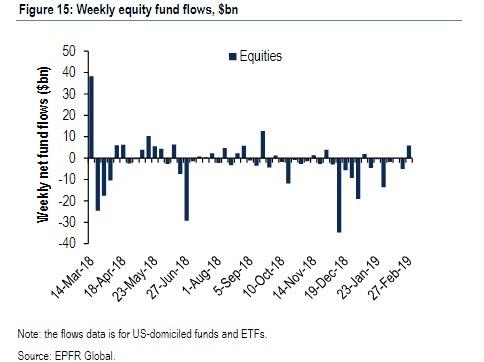

The buyer strike in US stocks is finally over.

After 12 consecutive weeks of outflows, which saw $50.3BN of redemptions – the worst start since 2016 – with US equity funds suffering a $4.6 billion outflow last week even as stocks continued their relentless ascent higher, BofA reports that according to EPFR data, equities finally saw an inflow of $9.1BN in the latest week, the largest since September as the bears finally threw in the towel and joined the CTA, stock buyback and short covering frenzy.

Even so, total global equity inflows were muted, and amounted to just $0.3 billion ($10.2BN in ETF inflows offsetting $9.9BN in mutual fund outflows), with all non-US regions seeing modest outflows:

- Japan: 3rd week of outflows ($0.9bn)

- Europe: chunky outflows again ($4.1n)

- EM: 2nd week of small outflows ($0.1bn)

Broken down by style, equity buying was modest and exclusively in “growth” not “value”. Specifically, inflows were observed in US large cap ($4.6bn) and US small cap ($0.3bn). A breakdown by sector saw inflows in: consumer ($1.7bn), tech ($1.3bn), healthcare ($0.7bn), real estate ($0.4bn), utilities ($0.2bn), materials ($41mn), while outflows were focused on energy ($1mn), and financials ($0.5bn).

A curious tangent: while there was a reversal in EM flows, with 2 consecutive weeks of outflows after a record inflow streak, China has curiously been lagging inflows to EM.

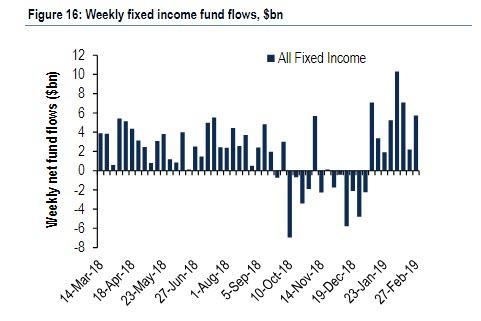

Meanwhile, it is quite notable that the tepid reversal into US equity flows did not come at the expense of bond outflows, which saw another impressive $6.5BN in total inflows.

Some more details on the latest relentless fixed income inflow data:

- 6th week of IG bond fund inflows ($2.9bn)

- 5th week of HY bond inflows ($0.8bn)

- EM debt inflows 7 of past 8 weeks ($1.1bn)

- 8th week of Muni fund inflows ($1.2bn)

- 8th week of MBS fund inflows ($0.6bn)

- Small Govt/Tsy inflows ($0.3bn)

That said, even here there was some modest outflows, including the 5th consecutive week of TIPS outflows ($0.5bn) and the 15th week of bank loan fund outflows ($0.1n).

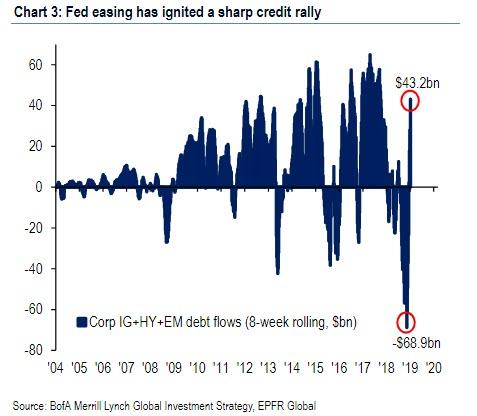

Commenting on the recent flows, BofA’s CIO Michael Hartnett writes that the “Fed has ignited credit”, and as shown in the chart below, inflows to IG/HY/EM debt for the past 8 weeks amounted to $43BN, a major reversal from $69BN of redemptions in these credit products in Nov/Dec.”

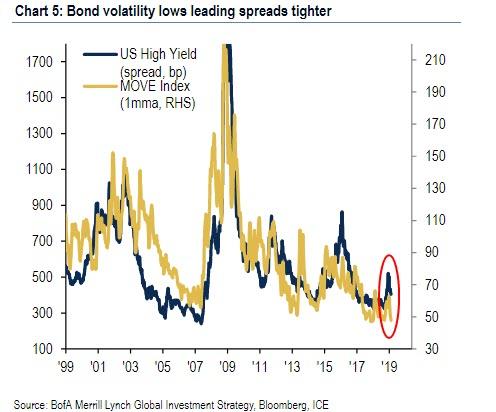

And speaking of the Fed, Hartnett also notes that the equity rally has not led to Fed tightening as was expected (on the contrary, Fed talking “inflation targeting” to head off MMT) while the PBoC/ECB/BoJ are now ready & willing to ease. As a result of this increasing dovishness, both US & Euro HY corporate bond returns are already back to highs, while as discussed two days ago, the bond volatility MOVE index at lows as policy makers are urging trade to “stay long risk.”

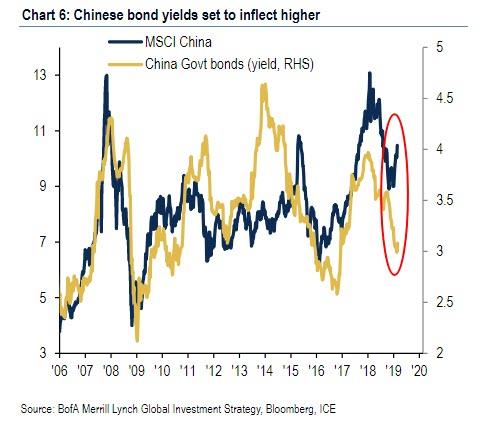

Ironically, while the global economy was sharply slowing, the read-through by markets was especially bullish as it assured even more dovish central bank responses. However, a recent risk has emerged to risk in the form of a new batch of “green shoots”: even as Japan/EU remain recessionary, China’s new orders rose for the 1st time in 9 months; Meanwhile in the US, claims data still low, while as a result of the “reflation” narrative, the 5s30s US yield curve has steepened 25bps past 3 months, as China bond yields inflecting higher.

To BofA, this suggests to position “for Q1 global EPS expectations trough”, in other after a brief earnings recession in Q1, BofA expects another sharp rebound in corporate earnings.

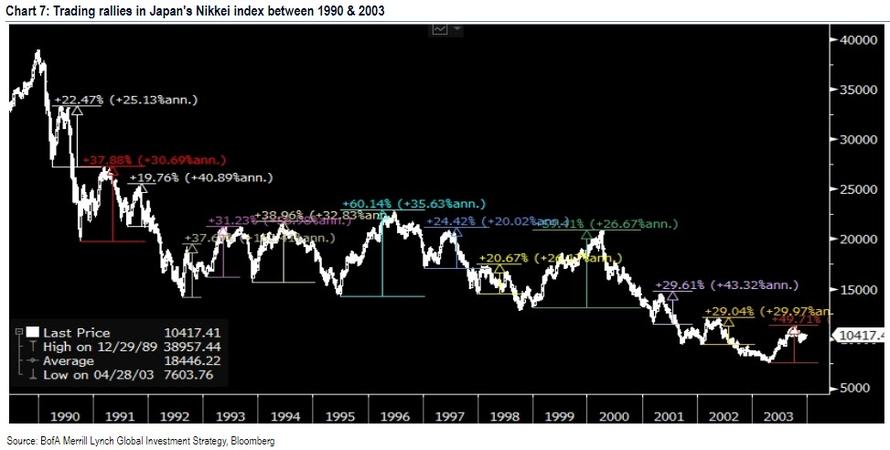

There is some more bad news however, and as Hartnett summarizes, these markets are for traders not investors, as “green shoots” are most powerful in secular bear markets (Europe & China today). And as a case study, he notes that in Japan between 1990 and 2003 there were 13 equity trading rallies that exceeded 20%, and seven trading rallies that exceeded 33%.

All of which begs the question: if this is indeed just another “green shoots” surge in a secular bear market, did investors – who had patiently stood on the sidelines for 3 months – once again top tick the inflection point in the market, and does this week’s US equity inflow mark the high point of the rally. For the answer check back in one week’s time.

via ZeroHedge News https://ift.tt/2Ta0nwc Tyler Durden