Meet Dr. Herbert Wertheim, a South Florida optometrist and small businessman who in several decades, became a billionaire.

Wertheim, 79, is a self-made billionaire worth $2.3 billion, according to Forbes‘ The World’s Billionaires list. His fortune comes from numerous inventions and buy-and-hold investing.

Wertheim could very well be the most significant individual investor many Americans have never heard of, and he recently sat down with Forbes to prove it.

Madeline Berg, a reporter at Forbes following the money, flipped through Wertheim’s brokerage statements which showed hundreds of millions of dollars in tech stocks like Apple and Microsoft, purchased long ago at their IPOs. There are dozens of other blue-chip stocks in the portfolio, ranging from GE, Google, BP, and Bank of America.

Here is Wertheim’s interesting path into becoming a billionaire.

In the early 1960s, he attended the Southern College of Optometry and after graduation started a small practice in South Florida. At nights, Wertheim spent his time tinkering on inventions, and in 1969, he invented an eyeglass tint for plastic lenses that filtered dangerous UV rays, helping to prevent cataracts.

Demand for Wertheim’s tint erupted, and he sold the royalty for $22,000. However, because of contractual breaches, he never collected any royalty funds from the deal.

So in 1970, Wertheim formed a new company, Brain Power Inc. (BPI). He established the company as a technology consulting firm, but at the same time, he reverted to developing tints, dyes and other technologies for eyewear.

A year later he invented the world’s first neutralizers, a chemical that restored lenses to their original state. At the time, he showed his wife a can containing the new chemical and said, ‘Nicole, what’s in this can is going to make us millionaires.’ ”

Between the tints, dyes, and neutralizers, Wertheim rolled the new technology into BPI, which became one of the world’s largest manufacturers of optical tints, selling products to companies like Bausch & Lomb, Zeiss and Polaroid.

Forbes said BPI “never achieved hypergrowth,” but it allowed Wertheim more freedom to pursue a life of investing.

Similar to Warren Buffett, Wertheim believes in doubling down when he feels passionate about companies.

“If you like something at $13 a share, you should like it at $12, $11 or $10 a share,” Wertheim says. “If a stock continues to go down, and you believe in it and did your research, then you buy more. You are actually getting a better deal.” Whenever possible, he adds, dividends are useful in cushioning the pain of stocks that drift down or go sideways.

Wertheim tells Berg he bought Microsoft at its IPO in 1986. “I knew a lot about computers and had been involved in building them,” he says. BPI used Apple IIe’s, but after Microsoft released its Windows operating system in 1985, Wertheim fell in love with the company. “Only Microsoft had an operating system that could compete with Apple,” he recalls.

The Microsoft shares he owns, which has been paying him a sizeable dividend since 2003, are now worth more than $160 million.

He also owns 1.25 million shares of Apple, mostly purchased during its 1980 IPO and also at $10 in the 1990s, are worth $195 million.

“My goal is to buy and almost never sell,” he says, parroting a Buffettism.

“I let it appreciate as much as it can and use the dividends to move forward.” In this way Wertheim, like the Oracle of Omaha, seldom reinvests dividends but instead uses the cash flow from his portfolio to either fund his lifestyle or make new investments.

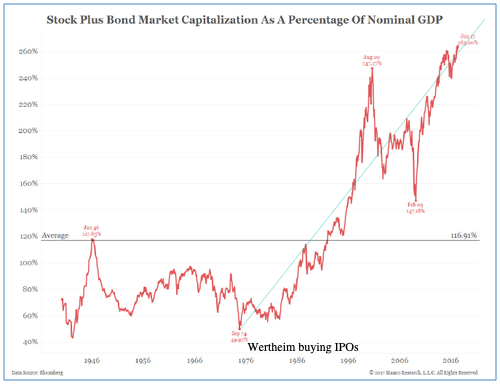

Wertheim’s billionaire status is not just a result of his buy-and-hold strategy, but it was his ability to buy the right stocks at the right time – during the start of four decades of easy money from the Federal Reserve.

Given that equity valuations are at levels never witnessed in the modern era, the return profile for the stock market in the next decade is rather scary: “A run-of-the-mill completion of this cycle will be a -60% loss in the S&P 500, erasing its entire total return vs T-bills since roughly 1998. What will shape that trajectory over shorter periods, but not ultimately, is the condition of market internals,” said John Hussman of Hussman Funds.

With that being said, maybe buy-and-hold investing has peaked, and a return to actively-managed portfolios is the next trend.

via ZeroHedge News https://ift.tt/2IMgk7c Tyler Durden