One week ago, when remarking on the sudden slide of the US retail sector into the post-Amazon abyss of irrelevance, when in the span of just 48 hours several big names in the American mall industry announced they would be slashing store counts to the tune of over 300 stores, we said that “the relapse of the sector suggests animal shorting spirits may soon re-emerge” noting that “back in 2017 we, and others, dubbed these U.S. retail store closures as the next “big short”. We said that “just like 10 years ago, when the “big short” was putting on the RMBX trade, and to a smaller extent, its cousin the CMBX, some were starting to short CMBS through the CMBX, a CDS index which tracks the values of bonds backed by various commercial properties.” We explained our reasoning for putting on this short through CMBX versus stocks:

The trade, as we discussed before, is not so much shorting the equities where a persistent threat of a short squeeze has burned the bears on more than one occasion, but going long default risk via CMBX or otherwise shorting the CMBS complex. Based on fundamentals, the trade indeed appears justified: Sold in 2012, the mortgage bonds have a higher concentration of loans to regional malls and shopping centers than similar securities issued since the financial crisis. And because of the way CMBS are structured, the BBB- and BB rated notes are the first to suffer losses when underlying loans go belly up.

To be sure, the trade lost some of its vigor in early 2018, when it seemed that the lows in CMBX BBB- may have been hit with the tranche trading in a tight range for the past 2 years; however we predicted that once the new wave of bankruptcies flows through the mall P&L and a new wave of distress hits the mall sector, we fully expect new lows to be observed in this trade which is basically an inverse bet on Amazon’s continued success in stealing market share from pretty much evereyone.

Well, we were right, because just ten days later, the largest credit hedge fund in the US, Beverly Hills’ Canyon Partners told Bloomberg that it is betting in excess of $1 billion against low-rated debt on U.S. commercial real estate over concerns that valuations are stretched and economic conditions are deteriorating.

“It’s enough to provide a fair bit of insurance in downturns,” Canyon Co-Chairman Josh Friedman said in a Bloomberg Television interview Wednesday in Beverly Hills, California.

While we have been saying that the BBB- tranche of CMBX Series 6 is the next “big short” since 2017, largely due to its overexposure to US malls which are rapidly turning into the next Chinese ghost cities, Canyon’s trade is slightly different.

Canyon, which has $25 billion in assets, is also shorting the BBB- tranche of CMBX, but instead the Series 6, it is targeting the recently introduced Series 11, because, as Friedman told Bloomberg, “properties are highly leveraged and at risk of default”, while some parts of the commercial real estate market are oversupplied.

“We just don’t need all that retail space,” the former Goldman and Drexel banker said.

While nowhere near as dramatic as the 2017 plunge in the Series 6, the BBB- tranche of the CMBX S.11, which debuted in January 2018, slumped late last year but has since recovered. The index traded at 94.9 cents on the dollar, up from 92.5 cents a month earlier. Meanwhile, according to ISDA, traders have wagered a net total of $1.8 billion on the BBB- portion of the index as of Feb. 8, with Canyon likely responsible for roughly half of this total.

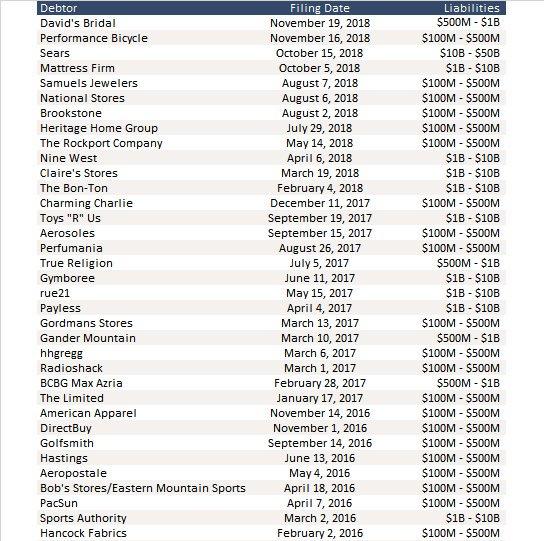

While the Canyon co-founder described the CMBX short as a hedge against a weakening economy – it outperformed in December when stock prices swooned and credit spreads widened – it is really just another wager on the secular decline in conventional bricks and mortar retailers who are filing bankruptcy at a record clip with 35 major retail chains, and countless smaller ones, filing for Chapter 11 since 2016….

… coupled with a bet against the US consumer, who as we discussed recently has rarely been in worse shape.

Just as troubling for the market is that Friedman, whose Los Angeles-based firm has long been seen as one of the best value investors in the US, increased Canyon’s cash holdings to “well over 20 percent” amid concern that assets are overpriced.

Meanwhile, amid the rising rate environment, the firm’s portfolio moved away from exposure to interest rates by shortening duration; Friedman also warned that there is a lot of “late market behavior,” such as litigation and disputes among different debt holders, that occurs when investors reach for yield and “maybe eat each other.”

“When you see that, you usually know that you’re at the end of the cycle,” he said. “It’s not that different from the end of civilization when people treat each other really bad.” Or, just after the end of civilization, eat each other.

And with that doom and gloom visual, it’s time to go all in on the pre-apocalyptic market meltup.

via ZeroHedge News https://ift.tt/2HjMohj Tyler Durden