Without the gamma-reaching momo-igniting fuel of quad-witch, markets largely went nowhere fast…apart from the buying panic at the open and close

After a couple of days of violent downside, Chinese stocks soared again on Monday…

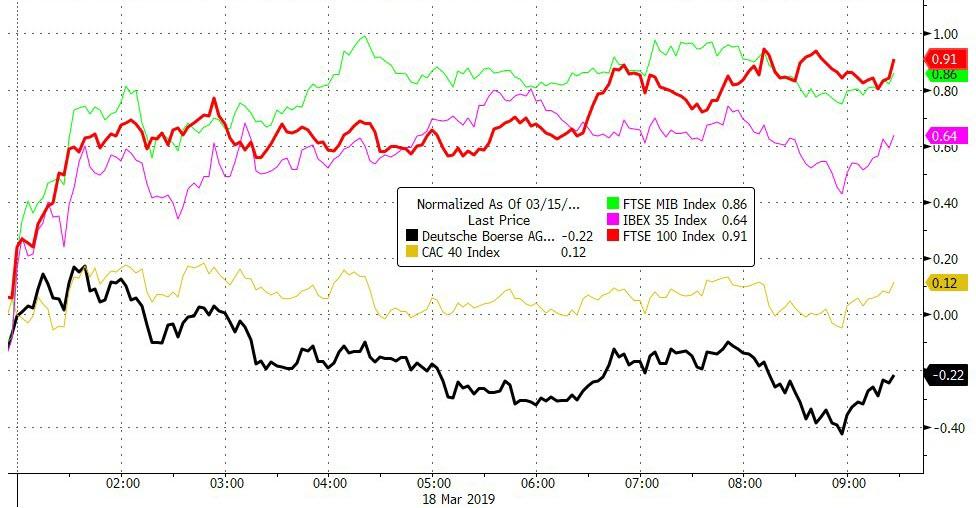

Mixed picture in Europe with DAX down but UK’s FTSE leading…

Other than the low-liquidity melt-ups at the open and close, US equity markets were a snoozefest as the Dow traded in a narrow range despite Boeing’s efforts to insert some vol. Post-Quad-Witch, and pre-Fed, everyone appears to be sitting in their hands…

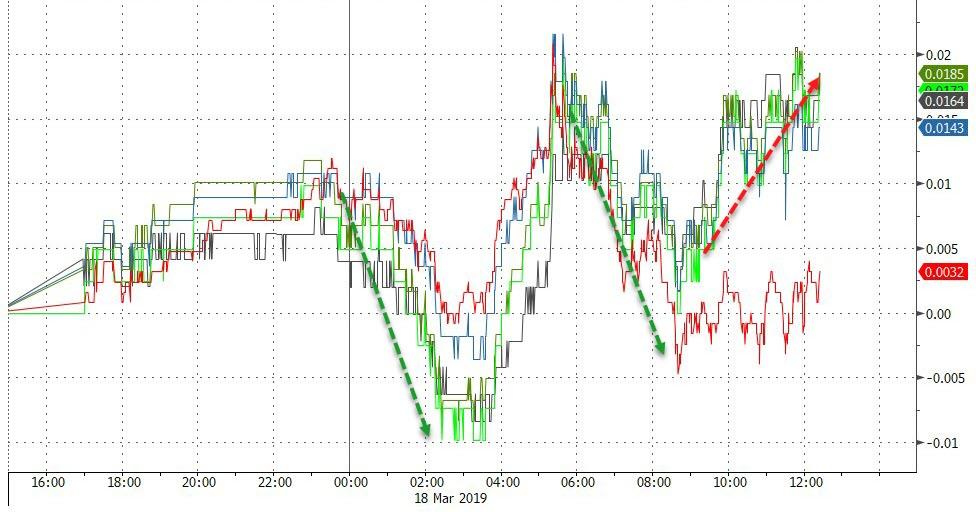

Crazy day in “most-shorted” stocks…

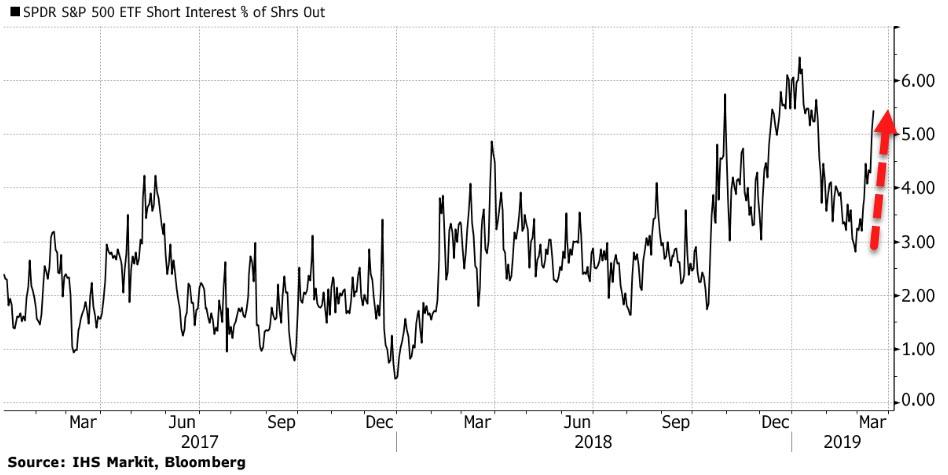

There is one notable fly in the ointment – IHS Markit’s short interest as a percentage of shares outstanding shot up by 1.16 ppts Thursday and Friday to 5.45%, the biggest two-day jump in short interest since early December…

Similar picture evolved in buyback-related stocks, surging at the cash open…

In other equity market news, Brazil’s IBOVESPA topped 100,000 for the first time today… (but spoiling the party just a little, we note that in USD terms it remains down 40% from its highs)…

VIX was crushed back towards a 12 handle after surging in the early going…

The gap between Stocks and Bonds continues (around 120 S&P points now!!)

Treasury yields rose by 1-2bps across the curve today but the long-end outperformed…

The Treasury curve flattened notably today – 2s10s flattest close since Jan 29th (FOMC), but 2s30s tumbled the most on the day…

Notably, 30Y yield is just below where it was in December when the Fed last hiked rates (and the rest of the curve is 20-26bps lower)…

The Dollar Index dipped back into the red this afternoon after rallying through the early day…

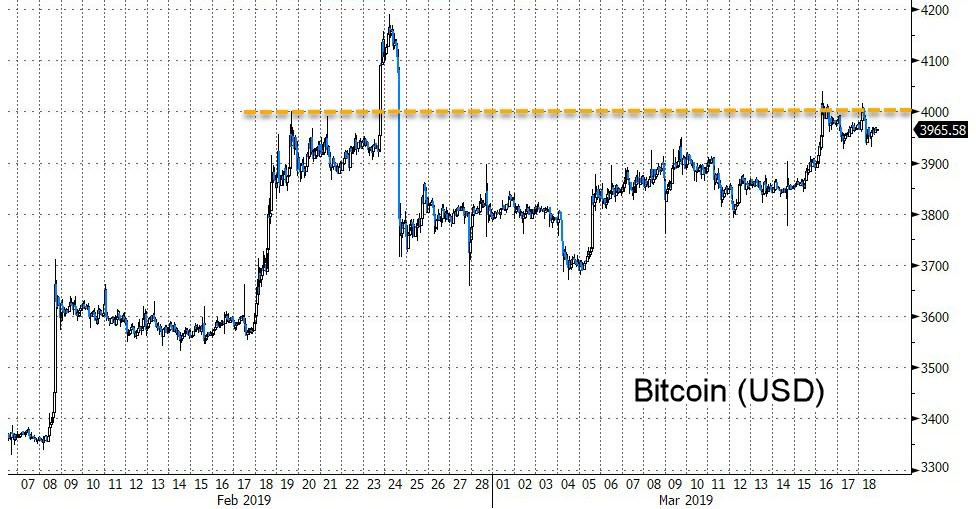

Bitcoin Cash surged…

Bitcoin topped $4000 twice over the weekend but was unable to hold it for now…

WTI extended its gains as Gold and Crude clung to unchanged…

Gold managed to bounce and hold above $1300…

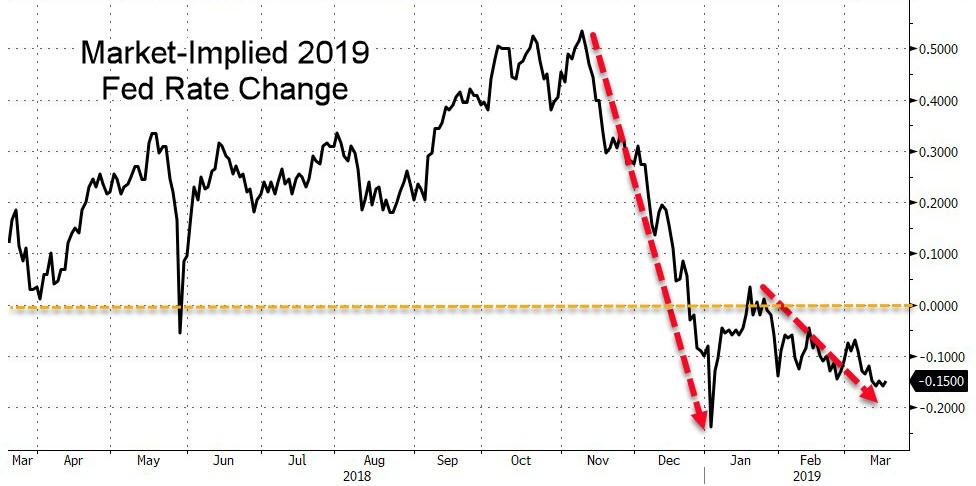

Finally, as FOMC looms, Jay Powell will face an uphill battle to out-dove the market’s expectations… (of a 16bps rate-cut in 2019)

Who will be right? Bonds Or Stocks?

via ZeroHedge News https://ift.tt/2CmY8eI Tyler Durden