With the latest positive report out of the US-China trade rumormill set to push futures solidly higher once they reopen on Sunday night, coupled with a breakout in 10Y yields from the recent descending triangle…

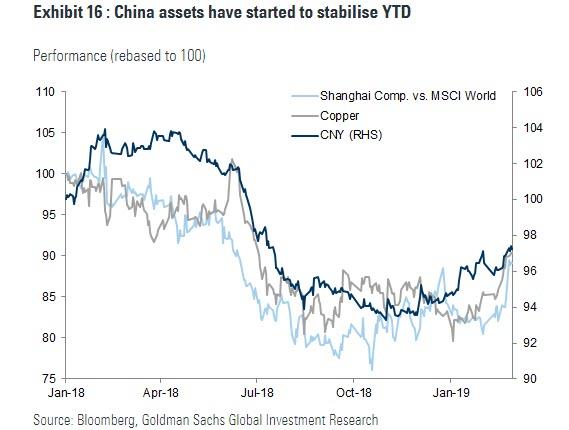

… as a result of growing speculation that the global macroeconomic headwinds have finally troughed following a handful of strong econ data releases including a higher than expected US Q4 GDP print and a strong rebound in China’s Caixin PMI, largely thanks to a gargantuan credit injection by China’s central bank, which has helped stabilize Chinese assets…

… and sparking a global reflationary impulse, the Fed may soon be trapped once again, as it was two months ago, only for the opposite reasons.

And as reflation rears its ugly head, denting the Fed’s plans to keep rate hikes on “pause” indefinitely and perhaps scuttling plans to prematurely end the Fed’s balance sheet runoff, traders may find out that just as markets did an overnight U-turn as “bad news was good news”, for the past two months as the “Goldilocks trade” made a return appearance, suddenly “good news may be bad news” as the Fed finds itself behind the curve once more, as the big market bears end up mauling Goldilocks.

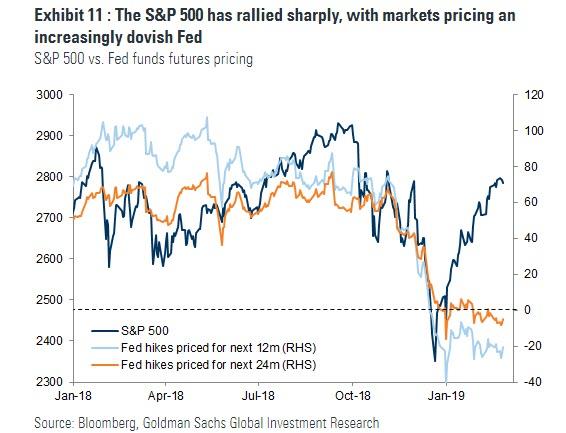

That’s the point made by Goldman’s Christian Mueller-Glissman, who warns in a late Friday note he expects the “Goldilocks rally” to fade and bond yields to increase (even more) from here. His argument is simple: there is now a material disconnect between Fed pricing and the S&P 500. As he notes in teh chart below – one which we have shown repeatedly in the past, not only are markets pricing no hikes in the next 12 months, but they are pricing a cut in the next 2 years.

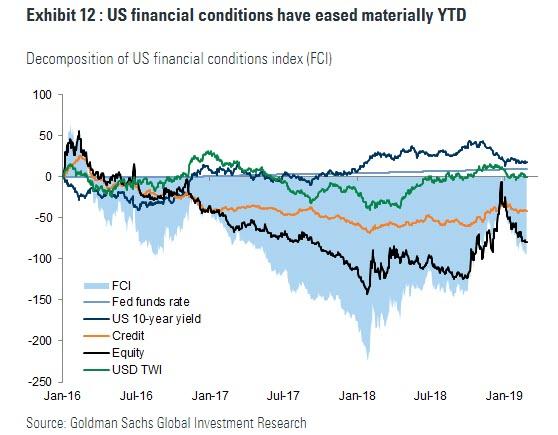

To Goldman, this seems inconsistent with the bullish message from risky assets and from the recent reflationary impulse and macro-economic trough. And even as Goldman economists expect 1 hike by the end of 2019 (which while contrary to the market’s dovish take is a far cry from the bank’s “4 hikes” call as recently as December, the bank notes that its US Financial Conditions Index (FCI) is back to levels from before the dovish Fed shift. In short: a pick-up in US inflation could drive concerns over the Fed resuming its hiking cycles, or drive a rebuild of term premia.

There is one “out”: Goldman concedes that “on the flipside, Fed may tolerate an inflation overshoot: the recent decline in real yields and increase in breakeven inflation are indicative of such a shift.” As a result, investors could eventually look to equities for ‘real yield’ exposure, resulting in a more reflationary rotation from fixed income to equities.

Of course, for that to happen, it would require the Fed to adjust its “inflation targeting” methodology, something which Fed speakers already hinted at over the past week. In such a case, it would be seen by markets as a “green light” to reflate another asset bubble, something which will make president Trump especially happy as it would result in new all time highs in the S&P on relatively short notice; of course, it will make the ensuing “mean reversion” that much more painful, although for Trump the only thing that matters is what happens to stocks – and the economy – ahead of the 2020 election. Should he win, an outcome that would be made more likely by another push higher in stocks, it would largely insulate Trump from any possible impeachment proceedings until 2024; should stocks then crash during Trump’s second term, well… he’ll cross that bridge when he has to.

via ZeroHedge News https://ift.tt/2TsPpBx Tyler Durden