Submitted by Gordon Johnson Of Vertical Group

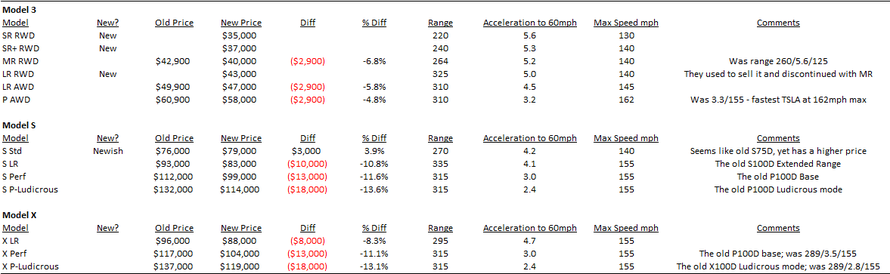

Earlier this evening in a widely anticipated announcement, TSLA, again, cut the prices on all existing cars – the third such cut in just two months – with the price concessions ranging from 4.8%-to-13.6% (Exhibit 1). Furthermore, TSLA announced availability of the widely anticipated $35K Model 3 (more on this below) – while this is welcome news to many, it comes 15 months after the car’s original promised timeline, which means the cost sensitive US buyer has lost $3,750 of the federal EV tax credit (and the true $35K version will only come in black, with any additional paint colors costing an extra $1.5K-$2.5K). However, TSLA also warned that 1Q19 would see its earnings go back into negative territory (after two straight quarters of profit), and announced its third round of layoffs just this year (TSLA is cutting the majority of its sales locations globally, shifting to a 100% online purchase model).

In short, there’s a lot to unload here; however, we believe tonight’s move is proof-positive TSLA has a serious demand problem (if TSLA was not experiencing tepid demand, in our view, it would not have cut the prices on all its cars three times just this year). In fact, we view this as an all-in move by TSLA to try to stay solvent (by our calculations, demand is very bad right now – we believe the Feb. sales report from InsideEVs will disappoint). With respect to the numbers, prior to today’s $2.9K price cut for the Mid-Range Model 3, TSLA cut the price by $2K on 1/2/19, then by $1.1K on 2/5/19. Moreover, when one also considers the fact that TSLA cut the price for Enhanced Auto Pilot (“EAP”) from $5K to $3K, or $2K in total, that’s another ~$1.540K in lost margin (~77% of buyers purchase EAP, so a $2K price drop is equivalent to a ~$1.540K drop in gross margin – EAP has virtually no associated costs, so it’s all margin). So, adding it all up, the ~20% margin on TSLA’s Mid-Range Model 3 alluded to in 4Q18 is now ~13% (by our calculation). Consequently, with OPEX expected to be up ~9% in 2019, that means TSLA is now firmly back in the loss-making column.

Exhibit 1: TSLA Pricing Dynamics

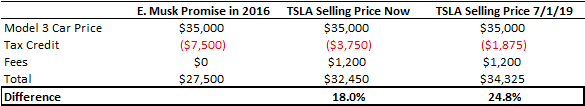

MODEL 3 DEMAND SET TO TAKE OFF… RIGHT? As detailed in Exhibit 2 below, with TSLA losing its Consumer Reports recommendation recently (link), as well as a number of well documented issues/problems with its Model 3 cars, for those that are saying the $35K Model 3 will unlock hundreds of thousands of incremental purchases, we are skeptical. What do we mean? Well, even with the price-cuts announced today, for the price-sensitive consumer looking to buy the $35K Model 3, the acquisition cost is still +18% higher than originally planned, and will rise even higher to a +24.8% premium 7/1/19 (when TSLA’s federal EV tax credit gets cut in half again).

Exhibit 2: Model 3 Affordability Tracker

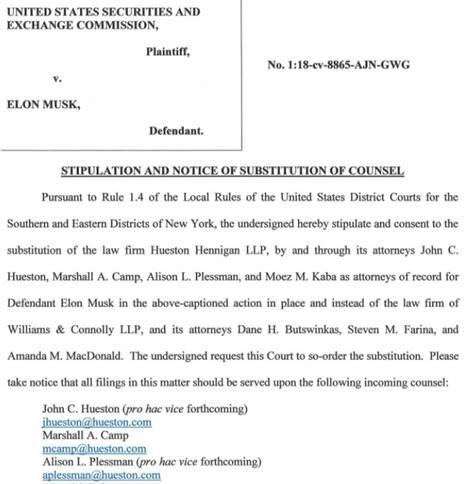

WILLIAMS & CONNOLLY HEADS FOR THE EXITS: In our view, and raising yet another red flag, TSLA’s lead counsel in its case against the SEC, Williams & Connolly, seems to have quit on the company with E. Musk facing an ongoing contempt motion (Exhibit 3) – link. In short, while it’s hard to know all the specifics here, our experience suggests changing lead counsel in the middle of an ongoing case with the SEC is not a good thing.

Exhibit 3: William & Connolly Leave TSLA as Counsel

TSLA GUIDES TO A LOSS IN 1Q19: Finally, as we warned earlier this week, TSLA is now guiding to a loss in 1Q19 vs. the current Consensus estimate for +$0.63/share in EPS.

CONCLUSION: We believe TSLA has a serious demand problem. That is, after building up backlog for two years for Model 3 cars and then burning through it in 3Q18 and 4Q18 we see TSLA’s current demand as far below its targeted production. We maintain our SELL rating and $72/shr year-end 2019 price target. We would be aggressively shorting TSLA’s shares.

via ZeroHedge News https://ift.tt/2VsCMnu Tyler Durden