Global stocks rebounded and US equity futures jumped overnight, ignoring concerns over a delay in the Trump-Xi meeting to at least April and North Korea’s threat to resume nuclearization, after a report that U.S.-China trade talks were making progress as fears about a global slowdown faded (even as China’s latest data showed a continued slowdown) and the UK voted to reject a no deal Brexit. European stocks just printed at session highs, rising 0.8%, alongside U.S. index futures which were trading at 2,824, above the 2,817 key resistance level, as emerging-market shares advanced, even as the dollar and Treasuries held steady.

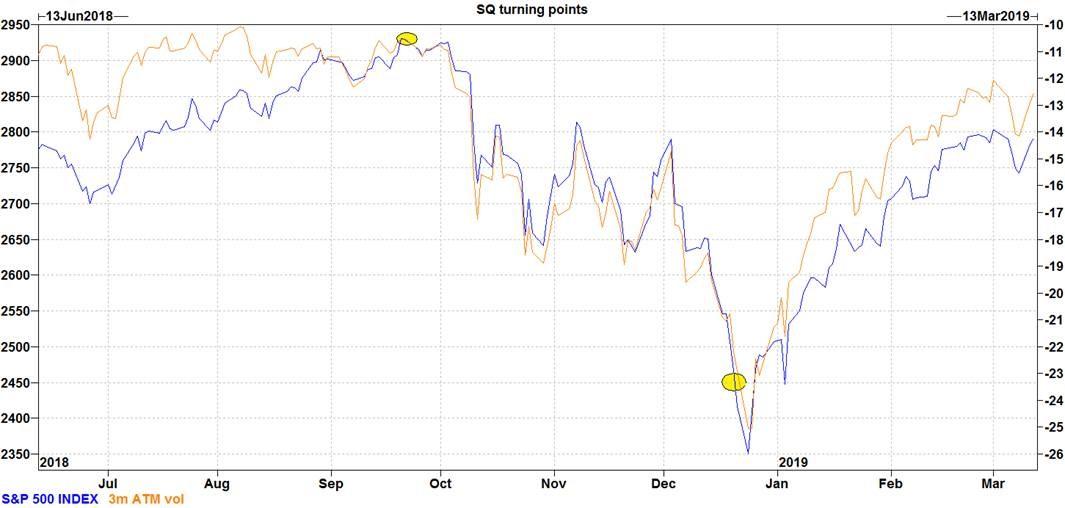

The question, as both Nomura and Goldman warned, is what happens after today’s “Quad Witching” Ides of March ends: as a reminder, today is “quadruple witching” Friday, when contracts for stock-index futures, stock-index options, individual stock options and individual stock futures all expire. The risk is that both prior “witches” took place just ahead of major reversals in the S&P, the first in September, just as the market peaked, the second in December, just before the trough.

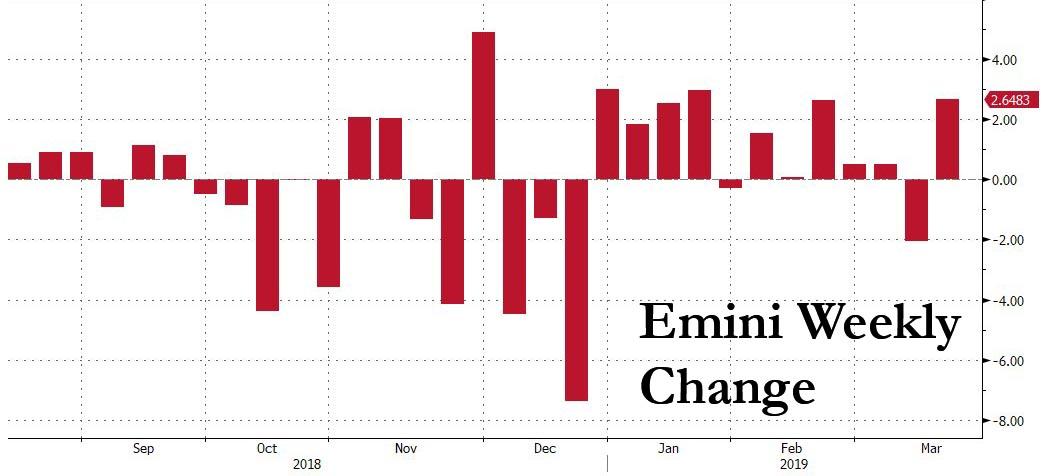

For now, however, it is shaping up as another impressive week for US stocks, which have not only erased all of last week’s losses but are set for their second best week of the year.

Sentiment was boosted after China’s Xinhua reported – for the nth time – that Chinese Vice Premier Liu He spoke by telephone with Treasury Secretary Steven Mnuchin and Trade Representative Robert Lightizer, and the two sides made substantive progress on trade, the news agency Xinhua reported.

Gains in U.K. shares and European technology companies led Europe’s Stoxx 600 to a five-month high after Britain’s parliamentary vote on Brexit, lifting futures on the S&P 500, Dow and Nasdaq. Earlier, Asian markets rose from Tokyo to Beijing, where the Chinese government said it would cut value-added taxes, reinforcing expectations for an eventual pick-up in the second-largest economy and helping push the Australian and New Zealand currencies higher.

“We view the overall outcome of this week’s votes … as positive for UK assets,” strategists at BNP Paribas wrote in a research note. “Indeed, the pound has risen by 2 percent on the week. Yet, while most of the routes ahead now look net positive, we still expect a bumpy path.”

In Asia, MSCI’s broadest index of Asia-Pacific shares outside of Japan gained over half a percent. MSCI’s broadest, All-Country World Index was up 1 percent on the day and was set for its best week since early January.

The Shanghai Composite Index added 1 percent and Japan’s Nikkei climbed 0.8 percent. South Korea’s KOSPI rose nearly 1 percent. The index had risen as much as 1.2 percent but gave up some gains following reports that North Korea might suspend nuclear talks with the United States. Comments from Chinese Premier Li Keqiang also helped sentiment. His remarks suggested Beijing is ready to roll out more forceful stimulus to bolster China’s economy.

To boost optimism, China also promised billions in tax cuts and infrastructure spending, as weakening domestic demand and the trade war with the United States curbs economic growth.

“China and Europe had been two of the key areas of concern at the start of 2019 and even though there is still much uncertainty, targeted fiscal stimulus in China (VAT cut April 1) and potentially some clarity emerging on Brexit over coming weeks could improve sentiment,” strategists at ING Bank wrote in a note to clients.

In the latest trade news, the most notable development was that Chinese Vice Premier Liu He conducted a phone call with US Treasury Secretary Mnuchin and Trade Representative Lighthizer in which China and US were said to have made further substantive progress on trade discussions, while Mnuchin had earlier commented that he is pleased with progress on trade talks with China and expects elements of Chinese trade talks to be resolved in the near future. Separately President Trump said we will have news on China trade deal in the next 3-4 weeks one way or the other, while he added that China has been very responsible and very reasonable. In related news, there were also earlier reports which suggested China was proposing tying in an official state visit by President Xi to a US trade deal.

In other China-related news, Premier Li said China faces new downward pressure but added they will not let growth slip out of reasonable range and that China can use reserve requirements as well as interest rates to support the economy. Premier Li added China will cut VAT tax from April 1st and will tighten its belt due to tax cuts, while he hopes US-China trade talks achieve results.

In the top overnight geopolitical news, North Korea is considering suspending nuclear discussions with US and does not intend to yield to US demands, while leader Kim is set to make an official announcement of his position, according to the Deputy Foreign Minister Choe Son Hui. Elsewhere other reports also noted that Kim Jong Un may rethink moratorium on missile launches and that the US threw away a golden opportunity at the Hanoi summit.

In currencies the dollar index slipped 0.2 percent to 96.619 after rising 0.25 percent on Thursday to recover from a nine-day trough of 96.385. The U.S. currency was flat at 111.74 yen. It had dipped to 111.49 yen after the Bank of Japan’s left interest rates unchanged. The central bank offered a bleaker assessment of exports and output, as global demand waned. Observers said, that it may be too early to expect the BOJ to ease policy further.

The pound strengthened at the end of a week made volatile by critical votes on Brexit in Parliament. Prime Minister Theresa May won the endorsement of British politicians to seek a Brexit delay. The euro edged up 0.1 percent to $1.1315 after slipping 0.2 percent overnight.

Elsewhere, in commodities oil prices rose as investors focused on global production cuts and supply disruptions in Venezuela. U.S. crude futures rose 0.2 percent to $58.74 per barrel, holding close to Thursday’s four-month peak of $58.74. Brent was 0.25 percent higher at $67.39.

Today’s expected data include industrial production and Empire State Manufacturing Survey. Linde and Stella-Jones are reporting earnings

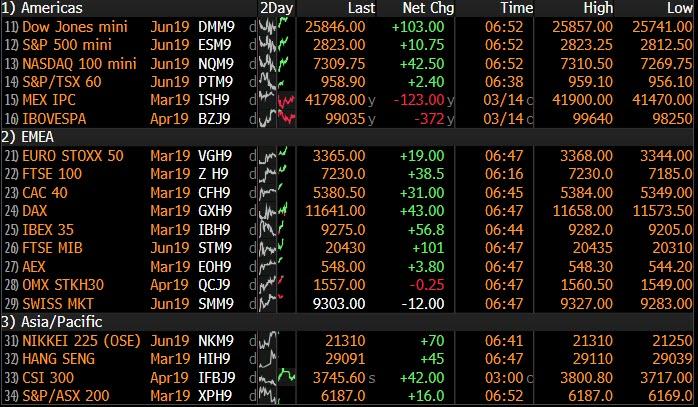

Market Snapshot

- S&P 500 futures up 0.3% to 2,814.25

- STOXX Europe 600 up 0.2% to 379.13

- MXAP up 0.7% to 158.86

- MXAPJ up 0.6% to 524.65

- Nikkei up 0.8% to 21,450.85

- Topix up 0.9% to 1,602.63

- Hang Seng Index up 0.6% to 29,012.26

- Shanghai Composite up 1% to 3,021.75

- Sensex up 1% to 38,131.78

- Australia S&P/ASX 200 down 0.07% to 6,175.17

- Kospi up 1% to 2,176.11

- German 10Y yield fell 0.3 bps to 0.083%

- Euro up 0.2% to $1.1325

- Italian 10Y yield fell 5.0 bps to 2.147%

- Spanish 10Y yield rose 0.3 bps to 1.194%

- Brent futures up 0.5% to $67.57/bbl

- Gold spot up 0.6% to $1,303.35

- U.S. Dollar Index down 0.2% to 96.62

Top Overnight News from Bloomberg

- Chinese Premier Li Keqiang said China will stick to its current targeted economic support strategy and resist the temptation to engage in large-scale stimulus like quantitative easing or a massive expansion in public spending

- Prime Minister Theresa May kept her deal with the European Union on life support by winning the backing of British politicians to seek a delay to Brexit just 48 hours after her plan looked dead and buried

- Bank of Japan Governor Haruhiko Kuroda defended the 2 percent inflation target that guides his monetary-stimulus program after the government advocated taking a flexible approach to the goal; The Bank of Japan left its monetary stimulus program unchanged as it downgraded its assessment of exports, factory output and overseas economies

- A meeting between President Donald Trump and President Xi Jinping to sign an agreement to end their trade war won’t occur this month and is more likely to happen in April at the earliest, three people familiar with the matter said

- North Korean Vice Foreign Minister Choe Son Hui said Kim Jong Un would decide soon whether to keep talking with the U.S. and maintaining his moratorium on missile launches and nuclear tests, AP reports

- China won’t resort to using quantitative easing or massive deficit spending in order to support the economy because such approaches would store up problems for the future, Premier Li Keqiang said.

- The Senate voted to block President Donald Trump’s declaration of a national emergency to pay for a wall at the border with Mexico, setting up his first veto and highlighting a growing willingness by Republicans in the chamber to split with their president

- Uncertainty over U.S. waivers for buyers of Iranian oil is starting to grip the market again, under very different circumstances than when American sanctions were set to go into effect last year

- Mario Draghi’s latest stimulus salvo means his successor as European Central Bank chief may not be forced into the kind of monetary policy U-turn he once faced; Draghi has set in place the conditions to keep the euro zone in easing mode until he leaves office

- One of the potential candidates to succeed Mario Draghi as European Central Bank president is pushing a review of the institution’s monetary-policy strategy to deal with the risk it may never reach its inflation goal

- OPEC nations have enough spare crude oil to make up for any supply shock from the escalating crisis in Venezuela, the International Energy Agency said

Asian stocks traded mostly positive across the board as US-China trade optimism helped the region shake off the negative lead from the US, where sentiment was subdued by growth concerns following recent discouraging data from China and the reported delay in the Trump-Xi summit. ASX 200 (-0.1%) and Nikkei 225 (+0.8%) were mixed with upside in Australia capped as weakness in mining names and financials offset the continued outperformance in energy, while the Japanese benchmark coat-tailed on recent currency moves. Elsewhere, Hang Seng (+0.6%) and Shanghai Comp. (+1.0%) were higher as overnight trade-related news flow spurred optimism including comments from President Trump that we will have news regarding a China trade deal in the next 3-4 weeks and although he included a ‘one way or the other’ caveat, he suggested that people will be talking about it for a long time and that China has been very reasonable. In addition, Chinese officials also contributed to the trade hopes after the NPC approved Foreign Investment law reforms dealing with forced tech transfers and IP theft which is seen as an attempt to appease US concerns, while Chinese Premier Li noted that China can use reserve requirements as well as interest rates to support the economy and confirmed VAT tax cuts will begin from next month. Finally, 10yr JGBs were relatively flat with demand dampened as focus centred on riskier assets and after the BoJ policy announcement proved to be a non-event in which it maintained policy settings and downgraded assessments on exports and output as expected.

Top Asian News

- China Vows to Stick to Targeted Stimulus Amid Jobless Pressure

- King of India Bond Sales Warns of Worst Crisis Since Lehman

Major European indices have remained firm after opening with mild gains [Euro Stoxx 50 +1.4%], continuing from overnight where risk sentiment improved following US-China trade optimism. Sectors are largely in the green, although there is some mild underperformance in healthcare names. Weighed on simultaneously by a downgrade at Citi Group and reports that the Co’s India operations are the focus of a Singapore probe are Wirecard (-9.1%) who are at the bottom of the Stoxx 600, although this was later refuted by the Co. Elsewhere, and towards the top of the Dax, are BMW (+1.0%) who have been in focus after warning of headwinds impacting the sector and reported FY18 revenue slightly above expectations and EBIT margin above target; which subsequently led to short-term volatility in Co. shares. Separately, UBS (-0.9%) are in the red after their annual trade report where the Co. stated that provisions for litigation, regulatory and other matters reduced FY18 operating profit before tax and net profit for shareholders by USD 382mln.

Top European News

- UBS Setting Aside Just $516 Million to Cover Record French Fine

- H&M’s Lower Prices Lift Sales as It Narrows Gap With Zara

- Hedge Funds Fighting Over Interserve Head for Showdown in London

- Swedbank May Have Handled Over $10 Billion in Suspect Flows

In FX, The Kiwi has rebounded firmly from lows close to 0.6800 vs its US counterpart after a more conciliatory tone from both sides of the US-China trade divide overnight compared to reports circling on Thursday highlighting ongoing issues that remain unresolved and have rolled back the likely date of a Trump-Xi official signing-off Summit. Nzd/Usd is currently towards the top of a 0.6858-24 range, but hampered somewhat by cross-winds as Aud/Nzd consolidates recovery gains above 1.0300 and the Aussie also reclaims lost ground against the Usd to retest resistance ahead of 0.7100.

- CAD/EUR/GBP – Also benefiting from the Greenback’s broad loss of momentum as the DXY failed to sustain yesterday’s more bullish technical impulses beyond 96.821 and closer to the 97.000 handle. The Loonie is also deriving some impetus from steadier oil prices and could get a helping hand from Canadian manufacturing sales if expectations for a rebound are confirmed. Usd/Cad is hovering just above 1.3300 and back to within striking distance of the 200 DMA. Meanwhile, the single currency continues to try and establish/build a base on the 1.1300 handle, but resistance around the recent 1.1340 high and mega option expiry interest remain formidable barriers to overcome, with 1.9 bn at the big figure and 3.3 bn running off between 1.305-25 at Friday’s NY cut. Turning to the Pound, and a bout of selling saw Cable test underlying bids/support ahead of 1.3200, while Eur/Gbp spiked to 0.8575, but with little obvious in the way of a catalyst and for once relative quiet on the Brexit front the relatively rapid moves have subsequently reversed to circa 1.3275 and 0.8525 respectively.

- JPY/CHF – Both relatively flat vs the Dollar and still rangebound, as Usd/Jpy meanders from 111.90 to 111.50 and just above the 200 DMA (111.44) in wake of a dovish BoJ policy meeting, as widely anticipated. Decent expiries from 111.50-65 (1.1 bn) could underpin the headline pair, while 112.00 and a Fib at 112.08 are keeping the upside in check. The Franc is even more contained within 1.0045-20 and vs the Eur around 1.1350 ahead of next week’s quarterly SNB policy review.

- SEK/NOK – The Scandi Crowns looks set to end the week on the front foot having regained the initiative over the Euro and crossed psychological/technical levels, and with some added backing from a US bank advocating long positions via the Eur/Sek cross and Usd/Nok – see our headline feed for more details.

In commodities,Brent and WTI prices are softer heading into the weekend, a sharp decline this morning saw prices drop significantly below the day’s ranges, with no significant fundamental news behind this. This morning saw the release of the IEA’s monthly report, which maintained the 2019 global oil demand growth forecasts at 1.4mln BPD, which has been supported by strong non-OECD consumption. IEA state that OPEC crude production in Feb was 30.68mln BPD, a decrease of 240k BPD; due to losses in Venezuela and lower output from both Saudi Arabia and Iraq. Adding that preliminary data for February points to a sharp drop in inventories. Looking ahead on the calendar sees the Baker Hughes rig count at 17:00 GMT due to the US time change, where total rigs decreased by 11 to 1027. Gold (+0.4%) is firmer in spite of the improvement in risk sentiment, potentially due to the yellow metal retracing some of yesterday’s decline where it dropped below USD 1300/oz, for reference spot gold is currently trading around USD 1302/oz. Separately, Indian gold demand may drop in May due to restrictions surrounding cash movement an Industry Official has reported. Elsewhere, copper prices improved overnight on the risk sentiment.

Looking at the day ahead, we get February industrial production (+0.4% mom expected), March empire manufacturing (+10.0 expected), January JOLTS report and preliminary March University of Michigan consumer sentiment report (95.7 expected). The ECB’s Rehn is also due to speak while the IEA monthly oil report is due out.

US Event Calendar

- 8:30am: Empire Manufacturing, est. 10, prior 8.8

- 9:15am: Industrial Production MoM, est. 0.4%, prior -0.6%; Manufacturing (SIC) Production, est. 0.1%, prior -0.9%

- 10am: JOLTS Job Openings, est. 7,225, prior 7,335

- 10am: U. of Mich. Sentiment, est. 95.7, prior 93.8; Current Conditions, est. 112, prior 108.5; Expectations, est. 88.1, prior 84.4

- 4pm: Net Long-term TIC Flows, prior $48.3b deficit; Total Net TIC Flows, prior $33.1b deficit

DB’s Jim Reid concludes the overnight wrap

Last week I discussed a new box set I’d been watching. Well this week’s evening entertainment has been streamed live from the House of Commons. I even missed a bit of Liverpool’s glorious victory in Munich on Wednesday to keep an eye on the manoeuvrings of our politicians. I’ve always loved politics and was a member of a UK political party as a teenager (partly in a failed attempt to impress a young lady). However nothing has beaten this week for drama, subterfuge and sub-plots. Last night’s votes were slightly on the more tame side but there were still some surprises. The main (and expected) event was the House of Commons overwhelmingly voting (412-202) to extend Article 50 out to June 30th. Earlier, an amendment to enable a second referendum suffered a big defeat (344-85) so we’re a very long way from such an outcome but Mr Corbyn left it firmly on the table in comments after the votes which reflects their strategic position. The more interesting vote was a narrow defeat (314-312) for an amendment that would have allowed Parliament to take control of the process with indicative votes in the last week of March. The government had already promised this in early April if no other deal is reached beforehand so the big difference is timing and the fact that the government and not Parliament will be still be controlling it. The pound had depreciated as much as -0.98% early in the session ahead of the votes, but partially pared its losses to end the day -0.72% weaker versus the dollar. It’s still +1.74% stronger this week as the direction of travel still appears to be toward a softer Brexit and reduced risks of a no-deal outcome.

So what next? It looks likely that Mrs May will bring the 3rd version of the WA to Parliament on Tuesday, ahead of the European summit next Thursday/Friday. If she fails the EU will likely insist on a long extension and then we’ll either move straight to indicative votes or Mrs May will try a 4th time first. There was some evidence yesterday that more Tory MPs and the DUP are engaging with the government to see how they can back the WA. According to Reuters, Attorney General Cox is in active discussions about how the UK could legally and unilaterally exit the Irish backstop if it wanted to in the future. The key will be if anything ends up changing the DUP’s mind. So far there are no firm conclusions but it’s clear discussions are ongoing.

In the world outside of Westminster risk took a bit of a pause for breath last night in the US following what had been a strong start to the week. Indeed on a light newsflow day, the S&P 500, DOW and NASDAQ closed -0.09%, +0.03% and -0.16% respectively after Europe closed higher with the STOXX 600 finishing +0.78%. Banks also had a good day in Europe (+0.68%), boosted by a +2.1bps rise in bund yields and sentiment towards Italy improved as well. Italian banks gained +1.09% and BTP yields fell -5.1bps, helped by optimistic comments from the ECB’s Benoit Coeure who said that Italy is not a threat to the euro area. The VIX held steady around 13.50,within 0.1pts of its year-to-date low, while the same can be said for the MOVE index (+0.7pts yesterday) and less than a point off its year-to-date low. The same situation applies the V2X in Europe, while the CVIX index of currency volatility has actually dropped to its lowest level in 14 months. So it’s very much back to the bottom of the range for volatility across asset classes. Meanwhile, cash HY spreads were bps -5bps and -1bps tighter in Europe and the US while Treasuries were close to flat.

In Asia this morning we’ve had the BoJ meeting where the central bank decided to maintain its policy rates and asset purchases, as was widely expected, while taking a gloomier outlook for the economy. The BoJ said that Japan’s economy continued to expand moderately, but the global slowdown had caused “some weakness” recently in exports and industrial production but added that the global economy would keep growing moderately and in turn support a rising trend in Japanese exports and a further expansion of the domestic economy. In the meantime, Japan’s Finance Minister Taro Aso said that the BoJ should take a flexible view of the 2% inflation target.

Yields on 10y JGBs are up +0.7bps to -0.045%. We should get further clarity on the BoJ’s view of the economy and the BoJ’s likely appetite for flexibility around the 2% inflation target from Governor Kuroda’s presser (06:30 GMT) which would have already started by the time this reaches your inbox. Elsewhere, China’s Premier Li Keqiang said in a speech at the NPC that China will use tools like reserve-requirement ratios and interest rates to support a slowing economy and won’t take the route of monetary easing (QE or massive deficit spending) as such approaches would lead to problems in the future. He also confirmed that announced tax cuts and social security reductions at the NPC would take effect from April 1 and May 1 respectively while adding that China won’t let the major economic indicators slide out of their proper range. Signifying the continued focus of China’s government towards easing credit access for the SMEs, Li Keqiang said that China will take multiple measures to lower the funding cost for SMEs by 1% this year. On the sticking points in the trade negotiations with the US, Li said that China will revise its intellectual property protection law and added that China will “certainly” implement measures to further open up its market.

In other news, as per Bloomberg Mao Shengyong, the spokesman of China’s National Bureau of Statistics attributed the recent weakness in China’s economic data to the Lunar New Year holidays. He said that many factories and companies close near the holidays thereby usually hurting industrial output in the 4 days ahead of Lunar New Year holidays and 15 to 20 days after it. Meanwhile, China also passed a foreign investment law today which will take effect from January 1, 2020. Under the updated new law China will treat all companies registered in China equally, as opposed to the current division between local and foreign businesses, according to lawmakers. Chinese government support will also apply equally to foreign firms, and their applications for operating licenses won’t be treated differently from domestic rivals while forced technology transfer will be banned. Elsewhere, Russian News Agency Tass has reported – citing North Korean deputy foreign minister Choe Son Hui – that North Korea is reviewing plans to suspend denuclearization talks with the US while adding that North Korea’s leader Kim Jong Un will make an announcement about his decision on this.

Markets in Asia are heading higher with China’s bourses leading the advance – the Shanghai Comp (+1.54%), CSI (+1.85%) and Shenzhen Comp (+1.88%) are all up on the back of above mentioned growth supportive speech from China’s Premier Li Keqiang with Trump’s favorable comments on China (mentioned below), likely also playing a part. The Nikkei (+1.02%), Hang Seng (+0.65%) and Kospi (+0.63%) are also up. Elsewhere, futures on the S&P 500 are up +0.24% and 10y treasury yield is down -0.9bp this morning. In the US, markets could experience higher levels of volatility today on account of “quadruple witching.”

The trade headlines yesterday included the news that President Trump and President Xi Jinping’s meeting was likely to be pushed back to April at the earliest according to Bloomberg. Further, late yesterday evening President Trump said that we will probably know in next three or four weeks about possible trade deal with China, thereby seconding the above Bloomberg story. He also added that China has been behaving very responsible and reasonable. Will there be a Brexit or US/China deal first? Risk was a bit weaker when that trade headline emerged although quickly reversed much of it. More durably, the dollar strengthened +0.22% on the day and the offshore yuan traded -0.32% weaker. The prospect of tariffs remaining in place for longer would be bullish the dollar, all else equal. A reminder that Lighthizer sounded a bit more cautious on trade talks following comments earlier this week. Late afternoon Trump reiterated that “we’re doing very well with China talks” and that “we’re getting what we have to get”. However he also added the caveat that we “can’t say if we’ll strike a final deal with China”.

On a more micro note, General Electric’s share price rose +2.96% and as much as +4.79% earlier after the market latched onto the latest guidance from management that cash flow bleed this year will be no more than $2bn. Credit investors also welcomed the news with 2.7% 22s for example -10.5bps tighter. A reminder that it was General Electric that spooked credit markets towards the back end of last year.

While we’re on that subject, yesterday we published a note looking at USD BBB ‘Super Issuers’. In it we find that these issuers are significantly on the rise and have more debt outstanding than ever before. However, the market is no less concentrated and is below the extremes of the early 2000s. That being said, fundamentals for this cohort are trending in the wrong direction. The fact that the majority of issuers appear to be deleveraging or at least still targeting an IG rating should lend some support, but intention and reality do not always turn out to be the same thing. See the link to the report here .

Staying with credit Michal Jezek has just written up DB’s 9th annual bank capital conference that took place on Wednesday. This included an interview with myself and ECB governor Nowotny. See here for the report.

In other news, yesterday’s data didn’t add much to the mix. In the US the latest weekly initial jobless claims print came in at 229k, a shade higher than the 225k expected and up from 223k the week prior. While that is a four-week high, the four-week moving average nudged down to 224k and has now dropped for three consecutive weeks. Meanwhile the February import price index reading came in at +0.1% mom ex petrol (vs. -0.1% expected) – a still benign reading – while March new home sales slumped (-6.9% vs. +0.2% expected), albeit offset by upward revisions in the prior two months.

In Europe the final February CPI revisions for both Germany (+0.5% mom) and France (+0.1% mom) were left unchanged versus the initial estimates. As you’ll see below we get revisions to the broader Euro Area reading today.

Outside of the usual Brexit drama, the highlights from the scheduled data releases today are the final February CPI revisions for the Euro Area (no change in the +1.0% yoy core expected), and February industrial production (+0.4% mom expected), March empire manufacturing (+10.0 expected), January JOLTS report and preliminary March University of Michigan consumer sentiment report (95.7 expected) in the US. The ECB’s Rehn is also due to speak while the IEA monthly oil report is due out.

via ZeroHedge News https://ift.tt/2TQ8ptM Tyler Durden