an overall improvement in return on capital. Why waste time attempting to raise returns on your existing capital when you can easily access more?”

Citing a study by Jay Ritter of the University of Florida, he determines,

“Countries with high growth potential do not offer good investment opportunities unless valuations are low.”

This provides useful insight as to why net buybacks are such an important factor. It’s not at all that growth is a bogus variable. Rather, just like a car with a great engine but a faulty transmission, economic growth provides power, but it will only move the car forward when that power gets transmitted to the wheels. Likewise, the power of growth only benefits existing shareholders to the degree that it gets transmitted without slippage.

Nor is the phenomenon of faulty transmission confined to country markets. The exact same phenomenon occurs with companies and sectors as well. In a previous blog [here] I noted that tech executives,

“Believe that they can always raise financial capital to meet their funding shortfall or use company stock or options to pay for acquisitions and employee wages.”

Such freely available capital results in a situation in which “The CEO’s principal aim therefore is not necessarily to judiciously allocate financial capital but to allocate precious scientific and human resources to the most promising projects …” In other words, existing shareholders are the ones who suffer.

This creates something of a zen-like paradox for investors. The more you look for growth to drive returns, the greater the chance your returns will suffer because of dilution by additional capital. So, growth does not give back when demands for external financing are either too high or too tempting.

Another situation in which growth can fail to deliver is when it gets overestimated. As James Montier describes [here]:

“Overoptimism and overconfidence are two well-known psychological traits of our species. They are particularly dangerous in the late stages of an economic cycle where these terrible twins result in investors overestimating return and underestimating risk …”

Further, our natural predilection for optimism can be exaggerated by an environment of low rates. As I also noted in a prior blog post,

“Low rates unleash natural limits to speculation and pave the way for inflated expectations to become even more so. This means that the hype cycle gets amplified, but it also means that the cycle gets extended.”

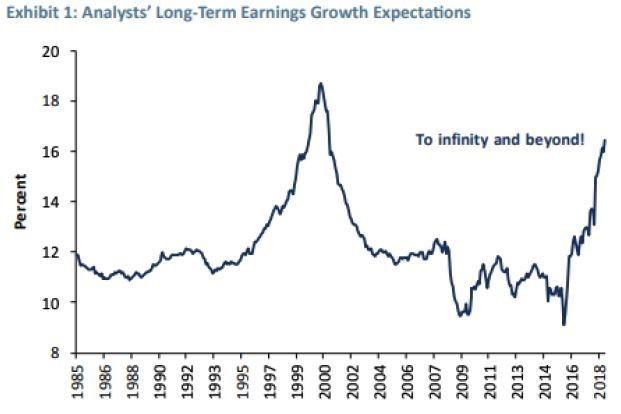

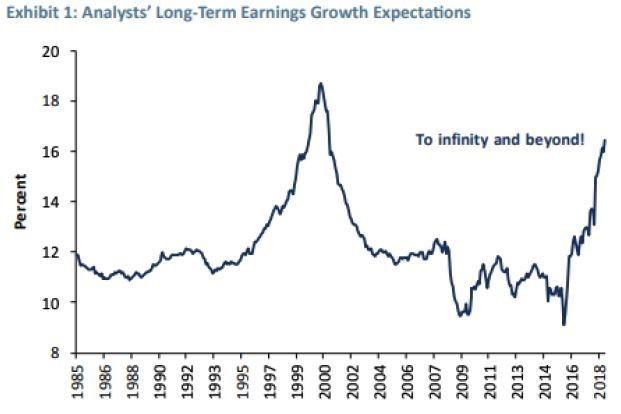

Such tendencies can also be fueled by earnings estimates. Montier shows:

“Take for example Exhibit 1. It shows the long-term EPS expectations from consensus bottom-up analysts. It appears that analysts are extremely optimistic about long-term growth prospects. Indeed, to borrow an expression from Toy Story’s Buzz Light Year, they appear to believe earnings can grow ‘To infinity and beyond.’ Their expectations have now soared to levels last seen during the tech bubble of the late 1990s.”

Source: GMO, I/B/E/S

This is interesting because this “unbridled economic enthusiasm” flies in the face of a far more mundane economic reality. Montier presents an exhibit (below) which “shows the flight paths of all post war economic expansions in terms of GDP.” He highlights:

“The current expansion is the slowest and weakest economic recovery witnessed in the entire post war period.”

Source: GMO

This is not an outlier forecast either; John Hussman corroborates the findings [here]. Taking his measure “from the peak of the economic cycle in 2007 to the current peak,” Hussman finds,

“Actual S&P 500 reported GAAP earnings have grown at an average rate of just 3.8% annually, with revenues growing at just 2.7%”.

In the context of such evidence, he characterizes current long-term earnings projections as “particularly offensive”.

Montier goes on to explain how estimates can become so inflated:

“Because most of the analysts are spoon fed the short-term outlook from company managements, they don’t have many degrees of freedom in their model to twiddle with to get their desired outcome, so they end up jacking up long-term earnings growth. So, in some ways, the picture in Exhibit 1 is a reflection of market prices action.”

So, on many occasions, there is a lot less to growth than meets the eye. It’s not so much that long-term growth prospects actually become so much better. Rather, there is a positive feedback loop in which expectations get inflated, investors chase prices up, and analysts raise growth estimates to adjust. Rinse and repeat.

Despite all of this, however, “the stock market remains well bid,” observes Montier, which despite wobbles in the fourth quarter remains true. As a result, one could plausibly argue that growth expectations may very well be too high, but so what if the stocks aren’t reacting?

It is a fair argument over the very short-term, but there are also clearly identifiable ways in which inflated growth expectations will come back to haunt investors over any longer period. One of those ways is described by Martin Tarlie at GMO [here]: He notes,

“Bubbles are prone to form when times are good (high valuation) and expected to get even better (positive expected change in sentiment). Bubbles burst when hopes of even better times ahead are dashed.”

So, one thing to look out for is anything that can dash hopes of even better times ahead. On this score, there is plenty of fodder to choose from. The FT reported [here],

“This global outlook does not help assuage growing pessimism over US corporate earnings growth and margins. Wall Street analysts have sharply cut their outlooks for profit expansion over the first half of this year.”

This negative assessment was complemented by another:

“Wariness rightfully prevails at the moment and this week the International Monetary Fund chimed in with the observation that global activity is weakening faster than expected.”

In addition, these reports were punctuated by Greg Jensen, co-CIO of Bridgewater, who indicated at the World Economic Forum in Davos [here] that “he sees a more negative outlook for growth than the markets and policy makers.”

With the knowledge, then, that growth expectations appear far too high, that bubbles burst when hopes of even better times are dashed, and that an increasing body of evidence is dashing those hopes, it looks like an accident waiting to happen.

Investors can also gauge the progress of this accident-in-the-making by monitoring market activity. Stocks remain well bid according to Montier:

“In large part from the buybacks (and mergers) from USA Inc. itself. However, individual investors have returned to the ‘party’ – never a good sign. Other portents of late-cycle capitulation include global fund managers throwing in the towel and buying into U.S. equities.”

So, three main groups of investors continue buying stocks at higher prices that assume even more exaggerated growth rates. Why would they do that?

Harley Bassman provides some helpful perspective [here] by noting simply,

“Everybody acts rationally from their own point of view.”

Fair enough. So what incentives might they have and how long might they persist?

US companies certainly have incentives to repurchase stock under certain conditions. For example, when organic growth rates are low or uncertain, companies can sensibly look elsewhere to deploy cash. In addition, when repurchases can be financed with cheap debt, a decent argument can be made to repurchase. Finally, few corporate executives would object to propping up share prices which serve as both their scorecard and remuneration package.

Companies have been repurchasing shares at a torrid pace but are unlikely to be able to do so indefinitely. For one, higher debt loads increasingly constrain the repurchasing capacity of many companies. As a result, companies increasingly depend on cash flows to finance repurchases and those will decline in any downturn. Sooner or later, this source is likely to dry up.

Global fund managers also have incentives to buy overpriced stocks when the risks of losing clients by being out of the market is greater than the risk of losing money for them. While career risk creates a potent motive for buying expensive stocks on the way up, it is just as potent of a risk on the way down.

Finally, individual investors are notorious for being late to the market party — both on the way up and on the way down. As a result, it is possible that they remain net purchasers of stocks long after the evidence, and the markets, have turned against them.

Because long-term growth estimates are so inflated right now and because capital is still readily available for which to dilute existing shareholders, there is enormous potential for investors to be disappointed by growth prospects. Fortunately, there are things investors can do to moderate this risk.

Two types of growth companies are especially vulnerable to significant dislocations and should be carefully assessed by investors. One type includes companies that have high growth expectations but low returns on capital. Due to the low returns, these companies rely heavily on external financing to fund their growth. If/when hopes get dashed, not only do growth expectations come down, but external financing can dry up in a heartbeat.

This not only puts company growth at risk, but often company viability as well. As such, the payoff structure looks a lot more like a call option than a stock. This isn’t inherently bad but given the potential for a substantial or total loss, it should probably not be a core holding in a retirement account. The poster child for this type of company is Tesla.

Another type of company has very high returns and very high growth expectations. For these companies, growth can be funded internally so lower growth prospects do not present the same kind of existential risk.

The bigger threat for these companies is valuation risk. The combination of high returns, high growth and strong competitive advantage is incredibly powerful for creating value. By the same token, however, when expectations are reduced, warranted value can fall precipitously. Apple is a good example.

Investors should also beware that regardless of what happens with growth expectations, it is very unlikely that they will receive any kind of warning that things are changing. As John Hussman describes,

“Instead of the investment profession acting as a historically-informed buffer to defend investors against reckless speculation, extrapolative projections … are actually endorsed and encouraged by the very people who should know better.”

As a result, the best way to avoid a big downdraft is to read the economic cues and adjust exposure before everyone else tries to.

Finally, L’Her, Masmoudi, and Karthik Krishnamoorthy leave readers with a useful message:

“This finding does not mean that economic growth is bad, simply that it is not necessarily captured by existing shareholders”.

That’s a good lesson to embrace. In an environment saturated with growth narratives and significantly inflated expectations, it helps to know when you get rewarded for growth and when growth doesn’t give back.

via ZeroHedge News http://bit.ly/2S31Ow7 Tyler Durden

Elizabeth Warren’s wealth tax is the worst form of stunt policy: a bad idea that gets us nothing.

Elizabeth Warren’s wealth tax is the worst form of stunt policy: a bad idea that gets us nothing.