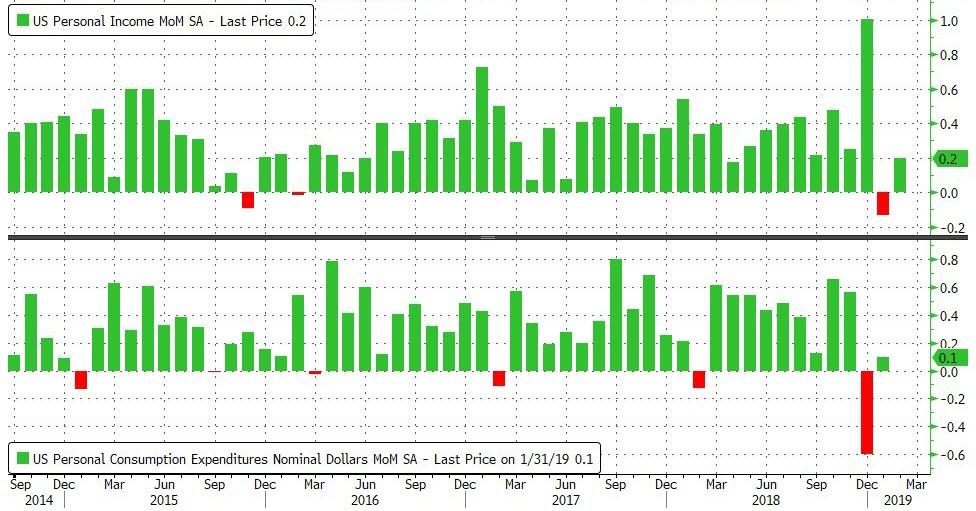

Following the tumble in income (Jan) and spending (Dec) in the last reported month, expectations were for a modest rebound of 0.3% MoM for each, but both underwhelmed.

-

US consumer spending rose just 0.1% MoM in January (well below the +0.3% gain, but still a rebound from the 0.6% MoM drop in Dec)

-

US personal income rose 0.2% MoM in February (missing the 0.3% MoM expectation).

The spending figures, which reflected weaker sales of new autos, signals first-quarter growth faces additional headwinds, though surveys show consumers remain generally upbeat despite projections for slower expansion.

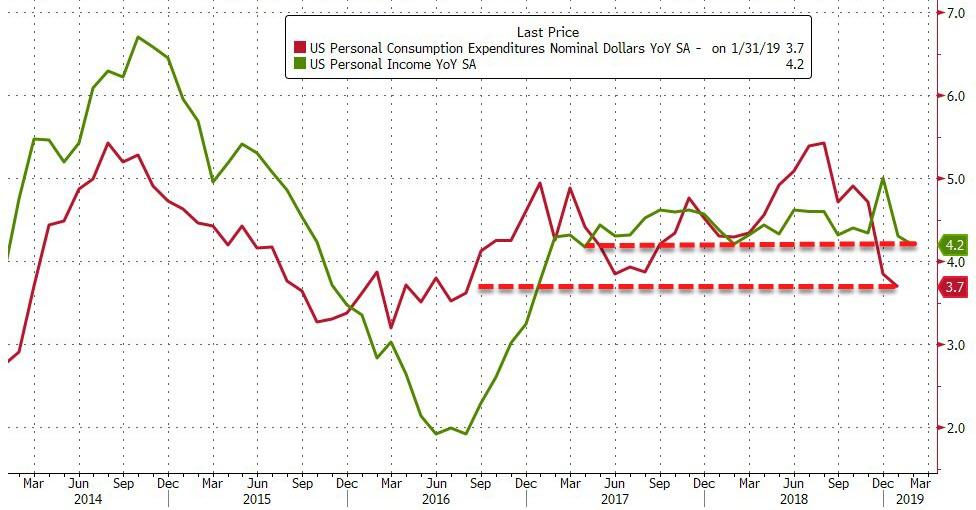

Both income and spending growth year-over-year fell to notable lows…

The spending data add to signs of weakness just ahead of the February retail sales report Monday.

Adjusted for inflation, January spending on goods dropped 0.2% on a monthly basis while purchases of services increased, driven by financial services and insurance.

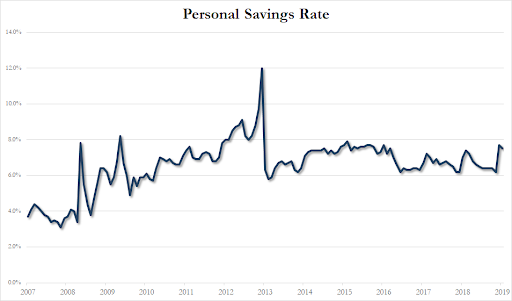

The most recent month saw a small drop in savings rate from the surging 7.7% in December to 7.5%…

At the same time as spending fell short of projections, inflation also eased, sending an early warning on the economy in the first quarter that may add to concerns about the outlook.

The Fed’s preferred price gauge – tied to consumption – fell 0.1% in January from the previous month and was up 1.4% from a year earlier, matching the annual projection with the slowest reading since late 2016.

Excluding food and energy, so-called core prices rose 0.1%, less than estimated. The index was up 1.8% from January 2018, also below forecasts, after an upwardly revised 2% gain.

All in all, call it some economic justification of the Fed’s patient stance (though that 1.4% headline inflation is of course driven by oil prices.) Chairman Jerome Powell said this month rates could be on hold for “some time” as inflation remains muted and global risks cloud the outlook.

Is this more goldilocks?

via ZeroHedge News https://ift.tt/2HZV63S Tyler Durden