While not exactly a surprise after its currency tumbled in 2018 as inflation soared, interest rates jumped, credit collapsed and the country was briefly targeted by US sanctions, overnight Turkey reported that its GDP tumbled by 2.4% last quarter in line with expectations, following a decline of 1.6% in Q3, officially entering a recession for the first time since the financial crisis.

The economic contraction will likely deal a blow to Turkey’s executive president Recep Tayyip Erdogan as the country heads toward bellwether municipal elections this month, although it is unlikely to result in any major political surprises.

For much of the past decade, capital poured into Turkey during an era of record monetary stimulus around the world driven by Erdogan’s push for growth at all costs and his pressure on the central bank to keep interest rates low. However this uninterrupted expansion that boosted the economy by an average of nearly 7% each quarter since late 2009 ended abruptly following a currency crash, policy missteps and an unprecedented diplomatic rift with the U.S, Bloomberg reported.

“This is an indictment of Erdonomics and a direct consequence of a monetary policy in 2018 conducted in the interests of short-term political expediency rather than economic pragmatism,” said Julian Rimmer, a trader at Investec Bank Plc in London.

The recession lays out the dilemma facing both Erdogan and his central bank: while the country desperately needs lower rates to preserve its impressive economic growth rate, inflation remains solidly in the double digits, and any interest rate cuts threaten to unanchor the lira, sending it tumbling once again and unleashing runaway inflation. Meanwhile, investors are worried that that Turkey will face a long slog to recovery as the torrent of foreign capital dries up while households and companies begin paying down debts. Indeed, private consumption tumbled at a whopping 8.9% last quarter, with Turkey’s GDP per capita falling to $9,632 from a little over $10,000 in 2017.

The Turkish lira declined as much as 0.5% after the data release however it has since recouped all losses as Japanese retail investors scrambled to buy the latest dip.

Despite the downturn, Treasury and Finance Minister Berat Albayrak said the silver lining is that the worst is now behind Turkey and the economy is on track for a rapid recovery. Rising exports and tourism income will be the key drivers for growth, he said on Twitter.

Whether he is right remains to be seen, however the undoing of Turkey’s growth model comes at a sensitive time for Erdogan, who braces for his first test at the ballot box since assuming vastly expanded executive presidential powers last year. After the March 31 vote, Turkey isn’t scheduled to hold another election for four years.

In its scramble to reboot growth, the government has pressured state banks to ramp up lending, helping annualized credit growth turn positive last month for the first time since August. It recapitalized three of its lenders by selling bonds to Turkey’s unemployment fund, and is working on a fresh plan to further bolster state-owned banks’ capital. However, for now the outlook remains bleak. GDP may be in contraction through the first half of 2019, followed by four quarters of tepid growth that will average less than 3 percent from a year earlier, according to analyst consensus.

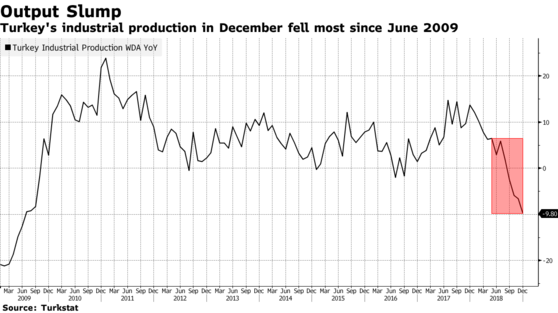

Adding to Turkey’s misfortunes, the central bank is holding rates high to stabilize the lira and keep inflation in check; as a result of high rates, credit shrank by 7.2% on a quarterly basis in the last three months of 2018. This trickled through the economy where industrial production recently plunged by the most in a decade.

“Unlike Turkey’s past V-shaped recoveries, there’s the significant risk that the recovery will be much slower this time round,” said Inan Demir, an economist at Nomura International Plc in London. “The entire Turkish economy may be facing deleveraging pressures.”

via ZeroHedge News https://ift.tt/2UvWmPt Tyler Durden