The US stock market has soared back from its December ‘Mnuchin Massacre’ lows, floating higher, blissfully ignoring the collapse in earnings expectations and macro-economic data.

The enabler of that blissful ignorance is simple – same as it has been for a decade – an ever-increasing hope that The Fed stands ready to do ‘whatever it takes’ to maintain the wealth (and inequality) driver of the new normal and the only policy prescription there is – the US stock market.

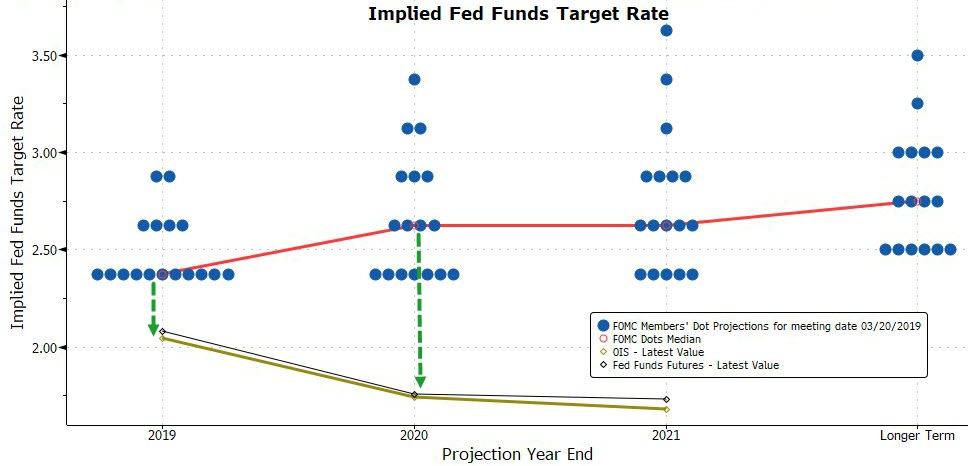

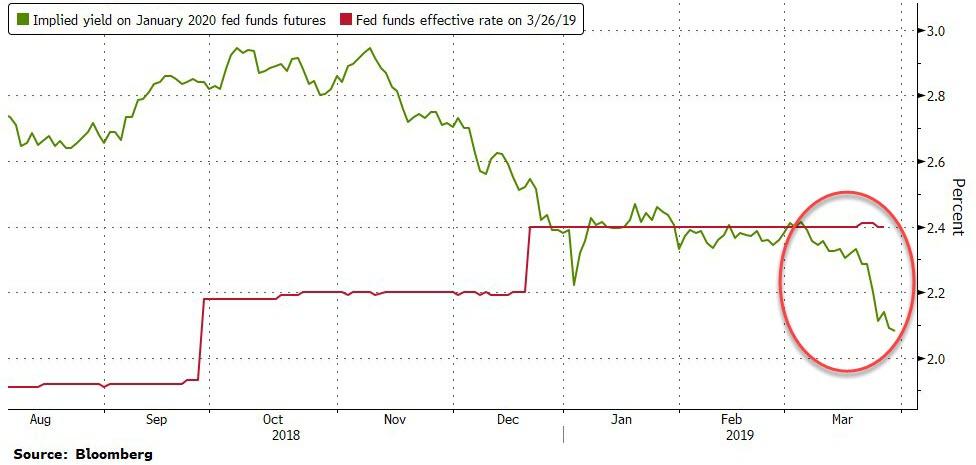

However, the market has seemingly got a little over its skis in recent weeks as it has priced in over 40bps of rate-cuts in 2019 – while The Fed just told the market to expect no rate-changes in 2019.

In fact, the market is now pricing in The Fed as being more dovish than The ECB in 2019…

And now, the divergence between the market and The Fed has got so wide that one trader has placed a huge bet that the market is wrong.

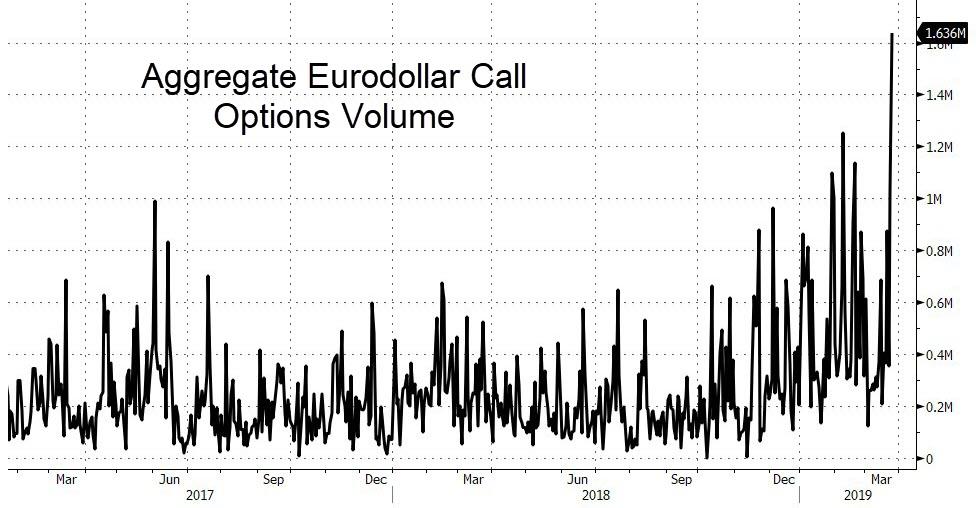

As Bloomberg reports, there is a new eurodollar whale in town. About $30 million has been plowed into an options bet that the market has gone too far in pricing in Federal Reserve cuts this year.

The eurodollar put condor across four December 2019 strikes continued to dominate options activity today following heavy-buying on Tuesday (175k to 200k EDZ9 97.50/97.375/97.25/97.125 put condor bought at 4 ticks according to U.S. based traders).

Eurodollar options volume this week has been dramatic and as Bloomberg notes, the ‘eurodollar whale’ position accounted for over half an average trading day’s options volume on its own.

Binky Chadha, a strategist at Deutsche Bank AG, has indicated that the move in yields and rate-cut bets may have its limits.

“In the absence of very negative data or worsening of any of the long list of well known risks, the market is unlikely to take a strong view on further rate cuts,” which argues for a potential rebound in 10-year Treasury yields, he wrote in a note.

The options mature on the Monday following the final (December 11th) FOMC meeting of the year, therefore also capturing any potential year-end funding issues.

Should the bet prove right, it would also likely have negative implications for a stock market drunk of Powell-Put kool-aid, and if today’s 5-year note auction (not well received) is anything to go by, perhaps – as usual – the market has run too far too fast in favor of the Powell-pivot (unless of course, things are so bad economically that The Fed is forced to move so aggressively).

via ZeroHedge News https://ift.tt/2CCajUX Tyler Durden