Ever since tumbling into a bear market in Q4 2018, the Nasdaq has exploded higher – led by the FAANG names – and surging more than 30% since Christmas, trading just shy of all time highs and nobody on Wall Street can explain why…

… because as Bloomberg put it, aside from the stock price itself, “everywhere else you look in the industry, bad news is overwhelming the good.”

As we further discussed last night, here are some of the reasons why Wall Street is puzzled: even as tech stocks soar, with the Nasdaq up 5 of the last 6 trading sessions (and set to make it 6 of 7 today) tech profits are shrinking “at an alarming pace”, valuations are reflating and politicians want to break the companies up. Worse, last week Samsung previewed a dismal quarter for semiconductor orders which have collapsed, while spending on infrastructure to support the all-important “cloud” is sliding. And yet, as Bloomberg framed it, the addiction to tech just won’t break.

And so, one explanation for this historic divergence between deteriorating fundamentals and soaring stock prices, is that as the economy sank and central banks turned more dovish, investors – the Pavlovian dogs of central planners everywhere for the past decade – rushed into growth names, eager to ride the rebound once the economic rout stabilizes (that this optimism may be unwarranted is what Morgan Stanley warned about earlier, warning that the earnings contraction set to emerge with this quarter’s earnings will once get worse and become a full blown earnings, if not economic, recession).

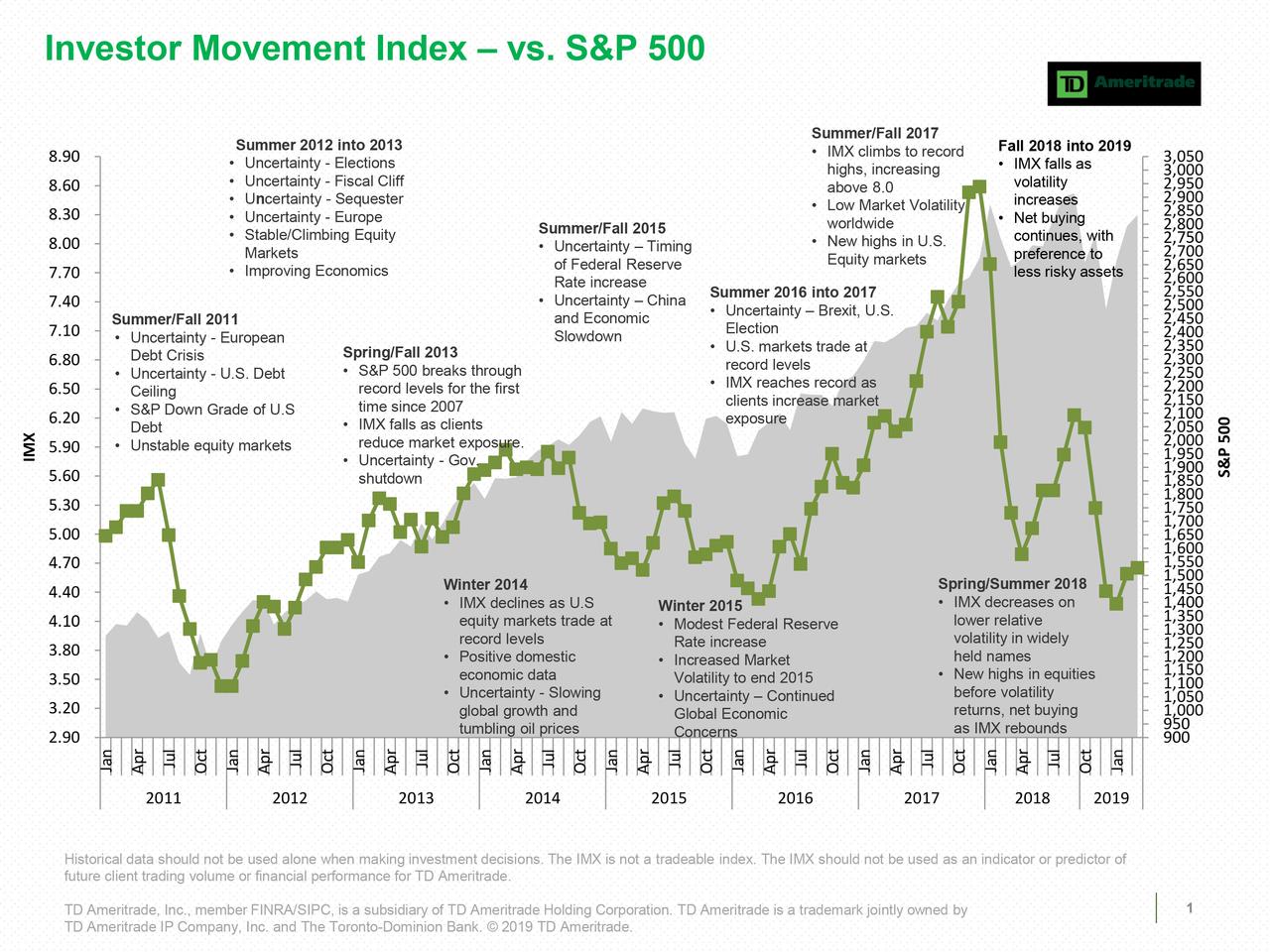

However, the mystery only grew deeper today, when according to TD Ameritrade’s Investor Movement Index, after a three-month rally that added approximately $800 billion to the market cap of FAANG stocks since Christmas Day, retail investors joined their institutional peers, and decided it’s time to cash out of these ultra high-flying names.

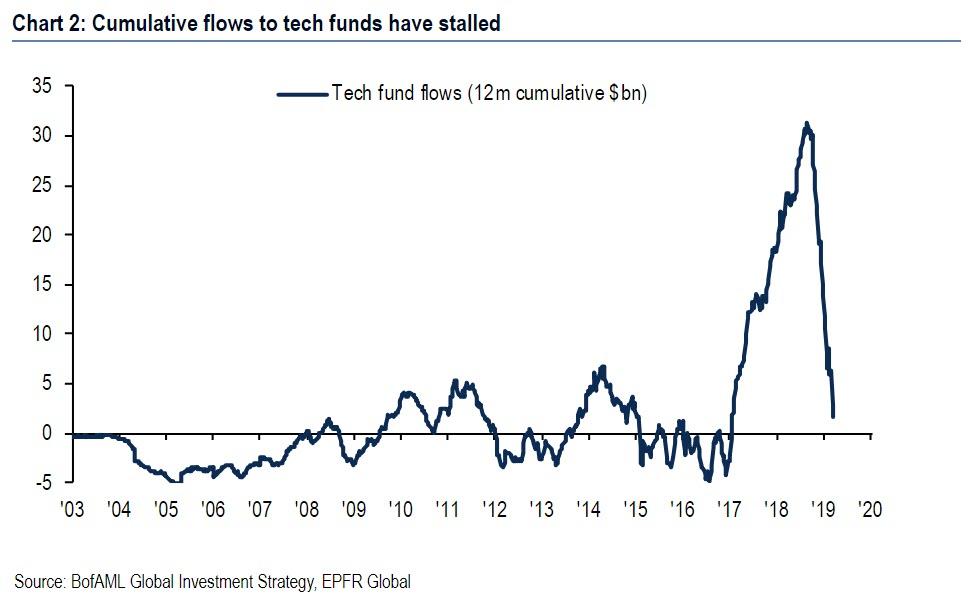

This is perplexing because as Bank of America showed two weeks ago, retail investors (and buybacks, of course) were long seen as the buyer of last resort, while institutional investors, hedge funds, high net worth clients and funds in general were dumping tech stocks en masse.

Well, now we can eliminate retail investors from the group of potential buyers too, because as clients at discount brokerage TD Ameritrade modestly increased their overall exposure to equity markets for a second consecutive month in March, they sold shares of Amazon, Facebook, Netflix and Apple. These four core FAANG members have gained at least 35% since stocks bottomed on Christmas Eve, one-and-a-half times the S&P 500’s return, even as it increasingly appears that investors were aggressively selling their shares…

… suggesting that the only marginal buyer were… the companies themselves (it is hardly surprising then that over the weekend Goldman warned that should stock buybacks be banned, the market could crash).

Speaking to Bloomberg, JJ” Kinahan, chief market strategist at TD Ameritrade, said that “taking profits isn’t the worst idea in the world,” noting clients had been buyers of Amazon for eight straight months. “What it makes me wonder is, they were the momentum stocks, so where do we get our new momentum?” Actually, before we answer that, a better question is if retail investors were – like everyone else – dumping tech names, who was buying (beside buybacks of course).

Aside from the dump in FAANGs, the IMX reading for the five-week period ending March 29, 2019 showed investors were once again increasing their risk exposure, but ranks “Moderately Low” relative to the historic level of exposure investors took to the market.

“Major decisions surrounding key political concerns like Brexit and the China trade deal are on hold for the time being and remain overriding factors,” said JJ Kinahan, chief market strategist at TD Ameritrade. “In the short term, we’ve seen hope of a positive resolution on trade issues and that helped the overall markets go higher in March.”

And while retail investors may have enough of tech for a while, they appear to have zeroed in on the next mini bubble: cannabis companies, as many TDA clients were buyers of Aurora Cannabis and CVS Health, which recently announced that it will begin selling CBD-infused products at more than 800 of its stores. Millennial clients also scooped up shares of Canopy Growth Corp., according to a statement from TD Ameritrade. Finally, while dumping FAANGs, retail investors were also large buyers of Tesla (oops), NIO (oops), and AT&T.

via ZeroHedge News http://bit.ly/2D2R3jG Tyler Durden