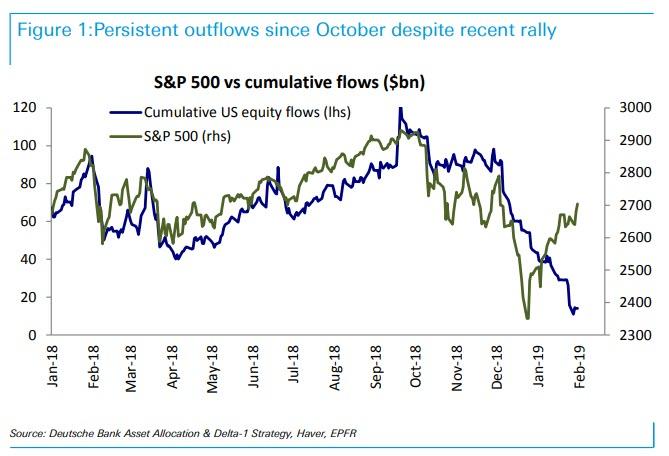

For the past two months, we have been highlighting what emerged as one of the greatest paradoxes of this market in 2019: even as stocks kept grinding higher, having almost wiped out all their Q4 losses as recently as last week, investors were locked in non-stop liquidation mode, selling stocks and pulling money out of equity funds week after week after week, for 12 consecutive weeks since December.

We noted most recently this in “How Are Markets Higher: Buyers’ Strike Continues For 11th Straight Week“, “Buyers’ Strike Continues For 12th Straight Week“, “This Is Strange”: Despite Historic Rally, Investors Continue To Dump Equities“, and even though we identified the “buyer” in the form of a persistent short squeeze and another record wave of stock buybacks, the question remained: who would be proven right – the market, which had successfully risen above the critical 2,800 level (if only briefly), or investors whose boycott suggested that few had any trust in the biggest market rally to start the year since 1987.

So now that the market appears to have finally reversed and the “goldilocks” rally is over, with BMO’s technician predicting that a retest of the December lows is now underway, it appears that all those skeptics who continued to sell even as stocks rose, were correct.

And sell they did again, because one week after it appeared that bearish investors had finally thrown in the towel with a modest inflow into US equity funds, EPFR reported that the latest week saw another $10.1 billion equity outflow ($1.7bn ETF outflows, $8.4bn mutual fund outflows), with the US seeing about half, or $5.5 billion, of this, while inflows into fixed income accelerated with $8.8bn flowing into bonds, $1.2bn pulled from gold.

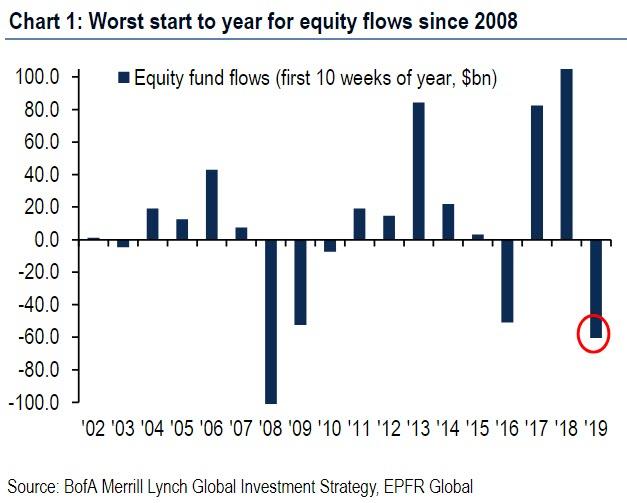

But back to stocks, where the outflows have now entered historic territory and as Bank of America calculates, 2019 is now the worst start to year for equity outflows since 2008; of course, recall that it wasn’t until March 2008 that Bear collapsed and it was only in Q3 and Q4 that the financial crisis fireworks really erupted. Which means that for whatever reason, investors were well ahead of the curve in 2008 when they rushed to pull money out of the market. The question is whether lightning will strike twice, and the same financial Armageddon that hit in 2008 – when investors pulled some $100BN from stocks in the first 10 weeks – will strike again this year.

And while equity outflows may be the largest in 11 years, something which naturally does not jive with market action YTD, this week marks another historic anniversary, with BofA reminding us that on Saturday, the bull market turns 10 years old, with the market cap of US stocks up $21.3 trillion, or 3x the rise in US GDP of $6.5tn, with the 3 Dow performers Boeing, Apple, Unitedhealth Group; while the worst performers are Walgreen, Exxon, IBM.

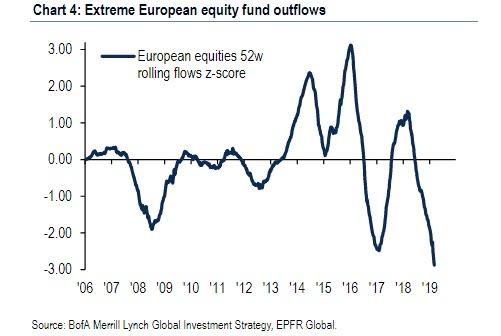

But while the US remains a case study of how a central bank should inject trillions into its market, if not economy, the rest of the world remains lacking, and 10 years after the GFC, the Eurozone remains trapped in deflationary “Japanification” of growth & interest rates, with EU rates unlikely to rise ever and EU equities in “value trap” according to BofA.

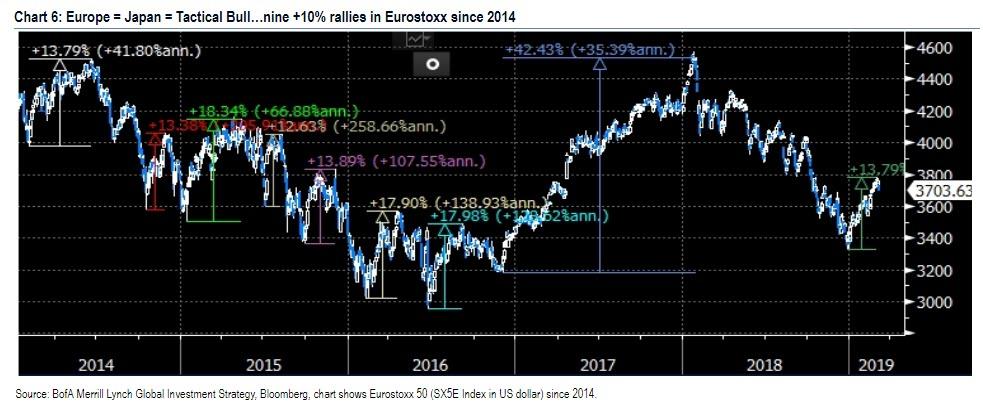

Ironically then, according to BofA “Europe = Japan” is now the most consensus trade in the world, with European stocks now the “ultimate contrarian trade”…

… which to BofA means they are likely to outperform in Q2’19 as: a) tightening Euro credit signaling Euro stocks higher; b) China “greenshoots” rally confirmed by rebound in March PMIs; c) dovish ECB = EUR @ 20-month low = boost for cheap, high beta Euro cyclicals.

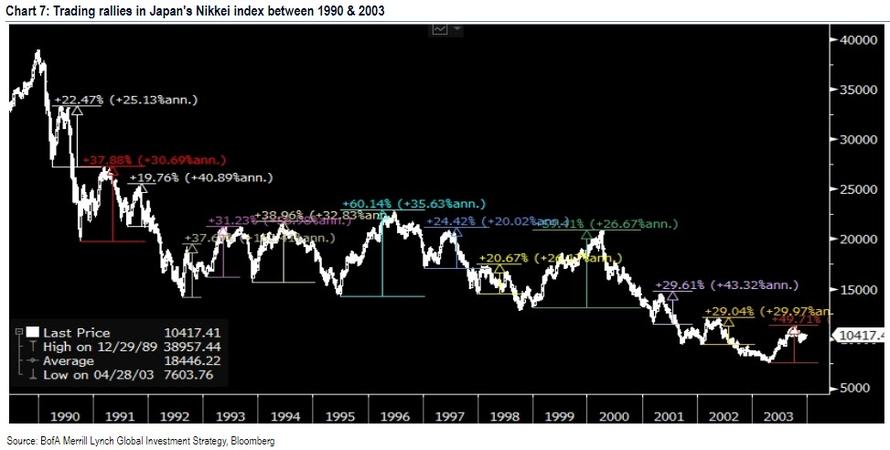

Finally, just as Hartnett showed that Japan “enjoyed” no less than 13 rallies that exceeded 20% during its secular bear market years from 1990 and 2003…

… he points out that in Europe too there have been nine +10% rallies in the Eurostoxx since ’14, with BofA confident that #10 is coming up.

via ZeroHedge News https://ift.tt/2XLgFdW Tyler Durden