This is what it looks like when doves cry…

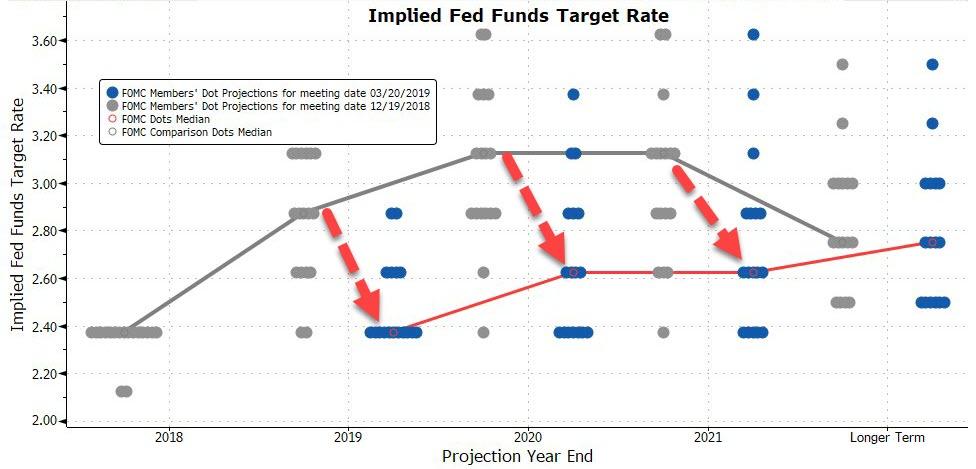

The Fed folded entirely to the market today, slashing its rate trajectory dramatically lower nearer the market’s implied dovishness…

Bloomberg’s Ye Xie noted that if we take the dot plot at face value (which, mind you, may not be a wise thing to do), then it seems the Fed will hold rates steady this year before raising one more time in 2020. If that pans out, it would be unprecedented. Since the 1970s, there have been three times when the Fed held rates steady for more than a year after raising them in the previous three months: 2006, 2000 and 1997. Invariably, the next move was a rate cut.

However, the market has shifted even more dovish, pricing in almost an entire rate-cut in 2019 now…

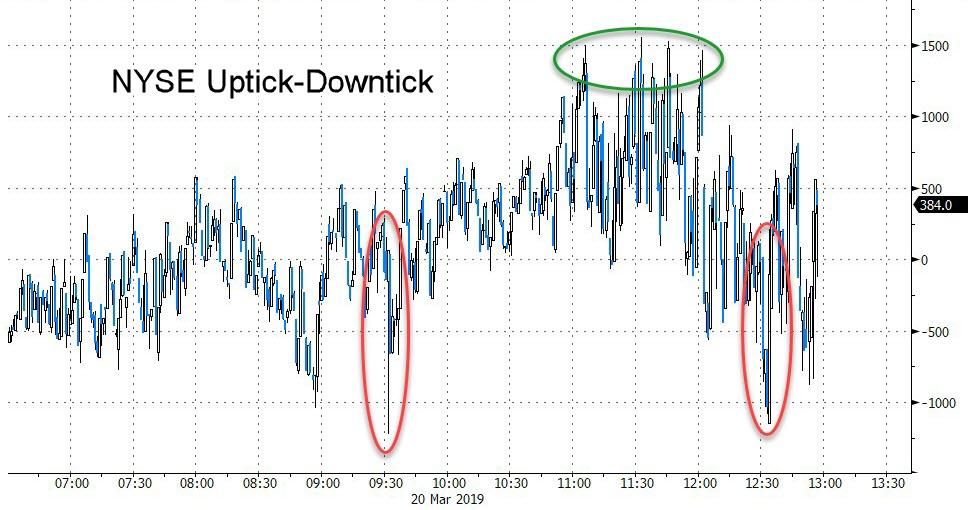

Stocks initially surged on the dovish surprise, dragging the Dow green, but as the last hour went on, traders wondered just how much fear The Fed must be feeling about growth to take such a machete to its rate forecasts and started to sell stocks…

Only Nasdaq managed to cling to gains on the day…

TICK gives us a sense of the flow as programs charged in long as The Fed statement hit but sellers dominated the last hour… (NOTE the drop earlier in the day when Trump commented on China tariffs)

Bank stocks did not like The Fed’s dovish message…

…but FANG stocks soared, even with some China trade headlines early on…

Buyback-related stocks pumped-and-dumped after The Fed…

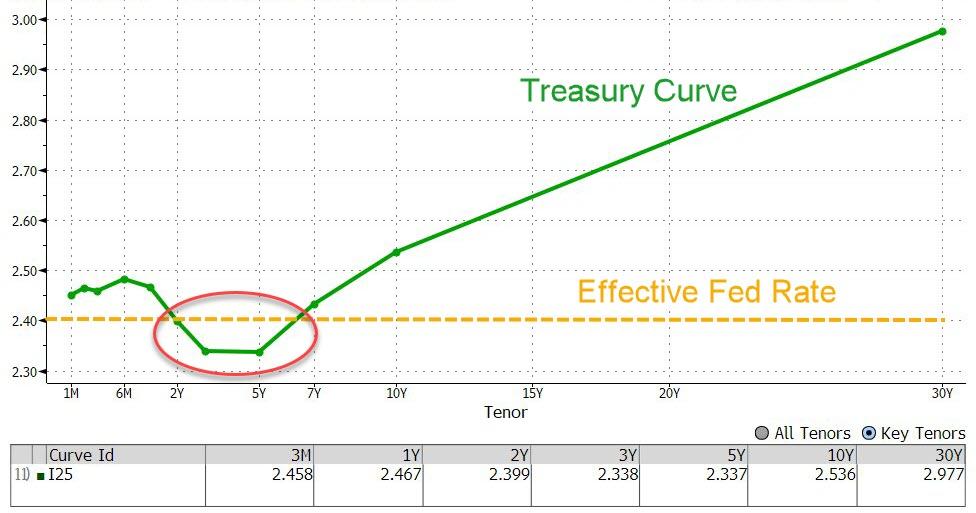

10Y yields are now trading where the 2Y yield was just 15 days ago, pushing down to 2.52% handle – the lowest since Jan 2018…

30Y yields tumbled back below the 3.00% level to the lowest since Jan 7th…

2Y-5Y yields are all now inverted relative to Fed Funds

With the curve out to almost 7Y now inverted relative to Fed Funds…

The Dollar Index crashed to its lowest since early Feb – perfectly back to the Jan FOMC meeting levels…

The dollar is down 8 of the last 9 days, after being up 7 days in a row.

Dollar weakness sparked a buying panic in EM FX – the biggest day since Jan 4th…

Gold was smacked lower on huge volume before the FOMC, breaking back below the $1300 level, but the uber-dovishness prompted huge volume buying in precious metals, sending gold soaring…

WTI spiked above $60 on a surprise inventory draw and maintained it after the FOMC…

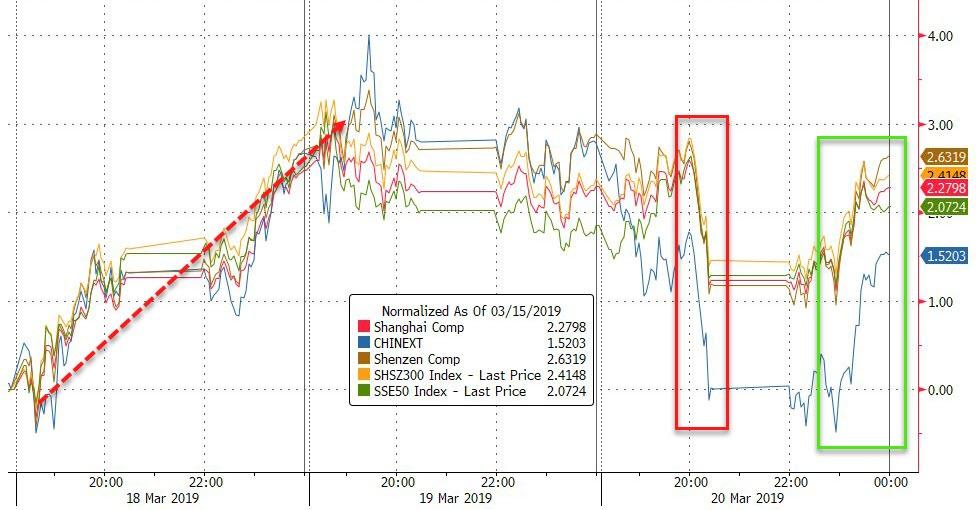

For completeness, here are Chinese stocks dipped in the morning session but were rescued once again into the close…

But European stocks were weak ahead of The Fed (with DAX dumped as BMW missed)…

And finally, one wonders at the irony of a massively dovish Fed’s action driving the yield curve to collapse sparking the highest recession risk of the cycle…

via ZeroHedge News https://ift.tt/2YbXQAI Tyler Durden