China’s manufacturing PMI surged overnight back above 50, “proving” that all that stimulus hype has finally fixed the Chinese economy – sparking stock and commodity buying worldwide as a reflation-fest sent bond yields reeling higher.

There’s just one thing… we’ve seen these PMI ‘green shoots’ a few times before in the last decade…

But never mind that – US stocks soared (despite a big disappointment in US retail sales) mean ‘everything is awesome’ again…

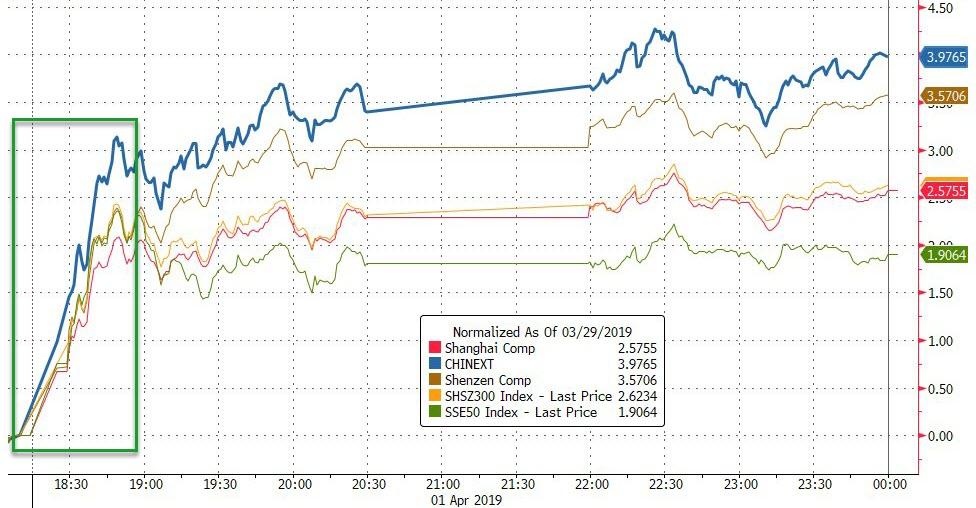

Chinese stocks surged on the ‘green shoot’ – with ChiNext up 4%!!

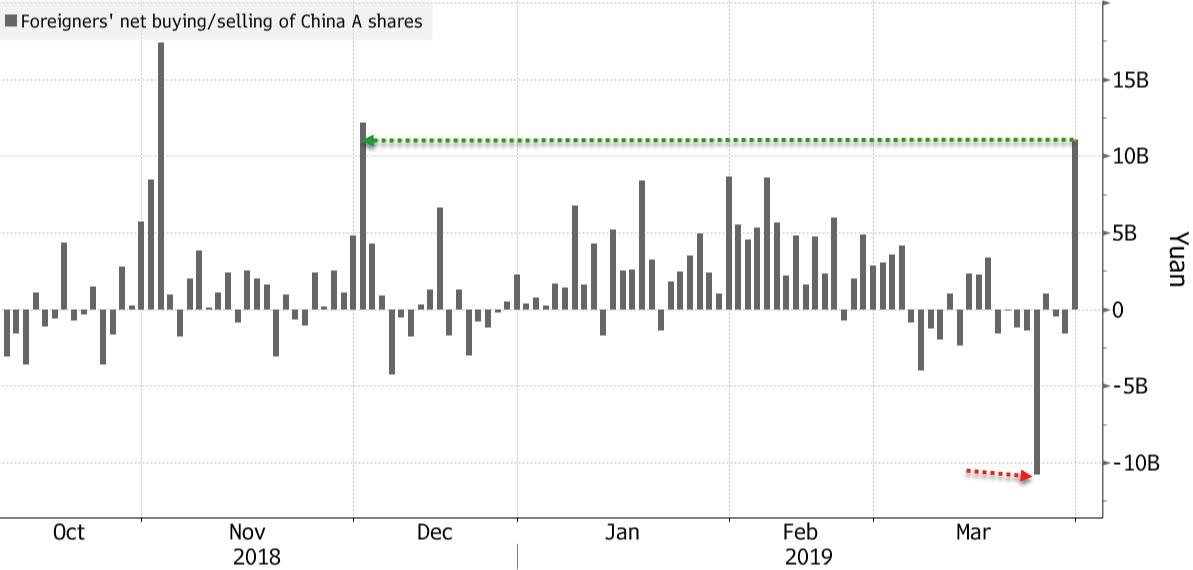

As a reminder – foreign investors bought the most China stocks since December on Friday…

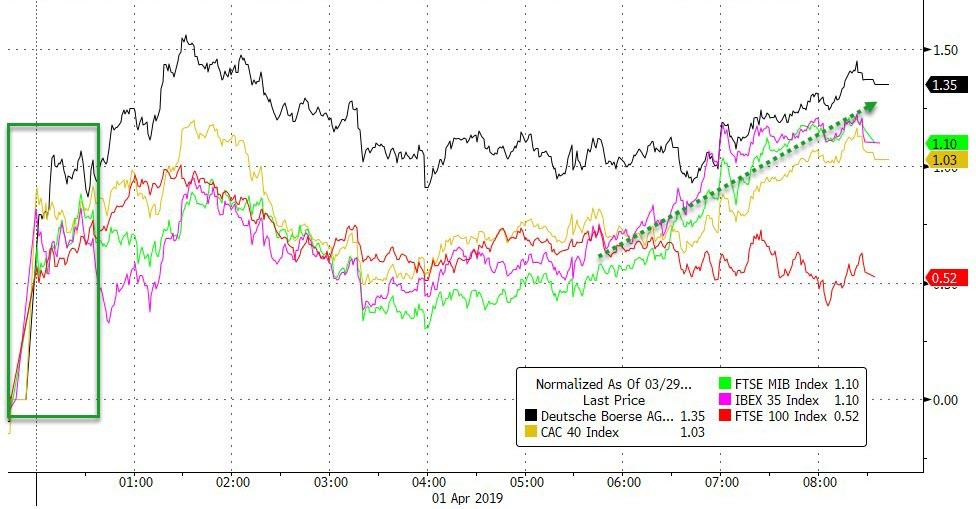

Despite a wall of disappointing PMIs across Europe, European stocks were panic bid at the open thanks to China optimism (UK’s FTSE lagged)

US equity futures show the opening panic bid drifted through the EU session then the algos stepped into lift it across the US day session…

Trannies were the day’s big winner – up a shocking 2.5%…

Busting above the 200DMA… (5th up day in a row)

The S&P took out the pre-Fed highs back to the Oct 10th plunge levels…

Remember The Dow has not fallen in April since 2005, and April seasonality for US Equities is a powerful phenomenon: April has posted the best avg monthly return for the S&P over the past 30 years (+1.64%) and actually posts the second-highest % hit-rate of “positive return instances” of any month over the past 90 years

There’s just one thing – VIX wasn’t playing along at all!!

So much for 20x oversubscribed! LYFT crashed back below its IP Price…

Grocers got hit on AMZN headlines…

US Treasury yields exploded higher today as the US Manufacturing ISM beat (after an initial kneejerk on the China data)…

Today was the biggest 10Y yield spike since Jan 4th’s big rebound from the Dec lows…

NOTE – the pattern of yields pikes at the start of each month.

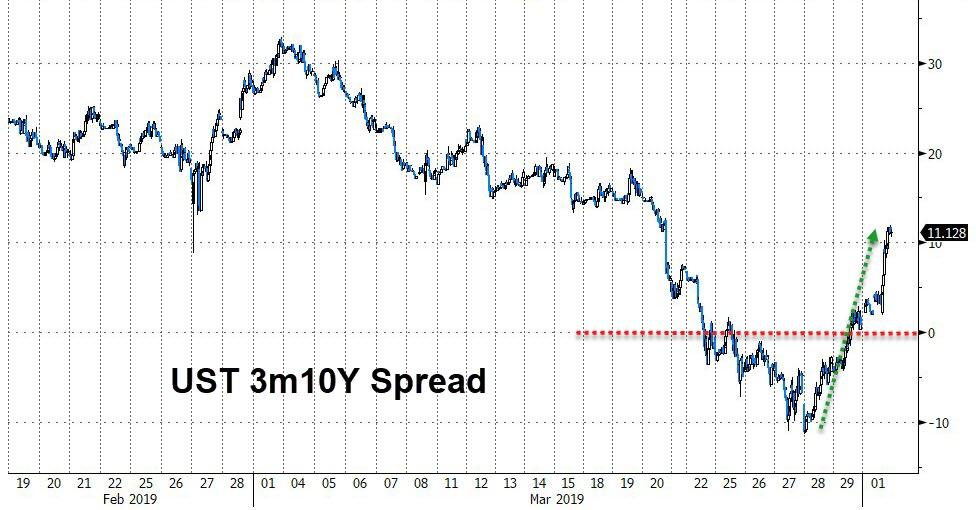

The 3m10Y curve has surged back from inversion…

The market’s expectations of Fed dovishness have hawkishly surged in the last three days…

The dollar ended the day unchanged, finding support overnight at around 97.00 figure once again…

Cryptos were mixed with Bitcoin back above $4100 but Bitcoin Cash and Litecoin lower…

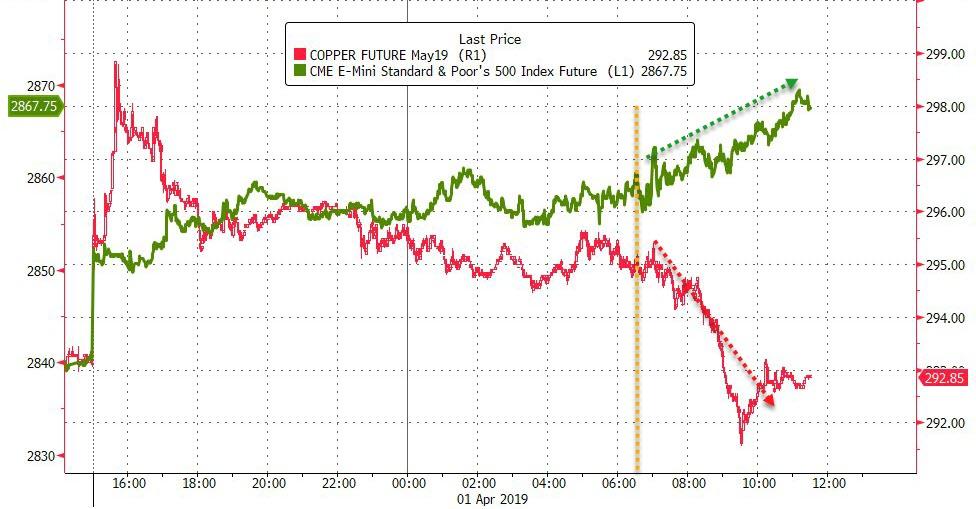

Copper and Crude jumped as China’s data hit but copper did not follow through at all…

WTI Crude kneejerked on Saudi production and then the liftathon algos took over…

Gold futures managed to scramble back above $1300 early on but then someone decided to puke over a billion notional paper gold into the market…

But if China is so awesome for the global economy, why didn’t copper rally?

And if oil is such a great signal of global growth, why aren’t inflation expectations following through?

Finally, we note that the last 24 hours have seen Aussie PMI plunged, Japan’s Tankan disappointed, South Korean exports disappointed (-8.2% YoY), German manufacturing massacre, French PMI miss, Italian new car registrations collapsed, EU inflation weak, US retail sales unexpectedly tumbled… but fuck yeah – we will focus on China’s PMI!

via ZeroHedge News https://ift.tt/2I6yY7F Tyler Durden