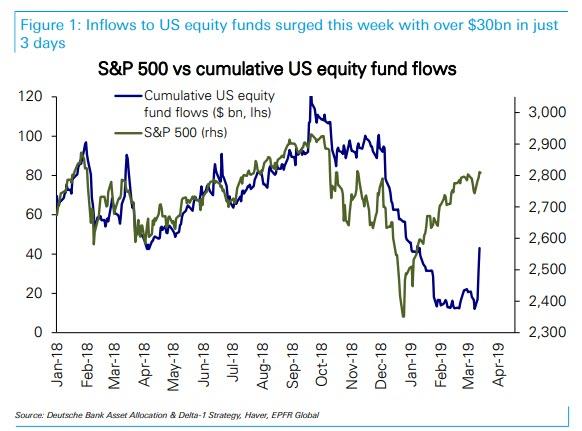

One of the more bizarre observations to emerge over the past three months has been that despite the torrid rebound in stocks so far in 2019, culminating with the best January for the S&P since 1987, investors had generally shunned US equities, selling stocks when they should be buying as the following recent chart from Bank of America demonstrated.

This perplexing behavior seemed to resolve itself last week, when EPFR reported that after a record stretcd of outflows, skeptical investors finally threw in the towel and bought a whopping $27.3Bn of US stock funds and ETFs in the week ending on March 13th. This was the second largest inflow on record, behind $38.30bn from March of last year.

Here are some of the key findings from the latest survey which polled 186 respondents who manage $557 billion in asets under management.

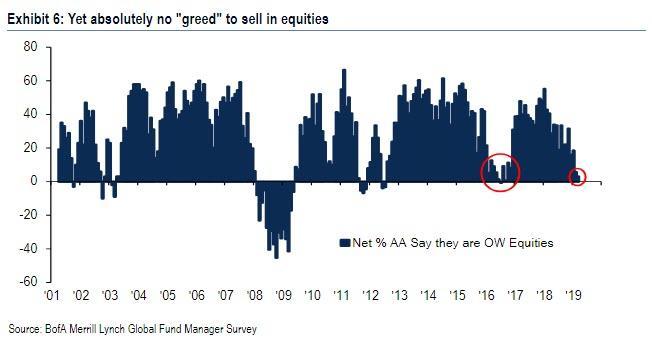

First and foremost, the allocation to global equities tumbled again, and after dropping from 12% to just net 6% overweight in February, the lowest level since September 2016, in March the global equities allocation fell again, down 3% to just 3% overweight, the lowest since Sept ’16. Should the allocation to equities drop by another 4%, it would be a historic event: as BofA notes, the equity allocation has only been negative once in the past 6 years.

What is paradoxical, is that this observation once again confirms that nobody has any faith in the current rally, which may indeed be simply a lingering artifact of Steven Mnuchin calling in the Plunge Protection Team in late December.

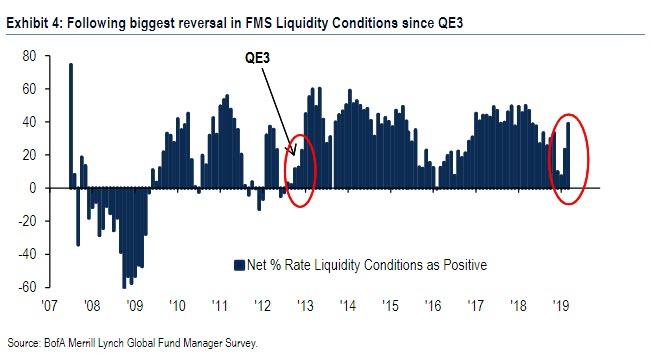

Yet what is perplexing is that investor appetite for stocks has collapsed even as Wall Street sees the broader investing environment as one of the best in years.

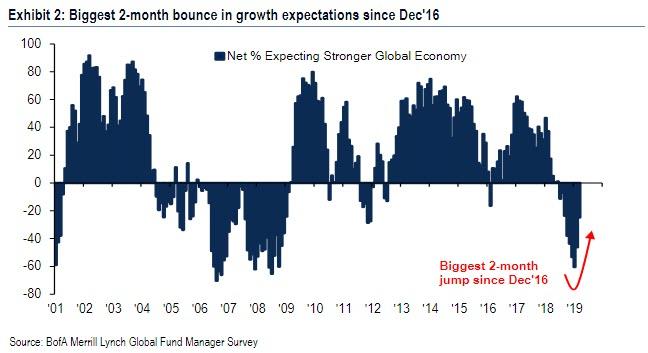

First, there is soaring market liquidity: the extremely easy central bank policy backdrop is the primary driver of improving macro sentiment; note 39% of FMS investors now think liquidity conditions are positive, up 16% MoM again and the biggest 2-month improvement since QE3.

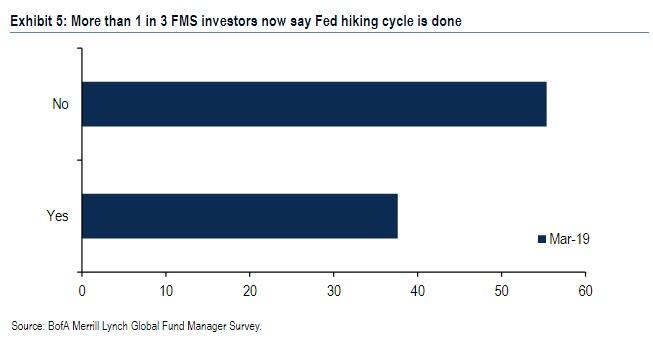

Second, a growing number on Wall Street believe that the Fed’s tightening cycle is over: 38% of FMS investors surveyed say they think the Fed hiking cycle is now done vs. 55% that expect future hikes; fed funds futures markets are pricing in 13bp of Fed rate cuts in the next 12 months.

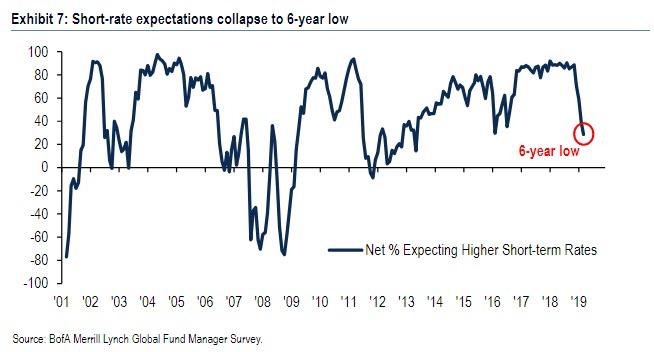

And linked to that, only net 28% of FMS investors think short term rates will rise in the next 12 months, a 6-year low.

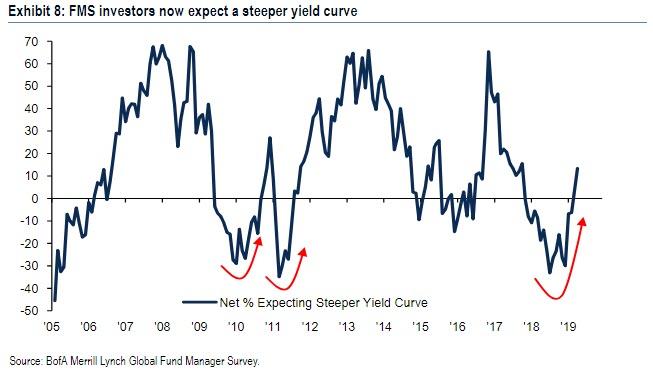

Meanwhile, as noted earlier, a yield curve steepening has become the consensus trade, as a majority of investors now think the yield curve will steepen for the first time since Oct ’17, rising 20ppt to +13%, saying they expect a steeper curve in the next 12 months.

To be sure, it’s not all doom and gloom, as both Growth…

… & EPS expectations rose for 2nd consecutive month:

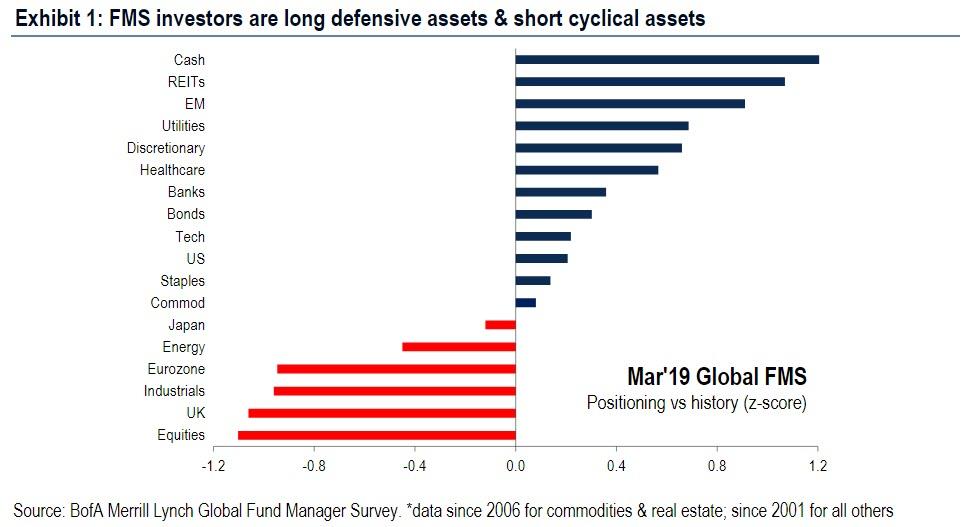

And yet, here another paradox emerges, because even as investors see the Fed as doing everything it can to spike the market, and prompt an economic recovery, investors remain long defensive assets that perform well when growth & rates fall, and short cyclical assets that perform well when growth & rates rise; allocation to bank stocks dropped to the lowest since Sep ’16.

Looking at the above chart, BofA concludes that contrarians would be long stocks vs. cash; long EU vs. EM stocks, long industrials vs. REITs.

Summarizing all of the above, Hartnett says that “the pain trade for stocks is still up,” and adds that “Despite rising profit expectations, lower rate expectations and falling cash levels, stock allocations continue to drop. There is simply no greed to sell in equities.”

On the other hand, who knows: should Powell truly shock the market tomorrow, and reverse his Jan dovish U-turn by hinting at 3 or more rate hikes, then all those bears who fought the biggest bear market rally since 1987, will end up being proven right.

via ZeroHedge News https://ift.tt/2HEjgAu Tyler Durden