Submitted by Nomura’s Bilal Hafeez

We recently got the latest US capital flow data for the US, which is for January 2019. The dominant capital flow themes of 2018 appear to have continued into the start of this year:

- Foreigners sold US equities for the 9th straight month and the scale of selling in January was the largest since late 2015. Undoubtedly some of this was linked to the sell-off in December. Foreign flows into US equities have also generally ignored the actual performance of US stocks since the financial crisis (see first chart – despite strong US stocks, foreigners haven’t bought).

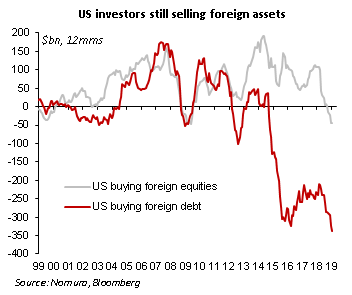

- US investors are still selling foreign bonds. In fact, since late 2014, US investors have sold foreign bonds in every month except two. They did buy foreign equities in January, but even there the trend has been for selling (see second chart).

The first point suggests that the transmission of US growth to the dollar is likely running primarily through interest rates unlike the pre-2008 period, when equity flows were an additional channel. The second point suggests that US investors aren’t finding EM compelling enough to venture back abroad, yet.

via ZeroHedge News https://ift.tt/2JzpPXZ Tyler Durden