As if following the plot of a scary movie, the automotive sector had a frightening moment early in 2017 followed by a period of calm which ended with slightly higher volume for 2018. The question on most investors minds now is, Do we have the all-clear to buy seemingly undervalued auto stocks or is this simply the part in the movie of dead silence right before the scene that makes us spit out our popcorn and jump out of our seats? My responsibility is to help you answer that question, and I’ll do so with the aid of proprietary indicators that I have developed to very accurately forecast volume and margin for several companies in the automotive sector. Before moving on, I strongly recommend watching my latest interview with Real Vision where I discuss the indicators that work, the indicators that lag, and the indicators that should be ignored altogether.

2018 Recap

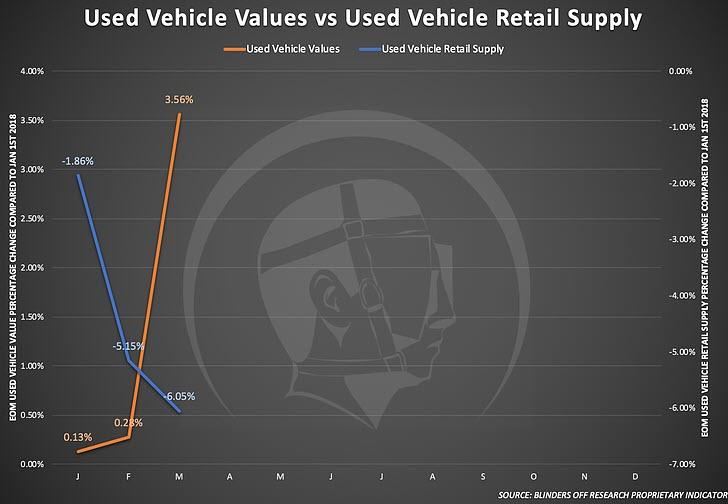

In order to fully understand the current state of the auto industry, I think it’s important to discuss the significant events that impacted last year’s results. In 2018, the auto market started with a decline in retail sales and a continued reduction in the rate of production from most manufacturers through the month of February. After writing this article for Real Vision’s Think Tank in October of 2017, everything seems to be going according to plan. Then something unexpected happened, used-vehicle values suddenly spiked above their expected range as a result of a large draw in used-vehicle retail inventory.

This was an early sign of concern for my short thesis. I knew the increase in used-vehicle values would translate into increased consumer purchasing power (most new vehicle sales include a trade). The sharp increase in used-vehicle values was also strong enough to reduce the Time to Equity (please click here for a full explanation of this indicator) of new-vehicle loans by offsetting the negative effects of increasing loan terms and higher interest rates.

This is extremely important because both captive banks and retail dealers have software that alerts them when a client reaches the breakeven point in their auto loan. When the alert is triggered, a direct marketing effort begins to convince clients with equity to trade their current vehicle in for a new one. The sudden drop in Time to Equity certainly triggered those alerts, and the efforts appeared to be successful as I witnessed a sudden and large drop in new-vehicle day supply.

The combination of higher used-vehicle values, reduced Time to Equity, and a significant draw in both new and used retail inventory led me to warn clients to cover their short positions ahead of the March retail sales report. My concerns were justified as March retail sales outpaced the prior three years which included two of the strongest years in auto sales history: 2015 and 2016.

The warning was also very timely as most auto stock prices rebounded sharply on both sales and used vehicle value data.

Moving forward towards the middle of the year, auto manufacturer stock prices took another leg lower on trade fears and slightly lower forward guidance due to increased commodity costs. During this time of extreme investor pessimism, the day supply of new vehicles continued to fall quietly in the background. Day supply is by far my favorite indicator for forecasting production volume and margin and the large drop in inventory was a very positive sign for both.

It was obvious to me at this time that most manufacturers would increase production and reduce incentive spending in response to the large drop in new-vehicle retail supply. I shared these thoughts with my clients. One month later, manufacturers reduced their incentive spending (translates into higher margins) for the first time in nearly 5 years and my wholesales indicator picked up an increase in production volume. It’s also important to note that all of this was happening during the same period of time that manufacturers announced production cuts and increased incentive spending a year prior. Higher new-vehicle prices as a result of lowering incentive spending triggered two important events. First, the demand for used vehicles increased which led to an abnormal rise in used vehicle values at an unexpected time of the year.

The second important event was a year-over-year retail sales decline of nearly 6% in Q3 due to the increase in new-vehicle prices. Focused on the decline in retail sales, most analysts missed the material increase in production compared to prior year, this led to significant earnings surprises for Q3. Perhaps the biggest earnings surprise was provided by GM which reported significantly better y/y wholesale volume during a time when they had a double-digit decline in sales.

Again, this was communicated with clients ahead of the earnings report, and GM shares, as well as others in the auto sector, rallied sharply higher on the news.

However, just as sentiment began to improve for the auto sector, things took a turn for the worse. The abnormally high wholesale value of used vehicles translated into used-vehicle retail prices that consumers simply could not support (this was confirmed by a large drop in the used-vehicle CPI number reported in September). The retail supply of used-vehicles began to increase at an alarming rate and the very important used-vehicle values that fueled the positive results through Q3 began to fall.

As a result, new-vehicle retail sales underperformed the three prior years in Q4.

The decline in new-vehicle sales led to an increase in new-vehicle day supply since the rate of sale was no longer strong enough to support the rate of production. Importantly, some manufacturers were reluctant to increase incentive spending (undoubtedly an effort to please investors by reporting higher margins) which further increased the day supply of new vehicles.

After all the ups and downs, 2018 ended with a total new-vehicle volume (includes government and fleet sales) increase of .5% and a retail sales decline of 1.84%. Most investors would consider 2018 to be a very good year and perhaps a slap in the face for anyone with bearish opinions of the auto sector if focused solely on the sales volume. However, after explaining the WHY behind the result in detail and the progression of events since the third quarter, I hope you’ve noticed that things are not as pretty as they appear on the surface.

Current Indicator Readings and Insight

As of the 24th of the month, new-vehicle retail inventory has increased by 4.25% on a year-over-year basis in the month of January. Keep in mind that retail sales declined by 1.84% in 2018 and most of those declines came in H2. In other words, we are starting the year with more inventory than the prior year and are currently trending lower in retail sales; not exactly a good sign for margins going forward since incentive spending will likely have to increase in the coming months. The following chart illustrates new-vehicle inventory fluctuations by comparing daily supply levels to the supply level at the beginning of the month.

As you can see, inventory levels are increasing at a faster pace in 2019 compared to 2018. We’re also starting the year with a higher day supply of new-vehicles than we had in January of 2018; 74 days vs 72 days.

As shown in the chart below, used-vehicle values are performing better on a year-over-year basis for the month of January (through the third week) in the truck and SUV segment but worse in the car and CUV segment. Please be aware that I use a proprietary mix of vehicles and model years designed to provide investment quality insight and my methodology is very different than that of other used-vehicle value data providers (this video provides more details).

When all segments are combined, there’s very little difference in the value of the vehicles that I track between January of 2019 and 2018, down .2% vs up .13% respectively. This is important because folks that respect and rely on used-vehicle value data as much as I do, will consider this month’s performance as normal and offer no warning. You might be wondering why are a warning is needed if used-vehicle values are normal. A warning is necessary because the increase in interest rates and loan terms from 2015 to 2016 alone have led to an increase in Time to Equity for 2019.

The Bull and Bear Case

Going forward, the bull case is a lower volume environment with healthy margins as the auto industry enters a new phase of slower replacement cycles due to consumers choosing longer finance terms to offset the higher cost of new vehicles. Though I give the bull case a very low probability, it’s important to respect the possibility and continue to monitor key data points that will either support or refute it. I’ll discuss the key data points that I’m monitoring, which at the moment are leaning heavily in support of the bear case.

The auto industry benefited from a tremendous and abnormal increase in used-vehicle values through the third quarter of 2018. For this reason, I think it’s critical to take a moment to show you what normal depreciation looks like. Please observe the depreciation curves for years 2014, 2015 and 2016 in the chart below.

Under normal conditions, used-vehicle values increase slightly in March as consumers receive their tax returns then gradually decline by ~10% into year’s end. When we observe the depreciation curve in 2017 and 2018, we can see an abnormal increase in the late summer months. The increase in late 2017 was fueled by replacement demand for vehicles destroyed by hurricanes Harvey and Irma. The increase in 2018 was caused by a very special set of circumstances which I discussed in the 2018 recap. I’m sharing this with you because (and I say with a very high degree of confidence) 2018’s results were heavily supported by abnormal increases in used-vehicle values that we should not use in forecasting or financial models. I’ll take it one step further and say that we absolutely do not have the ingredients for a repeat of abnormally high used-vehicle values in 2019, although I can’t predict the weather.

A fall in used-vehicle values or even a return to normal depreciation at this point in time would trigger a dangerous feedback loop that will pose a significant threat to the entire auto sector. As used-vehicle values fall, return rates rise and 2019 marks the peak in lease maturities for this cycle.

It’s important to note that maturities should only be looked at as potential wholesale supply. I say potential because only the maturing leases not used as a trade or kept by the lessee will work their way into the wholesale market which is what impacts values. Nonetheless, the potential for a significant increase in supply is very real and can put continuous pressure on used-vehicle values.

Another negative side effect if used vehicle values fall will be a further increase in Time to Equity. Based on my current calculations, every residual point drop will increase Time to Equity by one month. That leaves us only three residual points away from the peak in Time to Equity previously reached in 2008. Aside from reducing the velocity of new-vehicle sales, increased Time to Equity has another negative side effect, higher delinquency/default rates. The explanation is simple, most auto lenders believe longer loans have a higher the risk of default since the ability of the borrower to repay the loan is more likely to change. However, when one takes into consideration that few auto loans are held until maturity, it becomes very clear that the time it takes for the vehicle’s value to exceed the principal balance owed is far more important than the length of the loan at origination.

Aside from the credit risk and loan losses associated with increased Time to Equity (more so for lenders with high exposure to subprime auto loans), an increase in defaults will further pressure used-vehicle values as repossessed vehicles make their way to wholesale auctions.

Another trend that I’m following very closely is the very large shift in retail sales from cars to light trucks. The concern I have is that wholesale supply will follow the same path as the retail market share (think of retail sales in terms of future used-vehicle supply) putting downward pressure on light truck values.

For the first time since this data started being collected, the wholesale volume of light trucks (this includes SUVs, CUVs, pickups, and vans) has exceeded that of cars. Manufacturers have shifted production heavily towards light trucks and investors are counting on the higher margin produced by the favorable shift in vehicle mix. However, if light truck values fall, residual values will follow which is negative for lease originations. Another negative effect would be a reduction in the buying power of consumers that currently own light trucks. Make no mistake, the majority of consumers that buy new light trucks, have light trucks to trade.

There are early signs that the shift in wholesale supply is impacting values. The value retention of cars outperformed SUVs, CUVs, and pickups in 2018. This is clearly the result of a decreasing supply of cars and an increasing supply of CUVs, SUVs, and pickups.

It’s important to note that used-vehicle values don’t have to fall first in order to set off a negative chain reaction. An increase in new-vehicle incentive spending to manage the continued rise of day supply which started in H2 of 2018, is more than capable of pressuring used-vehicle values. Another potential trigger for higher incentive spending is a further increase in auto loan interest rates. Higher interest rates would limit the ability of manufacturers to subvent financing leaving them with only one option if the consumer can’t absorb the higher monthly payments: price reductions.

To be clear, the only way the bull case plays out is if used vehicle values remain strong, if manufacturers maintain a lean day supply of new vehicles at all times and if interest rates stop rising (although the damage may already be done); that seems like a lot to ask for considering current conditions. Failure in any of the three key ingredients just mentioned will set off a nasty and lasting chain reaction that will not easily be stopped.

via ZeroHedge News https://ift.tt/2UlkDaQ Tyler Durden