Now that President Trump’s insistence that he and President Xi would need to meet to finalize a sweeping US-China trade deal has been exposed as empty talk – since Beijing absolutely refuses to send Xi all the way to Florida only to risk him returning empty handed – traders are finally being forced to accept the harsh reality: That a US-China trade deal is far from assured.

As the Wall Street Journal said last night in a report that lays out, in broad strokes, the current state of the talks, Beijing – which has reportedly removed a tentative summit at Mar-a-Lago from Xi’s calendar – wants a summit between the leaders of the world’s two largest economies to be more of a signing ceremony than a final round of negotiations. Trump’s decision to abruptly abandon talks with North Korean leader Kim Jong Un last month has opened old wounds dating back to the Clinton administration of political embarrassments suffered at the hands of US presidents dating all the way back to the Clinton administration, as WSJ reminds us.

Looming over the summit negotiations is the history of the late-1990s negotiations over Beijing’s entry into the World Trade Organization. In 1999, Chinese Premier Zhu Rongji traveled to Washington for final negotiations for a WTO deal and came up empty-handed after President Bill Clinton judged it wasn’t the right time politically to conclude a deal, say former advisers of Mr. Clinton.

A humiliated Mr. Zhu faced a chorus of criticism at home that threatened to derail talks.

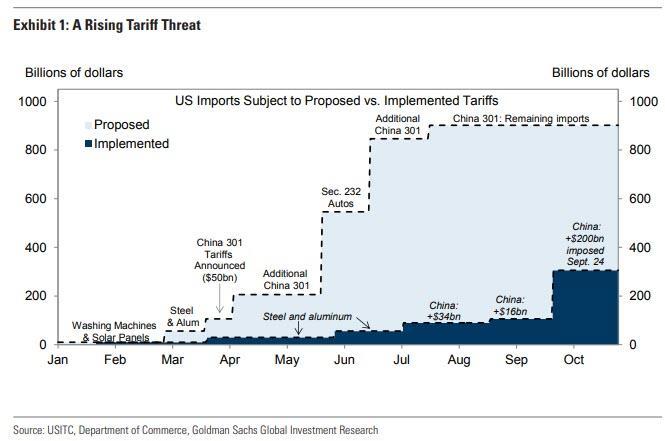

On Saturday, Bloomberg offered some more details about one of the purported sticking points to a final deal: The issue of enforcement. According to BBG, China wants the US to lift sanctions on $200 billion of Chinese goods (constituting the bulk of the new levies imposed since the dawn of the trade war)…

…while also seeking some mechanism for holding the US accountable for holding up its end of the deal. But the real takeaway here is that Beijing wants Trump to simply trust that it will follow through with the changes promised by the deal.

Vice Commerce Minister Wang Shouwen said during a Saturday press conference that enforcement of a deal must be “two way, fair and equal.”

Speaking Saturday at a press conference in Beijing, Wang said he “feels hopeful” about the prospects for the negotiations, which are nearing completion amid pressure from U.S. President Donald Trump to seal a deal. Wang is China’s deputy international trade representative and also leads the Chinese working team in the trade talks with the U.S.

While U.S. negotiators led by Trade Representative Robert Lighthizer have insisted on a mechanism – that could include a regular schedule of meetings – to enforce the terms of their agreement, that prospect has raised alarm in Beijing. Former high ranking officials have said that the deal will be seen as lopsided unless it also binds the U.S. to address China’s own grievances.

The U.S. and Chinese leaders agreed in December to work toward removing all additional tariffs, Wang said, adding that they’ve made substantial progress in the talks since then. He didn’t elaborate further on the enforcement mechanism or respond to a question on whether he expects that a deal can be signed this month.

But here’s the key detail from the story:

Chinese officials have made clear in a series of negotiations with the U.S. in recent weeks that removing levies on $200 billion of Chinese goods quickly was necessary to finalize any deal, according to people familiar with the discussions. But the U.S. wants to continue to wield the threat of tariffs as leverage to ensure China won’t renege on the deal, and only lift the duties fully when Beijing implemented all parts of the agreement.

Of course, Beijing has already broken many promises to past US administrations, particularly on ceasing its cyberespionage activities (they actually increased after Beijing promised the Obama administration that it would cool it). That leaves very little room for trust.

While President Trump tried to gas the markets on Friday by talking up the “very big” spike in stocks that would result from a deal being finalized, if anything, the widening US-China trade deficit revealed earlier this week will only make things more difficult for him. While China has reportedly promised to buy an absurd amount of US agricultural products (and whiskey) to help close the gap, abandoning the US’s insistence on enforcement and the other major asks of the China hawks (structural reforms, commitments to curb IP theft, ceasing its cyberespionage efforts, etc.) may risk making him look weak. Add to that the fact that, at this point, the possibility that a deal would result in the market “selling the news”, leaves very little upside for just taking whatever deal is presented in hopes of curbing anxieties about the prospect for slowing global growth.

That doesn’t mean that a deal won’t happen – it just means that we’re still a long way from a signing ceremony.

via ZeroHedge News https://ift.tt/2THnxcU Tyler Durden