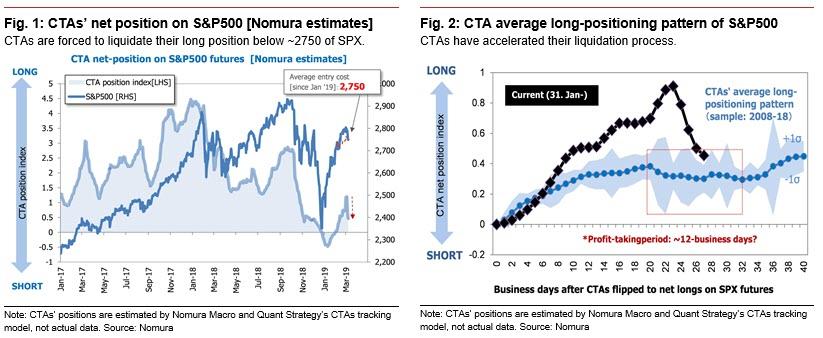

Earlier today, we explained why the technical picture for stocks is getting increasingly gloomy, when we noted that with the S&P dropping below 2,750, or a critical selling “trigger” for the trend-following community, CTAs have now started to sell.

And while the fundamentals have been turning increasingly more bearish in recent months (prompting every central bank to turn dovish in recent weeks), with the global economy rapidly slowing with Europe and Japan now effectively in recession, now not even the chartists can find a reason to remain bullish.

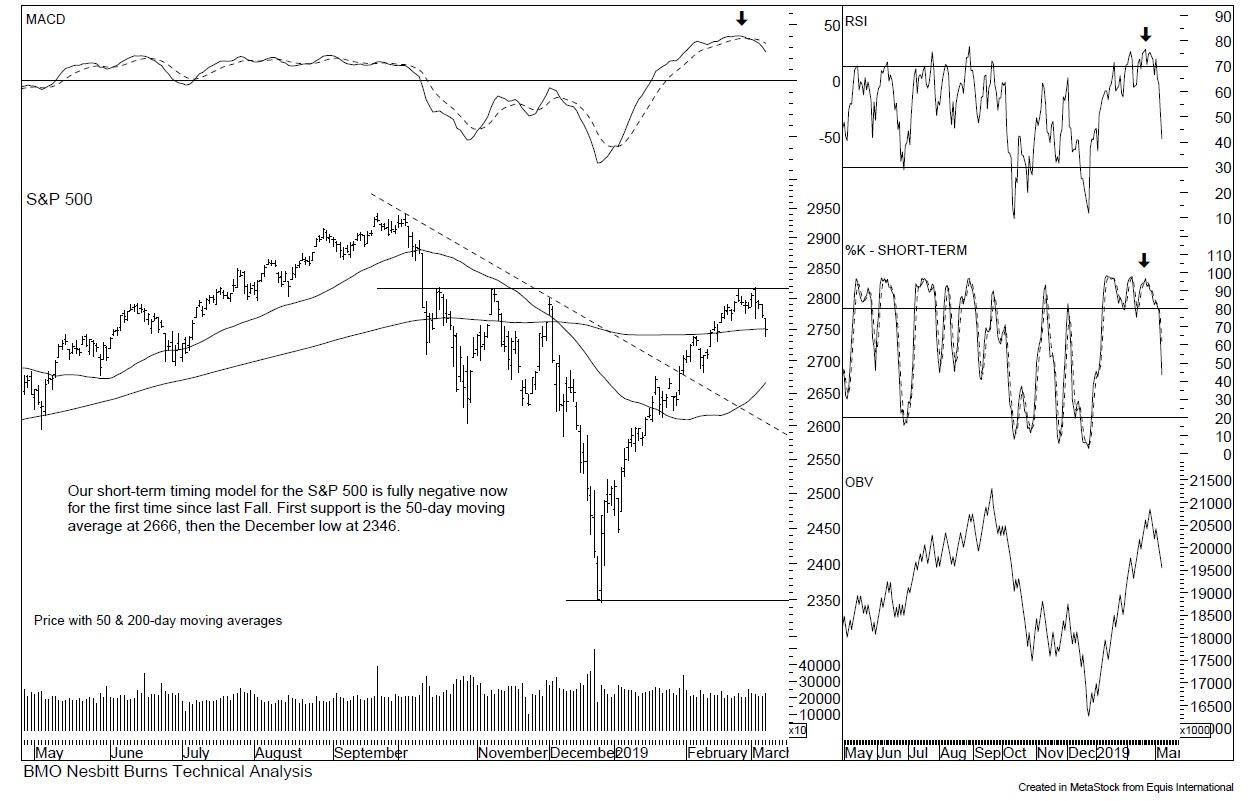

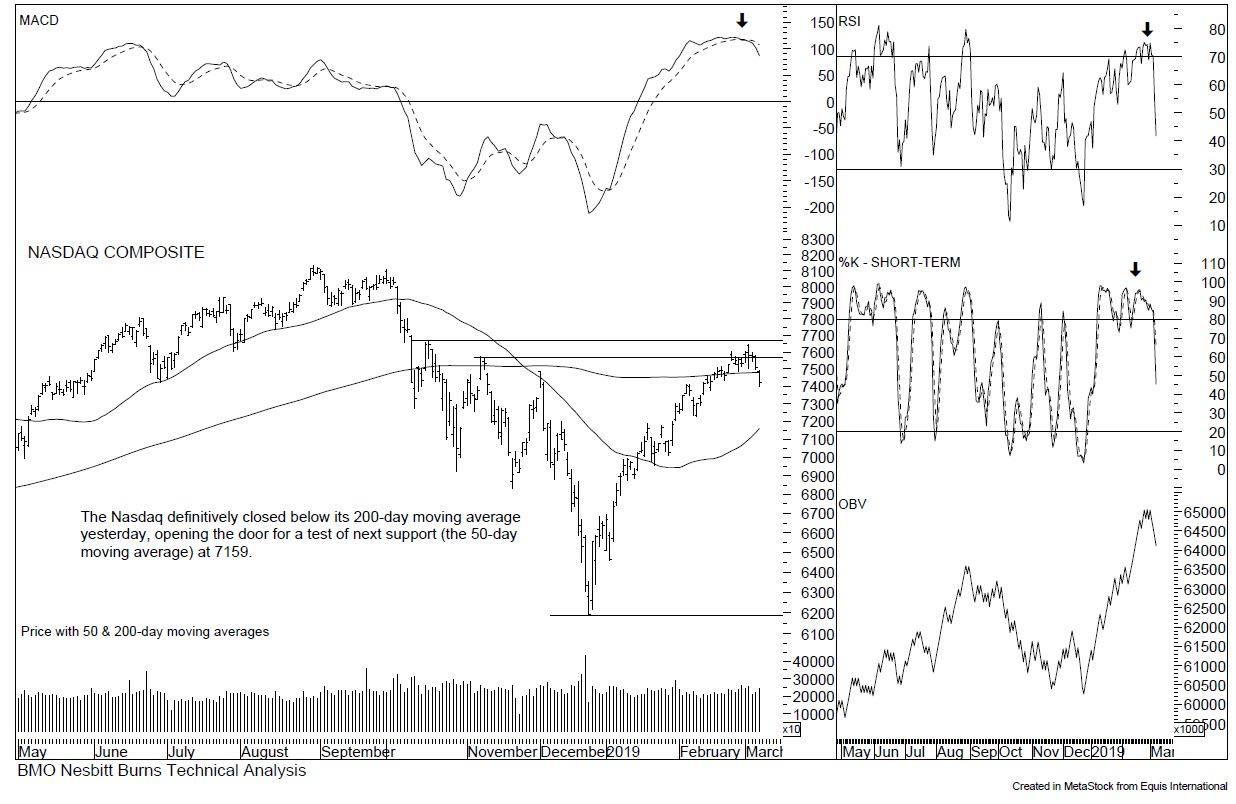

Case in point: BMOs chief technical analyst Russ Visch writes that after the “goldilocks” rally officially ended when the S&P failed to breach and hold 2800, “it appears as if the “re-test” phase of the “low, rally re-test” bottoming sequence is now underway in earnest as equity markets sold off sharply yet again yesterday, resulting in the S&P 500…

… and Nasdaq Composite closing below their 200-day moving averages again for the first time in nearly a month.”

With upside momentum broken, Visch says that the next support level from here is now the 50-day moving averages (S&P: 2666, Nasdaq: 7159) although, as the bearish technician has written in the past, he expects “a much deeper retracement than that.“

Additionally, and as Nomura warned previously, next Friday is “quadruple witching”, a day in which all four of the different types of options and futures contracts expire on the same day. This could be lead to even greater turbulence, as historically, markets have been prone to volatile price swings during expiry weeks as investors reposition large options and futures holdings so, as Visch notes, “it could get ugly pretty quickly.“

via ZeroHedge News https://ift.tt/2tVmPKF Tyler Durden