As extensively documented on this website, 2018 was a disastrous year to forgot for most hedge funds, which suffered another year of underperformance compared to both their benchmark and the S&P500, as most once again failed to generate alpha, resulting in a compensation plunge for the “smartest traders in the room.” Alas, as the latest annual report from New York State Comptroller Thomas DiNapoli reveals, 2018 was also a dismal year for broader Wall Street compensation in particular and the securities industry in general, even as overall profits rose by double digits.

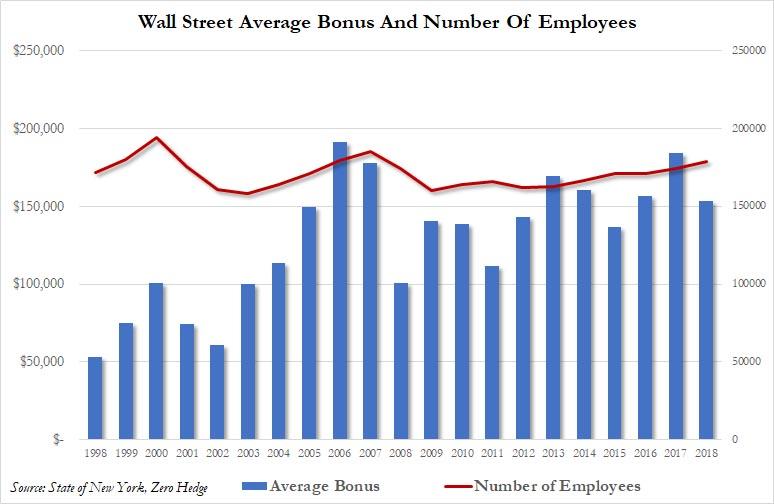

In a surprising turn of events, DiNapoli reported that despite securities industry profits in 2018 rising by 11%, the average bonus paid to industry employees in New York City declined by almost 17% to $153,700. This was not only the lowest average bonus since 2015, it matches the average bonus payment received all the way back in 2005. In other words, the average Wall Street bonus has remained unchanged for 13 years, with the peak still the $191,400 hit in 2006 with 2017 coming close at $184,400. Yet despite the lamentations of investment bankers everywhere, the $154K bonus was still double the average salary for non-financial New Yorkers.

Wall Street’s total bonus pool dropped 14% to an estimated $27.5 billion as employment in the industry increased in New York City. One big caveat: the estimate does not include stock options or other forms of deferred compensation for which taxes have not been withheld.

“Despite a sharp decline in the financial markets in the fourth quarter of 2018, the securities industry still had a good year with increased profits and employment,” DiNapoli said. “Profits grew in 2018 and have nearly doubled since 2015. Bonuses declined in 2018, but the average bonus was still double the average annual salary in the rest of the City’s workforce. It’s too soon to say how the industry will fare in 2019, but trade tensions, a slowing global economy and greater economic uncertainty are all factors that could affect results.”

Every year, DiNapoli’s office releases an estimate of bonuses paid to securities industry employees who work in New York City during the traditional bonus season. Bonuses paid by firms to their employees located outside of New York City (whether in domestic or international locations) are not included. The Comptroller’s estimate is based on personal income tax trends and includes cash bonuses for the current year and bonuses deferred from prior years that have been cashed in.

Despite increased market volatility, and the worst December for the Dow Jones Industrial Average since 1931, the industry had an 11 percent growth in pretax profits for the broker/dealer operations of New York Stock Exchange member firms (the traditional measure of securities industry profits). Profits totaled $27.3 billion in 2018 — up from $24.5 billion in 2017 — the highest level since 2010 and 81 percent higher than in 2015 after adjusting for inflation. Curiously, none of this increase trickled down to workers in the form of higher all in comp.

The report also revealed that employment in New York City’s securities industry increased by 4,700 in 2018 to 181,300 jobs, the highest level in a decade. With solid gains in four of the past five years, employment in the securities industry in the city is still 4 percent smaller than before the financial crisis in 2007. In contrast, the rest of the private sector in the city has grown by 25 percent since 2007.

Some other findings in this year’s report:

- Trading revenue was up 22 percent during the first three quarters of 2018, but was down 6 percent in the fourth quarter. For the year, trading revenue was up 17 percent and accounted for 6 percent of total revenue in 2018.

- The average salary (including bonuses) in the city’s securities industry ($422,500 in 2017, the latest annual data available) was more than five times higher than the average in the rest of the private sector ($77,100). Nearly one-quarter (24 percent) of the industry’s employees in the city earned more than $250,000, compared with less than 3 percent in the rest of the city’s workforce.

- The industry accounted for less than 5 percent of the private sector jobs in the city in 2017, but it generated more than one-fifth of all private sector wages paid in the city. DiNapoli estimates that nearly 1 in 11 jobs in the city are either directly or indirectly associated with the securities industry.

- Securities-related activities are a major source of revenue for both the state and the city. DiNapoli estimates that the securities industry accounted for 18 percent ($14 billion) of state tax collections in state fiscal year (SFY) 2017-18 and 7 percent ($4.2 billion) of city tax collections in city fiscal year (CFY) 2018.

And with banks already warning of sharp drops in trading revenue in 2019, the bad news on pay will continue this year. Compensation including bonuses and salaries for 2019 is likely to fall as pressure to lower fees and volatile markets weigh on firms’ revenue, Johnson Associates said last month.

Read the full New York state report here.

via ZeroHedge News https://ift.tt/2HUVJf0 Tyler Durden