Terrible German factory orders data added to the list of dismal global economic data of the last few months – but headlines from The FT that a trade-deal is nearing its “endgame” over-ruled all fun-durr-mentals on the day.

Probably nothing…

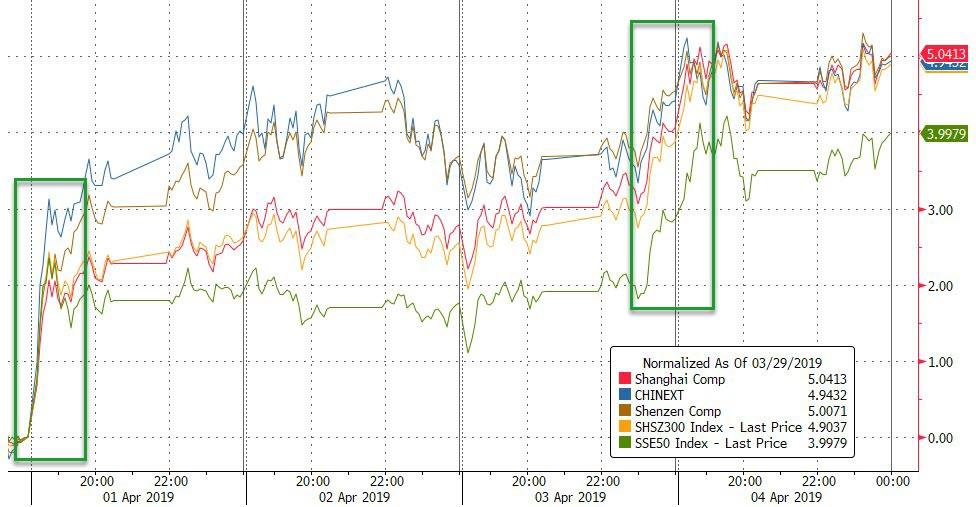

China had excited open thanks to the trade headlines…

Guess which market suffered the biggest crash in factory orders in a decade? Yep, DAX soared on no good, very bad, really terrible macro data…

US markets were mixed with The Dow higher (thanks to Boeing) and Nasdaq weaker. S&P up 6 days in a row…

Boeing bounced over 3% today (accounting for half of the Dow’s gains), despite being blamed for the Ethiopian Airlines crash, thanks to the trade hope overnight

Here’s how Bloomberg sees this farce:

“Hopes that the drawn-out China trade negotiations are entering the home stretch are helping Boeing Co. shares shrug off the latest developments emanating from the Ethiopia crash that, while concerning, may only serve to provide incremental new information.”

…even as…

“Grounding of the 737 Max will slow deliveries, prompting inventories to rise, and may curb $3.2 billion in free cash flow this year. Lawsuits and reimbursements, which could add up to $1.9 billion for a hypothetical six-month delivery pause, could become potential calls on Boeing’s $8.6 billion of cash.” — Matthew Geudtner, BI Credit Analyst

VIX and stocks remain decoupled…

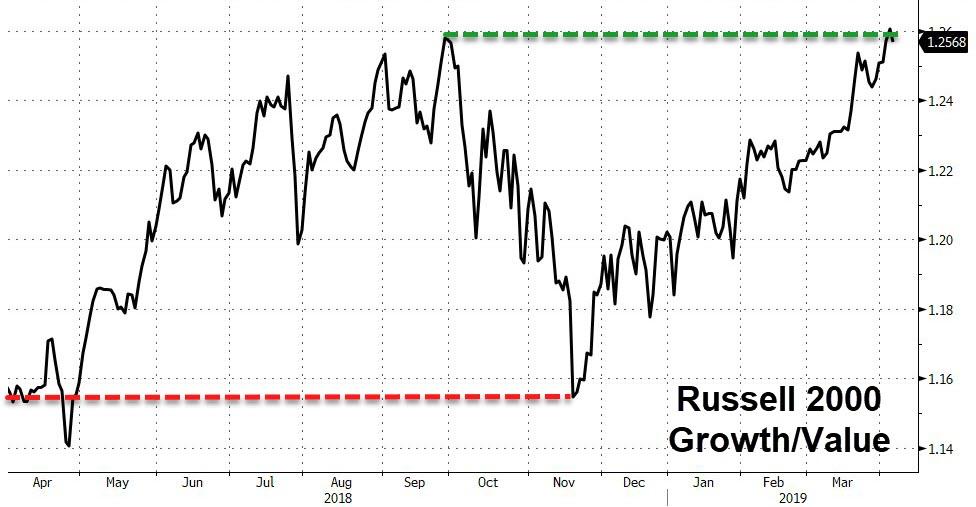

And before we leave equity-land, we note that Growth stocks have reversed all their losses relative to Value…what happens next?

Treasury yields slipped modestly lower on the day with the long-end outperforming

But 10Y remains just above 2.50% in a narrow range today

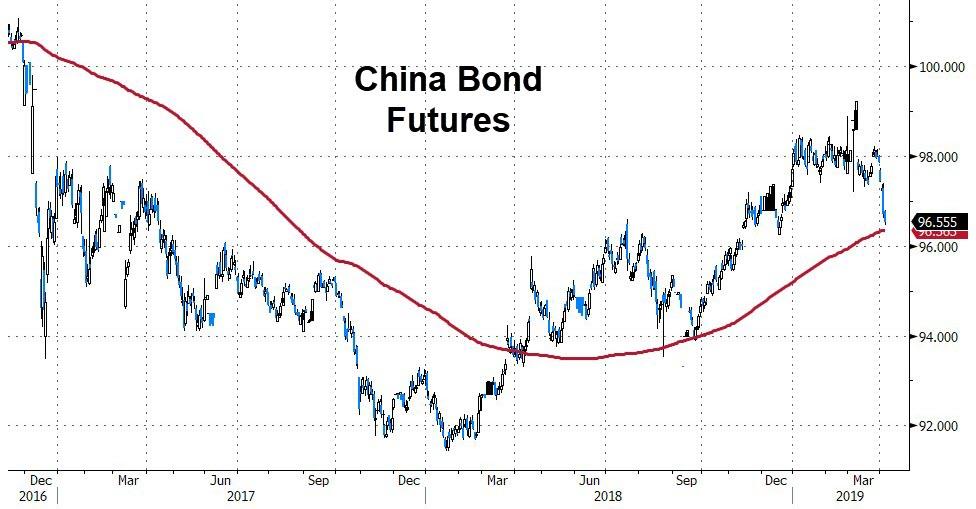

Chinese bond futures (prices) tumbled as the equity market gained – dropping to a key technical level…

The Dollar index rebounded after yesterday’s weakness…

Cable rolled over on no real headlines aside from nothing positive today…

Cryptos crumbled today led by a 20% decline in Bitcoin Cash (but remain well up on the week)…

Bitcoin is back below $5000, tumbling almost 10% today…

Some serious swings in commodity land today as PMs ended higher but WTI lower (for once)…

Another panic-puke in gold (and silver) today, but both dips were bought…

WTI found support at $62 again…

We’ll give the last word to Gluskin Sheff’s David Rosenberg, who once again points out the hyporcrisy of the cognitively dissonant…

You have to admit, it’s pretty funny that when the yield curve hit its maximum steepness back in 2010, signaling a long runway for the economic cycle, nobody seemed to have too much trouble with it as a leading indicator. It’s only an irrelevant indicator when it flattens. pic.twitter.com/WKP1p5YIQo

— David Rosenberg (@EconguyRosie) April 4, 2019

via ZeroHedge News https://ift.tt/2OPGTaR Tyler Durden