One day after the equity rally sputtered following Trump’s threat to impose new tariffs against the EU, global stocks are once again green across the board even as a barrage of critical economic, political and central bank events – including the ECB’s rate decision, the FOMC minutes, the Brexit-related EU Council meeting and US CPI data – is on deck and earnings season is set to begin in two days. Stocks in Europe rose, Asia was mixed, while US equity futures jumped to session highs, while Treasuries were mixed and the dollar dipped.

Europe’s Stoxx 600 index rose for the first time in three days, led by miners and oil companies, while Emini futs edged 8 points higher and just 10 points away from 2,900 as investors ignored the Trump administration’s threat of new tariffs on European goods and the IMF’s worst growth forecasts since the financial crisis. Network International shares surged in London after the payments processor raised 1.1 billion pounds ($1.4 billion) in Europe’s biggest IPO this year.

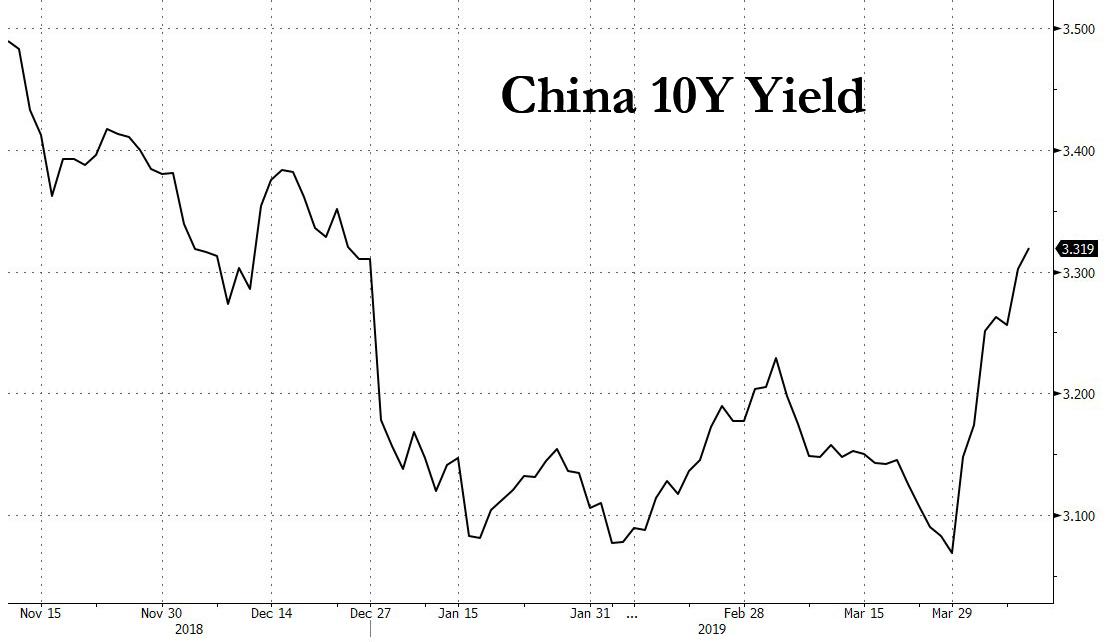

Earlier in the session, MSCI’s index of Asia-Pacific shares ex-Japan dropped 0.1%, a day after rising to its highest since Aug. 1, as shares fell in Japan and Hong Hong Kong earlier, while Chinese and Korean equities rose. Ten-year Treasury yields were stuck at 2.5%, but its yields in China that grabbed attention again, as China’s 10-year sovereign bond yield rose 3bps to 3.33%, the highest level since Dec. 24.

Sentiment rebounded from a Tuesday hit, when the IMF’s somber report on global growth highlighted fears about the outlook for the world economy that have simmered for months, while the U.S. appeared to open another front in its trade dispute with the European Union, and negotiations with China remain unsettled. Federal Reserve minutes, American inflation data and the ECB rates decision Wednesday could add to anxieties or help provide calm, with investors also focusing on the first-quarter earnings season getting under way this week.

With the rally fizziling, analyst commentary turned more soure:

- “Before we preview those, risk assets have been threatening to take their foot off the pedal in recent sessions and yesterday we finally saw that with a delayed reaction to the US/EU tariff headlines from yesterday’s Asian session seemingly doing much of the damage” said Deutsche Bank’s chief market strategist Jim Reid.

- “It’s quite a tricky environment because clearly the economy isn’t in great shape,” Patrik Schowitz, global multi-asset strategist at JPMorgan Asset Management, told Bloomberg TV in Hong Kong. “Central banks going into easing mode, the Fed pivot — that would not be happening if the economy was firing on all cylinders. At the same time, recession risks are overdone.”

Much of today’s attention will be on the ECB which is “going to come out with some more details on the TLTRO,” said Francois Savary, chief investment officer at Prime Partners. “The global picture has been set, now we are waiting for the details about what they do and if they are going to speak maybe about the adjustment of the negative interest rate policy on reserves.”

Israeli stocks and the shekel climbed as Benjamin Netanyahu looks set for a fifth term as prime minister. Turkey’s lira fluctuated as the government announced plans to bolster banks, while emerging-market stocks climbed for a 10th day, extending their longest run since January 2018.

Elsewhere, global debt yields held mostly steady, with the 10-year German Bund yield little changed around the zero percent mark. As a reminder, overnight Saudi Aramco sold $12 billion in debt with its first international bond issue after getting more than $100 billion in orders. It was a record-breaking vote of confidence by investors despite the murder of Saudi journalist Jamal Khashoggi in October.

Ahead of the ECB and US CPI print, major currencies are little changed before a European Union summit and the ECB meeting. The euro edged higher and the pound gained as the EU looks to delay Brexit by as long as a year. The Bloomberg Dollar Spot Index erased its Asia-session advance as the market awaits U.S. inflation data and minutes of the Federal Reserve’s latest review. Norway’s krone reached its strongest level in five months against the euro after the nation’s inflation rate rose at the fastest pace since 2016, boosting the case for interest-rate increases. Australia’s dollar rose against all its Group-of-10 peers except the krone after Deputy Governor Guy Debelle suggested the central bank is in no rush to cut rates despite slowing global growth.

Elsewhere, EU leaders are likely to grant British PM Theresa May a second delay to Brexit, but they could demand a much longer extension as France pushed for conditions to limit Britain’s participation in EU affairs. The British pound rose to session highs, inching close to $1.31 again. The dollar was flat at 111.19 yen, having fallen 0.5 percent so far this week.

In commodities, oil prices remained near Tuesday’s five-month highs as fighting in Libya raised supply disruption concerns. U.S. crude futures stood at $64.32 per barrel, up 0.3 percent after rallying to a five-month high of $64.79 on Tuesday. Brent crude futures were at $70.81 per barrel and in reach of Tuesday’s five-month peak of $71.34.

Expected data include mortgage applications, inflation and Fed minutes. Delta Air Lines and Bed Bath & Beyond are among companies reporting earnings

Market Snapshot

- S&P 500 futures up 0.3% to 2,890.50

- STOXX Europe 600 up 0.2% to 386.51

- MXAP down 0.2% to 163.14

- MXAPJ up 0.1% to 544.21

- Nikkei down 0.5% to 21,687.57

- Topix down 0.7% to 1,607.66

- Hang Seng Index down 0.1% to 30,119.56

- Shanghai Composite up 0.07% to 3,241.93

- Sensex down 0.5% to 38,737.95

- Australia S&P/ASX 200 up 0.03% to

- German 10Y yield rose 0.4 bps to -0.006%

- Euro up 0.04% to $1.1268

- Italian 10Y yield fell 6.0 bps to 2.072%

- Spanish 10Y yield fell 0.9 bps to 1.066%

- Brent futures up 0.4% to $70.91/bbl

- Gold spot little changed at $1,304.50

- U.S. Dollar Index little changed at 96.98

Top Overnight News from Bloomberg

- EU leaders will finalize the length of the Brexit delay at a summit on Wednesday. European Council President Donald Tusk wants them to agree to an extension of up to a year, and diplomats from member states say the debate now is between December and next March for the new departure date.

- ECB policy makers have a lot to ponder over — the U.S. has set off a fresh tariff threat, Italy’s government has almost given up on growth this year, and Brexit remains unresolved. On top of that, the International Monetary Fund on Tuesday cut its global outlook yet again. No policy shift is expected as officials scrutinize the economy to calibrate a new bank lending program announced last month.

- In what could be this year’s largest U.S. IPO, investors could get their first look at hundreds of pages of detailed information about Uber Technologies Inc. as soon as Thursday. As the ride-hailing giant gears up to publicly file for an IPO, with one of the people familiar said the company was looking to raise about $10 billion.

- Brexit anxiety is seeing South Korean borrowers sell Swiss franc bonds at a record pace. They are taking advantage of increased demand from European investors for such notes on expectations that Switzerland will be largely insulated from Brexit-related trouble in the region, according to UBS Group AG.

Asian equity markets were mostly negative amid spill-over selling from Wall St where all majors finished lower and the S&P 500 snapped an 8-day win streak as sentiment was pressured by EU-US trade tensions and downward revisions to IMF’s global growth forecasts. ASX 200 (U/C) was initially subdued with the energy sector pressured by a pullback in oil prices and with heavy losses seen in Crown Resorts after Wynn Resorts abruptly ended takeover talks, although the index has since pared its losses amid strength in gold miners, tech and the largest weighted financials sector. Nikkei 225 (-0.5%) suffered from the recent flows into JPY and disappointing Machine Orders, while Hang Seng (-0.1%) and Shanghai Comp. (U/C) conformed to the global downbeat risk tone amid further PBoC inaction and as participants awaited upcoming central bank activity and any fresh developments in the US-China trade saga. Finally, 10yr JGBs were marginally higher as they tracked gains in T-notes amid the risk averse tone across the region, while the BoJ were also present in the market with today’s Rinban operation heavily focused on the belly.

Top Asian News

- Top China Investor Only Has Eyes for One Mainland Stock

- CLSA Culture Clash Boils Over as More Top Executives Quit

- Singapore Bans Former HSBC, UOB Bankers for Fraud, Dishonesty

- Untouchable in 2018, China Bank Stocks Are Now All the Rage

- Turkey to Bolster State-Owned Banks in Bid to Revive Economy

Major European indices have been drifting higher [Eurostoxx 50 +0.5%] since the open following on from a downbeat Asia-Pac session where equity markets conformed to the negativity seen on Wall Street. European bourses are mostly higher by around 0.2-0.3% whilst the FTSE 100 (Unch) remains the laggard ahead of the crucial Brexit summit set to take place later today. Broad-based gains are seen across most sectors, although some underperformance is experienced in healthcare names. JP Morgan (from today’s note) believe that the consumer sector is currently the most oversold sector in Europe whilst autos “may be seeing tentative signs of recovery”. Furthermore, analysts at JPM think that the banking sector continues to look cheap and “continued underperformance means valuations remain extreme historically, notably on dividend yields where the sector now offers a 2% yield pick-up versus the market”. In terms of notable movers, UK’s Indivior (-72%) wiped out around three-quarters of its market cap (so far) after the US DoJ said the Co. has been charged with having engaged with fraudulent marketing schemes designed to increased opioid-based drug prescriptions. Finally, Tesco (+0.6%) shares rose after the supermarket raised its dividend, despite reporting below-forecast sales figures.

Top European News

- U.K. Economy Set for Strong Quarter as Output Rises in February

- Italy Government Turns on Itself as Forecasts Confirm Stagnation

- Network International Jumps After $1.4 Billion London IPO

- Deutsche Boerse Buys Axioma for $850 Million, Adds Analytics

In FX, NOK and AUD were the major outperformers and outliers, as Norwegian inflation slowed less than expected in March to underpin H2 Norges Bank rate hike guidance after yesterday’s disappointing GDP data raised a few doubts. Meanwhile, RBA deputy Governor Debelle was less dovish than anticipated earlier, with little sign of leaning towards an ease even though he acknowledged conflicting economic trends via strength in jobs vs weakness in consumption and production. Eur/Nok is testing technical support around 9.5900 and Aud/Usd is back up near 0.7150 after retreating to circa 0.7110 at one stage overnight. Note, however, hefty option expiry interest may hamper the Aussie given 1.5 bn sitting between 0.7145-25 and 1 bn from 0.7100 to 0.7090.

- NZD/GBP – The next best of the G10 bunch, as the Kiwi continues to largely track its Antipodean peer on cross consolidation within a 1.0595-43 range and while Aud/Nzd remains capped ahead of 1.0600. Nzd/Usd is back above 0.6750 ahead of US CPI data and the FOMC minutes that together with the ECB meeting and EU Brexit Summit form the key elements of ‘super Wednesday’. On that note, the Pound is underpinned towards the top end of 1.3085-45 trading parameters vs the Greenback after above consensus UK data in the form of GDP, ip, manufacturing and construction output, but will be prone to what evolves from the aforementioned EU gathering and especially the decision whether to grant Britain more breathing space, how much longer and on what terms etc.

- EUR – Also firmer vs the Dollar as the DXY continues to pivot 97.000, but like the index extremely rangebound just shy of Tuesday’s high and above 1.1250. Eur/Usd is still facing pre-1.1300 big figure resistance as 21 and 31 DMAs lie at 1.1280 and 1.1284 respectively, while expiries are also keeping the headline pair relatively contained (1.3 bn at 1.1245-50 and 2 bn at 1.1260-75). As noted, the ECB meeting looms and a full preview is available via the headline feed and Research Suite section.

- CAD/JPY/CHF – All narrowly mixed vs the Usd as the Loonie flits between 1.3320-41 and Yen trades just below 111.00 after a fractional/fleeting breach yesterday fell short of the 100 DMA (110.90). Weak Japanese machine orders and more dovish BoJ commentary courtesy of Governor Kuroda also in the mix along with decent expiry interest just under 111.00 at 110.90-75 (1.7 bn). Meanwhile, the Franc is back on the parity handle awaiting the impending major events.

- EM – The Rand has appreciated further against the Buck and is now testing 13.9700 having cleared the psychological 14.0000 mark, but the Lira continues to struggle amidst the post-regional election results tussle with little support from the eagerly-awaited Turkish Economic plan. Indeed, Usd/Try is still elevated, albeit closer to the base of a 5.7200-6700 band.

In commodities, WTI (+0.7%) and Brent (+0.6%) prices continue climbing despite the wider-than-forecast build in API crude inventories last night (+4.09mln vs. Exp. +2.3mln) where prices saw marginal short-lived downside in the immediate aftermath. Supply woes continue to provide a short-term bullish outlook for the complex with sources stating that Libyan air force undertook airstrikes on military targets for Haftar in the City of Gharyan, in close proximity of the pipeline connecting the El-Feel (340k bpd) oil field to the Zawiya port. Elsewhere, the UAE Energy Minister emerged on the wires, stating that there is a high probability of achieving market balance by the end of this year. It is worth keeping in mind that Russian Energy Minister Novak previously stated that Russia will not extend cuts if the market is expected to be balance in H2 2019. Finally, energy traders will be keeping an eye on the OPEC monthly report which is due to be release at 12:10 BST ahead of the weekly DoE inventory and production data at 15:30 BST. Gold (+0.1%) is essentially flat and trading within a narrow range just above the key USD 1300/oz level, as the yellow metal continues to trade cautiously ahead of today’s ECB decision, FOMC minutes & emergency Brexit summit, whilst copper similarly trades with no firm direction ahead of these key risk events. Separately, sources report that Venezuela removed eight tonnes of gold from its central bank’s vaults, expectations are that Venezuela are to sell the metal in order to generate funds in response to US sanctions.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 18.6%

- 8:30am: US CPI MoM, est. 0.37%, prior 0.2%; CPI Ex Food and Energy MoM, est. 0.2%, prior 0.1%

- US CPI YoY, est. 1.8%, prior 1.5%; CPI Ex Food and Energy YoY, est. 2.1%, prior 2.1%

- Real Avg Hourly Earning YoY, prior 1.9%; Real Avg Weekly Earnings YoY, prior 1.58%

- 2pm: FOMC Meeting Minutes

- 2pm: Monthly Budget Statement, est. $181.0b deficit, prior $208.7b deficit

DB’s Jim Reid concludes the overnight wrap

With less than two weeks until I move house after a 2-year project, yesterday my wife went to the house and learnt that our newly installed front door has been accidentally made 2cm too small. It may not sound a lot but everything now is all out of alignment with the surrounds and there’s a sizeable gap!! A bit like trouser legs that need to be taken down. Unbeknown to me there were numerous stressful meetings on site yesterday with my wife and the builder working out what to do about it. No agreement could be made and like Brexit, talks resume today. Unlike Brexit we can’t extend our membership of the rental accommodation and there will be a hard rentexit in a couple of weeks whether we have doors, windows, toilets, showers or a working kitchen in the new place or not. It’s touch and go on a number of these at the moment.

It’s a busy day to keep my mind off these stresses as today sees the quadruple whammy of an ECB meeting, the Brexit-related EU Council meeting, the US CPI report and FOMC minutes to look forward. Before we preview those, risk assets have been threatening to take their foot off the pedal in recent sessions and yesterday we finally saw that with a delayed reaction to the US/EU tariff headlines from yesterday’s Asian session seemingly doing much of the damage. Bloomberg reported that the EU is preparing retaliatory tariffs which will do little to appease the situation. The EU called the US complaint “greatly exaggerated” and Airbus said the US’s move was “totally unjustified.” Barbara Boettcher published a new note examining the tariff threats (link here ), where she argues that the proposed measures are small, but that risks are elevated moving forward, especially as we await the Section 232 decision on auto tariffs.

The S&P 500 (-0.59%) finally brought to an end an eight-session consecutive winning run with cyclical sectors like energy, industrials and financials really feeling the pinch. The DOW (-0.72%) and NASDAQ (-0.56%) also closed in the red while in Europe there was a fairly heavy fall for the DAX (-0.94%) while the STOXX 600, which in fairness traded higher in the early going, ended down -0.47%. An across the board global growth downgrade from the IMF also hurt sentiment although they were only catching down to more regularly updated street forecasts.

Credit didn’t struggle quite so much with HY spreads just +2bps wider in the US and flat in Europe. Meanwhile rates nudged lower, as Treasuries again flirted with the 2.50% level before ending -2.2bpts lower at 2.501% (down -1.3bps this morning to 2.487%). Bund yields fell back down to -0.01%. Interestingly 10yr BTPs rallied -6.2bps in spite of sharp downgrades to growth from the Government and the IMF and an increase in the forecast deficit from the former (see details later) which could raise tensions with the EC again. However in a way it was good to see Italy trade like a conventional government bond and rallying on weak economic news, rather than a more risky credit as it often does.

EM FX was mostly flat, though the Argentine peso (+0.87%) outperformed sharply. WTI Oil (-0.48%) gave back some of Monday’s gains after Russian President Putin said that he opposes “uncontrollable” increases in oil prices which would negatively impact the non-energy parts of Russia’s economy. He also talked about coordination with Opec, possibly hinting that he would not support a new round of production cuts.

This morning in Asia markets are largely following Wall Street’s lead with the Nikkei (-0.60%), Hang Seng (-0.42%) and Shanghai Comp (-0.39%) all down while the Kospi (+0.12%) is up on the back of news that the South Korean government is planning to draw up a supplementary budget of up to KRW7tn ($6.1bn) to support the slowing economy. Elsewhere, futures on the S&P 500 are trading flat (+0.03%). In terms of overnight data releases, Japan’s March PPI came in at +1.3% yoy (vs. +1.0% yoy expected) while February core machine orders came in at -5.5% yoy (vs. -4.6% yoy expected).

We should mention that yesterday our China Chief Economist Zhiwei Zhang published a short update on the property and land markets in China. He notes that while the land market remained weak in Q1, there are green shoots of signs of stabilisation that are now emerging. He expects more policy easing in the land and property markets in Q2 and a rebound in land sales in H2. This fits in with the narrative of our HouseView that although growth is weak, we’d expect momentum is actually improving. See his full report here .

In terms of the ECB today our economists published their expectations last week in a note you can find here . In summary, following an underwhelming message last month, they see the ECB press conference as an opportunity to inject confidence into the economy and the monetary policy process. They see there being two steps necessary to correcting. The first is for the ECB to talk up the economy and the second is clarification around the reaction function and talking up policy. From the perspective of managing risk, TLTRO3 is not sufficient in our colleague’s view and they now expecting tiering as part of their baseline in the coming months, however it’s unlikely that any new policy will be announced today with June more likely.

As for the FOMC this evening, expect the minutes to shed some light on what sets of conditions compel the Fed to shift from its decidedly neutral policy stance – in either direction. Prior to this we get the March CPI report in the US where the consensus is for a +0.2% mom core reading which would be enough to hold the annual rate steady at +2.1% yoy. Our US economists mirror the consensus.

It’s another crucial day for PM Theresa May with the emergency EU Council meeting deciding the UK’s EU membership extension request. How many more of these crucial days are we going to have before this saga ends? In terms of timing, leaders are due to arrive at 5pm CET (4pm BST) with the working dinner and meeting with PM May not taking place until 6.30pm CET. Tusk and Juncker are then due to host a press conference once the meetings finish however it’s anyone’s guess as to when that might be. We’d imagine there’s a reasonable bid-offer for that market.

There wasn’t a huge amount of new Brexit news to update going into that meeting. The press seems to be suggesting an extension to the end of 2019 (or March 2020) is the most likely take it or leave it offer from the EU, though there may be appetite for a short extension through May 22 if the UK passes the WA over the next two days and maybe the ability to cut short the extension if an alternative agreement can be found further down the line. EU Council President Tusk said in statement that “a rolling series of short extensions” would create “new cliff-edge dates,” seeming to argue in favour of a long extension. He was responding to the desire by some in the EU to insert rolling good behaviour clauses in any long extension.

Staying with the UK, yesterday the IMF cut its growth outlook to 1.2% this year which was a downward revision of -0.3pp from three months ago. The growth rate of the world economy was revised down two tenths to 3.3% which would be the weakest rate of growth since 2009. That is also the third downward revision in the last six months. The US was cut to 2.3% (down two-tenths) and Euro Area to 1.3% (down three-tenths) – but still notably above DB’s forecast of 0.9%. It wasn’t all doom and gloom though with China revised up one-tenth to 6.3%. The biggest downward revisions were reserved for Germany and Italy however, where both were revised down five-fifths to 0.8% and 0.1% respectively. Separately, as discussed earlier it’s worth noting that the Italian government yesterday downgraded growth also to 0.1% for 2019 compared to a previous 1% estimate. The deficit was also set at 2.5%. None of these numbers should have been a surprise yesterday but the headlines didn’t help sentiment.

To quickly recap yesterday’s relatively sparse data releases, the highlight in the US was the JOLTS job report for February, which showed the private quits rate staying at 2.6%, a post-crisis high. That bodes well for wage growth moving forward. In Europe, the only notable release was Italy’s retail sales figure for February, which rose +0.1% mom, beating expectations for -0.2%, with January’s figure revised up 0.1pp to 0.6% as well.

Finally to the day ahead which as mentioned above is headlined by the ECB, the EU Council meeting, FOMC minutes and US CPI report. Away from those we’ll also get the February industrial production report in France and the UK along with trade data in the latter and the February GDP reading. Late this evening in the US we’ll also get the March monthly budget statement. Also worth keeping an eye on today are scheduled comments by the Fed’s Quarles this afternoon and ECB’s Coeure this evening. Former Fed Chair Yellen is also scheduled to take part in a discussion with the Fed’s Kaplan.

via ZeroHedge News http://bit.ly/2WX6LEE Tyler Durden