By now, the idea that Florida police busted up an international sex slavery ring operating through Chinese massage parlors has firmly taken hold in the national narrative, even though most of the charges, including those levied at Patriots owner Robert Kraft, were misdemeanors for soliciting prostitution. A closer look at the arrests in this operation reveals just how shoddy the reporting on the case has been—and just how little the police statements on TV resemble what they’ve put in their actual reports.

By now, the idea that Florida police busted up an international sex slavery ring operating through Chinese massage parlors has firmly taken hold in the national narrative, even though most of the charges, including those levied at Patriots owner Robert Kraft, were misdemeanors for soliciting prostitution. A closer look at the arrests in this operation reveals just how shoddy the reporting on the case has been—and just how little the police statements on TV resemble what they’ve put in their actual reports.

No one in this case was arrested on suspicion of sex trafficking, forced labor, compelling prostitution, or any other charge that implies force, fraud, or coercion in the arrangement.

Of the workers we know of from police documents (including those who were arrested and those who weren’t), all have official massage therapy licenses in good standing. The Asian-owned massage and spa businesses raided across four counties were also licensed and in good standing with the state of Florida.

Police from Vero Beach said in a press release that one woman had been arrested for human trafficking, and Florida news outlets are still running with that story. But a simple check of county court records shows that this is not the case. Like her colleagues, the woman is charged with engaging in prostitution herself, “deriving support” from prostitution, and “racketeering,” which sounds serious but just means working with others to accomplish something illegal.

Mutually Trafficking Each Other?

All of the women who were arrested in these stings are being charged with prostitution themselves. They’re also facing felony charges for participating in and earning money from each other’s sex work. In this way, police have found a sort of loophole that allows them to bring felony charges against sex workers simply for working together.

Some of the women arrested were managers or owners at one of the 10 spas targeted, but others simply worked there themselves, giving massages and sometimes something extra, and occasionally accompanied their managers on errands like going to the store or bank. (Police suggest these instances of them traveling together could mean workers were victims who couldn’t be let out of eyesight, and yet they also charge the workers with felony crimes for going along on these tasks.)

Not counting clients like Kraft, nine women and one man are currently facing charges in conjunction with these stings, which come from two separate but similar operations carried out simultaneously on Florida’s southeast coast. One involved the participation of Homeland Security Investigations, the Vero Beach Police Department, and the Indian River Beach County Sherriff’s Office, while the other included authorities from nearby Martin and Palm Beach counties.

The Palm Beach County and Martin County Stings

The Palm Beach/Martin operation has been getting the most attention, since it’s the one that snagged Kraft. Some have extrapolated from his arrest to assume that all the customers at these massage parlors were rich, white men, and to insinuate that this is isolating them from more severe charges. But by all evidence, soliciting prostitution was the extent of their criminal conduct. And according to the arrest records, at least half of those arrested were men of color. Their listed occupations include an array of manual labor jobs, including “dog grooming,” “mover,” “roofer,” and “painter.”

The Palm Beach/Martin operation has been getting the most attention, since it’s the one that snagged Kraft. Some have extrapolated from his arrest to assume that all the customers at these massage parlors were rich, white men, and to insinuate that this is isolating them from more severe charges. But by all evidence, soliciting prostitution was the extent of their criminal conduct. And according to the arrest records, at least half of those arrested were men of color. Their listed occupations include an array of manual labor jobs, including “dog grooming,” “mover,” “roofer,” and “painter.”

All of the businesses targeted in Palm Beach and Martin Counties were legally registered and licensed in the state of Florida; one had opened in 2012, the others in 2016–2018. Orchids of Asia and Sequoia Apple Day Spa both list Hua Zhang as their owner; the other three (Florida Therapy Spa, Cove Day Spa, and Bridge Spa) were owned or run by Ruimei Li.

After at least six months of surveillance and undercover operations at these businesses, police wound up arresting Zhang, Li, and two other women on prostitution and prostitution-related charges. All of the women arrested were Chinese nationals in their late-thirties through fifties, and all of them came to the U.S. legally.

The Indian River Beach County and Orange County Stings

The stings in Indian River Beach and Orange counties netted more than 100 solicitation arrests for customers plus the arrest of six people (five women, one man) associated with the massage businesses. The man is accused of serving as a driver for women who worked temporarily at the spas while visiting from out of town; he has been charged with racketeering. The women are charged with prostitution, racketeering, and deriving support from the proceeds of prostitution. One is also charged with “unlawful transport for the purpose of prostitution.”

There is no evidence in initial complaints, the arrest affidavits, the arrest warrants, or subsequent court documents that any of those arrested were using force or deception at the massage businesses. On the warrants, the victim is listed as the State of Florida.

The police documents detail the lengths local cops and federal agents went to in order to show that some men were getting jerked off after their massages. In Orange and Indian River Beach, the investigation dates back to at least August 2018 and involved East Sea Spa, AA Massage, A+ Massage, and East Spa.

First, an undercover Homeland Security agent received massages and asked about add-on sexual services. A police report said that the agent kissed and had his penis touched by the worker but left before anything else could happen.

Then they staked out the businesses, went through their trash and tested it for semen, interviewed men who exited, and followed around the women who managed and worked at the spas. (One very detailed section of arrest affidavits describes two of the arrested women buying condoms.)

Then they got warrants to install hidden cameras in massage rooms and captured weeks’ worth of video evidence from within.

If abusive antics were an issue at these places, weeks of hidden camera footage should at least have hinted at it. Instead, nothing on the extensive surveillance footage yielded charges for sex trafficking or other abusive behavior. What it did catch was a bunch of regular massages being given and sometimes additional sexual activity—mostly hand jobs.

Cops Can’t Do Math (or Truth)

Police have suggested that “victims” at these businesses were sexually serving 1,500 men per year. But according to arrest documents, their cameras caught an average of about one sexual customer per employee every three days.

Those that were arrested stand accused of engaging in between 3 and 16 paid sex acts apiece throughout the 40-day surveillance period.

Police originally relied on two details to spin the trafficking narrative in the press: Some of the women were living at the massage parlors, and they “weren’t allowed to leave.” But Martin County Sheriff William Snyder later admitted that the part about not being allowed to leave was false.

Included as evidence that they lived there was the presence of “food and condiments” in a kitchen fridge—pretty standard for workplace kitchens, no? In addition, one of the places had two extra rooms, in which police found beds made with sheets and pillows and dressers holding personal belongings. Police later told reporters these women were sleeping on “cots” and in “squalor,” but that’s not what their official report says. (It’s also worth noting that the one woman police say for sure was briefly staying at one of the spas is also facing the most prostitution charges, so in practice police don’t really seem to think sleeping there equates to victimhood.)

In any event, the fact that some women may have temporarily lived in the spare bedrooms needn’t speak to anything untoward. Police suggest that some of the workers came in for a short time from other U.S. cities; these rooms could have been temporary crash pads while they were there.

Because these are Asian immigrant women, many people are quick to see visiting from other cities as something salacious and horror-filled. But sex workers (including those unquestionably on the high end of the empowerment and independence spectrum) often “tour” when work is slow in their cities, or to exploit the novelty factor to make money in a concentrated time period elsewhere. The fact that Chinese-American masseuses and sex workers may work together and have informal community ties doesn’t make them a vicious sex-slaving conspiracy.

Prices at the different spas varied—they were owned and staffed by different people—but they do not suggest overall that these women were operating at the most desperate level. At the Indian River Beach spas, a regular massage cost $50 and a “happy ending” (manual stimulation of the genitals) was $60 on top of that. Oral sex was an additional $100, and full sex $160. At others spas, women offered different arrangements and prices, which suggests they were setting their own terms.

Most of the women arrested are still being held in county jail. Their bonds have been set in the $200,000 to $800,000 range, and any money they earned working at the massage parlors (as far we know, their only source of income) cannot be used to pay this balance. So far, at least three have entered pleas of not guilty and are asking for jury trials.

The more that comes out about this case, the more it looks like police are just using human trafficking fears to justify their months of undercover massages and their big press announcement about arresting Kraft.

The authorities may eventually find illegal dealings beyond consensual commercial sex, but they certainly haven’t yet. Apparently, they chose to go on a national media offensive with the sex-trafficking story before even having a shred of evidence to that effect.

But now that Kraft has made headlines and the national media have milked the story, how many people will care if cops quietly drop the bit about the transnational sex cabal? Will anyone even notice what ultimately happens to these women that police stalked, made secret porn films of, and then locked in cages?

from Hit & Run https://ift.tt/2EelKCg

via IFTTT

Sen. Mike Lee (R–Utah) said today that under both Republicans and Democrats, the United States has “deviated from” the principles of federalism and separation of powers.

Sen. Mike Lee (R–Utah) said today that under both Republicans and Democrats, the United States has “deviated from” the principles of federalism and separation of powers.

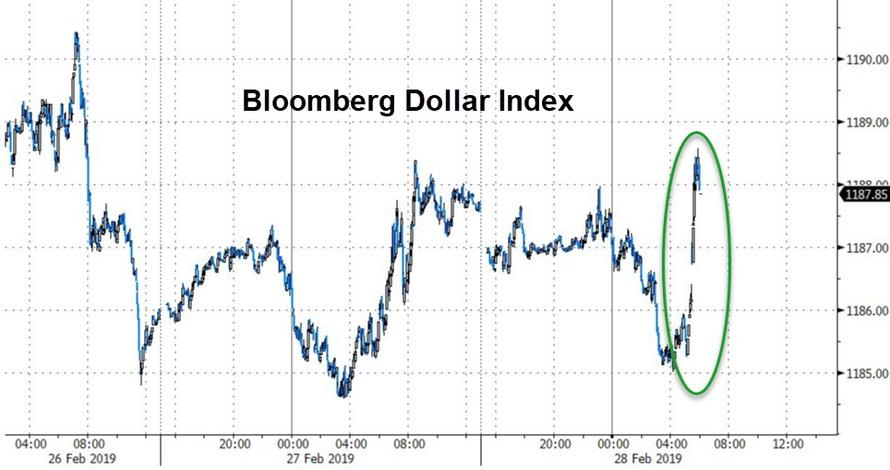

A “friendly” departure but no agreement. This time yesterday, President Donald Trump was being heralded for his meeting with North Korean leader Kim Jong Un, the second in a series meant to seal Kim’s approval for nuclear disarmament and other good deeds. That didn’t pan out.

A “friendly” departure but no agreement. This time yesterday, President Donald Trump was being heralded for his meeting with North Korean leader Kim Jong Un, the second in a series meant to seal Kim’s approval for nuclear disarmament and other good deeds. That didn’t pan out.