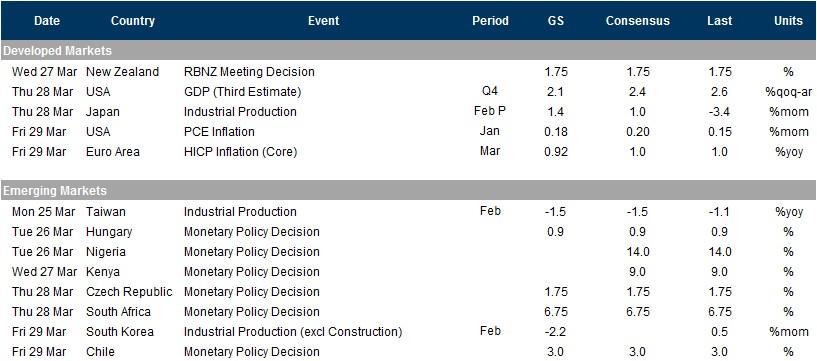

As Q1 draws to a close this week – as does the seemingly endless narrative of Trump “Russian collusion” – we will likely see Brexit continue to drive markets with another House of Commons vote expected on the Withdrawal Agreement. And, as DB’s Craig Nicol summarizes, we’ll also see a resumption of trade talks, with US Trade Representative Lighthizer and Treasury Secretary Mnuchin visiting China later in the week. We also have a number of central bank speakers, including ECB President Draghi, Federal Reserve Vice Chair Clarida and Vice Chair Quarles. Finally, a number of key data releases are expected, with the highlights including the German IFO surveys, Eurozone CPI data and updated readings for Q4 GDP in the US, UK and France.

Brexit developments can be expected to continue and will clearly be a major driver for markets. If the House of Commons agree the Withdrawal Agreement, then the EU have agreed to shift the date to May 22 to allow time for the necessary legislation to be passed. However, if the House of Commons rejects the Withdrawal Agreement again, then the deadline will be extended only until April 12, by which point the UK will have to decide where to go next. European Council President Donald Tusk said that “all options remain on the table”, including no deal, a deal, extending Article 50 or revoking Article 50. Prime Minister May, threatened by a weekend coup, will attempt to hold a third meaningful vote in the House of Commons on the Withdrawal Agreement next week, although a precise date is yet to be confirmed.

In terms of data highlights, from Europe we had the German IFO survey results on Monday, where the business climate indicator surprised to the upside, pushing Bund yields back over 0.00%. It also means an end to a run of six consecutive monthly declines in the reading. Another release of note is Friday’s March CPI data for the Eurozone, which the consensus expects to remain at 1.5%. From the US, the highlight will be the third reading of Q4 GDP on Thursday, which the consensus expects to be revised down to an annualised QoQ rate of 2.3% from 2.6% previously. Personal consumption data will also be released at the same time. And from Japan, Thursday will see the release of industrial production and retail sales data for February, as well as the unemployment rate that month. Other data releases worth mentioning include the final release of French Q4 GDP on Tuesday, along with manufacturing confidence for the country. In the US that day, we have the Conference Board’s consumer confidence reading for March, which is expected to rise slightly from February’s figure, as well as February’s housing starts and building permits data, which are both expected to show a slight reduction on January’s readings. On Thursday, we also have German CPI data and the final Eurozone consumer confidence reading for March, as well as Eurozone M3 money supply data for February. On Friday, there’ll be March’s CPI readings for France and Italy, the final reading of Q4 GDP in the UK, and February’s consumer credit and mortgage approvals data for the UK as well.

In terms of central banks, this week will be a quieter one following this week’s Federal Reserve and Bank of England meetings, although there will be a huge number of speakers throughout the week. It’s a big week for Fedspeak, starting early Monday in Hong Kong where Evans will be speaking, while Harker will be in London to speak on the economic outlook that same morning. On Tuesday, both Evans and Rosengren will be speaking in Hong Kong, while Harker is speaking in Frankfurt and Daly will be discussing managing inflation in the current climate. On Wednesday, George will be speaking, and on Thursday both Vice Chairs Quarles and Clarida will each be speaking, along with Bullard. On Friday, Vice Chair Quarles will be speaking again.

Turning to other central banks, the BoJ’s Harada will be giving a speech on Monday, while we have a number of ECB speakers. On Monday, there will be Costa and Coeure speaking in Lisbon, while Wednesday will be a major day, with President Draghi speaking in Frankfurt, along with Vice President de Guindos, Chief Economist Praet and Mersch, while both Nowotny and Lautenschlaeger will be speaking in Vienna and Villeroy de Galhau will be in Geneva. Finally, Vice President de Guindos will be speaking again in Frankfurt on Thursday and Coeure will be in Paris on Friday.

Looking at political developments, US Trade Representative Lighthizer and Treasury Secretary Mnuchin will be in China for further talks on Thursday and Friday. After signing an agreement with Italy which inducted the European country into China’s Belt and Road Initiative, President Xi’s visit to Europe will also involve a meeting with French president Macron on Monday. Also on Monday, Israeli Prime Minister Netanyahu will be meeting with US President Trump. Turning to elections, this week will see votes take place in the Australian state of New South Wales on Saturday, as well as a general election in Thailand on Sunday.

Summary of key events in the week ahead, courtesy of Deutsche Bank:

- Monday: It’s a relatively quiet start to the week with the only data releases being the January all industry activity index in Japan, February’s PPI in Spain, March’s IFO survey results in Germany and from the US, the February Chicago Fed national activity index and March Dallas Fed manufacturing index. Away from the data, the Fed’s Evans will speaking early morning in Hong Kong while the BoJ’s Kuroda, ECB’s Costa and Coeure, and the Fed’s Harker are also due to speak during the day.

- Tuesday: In terms of data, we’ll get the April GfK consumer confidence in Germany, March confidence and production outlook indicator in France along with final 4Q GDP and February finance loans for housing in the UK. In the US, there’ll be the February housing starts and building permits, January FHFA house price index and S&P CoreLogic HPI data, and March Richmond Fed manufacturing index and Conference Board confidence indicators. Regarding central banks, the Fed’s Rosengren and Evans are both due to speak in the morning in Hong Kong while the BOE’s Broadbent and Fed’s Harker and Daly are also due to speak during the day.

- Wednesday: It’s a busy day for ECB speakers with President Draghi, Vice-President Guindos and governing council members Nowotny, Praet, Lautenschlaeger, Mersch and Villeroy all due to speak during the day at different events in Frankfurt, Vienna and Geneva. Looking at the data releases, we’ll have China’s February industrial profits, France’s February PPI and March consumer confidence, the UK’s March CBI retailing sales data, along with the latest weekly mortgage applications, January trade balance and 4Q current account balance all in the US. In central bank speakers, the Fed’s George will speak to Money Marketeers of New York.

- Thursday: Trade talks between the US and China will recommence with Trade Representative Lighthizer and Treasury Secretary Mnuchin visiting China. Datawise, we will get preliminary March CPI for Germany and Spain, March confidence indicators for the Euro-area and final 4Q GDP print in the US along with latest weekly initial jobless and continuing claims, February pending home sales and March’s Kansas City Fed manufacturing activity index. Late in the evening we will get Japan’s unemployment rate, February industrial production and retail sales data. It’s again a busy day for central bank speaks with ECB’s Guindos and Villeroy, and Fed’s Clarida, Quarles, Williams and Bullard all due to speak.

- Friday: It’s a busy end to the week with a host of data releases lined up. The key highlight of the day is likely to be the preliminary March CPI releases in France, Italy and the Euro-area along with the release of January Core PCE data in the US and final 4Q GDP in the UK and Spain. Besides, we will also be getting France’s February YTD budget balance and Feb consumer spending data, Germany’s March employment report, Italy’s February PPI and the UK’s February consumer credit, money supply and mortgage approvals data. In the US, we will get the February personal income, personal spending and new home sales data along with March Chicago purchasing manager index and final March University of Michigan survey results. We will also get China’s February current account balance sometime during the day. Aside from the data, ECB’s Coeure and Fed’s Quarles are also due to speak, while trade talks between the US and China will continue.

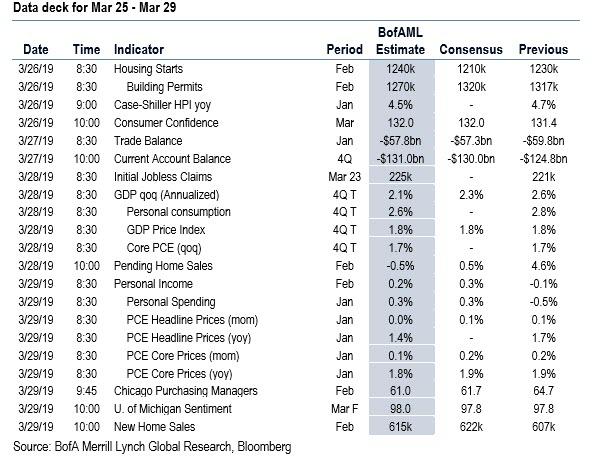

Finally, here is Goldman looking at key events in the US, noting that the key economic data release this week is the core PCE report on Friday. There are several scheduled speaking engagements by Fed officials this week, including one by Vice Chairman Clarida on Thursday.

Monday, March 25

- 1:00 AM Chicago Fed President Evans (FOMC voter) speaks; Chicago Fed President Charles Evans will deliver a speech at an investment conference in Hong Kong. Prepared text and audience and media Q&A are expected.

- 6:00 AM Philadelphia Fed President Harker (FOMC non-voter) speaks; Philadelphia Fed President Patrick Harker will discuss the economic outlook at an OMFIF City Lecture in London. Prepared text and audience Q&A are expected.

- 10:30 AM Dallas Fed manufacturing index, March (consensus +9.6, last +13.1)

- 8:30 PM Boston Fed President Rosengren (FOMC voter) speaks; Boston Fed President Eric Rosengren will give the keynote address at the annual Credit Suisse Asian Investment Conference in Hong Kong. Prepared text is expected.

Tuesday, March 26

- 3:45 AM Philadelphia Fed President Harker (FOMC non-voter) speaks; Philadelphia Fed President Patrick Harker will speak on the economic outlook at the ECB and Deutsche Bundesbank Joint Meeting in Frankfurt. Prepared text and audience Q&A are expected.

- 6:30 AM Chicago Fed President Evans (FOMC voter) speaks; Chicago Fed President Charles Evans will take part in a moderated Q&A on “U.S. Federal Reserve Policy: Influence and Impact on Hong Kong, Asia, and the Global Economy” in Hong Kong.

- 08:30 AM Housing starts, February (GS flat, consensus -0.8%, last +18.6%); Building permits, February (consensus -1.3%, last +1.4%): We estimate housing starts were flat in February following last month’s 18.6% surge. Our forecast incorporates a drag from winter weather and weaker construction job growth.

- 09:00 AM FHFA house price index, January (consensus +0.4%, last +0.3%); 09:00 AM S&P/Case-Shiller 20-city home price index, January (GS +0.3%, consensus +0.3%, last +0.2%): We estimate the S&P/Case-Shiller 20-city home price index increased 0.3% in January, following a 0.2% increase in December. Our forecast of a solid increase largely reflects the appreciation in other home prices indices such as the CoreLogic house price index in January.

- 10:00 AM Richmond Fed manufacturing index, March (consensus +12, last +16)

- 10:00 AM Conference Board consumer confidence, March (GS 133.0, consensus 132.1, last 131.4); We estimate that the Conference Board consumer confidence index increased by 1.6pt to 133.0 in March, reflecting continued increases in stock returns and other confidence measures.

- 3:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks; San Francisco Fed President Mary Daly will discuss managing inflation in the current environment at The Commonwealth Club in San Francisco.

Wednesday, March 27

- 08:30AM Trade balance, January (GS -$57.0bn, consensus -$57.5bn, last -$59.8bn); We estimate the trade deficit declined to $57.0bn in January after reaching a cycle-high in December. Outbound container traffic rose and inbound traffic declined in the month. The Census Bureau’s advance estimate for the goods trade balance was canceled for January and February.

- 10:00AM Current account balance, Q4 (consensus -$130.0bn, last -$124.8bn)

- 5:30 PM Kansas City Fed President Esther George (FOMC voter) speaks; Kansas City Fed President Esther George will speak to the Money Marketeers of New York University.

Thursday, March 28

- 7:15 AM Fed Vice Chairman for Supervision Quarles (FOMC voter) speaks; Fed Vice Chairman for Supervision Randal Quarles will give the keynote speech about the Financial Stability Board at a conference on financial intermediation co-hosted by the European Central Bank in Frankfurt. Prepared text and audience Q&A are expected.

- 08:30 AM GDP (third), Q4 (GS +2.1%, consensus +2.4%, last +2.6%); Personal consumption, Q4 (GS +2.3%, consensus +2.6%, last +2.8%): We expect a 0.5pp downward revision in the third vintage of the Q4 GDP report (previously reported at +2.6% qoq saar), with expected downward revisions to consumption, residential investment, government spending, and exports, partially offset by higher inventories.

- 08:30 AM Initial jobless claims, week ended March 23 (GS 225k, consensus 225k, last 221k); Continuing jobless claims, week ended March 16 (last 1,750k): We estimate jobless claims increased 4k to 225k in the week ended March 23. The claims reports of recent weeks suggest that the pace of layoffs remains low, though it probably remains somewhat higher than in early fall.

- 9:30 AM Fed Vice Chairman Clarida (FOMC voter) speaks: Fed Vice Chairman Richard Clarida will take part in a panel discussion on global shocks and the U.S. economy at a Bank of France conference in Paris. Prepared text and audience Q&A are expected.

- 10:00 AM Pending home sales, February (GS -0.5%, consensus -0.3%, last +4.6%): We estimate that pending home sales declined by 0.5% in February based on mixed regional home sales data, following a 4.6% increase in January. We have found pending home sales to be a useful leading indicator of existing home sales with a one- to two-month lag.

- 10:00 AM Fed Governor Bowman (FOMC voter) speaks: Fed Governor Michelle Bowman will discuss agriculture and community banking at a town hall event in Deming, New Mexico. Prepared text and a moderated Q&A are expected.

- 11:00 AM Kansas City Fed manufacturing index, March (last +1)

- 1:15 PM New York Fed Williams (FOMC voter) speaks: New Fed President John Williams will take part in a moderated discussion in Puerto Rico. Audience Q&A is expected.

- 5:20 PM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will discuss the outlook for the U.S. economy and monetary policy at the University of Wisconsin-Madison. Prepared text and audience and media Q&A are expected.

Friday, March 29

- 08:30 AM Personal income, February (GS +0.3%, consensus +0.3%, last -0.1%); Personal spending, January (GS +0.4%, consensus +0.3%, last -0.5%); PCE price index, January (GS +0.04%, consensus flat, last +0.06%); Core PCE price index, January (GS +0.18%, consensus +0.2%, last +0.15%); PCE price index (yoy), January (GS +1.46%, consensus +1.4%, last +1.75%); Core PCE price index (yoy), January (GS +1.90%, consensus +1.9%, last +1.94%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose 0.18% month-over-month in January, or 1.90% from a year ago. Additionally, we expect that the headline PCE price index increased 0.04% in January, or 1.46% from a year earlier. We expect a 0.3% increase in personal income in February, along with a 0.4% increase in January personal spending, following a rebound in January retail sales.

- 09:45 AM Chicago PMI, March (GS 59.0, consensus 61.0, last 64.7): We estimate that the Chicago PMI declined by 5.7pt in March, following an 8.0pt rebound in February. The index appears elevated relative to other manufacturing surveys, and the continued slowdown in global manufacturing may weigh on business sentiment in this report.

- 10:00 AM New home sales, February (GS -1.0%, consensus +2.1%, last -6.9%): We estimate that February new home sales edged 1% lower as mortgage loan applications declined.

- 10:00 AM University of Michigan consumer sentiment, March final (GS 97.8, consensus 97.8, last 97.8): We expect the University of Michigan consumer sentiment index to remain flat at 97.8 in the final estimate for March. The report’s measure of 5- to 10-year inflation expectations increased by two tenths to 2.5% in the preliminary report for March.

- 10:30 AM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will speak at a Global Asset Management Education conference in New York. Audience and media Q&A are expected.

- 12:05 PM Fed Vice Chairman for Supervision Quarles (FOMC voter) speaks: Fed Vice Chairman for Supervision Randal Quarles will speak on macroprudential policy to the Shadow Open Market Committee in New York. Prepared text and audience Q&A are expected.

Source: BofA, Goldman, Deutsche Bank

via ZeroHedge News https://ift.tt/2utaJZz Tyler Durden