It’s not fair…

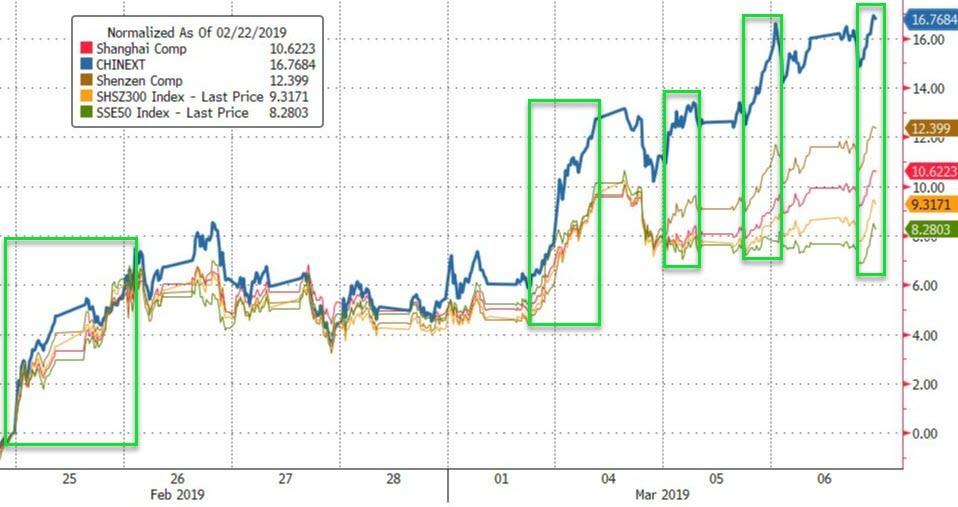

Chinese stocks are soaring but US markets are not…

Chinese stocks just won’t stop…

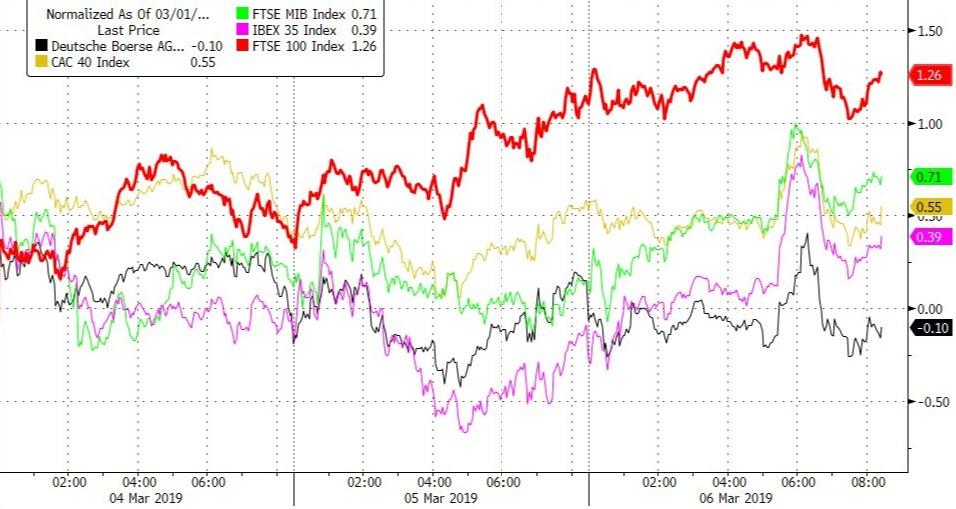

UK’s FTSE continues to bounce..

US equity markets were down notably today led by Small Caps – notably there was barely a bounce in today’s action…

Trannies are now down 9 days in a row – the longest losing streak since Feb 2009.

Small Caps are down around 3% this week – the worst 3-day drop since Dec 24 Mnuchin Massacre lows, breaking below the 200DMA…

S&P is now well below the key 2800 level…

GE was clubbed like a baby seal once again as the early year hype gives way to reality…(filling the gap from 1/30)

Notably credit markets have snapped decidedly wider in the last few days (HYG is down 5 days in a row)…

Credit decoupled from stocks once again…

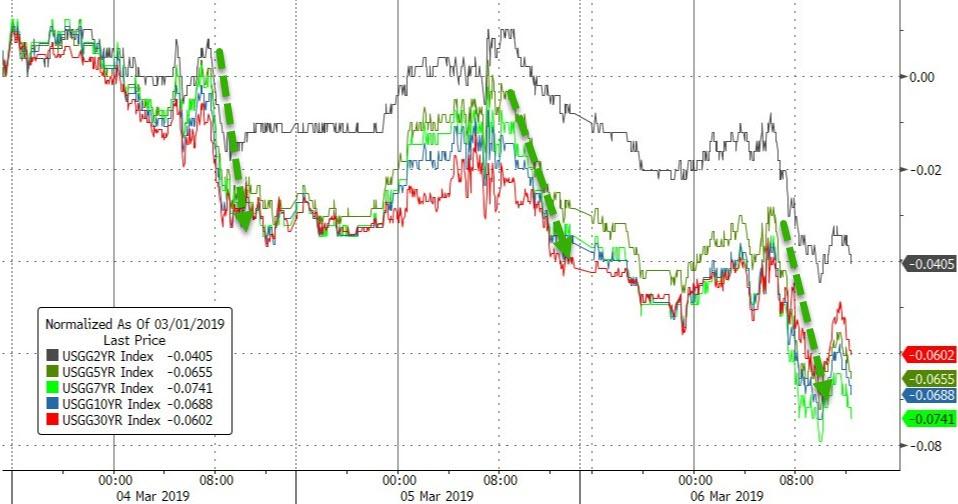

Treasury yields were lower once again…

Erasing more of last week’s sell-off…

The Dollar Index (DXY) tested 97.00 once again and failed…but ended marginally higher (for the 6th day in a row)

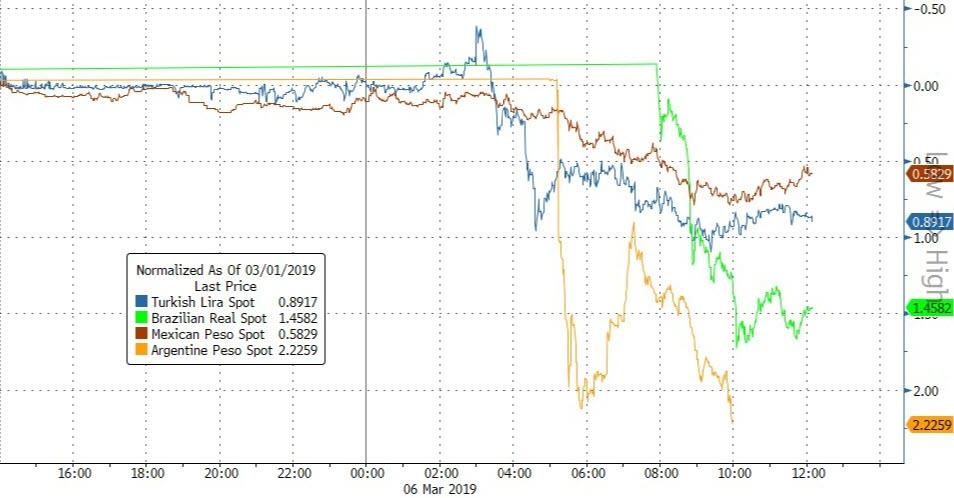

EM FX suffered notably today…

As BRL, TRY, ARS, and MXN all got hit

Yuan was notably weaker overnight…

Cryptos clung on to yesterday’s gains and once again Litecoin was well bid…

Commodities were all modestly lower on the day…

WTI ended the day lower but the machines did not like the post-EIA inventory drop and bid oil back up…seemingly keen to keep WTI above $56…

Finally, is the delusion ending? Global money supply has started to rollover…

via ZeroHedge News https://ift.tt/2VI3QPG Tyler Durden