Submitted by John Hanlon, and IHS Markit

For the past six months, Lyft’s IPO has been on the edge of everyone’s tongue. During the past two weeks, more focus has been on the old American mainstay brand, Levi’s, a San Francisco innovator in their own right with origins in the 19th century.

More info below on these and other IPOs expected to price this and next week:

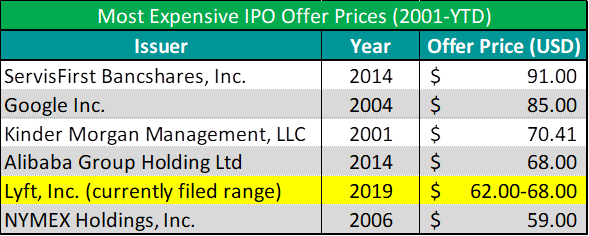

- Lyft, Inc. aims to have one of the highest offer prices since 2001…

- Only three IPOs have priced above Lyft’s currently filed range of $62-$68 since that year

- Lyft may price just behind Google and tie with Alibaba…

- If Lyft prices at the top of its expected range, it’ll be the fourth-highest offer price since 2001 after Google Inc, ServisFirst Bancshares Inc, Kinder Morgan Management LLC, and would tie with Alibaba Group Holding Ltd

- Lyft seeks valuation at greater than $20B…

- The high offer price is due to the company seeking a massive valuation

This Week: 3 IPOs are expected for proceeds of $1.38B

Notable information regarding the Levi Strauss & Co IPO:

- Currently filed to raise $550.0M in proceeds, Levi Strauss & Co aims to become the second-largest Clothing and Accessories IPO deal since at least 2001

- Michael Kors Holdings Ltd. raised $944.0M on December 14, 2011

- Known primarily as a hotspot for Technology companies, San Francisco has been home to only three Consumer Goods IPOs since 2001

- Most recently, Fitbit Inc. raised $841.2M on June 17, 2015

- If Levi Strauss & Co lists on a public exchange, it will be the oldest Clothing and Accessories company to list on a US exchange since 2001

- The company was founded in 1853

Notable information regarding the Up Fintech Holding LTD IPO:

- Up Fintech Holding LTD is expected to come to market at a price in the range of $5.00 to $7.00, possibly becoming the cheapest Financials stock since at least 2001

- The cheapest Financials IPO currently on record is China Rapid Finance Ltd, which came to market at an offer price of $6.00 on April 27, 2017

- Following a record year of Chinese IPOs from the Financials industry, Up Fintech Holding LTD could become the fourth Financials company to go public out of China in six months

- 360 Finance, Inc. priced on December 13, 2018

- Weidai Ltd and CNFinance Holdings priced on November 14, 2018 and November 6, 2018, respectively

- 2018 witnessed four Chinese Financials issuers come to market

- If Up Fintech Holding LTD comes to market as planned, it will become just the third Asset Management firm from China to list on a US exchange since 2001

Notable information regarding the Alight Inc. IPO:

- Domiciled in Illinois, if Alight Inc. comes to market as expected, it will become the first Technology IPO from the state since 2014

- Workivia Inc., Grubhub, Inc., and Paylocity Holding Corp. all came to market out of Illinois during 2014

- Alight Inc. is expecting to price in the range of $22.00 to $25.00, above the average Technology offer price of $14.39 among all deals out of the industry since 2001

Next Week: 3 IPOs are expected for proceeds of $2.18B

Notable information regarding the Lyft, Inc. IPO:

- The highly-anticipated Lyft, Inc. IPO, currently expected to raise $2.0B in proceeds, could become the largest IPO in nearly a year

- On May 9, 2018, AXA Equitable Holdings, Inc. raised $3.16B

- Classified as part of the Consumer Services industry, Lyft, Inc. could be the second-highest proceeds raising US company out of the industry since at least 2001

- Hilton Worldwide Holdings Inc. generated $2.71B out of the space on December 11, 2013

- If Lyft, Inc. comes to market within its currently filed range of $62.00 to $68.00, it will be the fifth-most expensive offer price among all IPO deals since at least 2001

Notable information regarding the 8i Enterprises Acquisition Corp. IPO:

- If 8i Enterprises Acquisition Corp. comes to market, it will become just the fifth Singapore-domiciled IPO since 2001

- This deal, however, will be the first IPO in the Financials industry that is domiciled in Singapore

- 8i Enterprises Acquisition Corp. is part of the Financials – Specialty micro industry, a niche space that has only witnessed 25 IPOs since 2001

- Since at least 2001, a company from the Asia-Pacific region has never debuted from this space on a US exchange

- 8i Enterprises Acquisition Corp. is looking to raise just $50.0M at an offer price of $10.00

- These are the lowest figures for both proceeds and offer price among all IPOs domiciled in Singapore since 2001

- Similarly, these are the lowest proceeds and offer price among all IPOs from the Financials – Specialty micro industry since 2001

Notable information regarding the Precision BioSciences Inc. IPO:

- Precision BioSciences Inc. looks to become the first company from Durham, NC to go public in nearly two years

- The last deal took place on June 28, 2017 when Dova Pharmaceuticals raised $75.0M in its debut

- Of the eight IPOs to launch out of Durham, NC since 2001, two have been unicorn IPOs; if Precision BioSciences, Inc. prices as expected for $126.4M, it will become the largest non-unicorn deal in that time frame

- Quintiles Transnational Holdings Inc. and Talecris Biotherapeutics Holdings Corp. raised $1.09B and $1.06B, respectively

- Square 1 Financial, Inc. raised $119.7M in its offering on March 26, 2014

- Since 2001, Durham-based IPOs have experienced subpar performance in the public markets

- Just one of the eight deals is currently trading above its offer price

- Five of the deals are currently trading very far below their offer prices

- Two issuers have been purchased by other companies since going public

via ZeroHedge News https://ift.tt/2Y8dBZr Tyler Durden