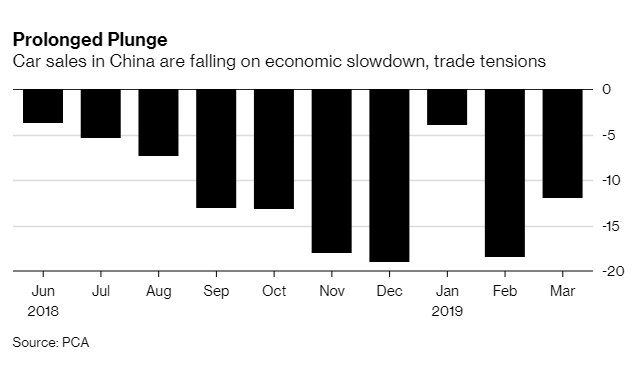

Car sales in China, the world’s largest vehicle market, continue to tumble, exposing an increasingly ugly picture for the global automotive market. The data marks a dismal and protracted reversal in a market that had done nothing but grow for decades, according to Bloomberg. In March, retail sales of sedans, SUVs, minivans and multipurpose vehicles dropped 12% to 1.78 million units, according to the China Passenger Car Association. This is after an 18.5% drop in February and a 4% drop in January.

The country’s slowing economy and continued trade tensions with the United States are weighing on consumer sentiment among its 1.4 billion people. Additionally, changes in tax policies and import tariffs have also acted as a headwind for car demand. Cars were the only consumer product category in China that shrank the first two months of 2019.

Cui Dongshu, secretary general of the CPCA, is among those calling for more government intervention to spur buying: “There are only 200 million private vehicles in China, leaving huge room for growth. Policies should be put in place to spur vehicle consumption in 2019.” Because as we all know, the government manipulating the market to create demand where there isn’t any could never backfire, right?

Even better, despite the horrifying data, Cui still thinks that car sales “may recover in April”, helped by the country’s planned tax reductions. He stopped short of predicting sales gains, but PCA raised its forecast for 2019 sales of new energy vehicles – battery, hybrid and fuel cell cars – to 1.7 million from 1.6 million.

With China out of the picture, global automakers like Toyota and Ford are left with few places to go for growth in sales. Markets in Europe and North America continue to slow alongside of China as the availability of car sharing services makes buying less necessary. Japan is also slowing down, while gains in smaller markets are unable to offset growth in larger markets.

Chen Hong, chairman of SAIC Motor, China’s biggest automaker, said: “2019 will bring severe challenges.” Trying to rally his employees in an internal worker memo, he called for his company to “accelerate innovation and strive toward higher quality”. SAIC’s sales fell 17% in the first two months of 2019.

Ford reported a 54% sales plunge in China last year and said last week that it’s introducing more than 30 vehicles targeted specifically for Chinese consumers over the next three years to help it hone its focus on the market

via ZeroHedge News http://bit.ly/2G6Lvp3 Tyler Durden