Tesla thought it was getting one over on the world last night when it waited until the close of extended hours trading before releasing its awful Q1 delivery numbers. But last night’s timing didn’t the stop reality from taking hold this morning, when Tesla stock crashed $26, down a little over 9% with further downside expected as exasperated mutual funds start dumping at the open.

Feeding the dismal mood, even formerly bullish analysts have come out swinging at Tesla this morning, throwing up all over its disastrous delivery numbers with RBC’s Joseph Spak saying that the delivery miss could wind up turning into a $1 billion revenue miss. Spak was previously looking for 52,500 Model 3 deliveries, down from his previous estimate of 57,000. He said in a note Thursday morning:

“To us, this signals that the tax subsidy cut in the US was a significant hit to these premium vehicles and/or Model 3 is having a bigger cannibalization impact,” he says. Tesla’s comment about challenges of delivering to Europe, China “speaks to a lack of planning and foresight,” Spak said.

Spak also expects a “sizeable cash burn” in Q1. JPMorgan analyst Ryan Brinkman also blasted the company in a morning note: “Tesla’s 1Q19 vehicle production & deliveries report was substantially worse than expected.” JPM lowered their price target to $200 from $215:

“Tesla‘s 1Q19 vehicle production & deliveries report was substantially worse than expected…Deliveries tracked just 63,000 units vs. JPM 70,500 and consensus as recently as March 27 of 74,930, suggesting materially less 1Q revenue, margin, and free cash flow… We believe the market postulated that if Tesla were to miss, it would be due solely to a materially greater than expected number of vehicles in transit (vehicles that could be sold in early 2Q, suggesting little need to lower full year estimates), but this appears to be only partly the case, with vehicles in transit at quarter-end totaling 10,600 vs. our estimate of 10,000, in our view implying lower underlying domestic demand…While most attention is being paid to the Model 3 ramp, deliveries of the higher price Model S & X declined substantially in 1Q, totally just 12,100 between them — less even than the Model S alone used to sell in some quarters preceding the full production ramp of the Model X, again in our view implying a deceleration in underlying demand unrelated to temporary delivery difficulties (maybe due to tax credit expiration?).”

Morgan Stanley poured some more gasoline on the fire, calling the quarter “one that Tesla might want to forget“:

“1Q19 is shaping up to be one TSLA may want to forget, but needs to explain to shareholders who own it as a LT disruptor. We felt the #1 2019 determinant for TSLA’s share price was if it could prove to the mkt. it can be self-funding on a sustainable basis.”

Bank of America says it sees “slower than anticipated progress” on the Model 3 production ramp and that it “continues to question” the company’s profitability, cash flow and valuation:

“Ultimately, given what appears to be slower than anticipated progress on the Model 3 production ramp, TSLA’s past production/ logistics challenges on the Model S/X, and now potentially new challenges with deliveries to Europe and China, we expect it will take some time before the Model 3 production/sales reaches mass scale; and thus, costs related to the ramp and lower priced variants may outweigh potential benefits of operating leverage for some time. .. .Moreover, there still remain a number of major hurdles ahead for TSLA, including: 1) ongoing Model 3 production ramp and future operational challenges associated with expanding the product lineup; 2) what could be a very material cash burn in coming quarters (from ongoing delivery/logistic issues, Shanghai factory construction, etc.) which could pressure TSLA’s liquidity even with recent capital inflows and require future capital raises; 3) faster than usual spike and burnout pattern for Model S/X; and 4) the prospect of new competition and longer term obsolescence. As such, we continue to question TSLA’s longer term profitability, cash flow, and valuation.”

The bears were rampaging, with Citi obviously maintaining its “sell/high risk” rating on Tesla shares:

“Though Tesla bulls might look past the Q1 Model 3 miss, the S/X numbers will likely spark some legitimate demand & company margin concerns, particularly given the risk for some incremental cannibalization from the recently introduced Model Y. We expect the stock to come under pressure on this and perhaps test recent lows—maintain Sell/High Risk.

…

At the very least, Q1 deliveries will likely cause the bull camp to revisit assumptions about the NT demand trajectory. Tesla confirmed its 2019 delivery targets, which of course now look quite aggressive requiring ~100k deliveries on average in each remaining quarter. So demand will likely be scrutinized even more so, and the outcome in the coming months could meaningfully re-shape the entire Tesla bulls/bear debate.”

Goldman Sachs also reiterated their “sell” rating on the company Thursday morning, saying that demand was likely negatively impacted by the phasing out of the Federal EV tax credit in the U.S. Goldman’s note also said that “production levels disappointed” and that “average production was ~4,800, which was marginally higher than the 4,700 in 4Q18 and below Goldman estimates of 5,500/week for 1Q19”.

“These disappointing results will likely lead to pressure on the shares and consensus estimates for the full year, and could potentially fuel investors’ concerns about falling demand,” Goldman’s note continues.

“Further, this likely puts downward pressure on our EBITDA and FCF estimates (as well as consensus) given the lower volume levels and worse utilization than anticipated.”

Back in April 2018 we asked the question of whether or not Elon Musk would be the next CEO faced with a margin call. In that analysis, it was calculated that Musk’s margin call could kick in around $232, or just $30 away (other analyses have arrived at differed “trigger” targets, with some as low as the mid $100’s).

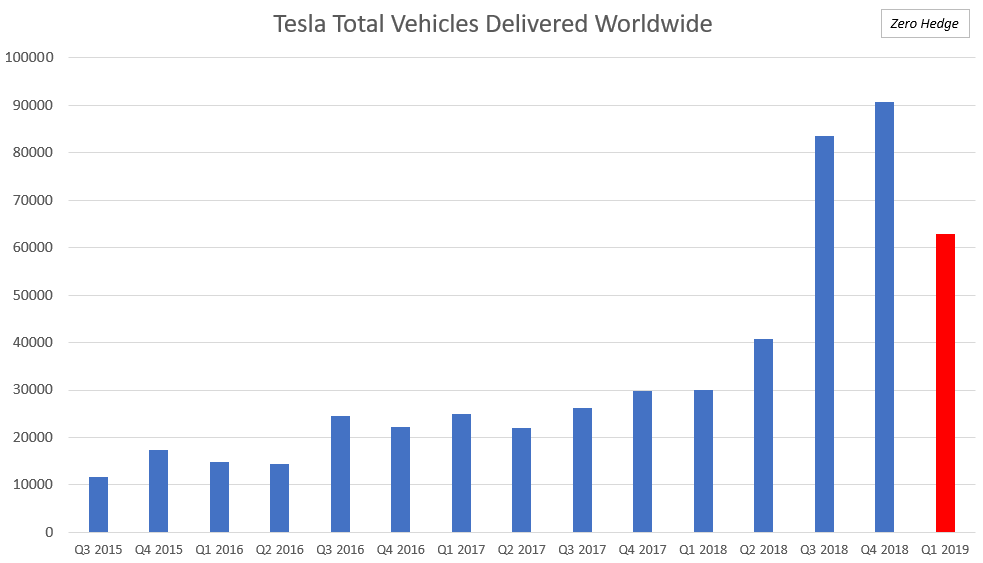

As a reminder, last night we reported that the company’s Q1 delivery and production numbers missed even the most pessimistic of estimates. Total deliveries came in at just 63,000 vehicles and Model 3 deliveries came in at a paltry 50,900. To add insult to injury, the company said it expects the poor delivery number to negatively impact its Q1 net income:

Because of the lower than expected delivery volumes and several pricing adjustments, we expect Q1 net income to be negatively impacted.

The Q1 Model 3 number missed consensus estimates of 55,100 by nearly 10% and also fell well short of the 63,000 Model 3s that the company produced last quarter. The number also fell short of analysts’ estimates of 58,900, according to IBES data from Refinitiv. Deliveries of all models fell 31 percent from the fourth quarter to 63,000 vehicles, including 12,100 Model S sedans and Model X SUVs.

via ZeroHedge News https://ift.tt/2CZE3LY Tyler Durden